A Review of the American Express® Gold Card

At first glance, the $325 annual fee (see rates and fees) charged by the American Express® Gold Card may seem relatively expensive, especially considering that there are many credit cards that don’t charge any annual fee whatsoever. However, this card comes with a suite of statement credits that can offset this annual fee year after year. The post A Review of the American Express® Gold Card appeared first on MileValue.

At first glance, the $325 annual fee (see rates and fees) charged by the American Express® Gold Card may seem relatively expensive, especially considering that there are many credit cards that don’t charge any annual fee whatsoever. However, this card comes with a suite of statement credits that can offset this annual fee year after year. If you’re a foodie looking for a card that offers good spending bonuses on dining and supermarkets, there’s no better place to look than the Amex Gold Card.

The Amex Gold Card has gained legendary status among credit card rewards enthusiasts because it earns 4X points on dining (on up to $50,000 per calendar year, 1X thereafter). These are the best dining rewards that you find from any credit card on the market today.

This card also offers 4X points at U.S. supermarkets (on up to $25,000 per calendar year, 1X thereafter), 3X points on flights booked through American Express Travel® and 2X on hotel bookings made through American Express Travel®. So, not only does Amex Gold offer stellar bonuses on food purchases, it’s also a pretty good travel rewards card as well.

Additionally, the Amex Gold is made of metal and comes in a gold version and a rose gold version.

Let’s look at all of the features of the Amex Gold Card to help you decide whether or not this card is right for your wallet. Plus, we’ll compare the Amex Gold to some of its competitors so you can see if there’s another card out there that might be even better for you.

Who Is the American Express Gold Card For?

Before discussing the specifics of the Amex Gold Card, let’s briefly discuss who this card is geared toward. As mentioned above, the Amex Gold offers the industry-best spending bonuses on dining. So, if you’re someone that frequently dines out, then this card is definitely worth considering. Likewise, if you tend to spend a lot on groceries (if you have to shop for a family, perhaps), then this card could also be rewarding.

On top of the spending bonuses for dining offered by this card, the Amex Gold also offers several valuable statement credits for dining, including Uber Eats, Dunkin’, Resy, Grubhub, The Cheesecake Factory, Goldbelly, Wine.com and Five Guys. We’ll discuss these credits and their values in greater depth below.

The Amex Gold Card is also a good choice for individuals who spend a lot on travel. You’ll earn 3X points when booking flights through American Express Travel® and 2X points on hotels and other travel through this portal. So, if you’re willing to book all of your travel through American Express Travel®, you can rack up a ton of points this way. Plus, American Express Travel® has a lowest rate guarantee, meaning they’ll match your price if you find a lower one somewhere else.

We recommend looking through your past bank statements to determine what your top spending categories are. If it turns out that your top two categories are dining and travel, then you’re probably a great candidate for the Amex Gold Card.

Benefits of Using the American Express Gold Card

While the Amex Gold Card charges an annual fee of $325 (see rates and fees), it also offers a ton of benefits that can quickly offset that fee, including a welcome bonus, spending bonuses, statement credits and even more benefits.

So, as you read through the following benefits, we recommend that you calculate the value of the benefits that you think you would use every year. If that annual value exceeds $325, then you may want to consider opening the Amex Gold Card.

American Express Gold Card Welcome Bonus

One of the most valuable benefits of the Amex Gold Card is the welcome bonus for new cardmembers. Here’s the current welcome offer from the Amex Gold Card:

American Express® Gold Card

Earn 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership.

As you can see, you’ll need to spend a certain amount of money on your Amex Gold card within an allotted time period to earn this bonus. So, before you submit your application for the Amex Gold Card, be sure that you’ll be able to hit this spending threshold without overextending your budget.

You should also be aware of the welcome bonus restrictions that Amex places on all of its credit cards. Here is the disclaimer from the Amex Gold Card’s terms and conditions:

“You may not be eligible to receive a welcome offer if you have or have had this Card, the Premier Rewards Gold Card, the Platinum Card®, the Platinum Card® from American Express Exclusively for Charles Schwab, the Platinum Card® from American Express Exclusively for Morgan Stanley or previous versions of these Cards. You also may not be eligible to receive a welcome offer based on various factors, such as your history with credit card balance transfers, your history as an American Express Card Member, the number of credit cards that you have opened and closed and other factors. If you are not eligible for a welcome offer, we will notify you prior to processing your application so you have the option to withdraw your application.”

