CEIR Q4 2024 Index: Growth of U.S. B2B exhibition industry continues

The U.S. B2B exhibition industry shows recovery in Q4 2024 with improved exhibitor participation and revenues, nearing pre-pandemic levels, according to CEIR Q4 2024 Index. The article CEIR Q4 2024 Index: Growth of U.S. B2B exhibition industry continues first appeared in TravelDailyNews International.

DALLAS – The Center for Exhibition Industry Research (CEIR) announced that the U.S. business-to-business (B2B) exhibition industry continues to rebound, recording strong improvement in the fourth quarter of 2024. Tempered performance for completed events – especially in exhibition attendance – set back the Q3 2024 Index value to 89.3 after strong performance in the first two quarters of the year.1 In Q4, the stronger performance of exhibitor participation and Real Revenues supported an increase to 95.6.

The Q4 CEIR Total Index – a measure of overall exhibition performance – registered 4.4% below the same period in 2019, marking an improvement over the 10.9% shortfall in Q4 2023. The Index gained 6.5 percentage points compared to Q4 2023 and 6.3 points compared to Q3 2024.

Figure 1 illustrates exhibition industry performance for events occurring between Q1 2022 and Q4 2024, compared to the same quarter in 2019. The latest results for Q4 2024 show it represented the strongest level of trade show activity since the onset of the pandemic, with a significant upturn relative to the third quarter of 2024. Among all events in the Index sample, 34.1% have surpassed their pre-pandemic CEIR Total Index performance. This represents an increase from Q4 2023 when 30.4% of events held in that quarter surpassed 2019 results.

The cancellation rate for in-person events remained low at 0.3%, consistent with the previous quarter and significantly lower than 1.4% in Q4 2023.

“Recent results confirm the continued recovery in trade show activity through the end of last year,” said Adam Sacks, President of Tourism Economics. “This year our baseline outlook remains positive, though we expect economic and policy uncertainty and weaker sentiment among international participants will weigh on business decisions and the ongoing recovery in trade show activity.”

“The robust performance across all four metrics in Q4 2024 demonstrates the remarkable resilience and ongoing recovery of the B2B exhibition industry,” added IAEE President and CEO Marsha Flanagan, M.Ed., CEM. “We are particularly encouraged to see exhibitor participation nearly matching pre-pandemic levels, with revenues close behind. The exhibition industry continues to prove its essential value as a platform for business connections and commerce, even amid economic uncertainties.”

Among the four components of the Total Index, the Exhibitors metric has recovered the most, reaching just 0.1% behind 2019. Real Revenues (inflation-adjusted) follows at 1.1% below Q4 2019. Net Square Feet (NSF) follows with a shortfall of 3.0% relative to 2019, and the Attendees metric has been the slowest to recover from Q4 2019, with a shortfall of 12.9% (Figure 2).

The U.S. Economy: Outlook Clouded by Trade Policy Uncertainty

The US economy demonstrated remarkable resilience over the past couple of years in the face of rapid inflation and high interest rates. Gross domestic product (GDP) rose a healthy 2.9% in 2023 and 2.8% in 2024 despite the Federal Reserve’s interest rate increases employed to slow inflation from a peak of 9% in mid-2022.

