Opinion: Victorinox’s Gloria Dix on the changing shape of Asia Pacific travel retail

Victorinox Head of Global Travel Retail & Fragrance Sales Gloria Dix explores how emerging brands can seize new opportunities amid shifting consumer demographics in APAC and why she believes that travel retail is still a strategic channel for growth.

Introduction: As the Asia Pacific travel retail landscape continues to evolve, the traditional dominance of heritage luxury brands is being redefined. Victorinox Head of Global Travel Retail & Fragrance Sales Gloria Dix argues that this evolving environment presents a golden opportunity for emerging brands to connect through authenticity, sustainability and innovation.

As the focus pivots toward experience-driven engagement and younger, values-led shoppers, brands able to build emotional resonance and long-term relevance are well placed to thrive in the region’s next chapter.

Asia Pacific continues to have huge appeal to brands as a vibrant and promising region for growth in travel retail, with international departures expected to increase +9% in Q2 compared to 2024 (source: Global Passenger Traffic Monitor, ForwardKeys, 2025).

However, the region is also seeing some interesting dynamics play out, which are changing spending patterns and shopper behaviour. Some larger brands are struggling with this adaptation and the flexibility required, which provides a great opportunity for emerging brands to demonstrate their willingness and power to the market.

This region has been a hotbed of luxury spending for many years, driven mainly by high-spending Chinese shoppers seeking out iconic names, but this is shifting.