Over the past several years, the welcome bonus from the Amex Gold Card has fluctuated between 60,000 and 100,000 points. Considering Amex points are worth a minimum of 1 cent apiece, 60,000 points would be worth at least $600, and 100,000 points would be at least $1,000. And by redeeming these points through transfer partners, those points could be worth considerably more than 1 cent apiece. So, this welcome bonus alone is enough to offset the Amex Gold Card’s annual fee for several years.

American Express Gold Card Spending Bonuses

With the Amex Gold Card, you’ll earn at least 1 Amex point on every purchase that you make. You’ll earn even higher rates in certain spending categories. Here are the spending bonuses currently available on the Amex Gold Card:

- 4X points at restaurants worldwide (on up to $50,000 in purchases per calendar year, 1x thereafter)

- 4X points on groceries at U.S. supermarkets (on up to $25,000 in purchases per calendar year, 1X thereafter)

- 3X points on flights booked directly with airlines or on AmexTravel.com

- 2X points on prepaid hotels and other eligible travel purchases booked through AmexTravel.com

- 1X points on all other purchases

The 4X points on restaurants and groceries offered by the Amex Gold Card are some of the best earning rates offered in these categories by any credit card available today, and the rewards earned in these two categories alone can offset this card’s annual fee if you spend a modest amount on dining and groceries each year.

Since both of these categories earn 4X points, you’d need to spend a minimum of $8,125 annually on groceries or dining to earn 32,500 Amex points (which are worth a minimum of $325), meaning you’d offset the Amex Gold Card’s annual fee. For many people, this is an achievable minimum, and it doesn’t even include the other spending bonuses and benefits offered by this card.

Additionally, the Amex Gold Card offers pretty good spending bonuses on travel as well. The 3X points on flights and 2X points on hotels rivals many of the best available travel credit cards. And because the American Express Travel® portal has a lowest rate guarantee, you can rest assured that you won’t be overpaying for travel while earning rewards.

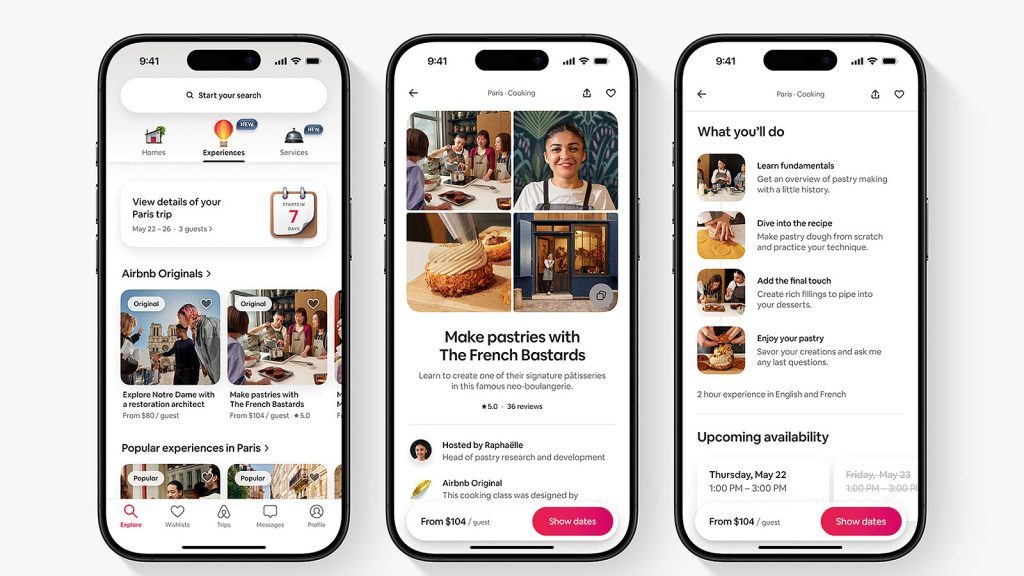

American Express Gold Card Statement Credits

In addition to the value provided by this card’s welcome bonus and bonus categories, the Amex Gold Card includes annual statement credits that are worth more than $500 per year if you use them to the fullest extent.

Here’s a list of the annual statement credits included with the Amex Gold Card:

- Up to $120 Uber Cash credits (up to $10 per month) when you select your Amex Gold Card as your payment method for your Uber or Uber Eats transactions.

