Rewards Earning Strategy to Book Domestic Travel

All information about the American Express Green Card has been collected independently by MileValue. We get it—not everyone is interested in flashy international trips in first class. The post Rewards Earning Strategy to Book Domestic Travel appeared first on MileValue.

All information about the American Express Green Card has been collected independently by MileValue.

We get it—not everyone is interested in flashy international trips in first class. For some individuals, particularly those with children, travel goals are centered around cost-effective domestic trips in economy class.

If that’s the case for you, then you’ll want to tailor your rewards earning strategy to maximize your savings and points redemptions for domestic travel.

Let’s take a look at the best currency for earning rewards toward domestic award flights as well as how to best book domestic award travel.

Earn the Southwest Companion Pass

While credit-card rewards currencies offer massive opportunities for domestic award travel redemptions, nothing competes with Southwest’s famous Companion Pass.

If you take frequent domestic flights or simply spend your family holidays inside the U.S. borders, earning the Southwest Companion Pass is a must.

The Southwest Companion Pass enables you to fly a nominated companion with you for just the cost of taxes and fees. The Companion Pass is valid for the remainder of the calendar year in which you earn it plus the following calendar year. So, if you manage to earn it early in the year, such as in January or February, you can use it for nearly two years.

What’s even better is that the benefit has unlimited usage within its validity period. So if you want to fly your companion to Hawaii and back 200 times for just $5.60 each way, you can.

To earn the Southwest Companion Pass, you’ll need to earn 135,000 Rapid Rewards points in a calendar year, which is best done through earning the welcome offers on two of Southwest’s co-branded Chase credit cards—even though you can technically earn it by flying 100 one-way flights with Southwest in a calendar year.

For a full breakdown, check out our guide on how to earn the Southwest Companion Pass.

For couples, one Companion Pass suffices. However, if you’re a two-parent, two-kid household, earning two Southwest Companion Passes enables you to fly your children with you and pay just the taxes and fees on two tickets.

By doing this, you’ll save even more money for other holiday expenses, including dining, theme park tickets and more.

Best Ways to Book Economy Award Fares

Let’s look at your options for booking domestic award fares with each credit card issuer through their airline transfer partners.