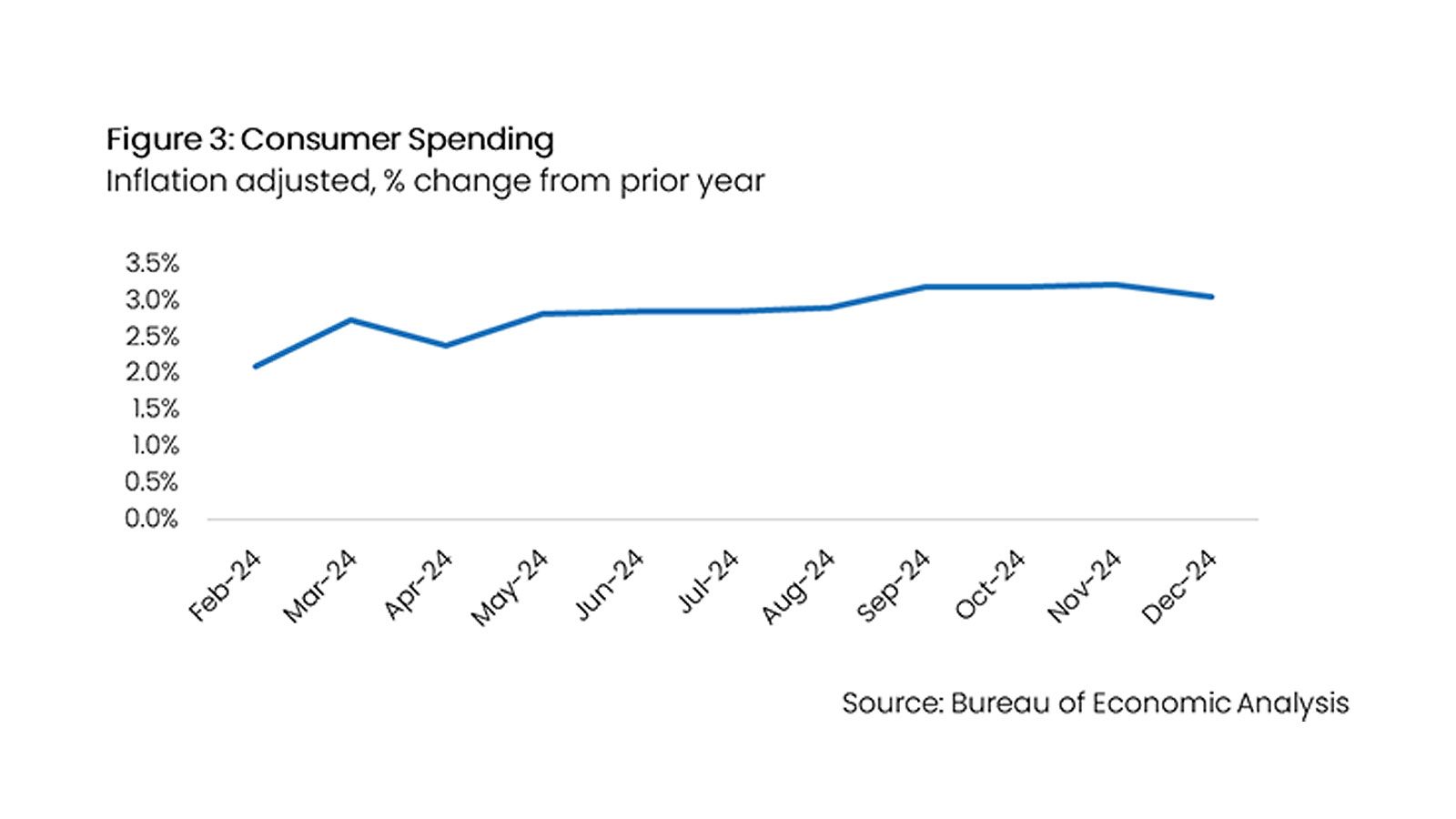

By late 2024, the rate of inflation had fallen below 3.0%, prompting the Federal Reserve to lower interest rates, the unemployment rate remained at historically low levels near 4.0%, and growth in real (inflation-adjusted) income contributed to robust consumer spending.

The resilience of the US economy is being tested again in 2025, this time by heightened trade policy uncertainty. President Trump, in his first month in office, has imposed additional tariffs on China, and in the second month, tariffs on Mexico and Canada came into effect. A 25% tariff on steel and aluminum from all countries effective has also been announced, as well as plans to add tariffs on imports from Europe, Taiwan, and others, as well as on a variety of critical industries like copper, pharmaceuticals, and semiconductors.

Tariffs, and the threat of tariffs, carry both direct and indirect economic costs. Tariff threats increase trade policy uncertainty, and history has shown uncertainty can dampen business investment in non-residential structures and equipment investment.

