Disney+, Hulu Combined Operating Profit Surges to $336 Million

When combined with ESPN+, the three streaming services grew to nearly 205 million subscribers in the last quarter The post Disney+, Hulu Combined Operating Profit Surges to $336 Million appeared first on TheWrap.

Disney shares climbed 6% in pre-market trading on Wednesday after the company easily beat Wall Street expectations during the last quarter, swinging to a profit of $3.28 billion and growing revenue 7% to $23.6 billion.

The results for the January-to-March period, its fiscal second quarter, were driven by revenue growth across its entertainment, sports and experiences segments, according to its earnings report. It also saw 61% jump in entertainment profits and 9% increase in experiences profit, which were offset by a 12% decline in profits in its sports division, largely on a write-off cost.

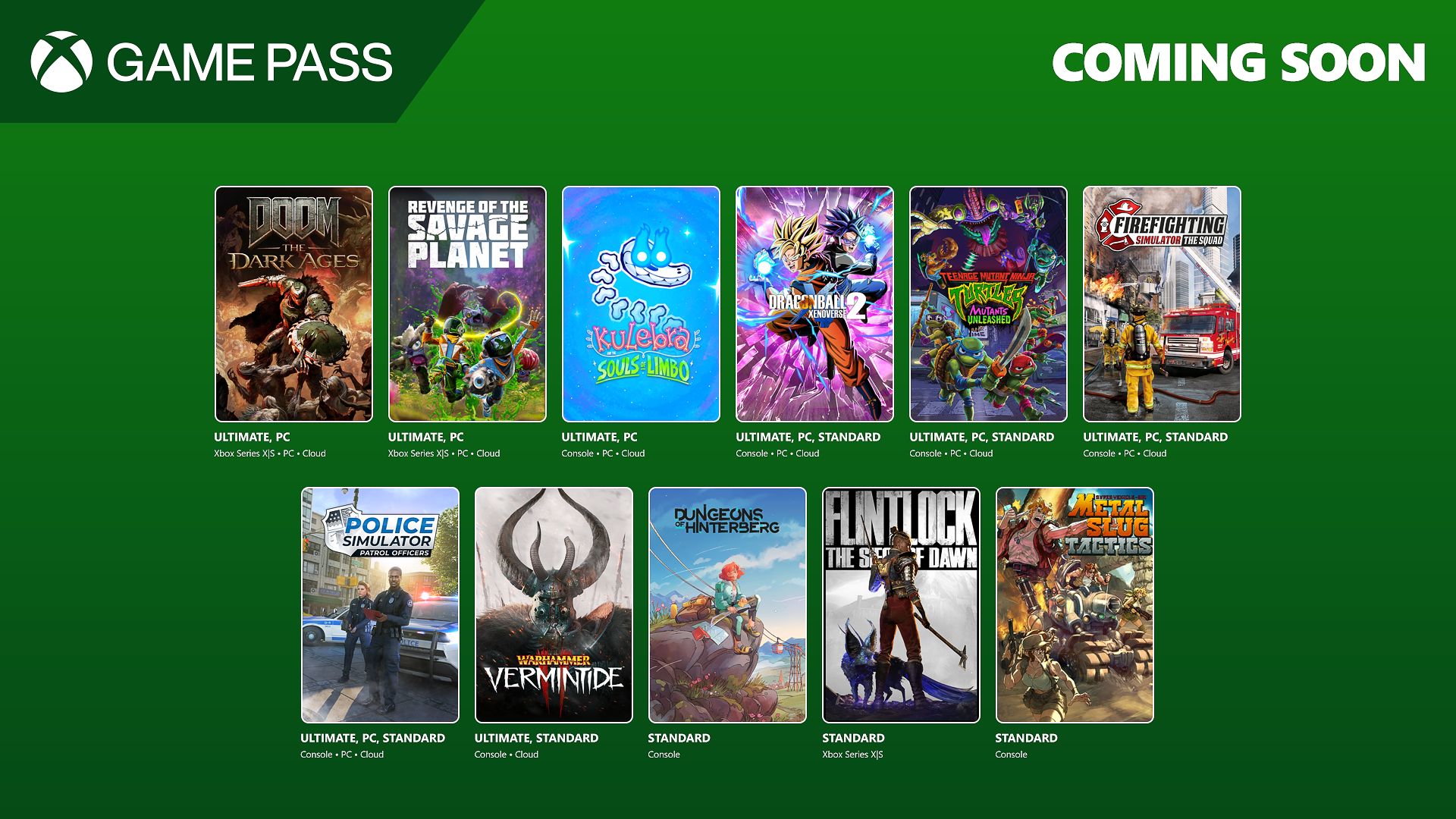

Disney+ and Hulu posted a combined operating profit of $336 million, up 615% from a profit of $47 million a year ago. Together, the streaming services added 2.5 million subscribers for a total of 180.7 million. When including ESPN+, the total subscriber count across the three services was 204.8 million. Disney did not break out whether ESPN+ posted a profit or loss for the quarter.