Chase Ultimate Rewards

Chase Travel℠

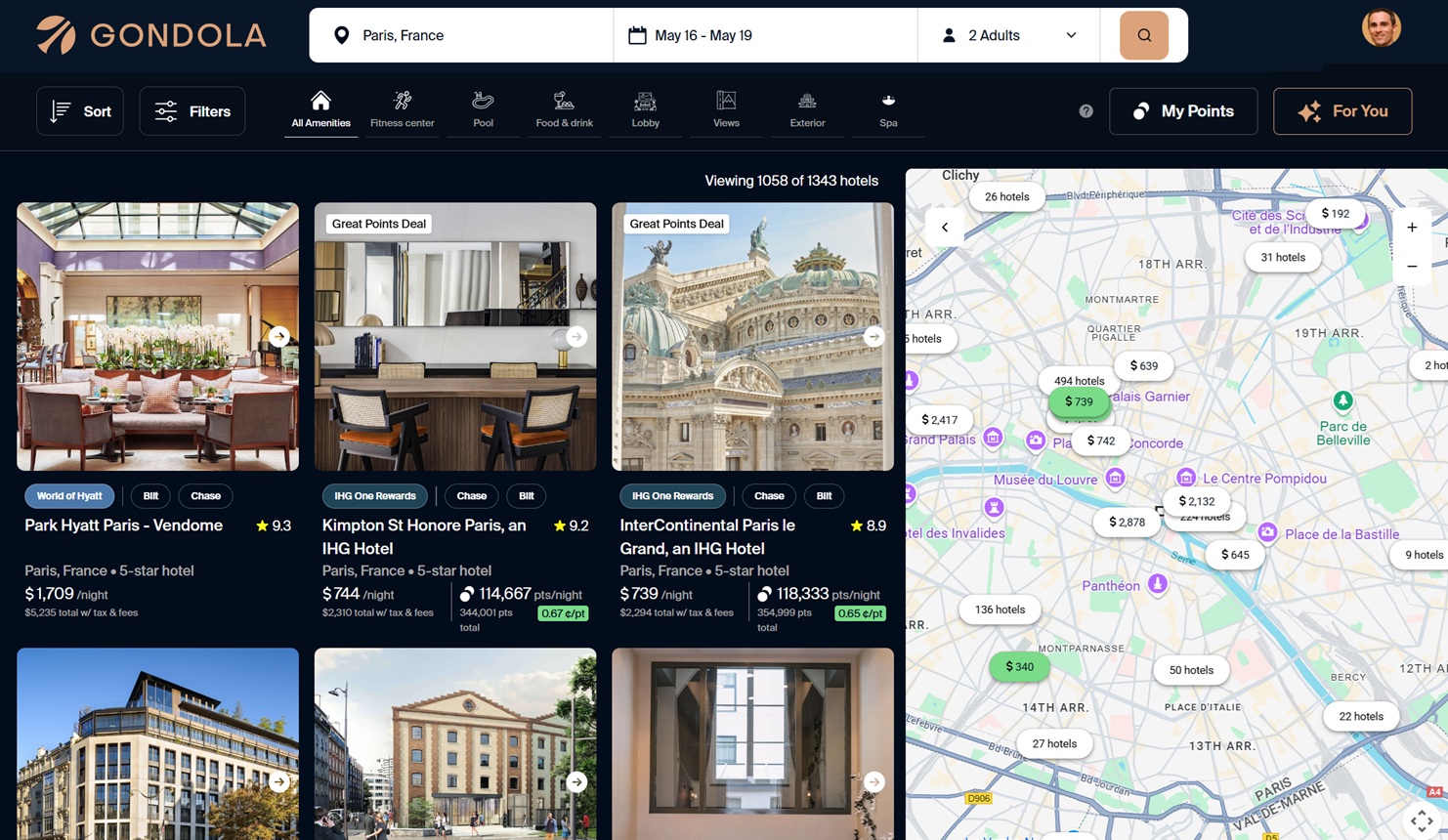

Redeeming your Chase Ultimate Rewards points through Chase Travel℠ is one of the easiest and most lucrative ways to book domestic economy award fares.

When booking through Chase Travel℠, the number of points required for a flight is tied to its cash price.

One of the main reasons to use the portal is the ability to book any flight you want for as many people as you want. You don’t need to hunt for the elusive award space, especially when booking flights for multiple travelers.

What makes booking through Chase Travel℠ particularly lucrative is that certain Chase credit cardholders can receive elevated rewards redemption rates.

For example, holders of the Chase Sapphire Preferred® Card or the Ink Business Preferred® Credit Card can enjoy an elevated redemption rate of 1.25 cents per point when booking through Chase Travel℠.

Likewise, the Chase Sapphire Reserve® cardholders receive a redemption rate of 1.5 cents per point when booking through Chase Travel℠, squeezing even more value out of your points.

For instance, if the cash price of a flight is $150, the Sapphire Preferred and the Ink Business Preferred cardholders would need to redeem 12,000 Ultimate Rewards points. However, the Sapphire Reserve cardholders would need to redeem just 10,000 points.

As a bonus, you’ll be able to earn frequent-flyer miles on your flights when booked through Chase Travel℠.

Booking domestic economy award fares through Chase Travel℠ is a solid way to get an above-average value for your points while keeping things as simple as possible.

Chase Sapphire Preferred® Card

100,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Chase Ink Business Preferred® Credit Card

90,000 bonus points after you spend $8,000 spend in 3 months.

Chase Sapphire Reserve®

Earn 60,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

Chase Airline Transfer Partners

Chase has 11 airline transfer partners, including the following loyalty programs:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- British Airways Executive Club

- Emirates Skywards

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

This wide range of transfer partners opens up many domestic redemption opportunities to take advantage of.

