A checklist for cancelling credit cards

Before cancelling a credit card, especially a rewards earning card, there are a few steps you should take… 1. Stop using the card well before cancelling If you have used your rewards card for any purchases since the last statement close date, then you are due additional rewards for that spend. If you cancel the […] The post A checklist for cancelling credit cards appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

Before cancelling a credit card, especially a rewards earning card, there are a few steps you should take…

1. Stop using the card well before cancelling

If you have used your rewards card for any purchases since the last statement close date, then you are due additional rewards for that spend. If you cancel the card now, you likely will not get those rewards. Consider waiting until you’ve earned the expected rewards before cancelling.

2. Use or receive annual perks

Many credit cards offer annual perks like hotel free night certificates, fee credits, statement credits, and other benefits. Be sure to take advantage of these before you cancel.

If a new membership year has just begun, you may even use the new year’s perks before deciding whether to keep or cancel. In most cases, it is possible to get those benefits around the time that your annual fee comes due, but still cancel and get the annual fee reimbursed (if it was already paid). If you’re expecting benefits like these, wait until you’ve received the benefit before cancelling your card.

Things like points and free night certificates that are already in your hotel or airline loyalty account are typically still valid even if you cancel the associated credit card (you do not need to rush to use points or free night certificates before cancelling your credit card as you will retain those rewards that are in your airline or hotel account). Similarly, in most cases, statement credits for qualifying purchases are not clawed back even if you decide to cancel your card.

3. Keep airline or hotel rewards

With hotel and airline credit cards, you do not have to fear losing your rewards when you cancel your credit card: your existing points are tied to your hotel or airline loyalty account, not to your credit card account. Note that phone representatives often provide incorrect information about this. It is not uncommon for a phone representative to incorrectly assert that you will lose your existing hotel or airline points when you cancel your credit card, but that is not the case. Once those points are in your airline or hotel account, they are yours to keep except in extreme circumstances.

4. Move bank-specific rewards or consider a product change

Many credit cards offer bank-specific rewards that you will lose if you cancel your account before transferring or redeeming rewards.

With cash back cards, simply make sure to redeem all expected cash back before cancelling. If your rewards are in the form of points that can be redeemed for gifts or travel, you might not want to cash in those points since you can usually get better value for travel.

With most bank points programs, you can downgrade to a no annual fee version of the card in order to keep your points alive. Each program has different specifics. Here is what we recommend with a few popular points programs:

- Chase Ultimate Rewards: Transfer points to another Ultimate Rewards account (either your own or one owned by a household member) or downgrade to a card with no annual fee like the Chase Freedom card. More information can be found in our Chase Ultimate Rewards Complete Guide.

- Amex Membership Rewards: Open a Blue Business Plus card, which keeps your points alive and transferable with no annual fee. On the consumer side, there is no option without an annual fee, though you could consider downgrading a Platinum or Gold card to the Green card. More information can be found in our Amex Membership Rewards Complete Guide.

- Citi ThankYou Rewards: Downgrade to no annual fee ThankYou Preferred card. Note that unlike with Chase and Amex, transferring Citi Thank You points to another card, even one you own, will not keep them alive. In the event that you cancel a card that earns Citi Thank You Rewards, the points earned from that card will expire 60 days after you cancel it. For that reason, you want to downgrade to a card with no annual fee rather than cancelling. More information can be found in our Citi ThankYou Rewards Complete Guide.

- Capital One Miles: Downgrade to the no annual fee VentureOne or transfer rewards to another Capital One Miles account (either your own or that of another cardholder — Capital One allows for the transfer of rewards to any other cardholder with a miles-earning card). More information can be found in our Capital One Miles Complete Guide.

5. Change automated payments

If you have any bills setup to autopay from this credit card account, don’t forget to change those payments to a different card.

6. Ask about retention offers

Call to say that you’re thinking of cancelling but want to know if there are any retention offers available to you. Make sure they list all available offers. Sometimes they’ll offer one and won’t tell you about another until you have declined the first one. If the retention offer is good enough, keep the card open.

With some issuers, it may be possible to do this online. For example, during normal weekday business hours, Amex chat representatives can usually transfer a chat to a retention specialist who can review any retention offers with you via the chat tool.

The value of retention offers can vary significantly. The bank may offer to waive the annual fee, provide a points bonus tied to purchases, add extra points per dollar spent up to a camp, etc. Be prepared to compare offers as some issuers will have more than one offer available.

7. Move credit line to other cards

If you decide to cancel the card completely, and if you have other cards with the same bank, ask to move the credit line to another card. Different banks have different rules about how much can be moved. This can maintain purchasing power and keep overall utilization low.

8. Get back your annual fee (or some of it)

Note that whether or not you owe some or all of your annual fee in the event of a card cancellation or product change varies by issuer.

Most (but not all) credit card issuers will waive or provide a refund of the annual fee if you cancel your card within 30 days of the fee posting to your account.