Progress on the inflation front appeared to stall near the end of 2024 and the spate of tariff announcements have contributed to expectations for higher inflation in 2025. Given that the labor market appears to be in relatively good shape, higher inflation expectations have likely shifted the Federal Reserve’s focus away from full employment and towards stable prices. After three cuts to the Federal Funds Rate in the last four months of 2024, the Federal Reserve is not expected to cut again until December of this year.

Inflation has been particularly strong among essentials (e.g., food, shelter, clothing) which has more significantly impacted middle- and lower-income households. High-income households tend to be insulated from these price gains by budget flexibility and wealth effects from gains in equity and home prices. Low and middle-income household budgets, on the other hand, remain under financial pressure from past increases in prices for food, rent, transportation, and energy.

Nevertheless, consumer spending is expected to remain the main growth driver in 2025, buoyed by a sturdy job market, rising wages, and rising household wealth. However, that is largely attributed to the resilience of high-income households, who account for most of the consumption (Figure 3).

The job market has softened but remains healthy overall. The unemployment rate of 4% in January was the lowest since May 2024 and unemployment is expected to remain low this year even though the hiring rate has slowed. Slower growth in the labor force is expected this year, in part due to tighter restrictions on immigration, and will help keep the unemployment rate low. Weaker labor force growth lowers the bar for the number of jobs the economy needs to create to keep the unemployment rate stable.

On the other hand, restrictive immigration policies represent a downside risk to the unemployment rate, meaning unemployment could fall further. Slower growth in the labor force due to significantly reduced immigration would put some upward pressure on nominal wage growth and, by extension, inflation. We do not view this as a significant risk to inflation, as long as productivity remains strong. Productivity growth will allow for a tight labor market without being a source of inflation.

While economic conditions in 2025 are forecast to support continued growth in travel, we see substantial risks to the outlook due to potential policy effects. Tariffs hold the potential to damage equity markets and affect a further downgrade in the economic outlook.

Perhaps more acutely, isolationist policy, restrictive immigration, and nationalist rhetoric all hold the potential to negatively impact inbound travel through direct travel restrictions as well as shifts in sentiment. This would mirror effects observed during the first Trump administration, which saw declines from Mexico, China, and the Middle East. The current situation warrants broader concern, including Europe.

Additionally, travel to the US could be negatively impacted by impediments to visas such as reductions in consulate staffing or greater scrutiny of travelers from certain origins. While our December 2024 forecast of inbound travel to the US anticipated growth of 9% in 2025, this combination of factors adds significant downside risk that could delay the US inbound recovery for several years.

Higher inflation represents another risk to the travel outlook (Figure 4). Inflation, as measured by the consumer price index, began to accelerate in the fourth quarter of 2024. The Travel Price Index, a combination of travel-related prices, also began to rise more rapidly after exhibiting very slow growth through the first half of the year.

1 Quarterly Index values have been revised following the completion of the data collection for all quarters of 2024.

The article CEIR Q4 2024 Index: Growth of U.S. B2B exhibition industry continues first appeared in TravelDailyNews International.

![Tommy Boy Director's Favorite Chris Farley Memory Involves A Classic Movie Star Impression And Some Car Chaos [Exclusive]](https://www.slashfilm.com/img/gallery/one-of-tommy-boys-most-quotable-moments-came-from-chris-farley-being-bored-exclusive/l-intro-1742930645.jpg?#)

![She Missed Her Alaska Airlines Crush—Then A Commenter Shared A Genius Trick To Find Him [Roundup]](https://viewfromthewing.com/wp-content/uploads/2024/07/alaska-airlines-in-san-diego.jpg?#)

.png?width=1920&height=1920&fit=bounds&quality=80&format=jpg&auto=webp#)

.png?width=1920&height=1920&fit=bounds&quality=80&format=jpg&auto=webp#)

![[Podcast] Should Brands Get Political? The Risks & Rewards of Taking a Stand with Jeroen Reuven Bours](https://justcreative.com/wp-content/uploads/2025/03/jeroen-reuven-youtube-1.png)