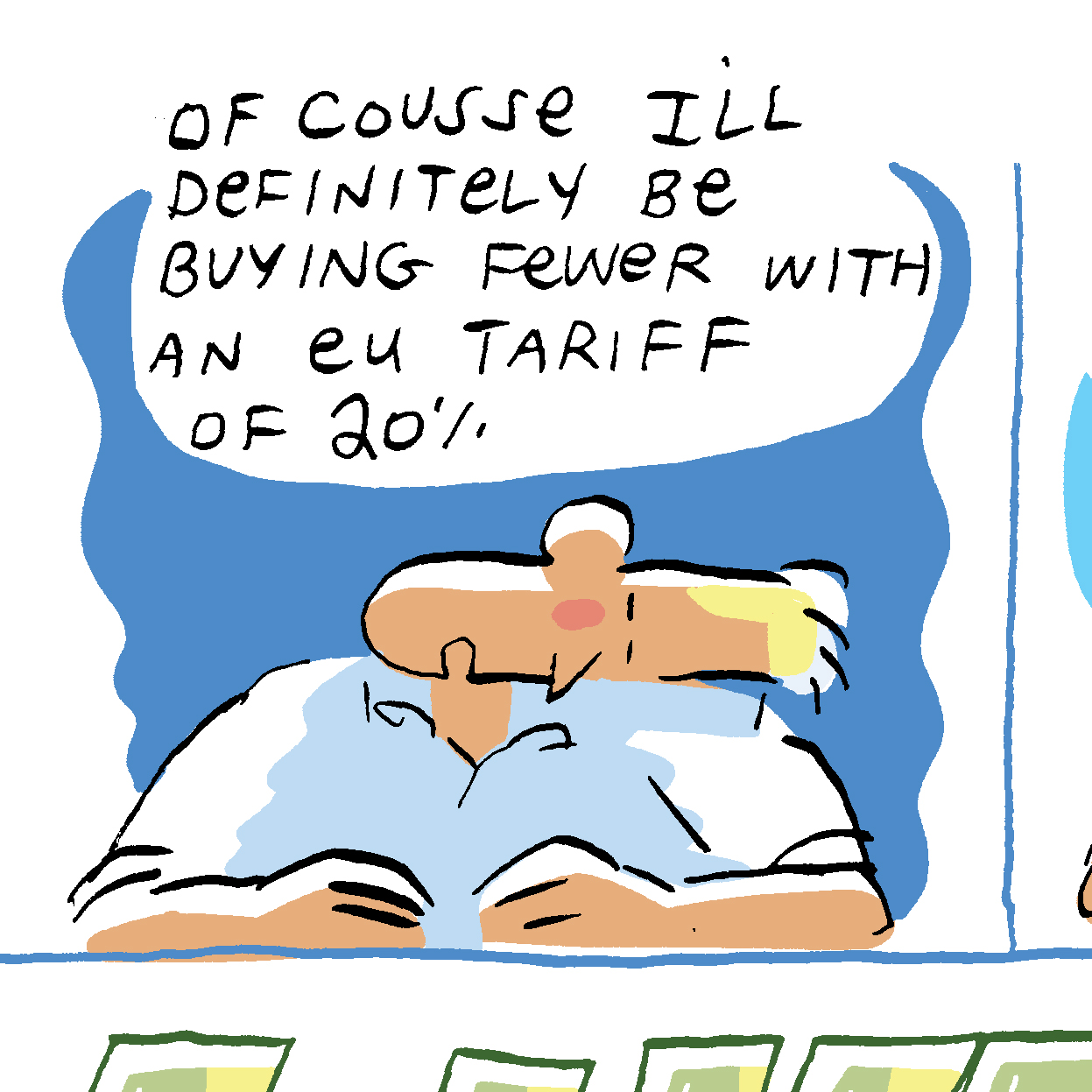

In 2025, only 56% of mainland Chinese luxury consumers plan to increase spending, reflecting cautious optimism and slower growth compared to previous years (source: Prestige). This signals a more careful and experience-focused approach to luxury purchases.

The recent crackdown on the Daigou trade in South Korea has also highlighted a possible over-reliance on Chinese shoppers and created a deficit that retailers will be keen to recover from. If they are not selling high-end beauty and luxury to Chinese shoppers, then they will undoubtedly be looking to reshape their offers in light of this new reality.

At Victorinox, we are committed to strengthening our presence in this dynamic and diverse channel. We see multiple dynamics playing out across the region that present opportunities for premium lifestyle brands that can bring differentiation to a channel which at present has a strong luxury focus.

Living up to our legacy as makers of the Original Swiss Army Knife, we have made it our mission to best prepare travellers for everyday challenges through smart and masterful solutions. Our strategy focuses on fostering meaningful connections with consumers, leveraging innovation, and staying relevant to younger generations while preserving the timeless appeal and quality of our Swiss-made craftsmanship.

Travel retail: A strategic channel for growth

Travel retail is the ideal setting for a brand like Victorinox, which spans multiple categories and offers a diverse range of high-quality, functional products.

With 37% of travellers identifying quality perceptions as their primary purchase driver according to m1nd-set, Victorinox is well-positioned to meet this demand. Unlike everyday items, our products invite deeper engagement to truly appreciate their craftsmanship, versatility and value. Whether discovering the precision behind a travel bag or personalising an accessory, the true depth of Victorinox products are revealed through time and exploration.

In Asia Pacific shoppers have a below-average tendency to buy on impulse (m1nd-set), highlighting the need for consumers to engage and familiarise themselves with items before buying. Airports, with their captive audience, provide the perfect environment for travellers to connect with the brand, transforming the shopping experience into a memorable journey of discovery rather than a quick transaction.

Appealing to the younger generation

Young generations are a key focus in travel retail, especially in the APAC region. In 2025, Gen Z are predicted to make up about 30% of China’s population, making them the second-largest Gen Z group in the world after India. As they become a major force in the travel market, their preferences are starting to shape the industry.

According to m1nd-set, almost three-quarters of China’s Gen Z workforce say that travelling abroad is a big reason they want to earn money, more important to them than traditional goals. To engage this demographic, it is essential to connect with them in ways that reflect their values.

Gen Z shoppers are drawn to stores with inviting and visually appealing environments, says m1nd-set, underscoring the importance of creating eye-catching designs and campaigns that resonate with them. They also place a high value on peer recommendations, with about three-quarters trusting friends and influencers more than any other source when making purchasing decisions. This highlights the critical role social media plays in shaping their shopping behaviour.