Air Canada Aeroplan is one example of a lucrative Chase transfer partner for domestic award flights. It’s a Star Alliance member, meaning you can take advantage of its distance-based partner award chart to book flights with United Airlines.

Aeroplan charges the following award rates for partner-operated flights within North America.

Distance (in miles)Number of miles required (per direction) Economy Business 0-500 6,000 15,000 501-1,500 10,000 20,000 1,501-2,750 12,500 25,000

By leveraging Aeroplan’s distance-based partner award chart, you can avoid United’s dynamically priced fares and score low rates on award flights across the United States.

You could fly from Chicago to Nashville, Tennessee; Newark, New Jersey, to Toronto; or San Francisco to Las Vegas for just 6,000 points each way.

Another benefit of Aeroplan’s partner award chart is that it includes Hawaii in its North America region, making it cheaper to fly to compared to other airline rewards programs. For instance, you could fly from Los Angeles to Honolulu for just 12,500 points per way.

Likewise, you can transfer your Chase Ultimate Rewards points at a 1:1 ratio to United, Southwest Airlines and JetBlue Airways. Both Southwest and JetBlue offer affordable fares across the nation, while United offers Saver Award fares to help you cut on costs. Southwest also comes with the benefit of two checked bags included in its basic airfare, making it perfect for family holidays where cabin baggage won’t cut it.

You can use Southwest’s Low Fare Calendar and JetBlue’s Best Fare Finder to search for the lowest award fares by the month.

Similarly, you can also get great value for your Ultimate Rewards points by transferring them to Virgin Atlantic to book partner flights with Delta Air Lines. Virgin Atlantic uses a distance-based partner award chart for booking flights with Delta, with the following rates:

Distance (in miles)Number of miles required (per direction) Main cabin Delta One 0-500 7,500 21,000 501-1,000 11,000 41,500 1,001-1,500 16,500 59,500 1,501-2,000 18,500 66,500 2,001-3,000 22,000 70,000

As you can see from the award chart above, you’ll get the best value on short domestic routes of up to 500 miles in distance. By booking these flights through Virgin Atlantic Flying Club, you’ll often get far better value than what Delta will charge for the same fares.

You also can compare the price of Delta award fares booked through Air France-KLM Flying Blue to the same fares booked directly with Delta SkyMiles or through Virgin Flying Club. Because Flying Blue doesn’t use an award chart, you might even score lower-priced award fares, depending on your season of travel.

Best Chase Credit Cards for Domestic Economy Travelers

The best all-around beginner rewards credit card is the Chase Sapphire Preferred Card.

For an annual fee of $95, you’ll be able to transfer your Ultimate Rewards points to all of Chase’s 14 hotel and airline partners as well as redeem your points for 1.25 cents apiece through Chase Travel℠.

You’ll also earn thousands of points on everyday spending with the help of the following bonus spending categories:

- 5X points on travel purchased through Chase Travel℠ (excluding hotel purchases that qualify for the $50 annual hotel credit)

- 5X points on Lyft rides (through March 2025)

- 3X points on dining, including eligible delivery services, takeout and dining out

- 3X points on online grocery purchases (excluding Target, Walmart and wholesale clubs)

- 3X points on select streaming services

- 2X points on all other travel purchases

- 1X points on all other purchases

Alternatively, if you’re a small-business owner, the Ink Business Preferred Credit Card offers excellent value for an annual fee of $95. Just like with the Sapphire Preferred, you’ll be able to transfer your Ultimate Rewards points to all of Chase’s 14 hotel and airline partners as well as redeem your points for 1.25 cents apiece through Chase Travel℠.