The numbers underscore the momentum Disney has shown in its streaming services in the past year, a business that just a few years ago had $4 billion in annual losses after aggressive investments and expansion.

Here is a rundown of the key quarterly results:

Net income: A profit $3.28 billion, compared to a loss of $20 million in the prior-year period.

Earnings Per Share: $1.81 per diluted share, compared to a loss of 1 cent in the year ago period. Excluding certain items, EPS grew 20% to $1.45, compared to $1.18 per share expected by analysts surveyed by Zacks Investment Research.

Revenue: $23.6 billion, up 7% year over year, compared to $23.14 billion expected by analysts surveyed by Zacks Investment Research.

Operating income: $4.4 billion, up 15% compared to $3.8 billion a year ago.

Disney+ subscribers: Added 1.4 million during the quarter for a total of 126 million.

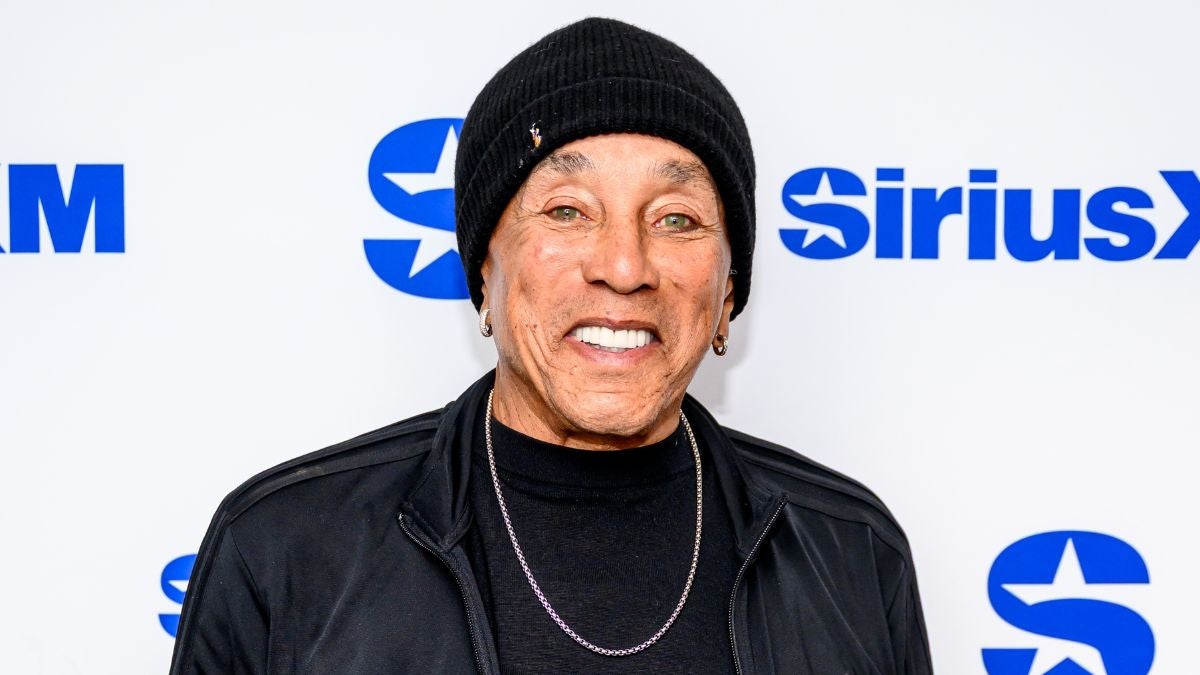

“Our outstanding performance this quarter underscores our continued success building for growth and and executing our strategic priorities,” CEO Bob Iger said in a statement. “Following an excellent first half of the year, we have a lot more to look forward to, including our upcoming theatrical slate, the launch of ESPN’s new (direct-to-consumer) DTC offering, and an unprecedented number of expansion projects in our Experiences segment. Overall, we remain optimistic about the direction of the company and our look for the remainder of the fiscal year.”

Looking ahead, Disney expects a modest increase of Disney+ subscribers in its third quarter relative to the second quarter.