- Up to $120 annual dining credits (up to $10 per month) when you pay with your Amex Gold Card at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com and Five Guys. Enrollment required.

- $100 credit toward eligible charges at over 1,000 upscale hotels worldwide every time you book a stay with The Hotel Collection through AmexTravel.com. (Eligible charges vary by property)

- Up to $100 annual Resy credits (up to $50 semi-annually) when you pay with your Amex Gold Card at U.S. Resy restaurants or make other eligible Resy purchases. Enrollment required.

- Up to $84 annual Dunkin’ credits (up to $7 per month) available in the U.S. Dunkin locations. Enrollment required.

Combined, the Resy credit, Dunkin’ credit, Uber Cash and dining credit add up to $424 if you use the monthly maximum credit every month. Plus, the $100 credit at The Hotel Collection is available every time you book a stay with The Hotel Collection (a portfolio of luxury hotels available to book through AmexTravel.com). The amenities to which this $100 credit can be applied varies based on the property. So, if you’re booking a hotel with The Hotel Collection, you should inquire about which amenities are eligible for the $100 credit.

As you can see, if you use these statement credits to the fullest, you can offset your card’s annual fee year after year. If you do sign up for the Amex Gold Card, you’ll want to set reminders for yourself to ensure that you’re taking full advantage of these credits each month.

American Express Gold Card Other Benefits

In addition to the benefits listed above, the Amex Gold Card includes several other benefits, most of which are travel-related and purchase-related. While these benefits are often glanced over, they can save you a lot of money in certain situations. So, if you plan on opening the Amex Gold Card (or another Amex credit card), it’s definitely worth familiarizing yourself with these benefits.

Here are some of the other benefits included with the Amex Gold Card:

- No foreign transaction fees

- Insurance coverage of up to $1,250 for carry-on baggage and up to $500 for checked baggage when you purchase your entire fare for a “common carrier vehicle ticket” with your Amex Gold Card

- Car rental loss and damage insurance coverage if you decline the collision damage waiver (CDW) at the rental counter. Coverage is not available in Australia, Italy and New Zealand.

- Global Assist Hotline available for emergency assistance and coordination services whenever you travel more than 100 miles from home

- Purchase protection for up to 90 dates from the purchase date for loss, theft or accidental damage. This benefit covers you up to $10,000 per claim and $50,000 per calendar year.

- Extended warranty of up to one year on top of manufacturer’s warranty as long as the manufacturer’s warranty is five years or less. Coverage is up to the actual amount charged to your card for items up to a maximum of $10,000. Benefit covers up to $50,000 per calendar year.

These benefits can save you a ton of money in certain situations. For instance, each time you rent a car, you can save hundreds on the collision damage waiver charged by the rental company. If you get in an accident while driving a rental car, the car rental loss and damage insurance could end up saving you thousands of dollars in damages.

Drawbacks of Using the American Express Gold Card

There are a lot of things to love about the Amex Gold Card, and it’s definitely one of the best cards available in terms of dining rewards and travel rewards. However, there are a few drawbacks of this card that you should know.

High Annual Fee

Perhaps the biggest drawback of the Amex Gold Card is its relatively high annual fee of $325 (see rates and fees). With so many credit cards available with lower annual fees or $0 annual fees, many consumers find it difficult to pay hundreds of dollars annually for the Amex Gold Card.

It can also be difficult to pay such a high annual fee if you have limited excess cash every month. The $325 annual fee becomes due at the end of the first month of each cardmember year, and if you’re unable to pay the full annual fee within that month, you could incur interest charges or even hurt your credit score.

With that being said, if you can afford the annual fee charged by the Amex Gold Card, you can easily offset it and still get a lot of value out of this card if you use all of the benefits described above fully.

Points Transfer Fees

One major disadvantage that American Express cards have compared to cards from other major issuers is that the American Express Membership Rewards program charges a fee of $0.0006 per point (with a maximum fee of $99) to transfer points to U.S.-based travel rewards programs.

For example, if you wanted to transfer 80,000 Amex points to Delta SkyMiles, you’d have to pay a fee of $48. If you value those Amex points at 1 cent apiece (meaning that the 80,000 points are worth $800), then this essentially amounts to a 6% fee, which is fairly significant. By contrast, other credit card rewards programs, such as Capital One Rewards or Chase Ultimate Rewards, don’t charge any points transfer fees.