It offers the following bonus spending categories for business owners:

- 3X points on the first $150,000 spent in combined purchases in the following categories every account anniversary year:

- Shipping purchases

- Advertising purchases made with social media sites and search engines

- Internet, cable and phone services

- Travel

- 1X points on all other purchases

If you’re open to paying a higher annual fee in return for a wider range of benefits, the Chase Sapphire Reserve is your best bet. For $550 per year, you can redeem your Ultimate Rewards points for 1.5 cents apiece through Chase Travel℠ as well as transfer them to Chase’s 14 airline and hotel partners.

With a $300 annual travel statement credit, complimentary Priority Pass Select membership and the card comes with statement credit to help with the cost of Global Entry/TSA PreCheck, offsetting the Sapphire Reserve’s annual fee is straightforward.

membership and the card comes with statement credit to help with the cost of Global Entry/TSA PreCheck, offsetting the Sapphire Reserve’s annual fee is straightforward.

You can earn Ultimate Rewards points on everyday spending with the help of the following bonus spending categories:

- 10X points on hotels (excluding The Edit℠) and car rentals when you purchase travel through Chase (after the first $300 is spent on travel purchases annually)

- 10X points on Chase Dining purchases

- 10X points on Lyft rides (through March 2025)

- 5X points on flights purchased through Chase Travel℠ (after the first $300 is spent on travel purchases annually)

- 3X points on dining at restaurants, including eligible delivery services, takeout, and dining out.

- 3X points on all other travel purchases (after the first $300 is spent on travel purchases annually)

- 1X points on all other purchases

Once you’re equipped with a premium Ultimate Rewards-earning card from Chase—either the Sapphire Preferred, the Ink Preferred or the Sapphire Reserve—you can open a $0 annual fee Freedom card with Chase to expand your points-earning ability.

The Chase Freedom Flex® and the Chase Freedom Unlimited® are marketed as cashback cards. However, they actually earn Ultimate Rewards points that can be redeemed for cash back. That’s unless you hold them in conjunction with one of the aforementioned Ultimate Rewards-earning cards.

If you hold the Sapphire Preferred, the Ink Preferred or the Sapphire Reserve card, you can combine your rewards earned with your Freedom card and then either redeem them for 1.25 to 1.5 cents apiece through Chase Travel℠ or transfer them to any of Chase’s airline and hotel partners.

This is a key pillar of any successful Chase card strategy, and it’s particularly important for those prioritizing domestic economy travel.

Chase Freedom Unlimited®

Limited Time Intro Offer: Earn a $250 Bonus after you spend $500 on purchases in your first 3 months from account opening. Last Chance! Offer will end at 9 AM EST on 5/01/2025.

Capital One Miles

Capital One offers a range of lucrative credit cards with a solid choice of more than 15 transfer partners to accompany them.

You can transfer your Capital One Miles at a 1:1 ratio to any of the following airline partners:

- Aeroméxico Rewards

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- Avianca LifeMiles

- Cathay Pacific Asia Miles

- British Airways Executive Club

- Emirates Skywards

- Etihad Guest

- Finnair Plus

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

- TAP Miles&Go

- Turkish Airlines Miles&Smiles

- Virgin Red

For domestic travelers, you’ll want to focus on transferring your Capital One Miles to Air Canada Aeroplan, Finnair Plus and Virgin Red.

With Air Canada Aeroplan, you’ll be able to take advantage of the Star Alliance partnership and book domestic United flights for 6,000 to 12,500 points, including to Hawaii.

You can transfer your Capital One Miles to Virgin Red to book cheap award flights with Delta (on routes up to 500 miles). Keep in mind that you’ll need to link your Virgin Red and Virgin Atlantic Flying Club accounts to do this. You can also check award pricing for Delta flights booked through Flying Blue to see if you can find better rates.

Likewise, you can book flights on American Airlines through Finnair due to their membership in the Oneworld alliance. Finnair uses a zone-based award chart to price its partner award fares with American Airlines.

While economy award flights within North America and Canada price at 16,500 miles one way—significantly higher than booking United flights through Aeroplan or Delta flights through Virgin—the real value comes from booking flights from the Midwest and the East Coast to Hawaii.