Many (but not all) credit card issuers will waive or provide a refund of the annual fee if you product change to a different card within 30 days of the fee posting. Notably, Capital One typically does not waive the annual fee in the event of a product change that occurs after the fee has posted.

Some credit card issuers will issue a prorated refund of the annual fee if you product change more than 30 days after your annual fee has posted (but not if you cancel). For instance, if it has been more than 30 days since your annual fee posted, American Express will not waive the fee or provide any refund if you cancel your card. However, if you product change your card, Amex will provide a prorated refund for the card from which you change and charge a prorated fee for the card to which you change.

As an example, if you have a Platinum card ($695 annual fee) and you cancel 3 months after your annual fee has posted, you will not receive any refund of the fee. If you instead product change to an Amex Green card at that 3-month mark, you will receive a refund for 75% of the annual fee (9 months is 75% of a year), which will be about $521, and you will be charged 75% of the $150 annual fee of the Amex Green card ($112.50).

After cancelling or downgrading…

9. Update your credit card tracking spreadsheet

If you sign up for lots of credit cards, its important to keep track of which cards you’ve signed up for, when you signed up, and when you cancelled (or downgraded). Travel Freely is a great tool for keeping track of this, but be sure to update your records.

10. File or dispose of old card

Don’t forget about authorized user cards too.

The post A checklist for cancelling credit cards appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

![White Paper Games Announces Psychological Thriller ‘I Am Ripper’ [Trailer]](https://bloody-disgusting.com/wp-content/uploads/2025/05/iamripper.jpg)

.png?format=1500w#)