No Trip Delay or Trip Interruption Insurance

Noticeably absent among the benefits offered by the Amex Gold Card is trip delay/interruption insurance, which is included with most other credit cards in the Amex Gold Card’s price range and even with several credit cards that have much lower annual fees.

Trip delay/interruption insurance covers travelers in the event that a part of their travel itinerary is canceled or delayed and they have to incur certain expenses, such as booking a hotel room while you await a rescheduled flight, booking a new flight because your original flight was canceled and more.

Trip delay/interruption insurance is a benefit of the Chase Sapphire Reserve® ($550 annual fee), the Capital One Venture X Rewards Credit Card ($395 annual fee) and the Citi Strata Premier℠ Card ($95 annual fee).

American Express Gold Card Transfer Partners

One of the best features of the American Express Membership Rewards program is the fact that you can transfer points to partner travel rewards programs.

Here’s the current list of travel rewards programs to which you can transfer Amex points:

- Aer Lingus AerClub

- Aeroméxico Rewards (1:1.6 transfer ratio)

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- ANA Mileage Club

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Choice Privileges

- Delta SkyMiles

- Emirates Skywards

- Ethiad Guest

- Finnair Plus

- Hawaiian Airlines HawaiianMiles

- Hilton Honors (1:2 transfer ratio)

- Iberia Plus

- JetBlue TrueBlue (5:4 transfer ratio)

- Marriott Bonvoy

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

- Virgin Atlantic Flying Club

For all programs for which the transfer ratio isn’t specified, the transfer ratio is 1:1. So, for instance, if you were to transfer 100,000 Amex points to the British Airways Executive Club program, you’d receive 100,000 British Airways Avios. However, if you were to transfer 100,000 Amex points to the JetBlue TrueBlue program (which has a 5:4 transfer ratio), you’d receive 80,000 TrueBlue points.

Once again, you should be aware that American Express charges a fee of $0.0006 per point transferred to U.S.-based travel rewards programs (with a maximum fee of $99), including Delta SkyMiles, JetBlue TrueBlue and Hawaiian Airlines HawaiianMiles. So, if you were to transfer 100,000 points to one of these partner programs, you’d need to pay a fee of $60. But if you were to transfer 200,000 points at once, you’d pay the maximum fee of $99.

Despite these fees, transferring points to partner travel programs can often be the best way to maximize the value of your Amex points. When redeemed in other ways, Amex points are typically worth 1 cent apiece. However, when redeemed through transfer partners, you can often get several cents per point in value.

For example, if you redeemed 100,000 Amex points (which would be worth $1,000 toward flights booked through American Express Travel®) through transfer partners, they could be worth $2,000, $3,000 or even more.

American Express® Gold Card

Earn 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership.

The Best and Worst American Express Transfer Partners

As we’ve established, you can often find outsized value for your Amex points by transferring them to partner travel rewards programs. However, not all transfer partners offer the same value per point on average.

If you want to get the most possible value out of your Amex points, here are three American Express transfer partners that tend to offer the most value per point:

- Air Canada Aeroplan

- ANA Mileage Club

- Avianca LifeMiles

Likewise, there are some Amex transfer partners that generally offer lower value per point. So, here are three of the transfer partners that tend to offer the lowest value per point and should probably be avoided:

- Choice Privileges

- JetBlue TrueBlue

- Marriott Bonvoy

Whenever you’re assessing the value of a specific redemption through a transfer partner, find the cash value of the award and then divide that cash value by the number of points that you’ll need to redeem for that award.

For example, if the cash price of an award flight is $300, but you can get that same flight as an award for 15,000 miles, then the value of that redemption would be 2 cents per point ($300 x 100 cents / 15,000 points = 2 cents per point).

Other Cards to Consider

The Amex Gold is a great credit card, especially if you spend a lot on dining and travel. However, before you go ahead and open the Amex Gold, we definitely recommend looking into other similar credit cards and comparing the value that they could provide for you.

To get you started, below are some other credit cards that you may be interested in.

Citi Strata Premier℠ Card

If you’re in the market for a dining and travel rewards credit card, then it’s definitely worth looking into the Citi Strata Premier℠ Card, which has an annual fee of $95, which is $230 lower than the annual fee charged by the Amex Gold Card (see rates and fees).

