United & Chase Refresh Cobranded Card Portfolio With Higher fees & Structured Credits

United Airlines and Chase on Monday launched a refreshed line of cobranded cards with higher fees than previously. The increased fees are in effect immediately for new applicants, while existing cardholders will see them applied in the next renewal or in 2026. The enhanced benefits […]

United Airlines and Chase on Monday launched a refreshed line of cobranded cards with higher fees than previously.

The increased fees are in effect immediately for new applicants, while existing cardholders will see them applied in the next renewal or in 2026. The enhanced benefits are available immediately.

You can access Chase’s page for United cards here.

Here are the fee increases:

United Explorer Card

Annual Fee: Increases from $95 to $150.

United Quest Card

Annual Fee: Increases from $250 to $350.

United Club Infinite Card

Annual Fee: Increases from $525 to $695.

Free Increase Timing For Existing Cardholders:

August 1, 2025 for Quest and Club cards

January 1, 2026 for Explorer cards

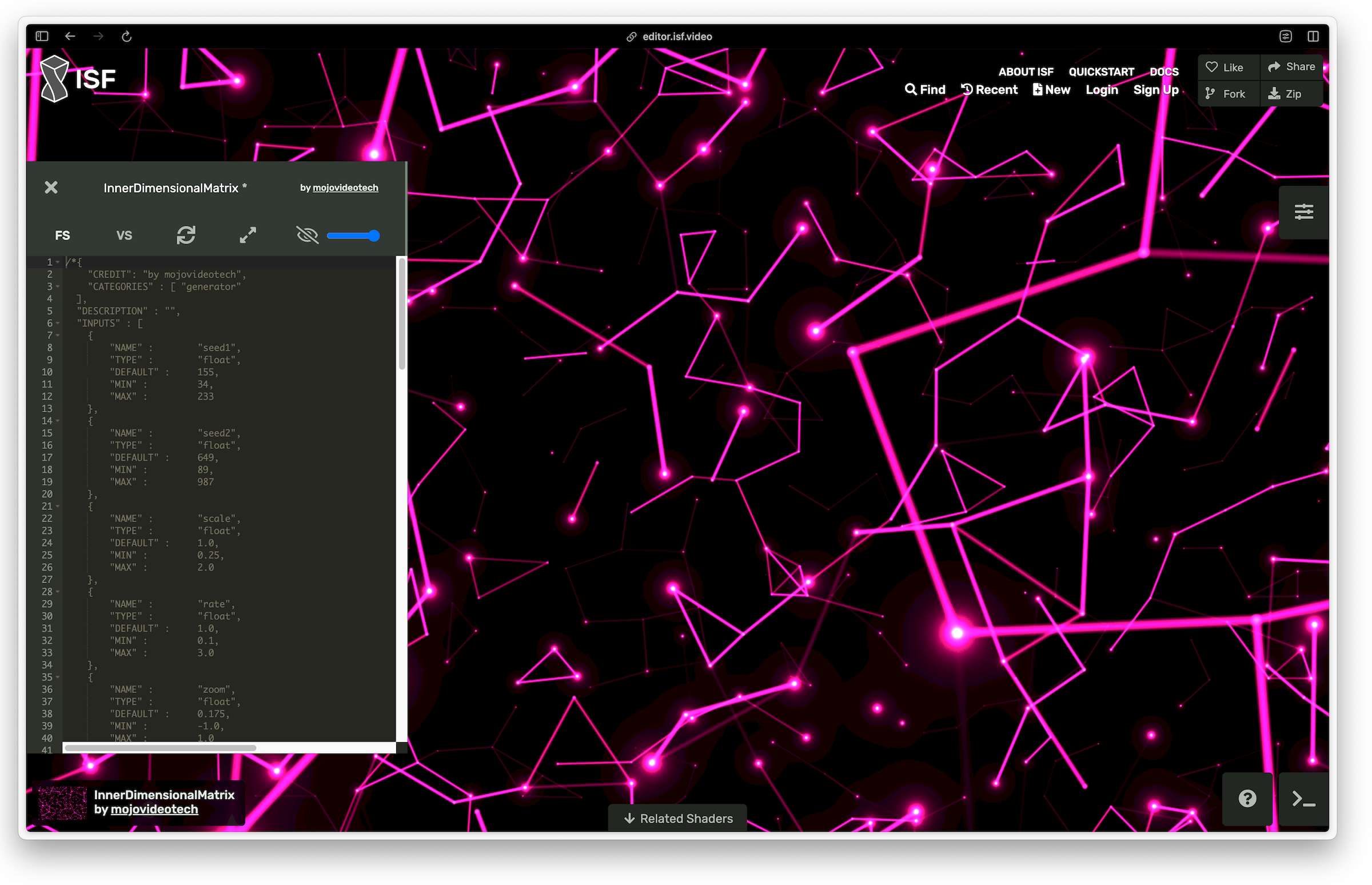

Chase & United Cobranded Card Matrix:

Conclusion

Looking at these benefits and how various credits are structured for maximum breakage (you don’t use them), my head is spinning.

Swiping cobranded airline credit cards is usually a lose-lose situation unless you use them to reach or maintain a tier. Even then, you should probably ask yourself whether that is worth the price.

There is nothing wrong with having one or two for the benefits (bags & lounge) but just remember that you should direct credit card charge activity to products that offer flexible points currency rather than bank them with a closed program such as MileagePlus.

Also, United has significantly devalued Star Alliance partner awards, which are now much better value when redeemed with other programs, such as Air Canada’s Aeroplan.

![She Missed Her Alaska Airlines Crush—Then A Commenter Shared A Genius Trick To Find Him [Roundup]](https://viewfromthewing.com/wp-content/uploads/2024/07/alaska-airlines-in-san-diego.jpg?#)

.png?width=1920&height=1920&fit=bounds&quality=80&format=jpg&auto=webp#)

.png?width=1920&height=1920&fit=bounds&quality=80&format=jpg&auto=webp#)

![[Podcast] Should Brands Get Political? The Risks & Rewards of Taking a Stand with Jeroen Reuven Bours](https://justcreative.com/wp-content/uploads/2025/03/jeroen-reuven-youtube-1.png)

![[Podcast] Should Brands Get Political? The Risks & Rewards of Taking a Stand with Jeroen Reuven](https://justcreative.com/wp-content/uploads/2025/03/jeroen-reuven-youtube.png)