‘Food for Thought’ – Towards 2030 in airport dining

A more enlightened attitude to food & beverage is taking this commercial segment to new heights, says Blueprint Partner Thomas Kaneko Henningsen.

In the second in a series about the future for airport concessions in Europe compiled by Blueprint with data from ACI, Blueprint Partner Thomas Kaneko Henningsen comments on the role of food & beverage in supporting airport revenue growth. Click here for the first in the series.

The focus on airport food & beverage is changing fast. Large gateways have moved quickly to expand their offerings to appeal to everyone from fast-food lovers to foodies looking for Michelin-starred sit-down meals in immersive surroundings.

As well as changing their image for the better, by appealing to all types of traveller airports benefit from a bigger revenue take. This is vital in a post-COVID period where, according to management consultancy Kearney, retail spend per head is falling.

To maintain spending, and to improve the passenger experience – another vital focus of airport management today – F&B has thrust itself further into the spotlight. In just a few years some locations have become unrecognisable as airports have given over more space to dining, with accessible food courts landside and airside becoming the norm.

Airport culinary experiences – a megatrend

Instantly recognisable chefs such as Dabiz Muñoz, Yannick Alléno, Jamie Oliver and Gordon Ramsay have been bringing added lustre to airports for a while, helping to change perceptions of this sector. Todd English recently partnered with Lagardère Travel Retail for a pub and market concept at Abu Dhabi’s Zayed International Airport.

Elsewhere, Avolta and Grupo UniverXO have incorporated Muñoz’s Hungry Club into walkthrough stores at Málaga, Barcelona and Madrid airports. Wolfgang Puck has an array of well-known and popular airport outlets.

Whether it is simply good gelato from Venchi, now open at Hong Kong International Airport among other locations; a terrace dining experience at Eataly in Rome Fiumicino Airport; authentic Japanese cuisine at Tokyo Haneda Airport; or the exquisite fusion of luxury gastronomy and French savoir-faire at the Louis Vuitton Lounge by Yannick Alléno at Hamad International Airport, everyone can find something to suit their taste and pocket.

How is airport concession revenue trending?

Blueprint, as a business development partner specialising in travel retail, has aligned with some of the best research consultancies in the airport and travel shopping universes. One important analysis is to examine the fortunes of airport retail and F&B to 2030.

Based on airport association ACI World’s historical data and put together by Blueprint Associate Thomas Thessen – previously Chief Economist with Copenhagen Airport, a former ACI member and currently SAS Chief Analyst – we have unearthed some useful findings with implications for airports’ shopping and dining elements.

In our previous column, we detailed our forecasts for airport concession revenue from 2023 to 2030. It showed that total global retail, F&B and duty-free concession revenue would grow +5.1% (CAGR) over the period and will be led by Asia Pacific (+6.6%) and the Middle East (+5.2%).