For a card with a significantly lower annual fee, the Citi Strata Premier still has some impressive spending bonuses. Here are the current earning rates offered by this card:

- 10X points on hotel, car and attractions purchased through Citi Travel

- 3X points on air travel, hotel purchases not made through Citi Travel, restaurants, supermarkets, gas stations and EV charging stations

- 1X points on all other purchases

This card also includes an annual credit of $100 off a hotel stay of $500 or more booked through the Citi Travel portal. Plus, it comes with many of the same travel protection offered by the Amex Gold Card, including lost or damaged luggage insurance and auto rental collision damage waiver. Unlike the Amex Gold Card, the Citi Strata Premier Card includes trip delay/cancellation insurance.

All in all, the Amex Gold Card includes many more dining statement credits than the Citi Strata Premier and offers better spending bonuses on dining and groceries. However, the Amex Gold Card also charges a much higher annual fee and if you aren’t going to use the Amex Gold’s statement credits, then that higher annual fee probably isn’t worth it.

On the other hand, the Citi Strata Premier offers fantastic earning rates on hotels and rental cars through Citi Travel. So, if that’s a major spending category for you, then the Citi Strata Premier might be a great choice for you.

Capital One Savor Cash Rewards Credit Card

If you’re interested in the excellent rewards on dining and groceries offered by the Amex Gold Card but are unwilling to pay its high annual fee or don’t think that you’ll use its statement credits, then you should look into the Capital One Savor Cash Rewards Credit Card.

This cashback card from Capital One doesn’t charge an annual fee and offers excellent spending bonuses on dining, groceries and more. Here are the spending bonuses currently offered by this card:

- 8% cash back on Capital One Entertainment purchases

- 5% cash back on Capital One Travel purchases

- 3% cash back on dining, entertainment, popular streaming services and at grocery stores (except Walmart and Target)

- 1% cash back on all other purchases

The Capital One Savor Cash Rewards Credit Card also offers 0% APR on purchases and balance transfers for the first 15 months after account opening, which is a fairly long APR-free intro period.

While the Capital One Savor doesn’t have any of the statement credits or travel protections offered by the Amex Gold Card, if you want to get good bonuses on dining and groceries without paying a high annual fee, the Capital One Savor is a great option. Plus, if you want a credit card to finance a large purchase or to make a balance transfer, the Capital One Savor is a great option due to its 15-month 0% intro APR period.

Chase Sapphire Preferred® Card

Another great card for dining and travel rewards that has a lower annual fee than the Amex Gold Card is the Chase Sapphire Preferred® Card. This is one of the most popular credit cards on the market due to its combination of a low annual fee and excellent spending bonuses and other benefits.

Here are the earning rates currently available to the Chase Sapphire Preferred Card members:

- 5X points on travel purchased through Chase Travel℠

- 3X points on dining (including eligible delivery services, takeout and dining out), online grocery purchases (excluding Target, Walmart and wholesale clubs) and select streaming services

- 2X points on other travel purchases

- 1X points on all other purchases

The Chase Sapphire Preferred also includes a complimentary 12-month DoorDash DashPass membership, which includes $0 delivery fee and lower service fees, when you activate your membership by Dec. 31, 2027. The Sapphire Preferred also includes travel and purchase protections, including auto rental coverage, baggage delay insurance, trip delay/cancellation insurance, travel and emergency assistance, purchase protection and extended warranty.

So, if you’re looking for a credit card with a lower annual fee than the Amex Gold Card and you want to earn good rewards on travel and dining, then the Chase Sapphire Preferred is an excellent alternative. Plus, Chase points are worth 25% more when redeemed through Chase Travel℠, which is a great option if you don’t want to redeem through transfer partners.

Is the American Express Gold Card Worth It?

With the high annual fee of $325 (see rates and fees) charged by the Amex Gold Card, you may be wondering whether or not it’d be worth it to apply for this card. The answer to that question depends on your spending habits and how likely you are to use the statement credits and other benefits offered by the Amex Gold Card and whether you’re able to pay this card’s annual fee.

In terms of the value of the Amex Gold’s spending bonuses, we recommend looking back on your spending categories from the previous year and calculating how many Amex points you’d earn with the same spending patterns as the Amex Gold. Many banks will automatically generate annual spending reports, regardless of whether that spending was done on debit card or credit card.