These flights price at a flat rate of 15,000 points one way in economy, saving you points compared to booking with other airlines.

So while Capital One may not have any U.S. airlines in its transfer partner list, you’re certainly not restricted when it comes to booking domestic award travel. However, for the best value, you’ll want to stick to transferring your points to Capital One’s partners instead of going through Capital One’s travel booking site.

Best Capital One Credit Cards for Domestic Economy Travelers

The Capital One Venture Rewards Credit Card is a solid card choice that you can pull out in every situation.

It earns 2X miles on all purchases, enabling you to earn points on non-bonus category spending. In addition, it earns a total of 5X miles on hotels, vacation rentals and rental cars booked through Capital One’s travel booking site. For an annual fee of $95, it’s a great card for those looking to redeem points for domestic economy travel.

Alternatively, for an annual fee of $395, the Capital One Venture X Rewards Credit Card earns 10X miles on hotels and rental cars booked through Capital One’s travel booking site, 5X miles on flights and vacations booked through Capital One’s travel booking site, and 2X miles on all other purchases.

The card also offers complimentary access to Capital One Lounges as well as Priority Pass and Plaza Premium Group lounges. Additionally, you’ll be able to take a chunk out of the annual fee by using the card’s annual $300 travel statement credit for bookings made through Capital One’s travel booking site and collecting an anniversary bonus of 10,000 miles each year you renew the card.

You can also opt to redeem your miles toward your statement at 1 cent apiece, allowing you to use points to effectively “fund” any purchase.

Capital One Venture Rewards Credit Card

$250 to use on Capital One Travel in your first cardholder year plus earn 75,000 bonus miles

after you spend $4,000 on purchases within 3 months from account opening.

Capital One Venture X Business

For a limited time, earn up to 350,000 bonus miles

150,000 miles once you spend $30,000 in the first 3 months, and an additional 200,000 miles once you spend $200,000 in the first 6 months

Bilt Points

If you want to earn points on your monthly rental payments that you can redeem toward travel purchases, the Bilt Mastercard® is an excellent choice.

You can earn 1X points on rental payments, up to 100,000 points on rent each calendar year, when you use your card five or more times within a billing cycle (see rewards and benefits). You also can earn 2X points on travel purchases, including flights booked directly with airlines, rental cars, hotels, cruise lines or purchases made through the Bilt Travel Portal.

Bilt has a lucrative range of airline transfer partners:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- Alaska Airlines Mileage Plan

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Emirates Skywards

- Iberia Plus

- TAP Miles&Go

- Turkish Airlines Miles&Smiles

- United MileagePlus

- Virgin Red

One of the most valuable transfer partners of Bilt is Alaska Airlines Mileage Plan. Its distance-based partner award chart offers lucrative redemption opportunities with Oneworld alliance partners, such as American Airlines.

Here’s an overview of what you’ll pay when booking domestic American Airlines award fares through Mileage Plan.

Distance (in miles)Number of miles required (per direction) Economy Premium economy Business First class 0-700 4,500 6,000 9,000 13,500 701-1,400 7,500 10,000 15,000 25,000 1,401-2,100 12,500 17,500 25,000 40,000 2,101-4,000 17,500 22,500 35,000 52,500

That means you can book a flight of up to 700 miles for just 4,500 points per way and flights of up to 1,400 miles for as few as 7,500 points per way.

Likewise, you can get excellent value by booking award fares on Alaska-operated flights. You can score the following rates based on the distance of your flight:

- Economy flights starting at 5,000 Mileage Plan miles for distances of 700 miles or less

- Economy flights starting at 7,500 miles for distances between 701 and 1,400 miles

- Economy flights starting at 10,000 miles for distances between 1,401 and 2,100 miles

- Economy flights starting at 12,500 miles for distances greater than 2,101 miles

Alaska’s hubs are on the West Coast, including Anchorage, Alaska; Seattle; Portland, Oregon; San Francisco; and Los Angeles, making it ideal for commuting coast to coast.