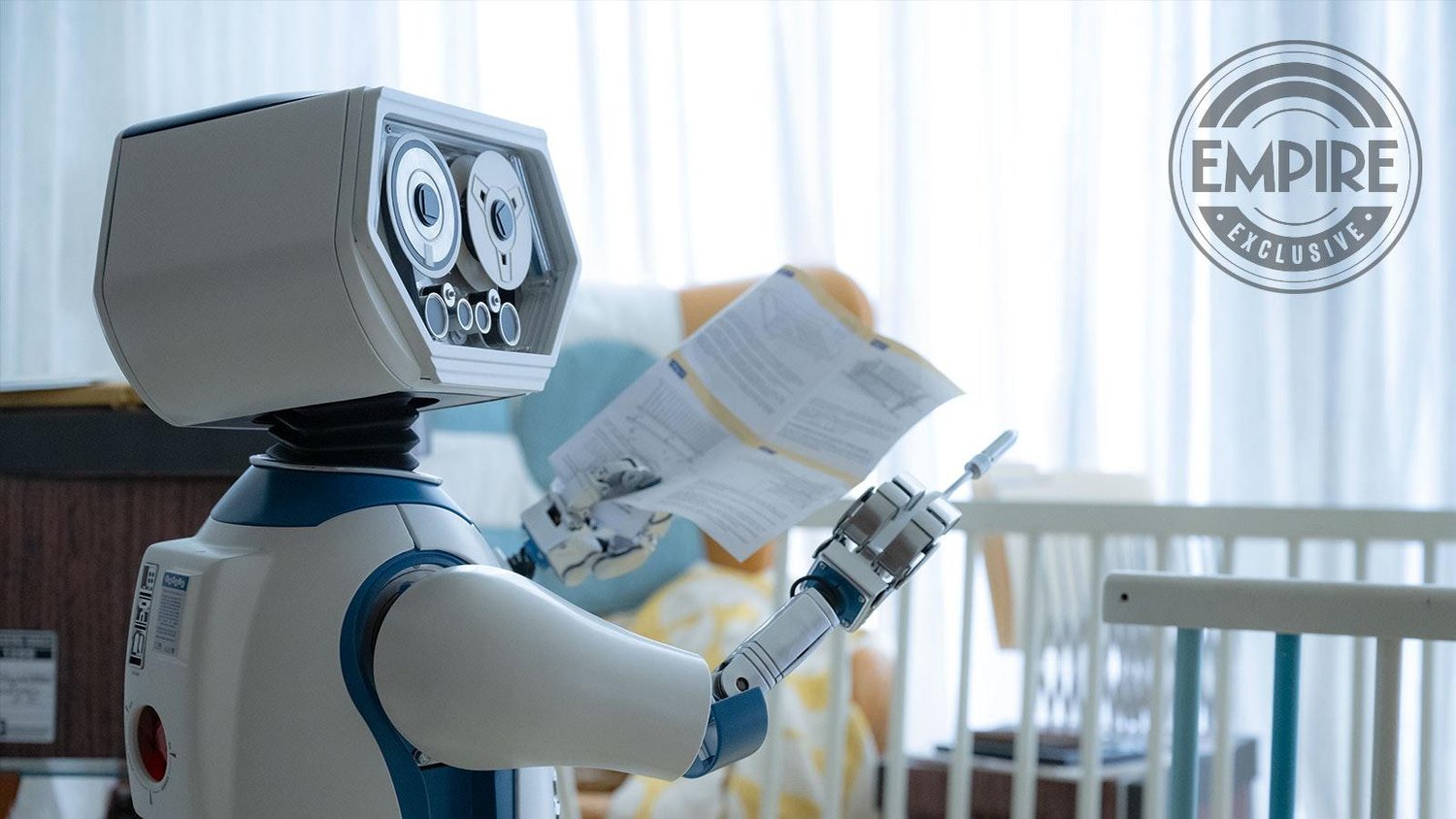

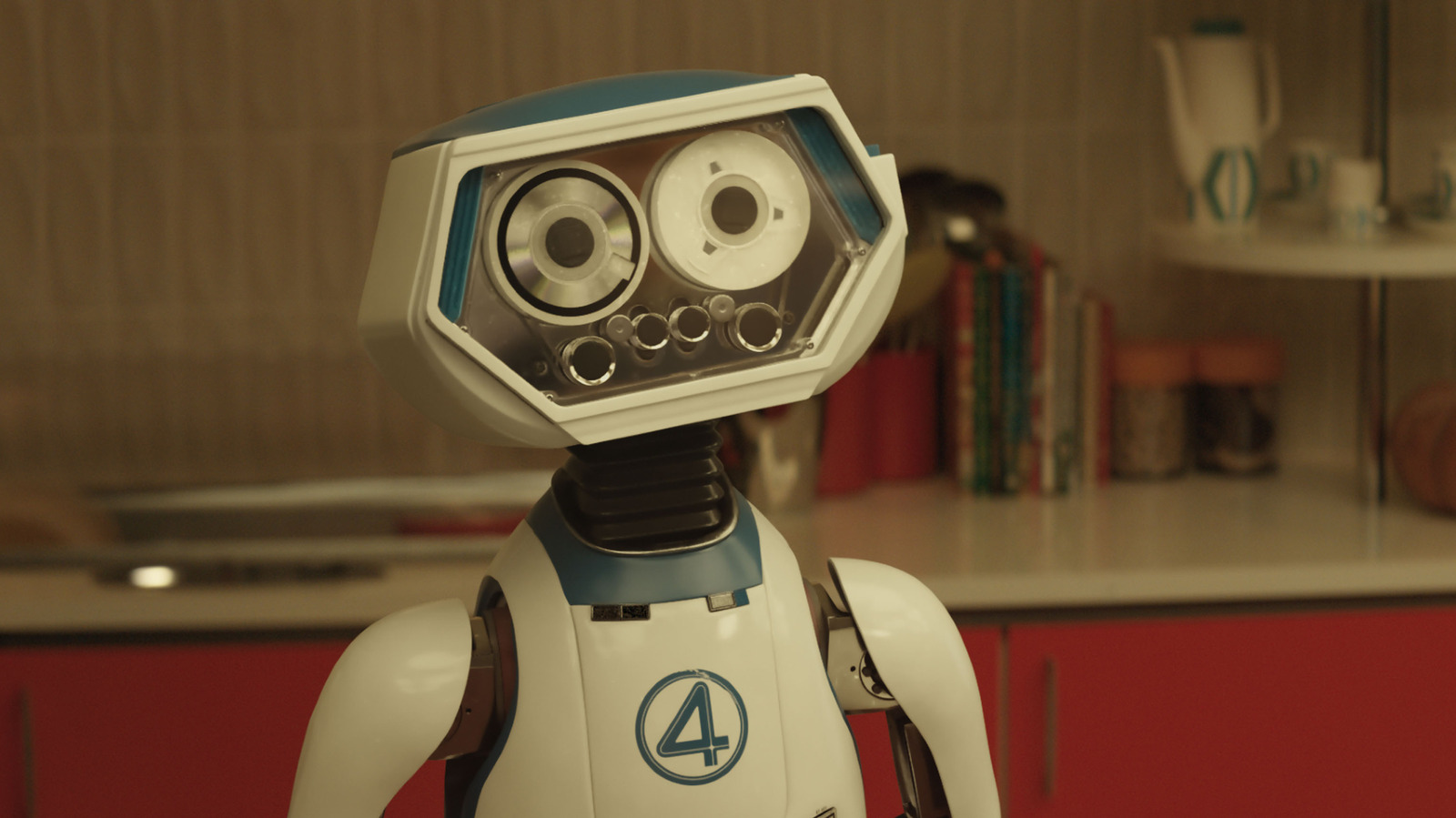

![It All Adds Up [FOUR CORNERS]](https://jonathanrosenbaum.net/wp-content/uploads/2010/08/fourcorners.jpg)

-Pokemon-GO---Official-Gigantamax-Pokemon-Trailer-00-02-12.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![[Dead] Japan Airlines First Class wide open through JetBlue TrueBlue (though it’s expensive)](https://frequentmiler.com/wp-content/uploads/2024/11/JAL-first-seat.jpg?#)