Additionally, personalisation resonates strongly with this group. Victorinox taps into this trend with products such as Swiss Army Knives and travel accessories across various regions. Last Christmas, Victorinox Travel Retail collaborated with local artists in Macau to offer personalised Swiss Cards, a compact, multi-functional tool shaped like a credit card.

Younger generations are eager to express themselves and connect with products in unique ways. Creating emotional connections through experiences that evoke happiness and excitement is key to driving engagement.

Sustainability and conscious shopping: Meeting the demands of the modern consumer

In today’s increasingly eco-conscious market, sustainability is no longer a choice but a necessity. Around two-thirds of shoppers state that environmentally friendly values are of importance to them when purchasing in travel retail, according to m1nd-set. This also aligns with the values of younger consumers, with 57% of Gen Zs saying they purchase more from brands that are authentically preserving the environment.

Victorinox is dedicated to meeting these demands by incorporating sustainability into every aspect of our business. For example, our core product, the Swiss Army Knife, is crafted from over 80-90% recycled steel, and this commitment is gradually being extended to our other categories.

In addition, we design packaging to use only what’s necessary, with much of it being recyclable. We also take pride in the quality of our products, offering warranties that exceed industry standards and comprehensive repair and refurbishing services to extend the lifecycle of our products.

This approach resonates particularly well with the APAC market, where, according to m1nd-set, 72% of shoppers place importance on eco-friendly production processes of products.

Challenges and opportunities in the APAC market

While we are optimistic about the future, we also recognise the challenges in entering the APAC market, particularly when competing with established brands. These big brands have large budgets that allow them to dominate the market with high-profile ambassadors with superstar status, where we take a softer approach to bringing through the local relevance via regional influencers. However, the challenges being faced by the luxury sector suggest that change is required if travel retail is to remain relevant.

We see this as an opportunity to differentiate ourselves. By staying true to our core values, we continue to carve out a unique space in the market, appealing to consumers who value quality, authenticity and genuine connections.

At Victorinox we make sure that we have a harmonised pricing strategy, a clearly defined model that distinguishes local markets and travel retail pricing. This ensures duty-free pricing for the consumers buying through our channel.

The path forward

Our strategy in the APAC region was built with a focus on Greater China, with plans for expansion into Korea, Thailand, Singapore, and other Southeast Asian markets. We hope to leverage our global network of business partners while also exploring opportunities with new regional heroes to enhance our distribution channels.

As we look to the future, Victorinox Travel Retail is committed to growing in the APAC region by continuing to foster deeper connections with consumers, offering personalised and meaningful experiences, and remaining agile in the face of changing trends. In a market as diverse as APAC, our ability to adapt, listen and connect will determine our long-term success.

We are making a shift in focus from the more general to the specific. Recent years have seen a transformation in how we show up in stores and online. New retail and wholesale concepts, website and campaign refreshes, and a new approach to packaging all underlined by our guiding principle that being prepared makes life better. That means being prepared not only for growth, but to answer the needs of an evolving consumer base in APAC travel retail.

![‘Predator: Badlands’ – Dan Trachtenberg Previews His “Big, Crazy Swing” [Interview]](https://bloody-disgusting.com/wp-content/uploads/2025/04/image-26.jpg)

![Last Chance Before Southwest Ends Open Seating: 90s Legend Kato Kaelin’s Barf Bag Hack Scores Empty Middle Seat [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/kato-kaelin-southwest.jpg?#)

-Classic-Nintendo-GameCube-games-are-coming-to-Nintendo-Switch-2!-00-00-13.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![[Podcast] Unlocking Innovation: How Play & Creativity Drive Success with Melissa Dinwiddie](https://justcreative.com/wp-content/uploads/2025/04/melissa-dinwiddie-youtube.png)