Travel retail ‘strategic reset’ well underway as The Estée Lauder Companies improves in Q3

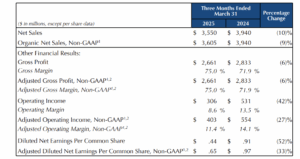

While travel retail’s struggles in the key North Asia markets of South Korea and Mainland China (particularly Hainan) continued to drag, US beauty powerhouse The Estée Lauder Companies today (1 May) posted a better than anticipated Q3 showing, with reported net sales down -10% year-on-year (-9% organic) to US$3.6 billion.

While travel retail’s struggles in the key North Asia markets of South Korea and Mainland China (particularly Hainan) continued to drag, US beauty powerhouse The Estée Lauder Companies today (1 May) posted a better than anticipated Q3 showing, with reported net sales down -10% year-on-year (-9% organic) to US$3.6 billion.

Operating income fell -42% to US$306 million.

President and Chief Executive Officer Stéphane de La Faverie said, “In the third quarter of fiscal 2025, we delivered our organic sales outlook and exceeded profitability expectations.

“We are moving decisively and building momentum as we bring our ‘Beauty Reimagined’ strategic vision to life across its five key priorities. This is evidenced by our prestige beauty share gains in strategic markets like the US, China, and Japan and our mid single-digit organic net sales growth online [we’ll bring you more from Stéphane de La Faverie after today’s earnings call].

Travel retail ‘reset’ well underway

“Our global business organic sales trends, excluding travel retail, showed sequential improvement.

“With the strategic reset of our travel retail business well underway to better reflect recent industry trends and market conditions, and provided there is meaningful resolution of the recently enacted tariffs to mitigate potential related negative impacts, we are confident in our ability to return to sales growth in fiscal 2026.”

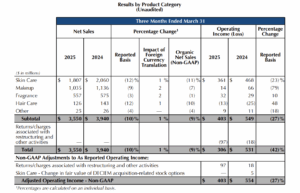

Skincare was the category most affected by the well-documented China and South Korea travel retail doldrums, with net sales down -11% year-on-year. This was primarily due to the decrease in the Asian travel retail business, which in turn drove declines from Estée Lauder and La Mer.

Ongoing subdued sentiment and lower conversion from Chinese consumers also contributed to the skincare decline, the group said.

Other negatives were a difficult comparison to the prior-year period due to the resumption of replenishment orders in the fiscal 2024 Q3 and the company’s strategic decision to reduce its exposure to reseller activity.

Changing travel retailer strategies

The group also highlighted retailer shifts in strategies toward more profitable duty-free business models in both South Korea and Mainland China, which led to lower replenishment orders.

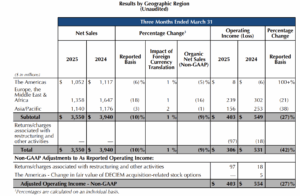

The same factors impacted Europe, the Middle East & Africa (into which global travel retail reports financially) where sales decreased -16% year-on-year as a result.

In Asia Pacific net sales decreased -1%, primarily driven by double-digit declines in Hong Kong and South Korea, partially offset by mid-single-digit growth in Mainland China.

The decline in Hong Kong reflected the company’s strategic decision to reduce its exposure to reseller activity.

The downturn in South Korea was primarily due to the impact of political and social unrest, which reduced retail traffic and dampened retail sales, as well as the strategic exit of Dr.Jart+ from the travel retail channel in November 2024.

More positively, these declines were partially offset by growth in Mainland China for several reasons, including the “partial recapture” of consumer demand in Mainland China from Asia travel retail and Hong Kong and the success of innovation, such as La Mer’s Night Recovery Concentrate.

Bigger travel retail decline in Q4

For its fiscal 2025 full-year outlook, the company is projecting a stronger double-digit net sales decline in Q4 for its global travel retail business compared to Q3, reflecting the impacts from retailer shifts in strategies toward more profitable duty-free business models in South Korea and Mainland China.

Weak consumer sentiment and conversion from Chinese consumers will also contribute, the group said.

“This decline also reflects a difficult comparison to the prior-year period due to the resumption of replenishment orders in the second half of fiscal 2024 as well as the company’s strategic decision to reduce its exposure to reseller activity.”

![Sally Hawkins Gets Bloody in Exclusive ‘Bring Her Back’ Image [Summer Preview]](https://bloody-disgusting.com/wp-content/uploads/2025/04/BHB_08698-2-scaled.jpg)

![‘Havoc’: Gareth Evans Talks Tom Hardy, Virtual Cameras, Christmas Violence & The Possibility Of ‘The Raid 3’ [The Discourse Podcast]](https://cdn.theplaylist.net/wp-content/uploads/2025/04/30222628/%E2%80%98Havoc-Gareth-Evans-Talks-Tom-Hardy-Virtual-Cameras-Christmas-Violence-The-Possibility-Of-%E2%80%98The-Raid-3-The-Discourse-Podcast.jpg)

![Kyoto Hotel Refuses To Check In Israeli Tourist Without ‘War Crimes Declaration’ [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/war-crimes-declaration.jpeg?#)

.jpg)