The Estée Lauder Companies to face lawsuit over China daigou issues

Shareholders in the action said The Estée Lauder Companies became dependent in China on the reseller trade after the COVID-19 pandemic began, particularly in Hainan province.

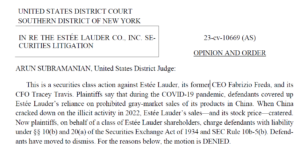

The Estée Lauder Companies (ELC) and the group’s former CEO Fabrizio Freda and CFO Tracey Travis are to face a lawsuit that claims shareholders were defrauded over the American beauty group’s alleged concealment of its overdependence on daigou-related sales in China, a United States District Judge ruled yesterday (31 March).

ELC had sought dismissal of the case, arguing there was no proof of fraudulent intent, nor that any legally actionable false statements had been issued causing shareholder losses.

Their request was denied by District Judge Arun Subramanian in a ruling obtained by The Moodie Davitt Report. ELC declined to comment when contacted by us.

The plaintiffs argue that during the COVID-19 pandemic, defendants covered up ELC’s reliance on grey-market sales of its products in China. When China cracked down on the illicit activity in 2022, ELC’s sales – and its stock price – “cratered”, the ruling says.

Judge Subramanian said shareholders identified “several misleading omissions” in the company’s disclosures, related to how the group had been negatively impacted by a Chinese national and local government crackdown on the reseller market from January 2022.

Shareholders in the action said The Estée Lauder Companies became dependent in China on the daigou trade after the COVID-19 pandemic began, particularly in the offshore duty-free haven of Hainan province.

They claimed the beauty powerhouse concealed the truth about how the island-wide crackdown was impacting sales until 1 November 2023, causing the group’s share to plunge -19%, wiping out some US$8.7 billion of market value.

More to follow.

![“Tokyo Ghoul” and Ken Kaneki Now Available in ‘Dead by Daylight’ [Trailer]](https://bloody-disgusting.com/wp-content/uploads/2025/04/dbdtokyo.jpg)

![Extended: Buy Marriott Bonvoy Points with a 45% Bonus [0.86¢ or ₹0.74/Point]](https://boardingarea.com/wp-content/uploads/2025/04/46523d48a9dbea5cac3a9961201c257d.jpg?#)

![Miles & More Mileage Bargains Promo Awards [Apr’25]](https://boardingarea.com/wp-content/uploads/2025/04/335d951d4569e7d51813bc1c8be3a5d1.jpg?#)

.png?#)

.jpg?width=1920&height=1920&fit=bounds&quality=80&format=jpg&auto=webp#)