For the full year, however, Disney’s adjusted earnings-per-share is expected to grow 16% year over year to $5.75 and cash provided by operations will be $17 billion, a $2 billion increase over prior guidance driven by the deferral of tax payments, the company said. It also anticipates double-digit growth in operating income for entertainment, 18% operating income growth for sports and 6% to 8% operating income growth for experiences.

Additionally, it expects to incur pre-opening expenses of roughly $200 million for Disney Cruise Line, with roughly $40 million in the third quarter and $50 million in the fourth quarter, and an equity loss of roughly $300 million for its India joint venture.

Disney added that it continues to monitor macroeconomic developments for potential impacts to its business and “recognize that uncertainty remains regarding the operating environment for the balance of the fiscal year.”

Disney Entertainment

Disney’s entertainment segment, which includes Disney+, Hulu and the company’s entertainment linear networks, grew revenue 9% to $10.68 billion and operating profit 61% to $1.26 billion, driven by improved results in direct-to-consumer and content sales, licensing and other.

Linear networks revenue fell 13% to $2.42 billion and operating income rose 2% to $769 million. Domestic linear revenues fell 3% to $2.2 billion, while operating income jumped 20% to $625 million.

The increase in operating income was driven by lower technology costs; lower marketing costs from fewer new shows at its cable channels and fewer season premieres at ABC Network than the prior year period; a decrease in ad revenue from lower rates and average viewership and fewer impressions; and lower programming and production costs at its cable channels, offset by higher costs at ABC Network.

International linear networks revenue fell 55% to $223 million, while operating income tumbled 84% to $15 million. The decrease was due to the Star India transaction with Reliance Industries.

Entertainment direct-to-consumer revenue grew 8% to $6.1 billion, driven by higher pricing and more subscribers, offset by an unfavorable foreign exchange impact and the absence of Star India subscription revenue and programming costs; higher ad revenue and technology and distribution costs; rate increases at Hulu + Live TV; and more subscribers to bundles with third-party offerings, including premium add-ons.

Disney+ reported a total of 57.8 million domestic subscribers and 68.2 million international subscribers. Disney+ domestic average revenue per user (ARPU) grew 1% to $8.06, driven by price increases and lower ad revenue, while international ARPU grew 5% to $7.52, due to price increases, subscriber mix shifts and the unfavorable impact of foreign exchange rates.

Hulu reported a total of 54.7 million subscribers, including 50.3 million SVOD-only and 4.4 million Hulu + Live TV subscribers. SVOD-only ARPU fell 1% to $12.36, while Hulu and Live TV ARPU grew 1% to $99.94, both driven by price increases and lower ad revenue.

Content sales, licensing and other grew revenue 54% to $2.15 billion and swung to a profit of $153 million from a loss of $18 million a year ago, driven by an increase in sales of episodic content, the home entertainment performance of “Moana 2,” and the carryover theatrical performance from the film and “Mufasa: The Lion King.”

Disney Sports

Disney’s sports segment, which includes ESPN and ESPN+, grew revenue 5% to $4.5 billion, but operating profit fell 12% to $687 million due to write-off from exiting its Venu Sports business.

ESPN grew domestic revenue 7% to $4.2 billion and international revenue 11% to $379 million. Operating income fell 17% to $648 million domestically, but rose 11% to $21 million internationally.

The domestic results reflected higher programming and production costs due to three additional college football playoff games and one additional NFL game; ad revenue growth of 29% due to rate and average viewership increases; and a modest increase in affiliate revenue offset by fewer subscribers.

ESPN+ subscribers grew fell 3% to 24.1 million, with ARPU growing 3% to $6.58 driven by price increases and the impact of a shift in subscriber mix. Disney is gearing up to launch its fully direct-to-consumer version of ESPN this fall, which will package the network’s sports programming with fantasy sports integrations, enhanced statistics, betting features and e-commerce.

Disney Experiences

Disney’s experiences segment, which includes its theme parks, hotels, Disney Cruise Line and consumer products, grew revenue 6% to $8.9 billion and operating income 9% to $2.5 billion.

Domestic parks and experiences revenue grew 9% to $6.5 billion, while operating income grew 13% to $1.8 billion. The results in its domestic business was reflected higher volumes in passenger cruise days reflecting the launch of the Disney Treasure, theme park attendance and guest spending, occupied room nights and Disney Vacation Club sales and increased costs due to DCL’s fleet expansion and inflation.

International revenue fell 5% to $1.4 billion, while operating income fell 13% to $225 million. The results in its international business reflected lower theme park attendance and increased costs at Shanghai Disney and Hong Kong Disneyland.