Using your Bilt Points, you can also look for Saver Award fares with United or book United award fares through Air Canada Aeroplan to benefit from its distance-based partner award fare pricing.

You also can take advantage of Bilt’s partnership with Flying Blue and Virgin Red to book short Delta flights of up to 500 miles in distance.

Citi ThankYou Rewards

The Citi ThankYou Rewards program offers a selection of 14 airline transfer partners, which can come in handy when booking domestic award flights.

You can transfer your Citi ThankYou Points at a 1:1 ratio to the following airline loyalty programs:

- Aeroméxico Rewards

- Air France-KLM Flying Blue

- Avianca LifeMiles

- Cathay Pacific Asia Miles

- Emirates Skywards

- Etihad Guest

- EVA Air Infinity MileageLands

- JetBlue TrueBlue

- Qantas Frequent Flyer

- Qatar Privilege Club

- Singapore Airlines KrisFlyer

- Thai Royal Orchid Plus

- Turkish Airlines Miles&Smiles

- Virgin Atlantic Flying Club

You can transfer your Citi points to JetBlue and use its Best Fare Finder to score the lowest priced award fares by month. With hubs in Los Angeles; Fort Lauderdale, Florida; Boston; and New York, JetBlue operates cheap flights across the nation.

Alternatively, you can take advantage of both Avianca LifeMiles and Turkish Airlines Miles&Smiles to book cheap domestic award fares with United Airlines. While Avianca no longer publishes an award chart, you can still find lucrative award fares when booking partner awards.

On the other hand, Turkish uses a zone-based partner award chart that prices domestic U.S. flights, including to Hawaii, at just 10,000 points per way in economy class.

It’s also possible to search for low-priced Delta award fares through Flying Blue and Virgin Atlantic and compare which one will give you the biggest bang for your buck.

Best Citi Credit Cards for Domestic Economy Travelers

The Citi Strata Premier℠ Card offers lucrative earnings rates for an annual fee of $95.

You’ll benefit from the following points multipliers:

- 10X points on hotels, car rentals and attractions booked through CitiTravel.com

- 3X points on air travel and other hotel purchases, restaurants, supermarkets, gas stations and EV charging stations

- 1X points on all other purchases

Alternatively, the Citi Double Cash® Card earns 2% cash back (1% when you buy and 1% when you pay) on all purchases for a $0 annual fee. If you also hold a Citi ThankYou Rewards-earning card, you’ll then be able to transfer these cashback earnings to the latter card account to use them for lucrative transfers to Citi’s airline and hotel partners.

American Express Membership Rewards

American Express has a long list of transfer partners accompanied by some of the most lucrative credit cards on the market.

It offers the following airline partners that you can transfer your American Express Membership Rewards points to at a 1:1 ratio:

- Aer Lingus AerClub

- Aeroméxico Rewards

- Air Canada Mileage Plan

- Air France-KLM Flying Blue

- All Nippon Airways (ANA) Mileage Club

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Delta SkyMiles

- Emirates Skywards

- Etihad Guest

- Hawaiian Airlines HawaiianMiles

- Iberia Plus

- JetBlue TrueBlue

- Qantas Frequent Flyer

- Qatar Airways Privilege Club

- Singapore Airlines KrisFlyer

- Virgin Atlantic Flying Club

However, unlike other credit card rewards programs, Amex charges an excise tax offset fee of $0.0006 per point transferred to domestic airlines, up to a maximum fee of $99 per transfer. That means you’ll be hit with the fee when transferring your Membership Rewards points to Delta, JetBlue and Hawaiian Airlines. For this reason, you’ll want to avoid direct point transfers to these programs.

Instead, you can skip on the fee by booking Delta and Hawaiian award flights through Virgin Atlantic, as well as by booking Delta award flights through Flying Blue.

