La Prairie Q1 revenues hit by travel retail and China market headwinds

In a challenging market environment in China, the brand faced persistent headwinds in travel retail. Beiersdorf responded with a significant reduction of stock levels during the first quarter, especially in Hainan.

Beiersdorf’s luxury skincare brand La Prairie posted a -17.5% year-on-year decline in organic sales for the quarter from January to March 2025 against a strong 2024 baseline.

In a challenging market environment in China, the brand faced persistent headwinds in the travel retail channel. Beiersdorf responded to this with a significant reduction of stock levels during the first quarter, especially in the key Hainan offshore duty-free sector.

Addressing concerns about stock levels in Hainan and travel retail for Q2, Beiersdorf CEO Vincent Warnery said during an earnings call: “At this time, we have absolutely the right level of stocks not only in China brick-and-mortar, but in China travel retail, in Hainan, so we have exactly the number of weeks we’re expecting. And this is why I’m more optimistic regarding China and, in particular, La Prairie for the quarters to come.”

While the company expects Q2 growth to remain flat, it remains optimistic about La Prairie’s outlook for the second half of the year, with a stronger rebound in Q3 and Q4. Key drivers include upcoming product launches, a refreshed brand image and strong ecommerce performance, particularly in China.

When asked about the potential market reallocation of La Prairie products, Warnery highlighted the brand’s shift away from its previous heavy reliance on the Chinese market, both domestically and in travel retail. China currently represents less than 40% of La Prairie’s business as the brand diversifies its focus, expanding its presence in the USA and Europe, and entering India with strong prospects.

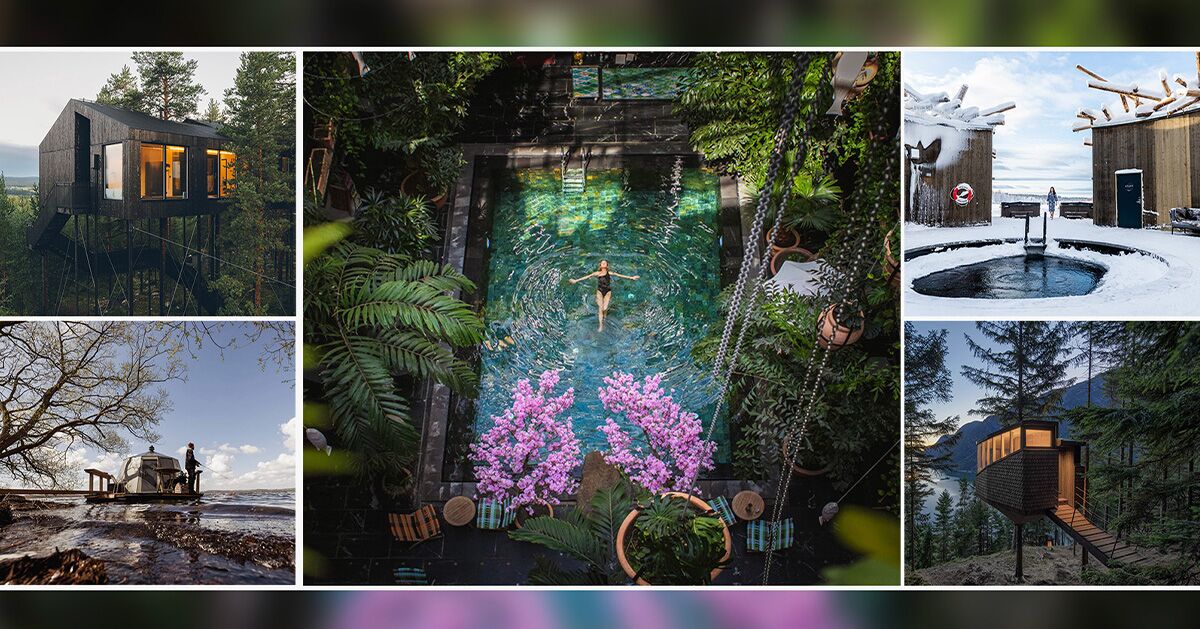

In addition, La Prairie is expanding its travel retail presence in previously untapped markets.

Across the group, Beiersdorf delivered a strong start to the year, with revenues reaching €2.7 billion in Q1, up +3.6% (organic terms).

The positive performance was driven by the Consumer Business segment, which saw sales reach €2.3 billion, organic growth of +2.3%, mainly benefitting from the Derma business.

The tesa Business segment reported €441 million in revenue, reflecting +10.7% organic growth.

Warnery said, “In a continuously dynamic market environment, Beiersdorf’s positive performance in the first quarter of 2025 was fully in line with our expectations. It was driven by our ongoing commitment to expanding into white spaces and delivering breakthrough innovations. In addition, we are putting our house in order in China to set the foundation for future growth.”

The company’s Nivea brand drove strong performance with +2.5% organic sales growth, while its Derma brands Eucerin and Aquaphor saw even higher growth at +11.4% (organic).

While Q1 met targets, Beiersdorf noted persistent economic headwinds present short-term planning challenges.

Looking ahead, the company said it remains proactive in adjusting to market conditions, while focusing on sustainable growth as it navigates challenges in the near future.

![‘Predator: Badlands’ – Dan Trachtenberg Previews His “Big, Crazy Swing” [Interview]](https://bloody-disgusting.com/wp-content/uploads/2025/04/image-26.jpg)

![Last Chance Before Southwest Ends Open Seating: 90s Legend Kato Kaelin’s Barf Bag Hack Scores Empty Middle Seat [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/kato-kaelin-southwest.jpg?#)

-Classic-Nintendo-GameCube-games-are-coming-to-Nintendo-Switch-2!-00-00-13.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.jpg?#)

![[Podcast] Unlocking Innovation: How Play & Creativity Drive Success with Melissa Dinwiddie](https://justcreative.com/wp-content/uploads/2025/04/melissa-dinwiddie-youtube.png)