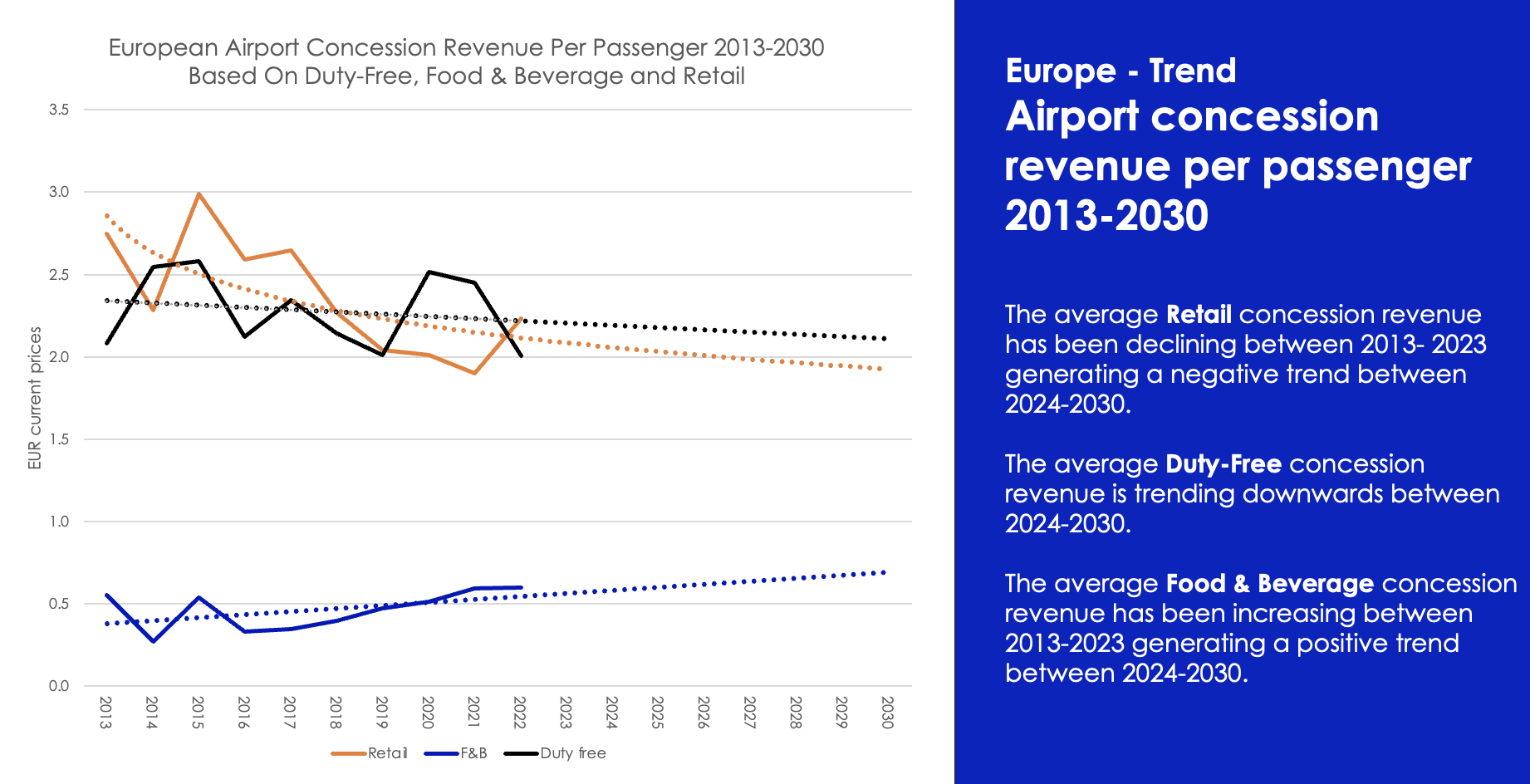

Drilling down into a single region – Europe – we can see a more fascinating or worrying trend; that concession revenue per passenger will remain flat at just below €5. This will be camouflaged by the fact that passenger numbers will be rising, so overall revenues should keep increasing.

Nevertheless, travel retailers will want to fix this per-passenger spending freeze. A further breakdown of concession revenue per passenger into its three components of retail, F&B and duty free indicate that it is the F&B sector doing the heavy lifting (see chart above).

While both duty-free and retail concessions will see a downward movement in terms of spend per head, F&B is on the rise. That rise is also steeper than the falls from the other two components that make up commercial sales.

We believe this is something that travel retailers need to act on. It is already the case that F&B has been put to the front of the commercial proposition at airports and accelerated during the pandemic – now it is time to supercharge that effort.

On a global scale, the concession F&B market is set for steady growth between 2024 and 2031, going from US$33.7 billion to almost $50 billion, according to a 2024 report from Verified Market Research. That is a CAGR of +5.3%. The concessions include stadiums and event venues, offices and universities, airports and travel hubs, and city and leisure sites. The CAGR is close to our own study (+5.1%).

By further tapping into rising F&B trends, such as the plant-based and cultivated meat markets, both of which are predicted to increase, there will be opportunities to take F&B growth past +5.1%.

Airport quick-service restaurants are also forecast to be on a strong upward trend and reach US$8 billion by 2033, a CAGR of +6.5%. The biggest segments here are fast food (45%), cafés (30%) and grab-and-go (25%). In these environments, technologies such as screen ordering will be vital to delivering the volumes and quick service that passengers now expect as the norm.

To finish I would like to cite Fraport, the operator of Frankfurt Airport, which recently announced its concession awards for F&B at the new Terminal 3, which is still being built and will eventually be able to accommodate 19 million passengers. Twenty-two F&B units have been awarded to Avolta and Lagardère Travel Retail covering 2,900sq m.

The airport is implementing much of what has been discussed above, from German bakeries (for example Brot.by Axel Schmitt, a master baker) to snack shops, a high-end bar with fresh tapas and sushi, and chic Italian restaurants. This extraordinary project is still taking shape and will open in summer 2026. It should offer some pointers to the current thinking in airport F&B, and where this expanding segment can go next.

![Killer Scarecrow Horror Movie ‘Field of Screams’ Releasing in May [Trailer]](https://bloody-disgusting.com/wp-content/uploads/2025/03/Screenshot-2025-03-25-093432.png)

![Explore ‘Backrooms Level 11’-Inspired Psychological Horror in ‘Liminal City’ [Trailer]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/03/liminalcity.jpg?fit=900%2C580&ssl=1)

![[Changes go live 3/25] Air Canada Aeroplan adopting dynamic pricing for some partners (including United)](https://frequentmiler.com/wp-content/uploads/2025/02/Air-Canada-new-award-chart.png?#)

![She Missed Her Alaska Airlines Crush—Then A Commenter Shared A Genius Trick To Find Him [Roundup]](https://viewfromthewing.com/wp-content/uploads/2024/07/alaska-airlines-in-san-diego.jpg?#)

-(1).png?width=1920&height=1920&fit=bounds&quality=80&format=jpg&auto=webp#)

![[Podcast] Should Brands Get Political? The Risks & Rewards of Taking a Stand with Jeroen Reuven Bours](https://justcreative.com/wp-content/uploads/2025/03/jeroen-reuven-youtube-1.png)

![[Podcast] Should Brands Get Political? The Risks & Rewards of Taking a Stand with Jeroen Reuven](https://justcreative.com/wp-content/uploads/2025/03/jeroen-reuven-youtube.png)