You also can use your Amex points to book United award flights through Air Canada Aeroplan.

That said, Ultimate Rewards points, Bilt points, Capital One Miles and Citi ThankYou Points will give you more flexibility when it comes to booking domestic award flights. So unless you have a stash of Amex points that you’re not using for any other redemptions, stick to the other card issuers.

Best Amex Credit Cards for Domestic Economy Travelers

The American Express® Gold Card offers lucrative rewards on everyday spending. For an annual fee of $325 (see rates and fees), you’ll benefit from the following bonus spending categories:

- 4X Membership Rewards® points when you dine at restaurants worldwide (on up to $50,000 in purchases per calendar year). Then 1x points for the rest of the year

- 4X Points at U.S. Supermarkets on up to $25,000 per calendar year in purchases, then 1X points for the rest of the year.

- 3X Membership Rewards® points on flights booked directly with airlines or on AmexTravel.com with the American Express® Gold Card.

- 2X Membership Rewards® points per dollar spent on prepaid hotels and other eligible purchases booked on AmexTravel.com.

- 1X Membership Rewards® point per dollar spent on all other eligible purchases.

The Amex Gold also offers up to $500 worth of value in statement credits, making it easy to offset the annual fee.

Likewise, the American Express Green Card offers competitive points multipliers for a lower annual fee of $150:

- 3X points on travel

- 3X points on transit

- 3X points on dining at restaurants worldwide, including takeout and delivery in the U.S.

- 1X points on all other purchases

If you want all-out luxury and aren’t afraid of paying $695 in annual fees (see rates and fees), The Platinum Card® from American Express is a great option for cardholder perks.

You’ll get more than $1,500 worth of value from its perks, including complimentary access to The American Express Global Lounge Collection, complimentary Hilton Honors and Marriott Bonvoy Gold Elite status, also comes with statement credit to help with the cost of Global Entry/TSA PreCheck* and numerous other statement credit perks.

* Receive either a $120 statement credit every four years for a Global Entry application fee or a statement credit up to $85 every 4.5 years for a TSA PreCheck® application fee (when applying through a TSA official enrollment provider), in each case when charged to your eligible American Express card.

American Express® Gold Card

Earn 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership.

Earn 80,000 Membership Rewards® Points after you spend $8,000 on eligible purchases on your new Card in your first 6 months of Card Membership.

Final Thoughts

You’re not stuck for choices when it comes to booking domestic award travel. While it may not be as glamorous as flying first class internationally in lie-flat seats, economy award fares can still deliver massive value and even bigger savings—particularly for families.

For the best results, begin by focusing on earning Ultimate Rewards points through Chase cards. That way, you’ll have the greatest flexibility when it comes to booking.

The post Rewards Earning Strategy to Book Domestic Travel appeared first on MileValue.

![Hollow Rendition [on SLEEPY HOLLOW]](https://jonathanrosenbaum.net/wp-content/uploads/2010/03/sleepy-hollow32.jpg)

![It All Adds Up [FOUR CORNERS]](https://jonathanrosenbaum.net/wp-content/uploads/2010/08/fourcorners.jpg)

![John Wick's 'Gun-Fu' Action Style Was Originally Designed For A Jason Statham Movie [Exclusive]](https://www.slashfilm.com/img/gallery/john-wicks-gun-fu-action-style-was-originally-designed-for-a-jason-statham-movie-exclusive/l-intro-1746726001.jpg?#)

![‘The Surfer’: Nicolas Cage & Lorcan Finnegan Dive Into Aussie Surrealism, Retirement, ‘Madden’ & ‘Spider-Man Noir’ [The Discourse Podcast]](https://cdn.theplaylist.net/wp-content/uploads/2025/05/08055648/the-surfer-nicolas-cage.jpg)

![Marriott Hotel Demanded Women Show ID To Prove Gender—While They Were Using The Restroom [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/05/liberty-hotel-boston.jpeg?#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.jpg)