For example, let’s say that you spent $4,000 annually on dining, $7,000 annually on groceries, $2,000 on flights, $1,000 on hotels and $8,000 on all other expenditures. If you were to shift all of this spending to the Amex Gold Card, you’d earn the following number of Amex points:

Spending category Total expenditures Spending bonus Potential Amex points earned Dining $4,000 4X 16,000 Groceries $7,000 4X 28,000 Flights $2,000 3X 6,000 Hotels $1,000 2X 2,000 Other $8,000 1X 8,000 Total $22,000 – 60,000

At the spending levels above, you’d stand to earn 60,000 Amex points from that $22,000 in spending. Since Amex points are worth at least 1 cent apiece, those 60,000 points would be worth at least $600, which is enough to offset the Amex Gold’s annual fee. So, before you sign up for any credit card, you should do an analysis similar to the one above for your previous year’s spending.

Of course, you should also consider which of the Amex Gold Card’s statement credits and other benefits you’ll use each year and then assign a monetary value to those benefits. For example, if you tend to spend at least $7 at Dunkin’ per month, then the Dunkin’ statement credits benefit is worth the full $84. And, if you think you’ll use the full $10 in monthly Uber Cash credit, then that benefit would be worth the full $120.

On the other hand, if you tend to only stay at budget hotels, then you’re likely to never use the $100 credit to The Hotel Collection included with the Amex Gold Card. And if you live in a state without Dunkin’ locations, you shouldn’t factor in this benefit when calculating the value of the Amex Gold Card.

You should also calculate the potential value of the other benefits provided by the Amex Gold Card, such as rental car insurance, purchase protection, extended warranty and baggage insurance. For instance, if you consistently rent cars, using the Amex Gold Card’s rental car insurance instead of paying for insurance from the rental agency will typically save you $100 or more each time you rent a car.

Finally, consider the value of the welcome bonus currently being offered by the Amex Gold Card and whether you’ll be able to earn that welcome bonus.

Once you calculate the value that the Amex Gold Card’s spending bonuses, welcome bonus and other benefits can provide for you each year, subtract the annual fee to find out how much value you’ll get out of this card.

For instance, if you calculated that the annual value of the benefits offered by the Amex Gold Card to be $1,250, you would then subtract the $325 annual fee and the net annual benefit of this card would be $900.

You could then perform the same calculations for other credit cards that you’re considering to find out which credit card would be best for you.

The Bottom Line

The Amex Gold Card is definitely one of the best dining and groceries rewards credit cards available to consumers today. This card offers 4X points on dining (on up to $50,000 spent per calendar year, 1X thereafter) and 4X points on U.S. supermarkets (on up to $25,000 spent per calendar year, 1X thereafter), and you won’t find better spending bonuses in these categories on an ongoing basis from any other credit card out there. Plus, the Amex Gold Card offers impressive spending bonuses for travel purchases made directly through airlines or through the American Express Travel® portal.

On top of these regular spending bonuses, the Amex Gold Card also offers a large welcome bonus for new cardmembers as well as a suite of statement credits (with a potential value of more than $500) that are available every year to Dunkin’, Resy, Uber, Grubhub, Wine.com and more. With all of these great benefits, you can easily offset the Amex Gold’s annual fee and get a lot of value.

With that being said, it’s still worth looking into some of the other dining- and travel-focused credit cards to determine which credit card is best for you. In particular, we recommend checking out the Citi Strata Premier℠ Card, the Capital One Savor Cash Rewards Credit Card and the Chase Sapphire Preferred® Card as these cards have similar rewards to the Amex Gold and charge lower annual fees.

Nonetheless, the Amex Gold Card is still a great credit card for consumers who spend mostly on dining and travel and may be a fantastic addition to your wallet.

American Express® Gold Card

Earn 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases on your new Card in your first 6 months of Card Membership.

The post A Review of the American Express® Gold Card appeared first on MileValue.

![Odd Couplings [BODY OF EVIDENCE & DAMAGE]](http://2.bp.blogspot.com/_0uQUF0LK0NQ/Svr4k4n2lbI/AAAAAAAAAG8/sKnt2TuDgt4/s320/MADONNA++-++WILLEM+DaFOE.bmp)

![Don’t Look Back [short story]](https://jonathanrosenbaum.net/wp-content/uploads/2011/11/friedrich-mountain-landscape1-300x232.jpg)