Consumer products revenue rose 4% to $949 million, while operating income climbed 14% to $443 million. The results reflected higher licensing revenue that included the benefit of the release of “Marvel Rivals.”

The post Disney+, Hulu Combined Operating Profit Surges to $336 Million appeared first on TheWrap.

![White Paper Games Announces Psychological Thriller ‘I Am Ripper’ [Trailer]](https://bloody-disgusting.com/wp-content/uploads/2025/05/iamripper.jpg)

.png?format=1500w#)

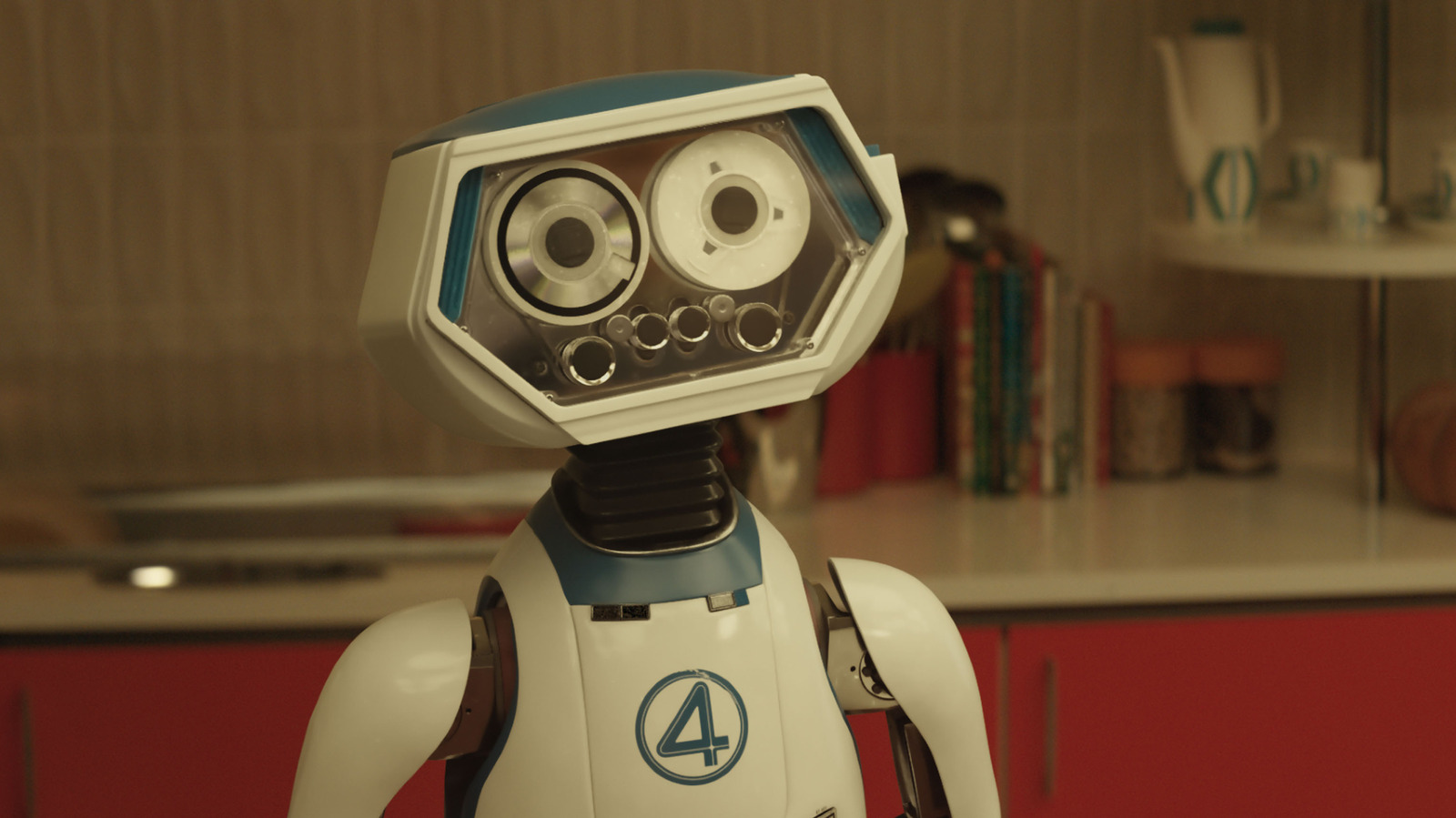

![It All Adds Up [FOUR CORNERS]](https://jonathanrosenbaum.net/wp-content/uploads/2010/08/fourcorners.jpg)

-Pokemon-GO---Official-Gigantamax-Pokemon-Trailer-00-02-12.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)