‘60 Minutes’ vs. a Corporate Merger? You’ve Seen This Movie Before – in ‘The Insider’

In key ways, the resignation of EP Bill Owens mirrors the 30-year-old scenario portrayed in the 1999 Michael Mann thriller The post ‘60 Minutes’ vs. a Corporate Merger? You’ve Seen This Movie Before – in ‘The Insider’ appeared first on TheWrap.

Stop me if you’ve heard this one: “60 Minutes” faces pressure from its corporate bosses in order to grease the wheels on a proposed merger, leading to accusations that journalistic integrity has been sacrificed on the altar of profit.

While that applies to Paramount Global’s current jockeying with the Trump administration as the company seeks approval for its $8 billion Skydance Media merger, it also describes what happened 30 years ago, when “60 Minutes” caved to CBS’ lawyers to avoid putting a roadblock in the way of its planned acquisition by Westinghouse.

At the time, it was a Mike Wallace segment on “60 Minutes,” interviewing tobacco industry whistleblower Jeffrey Wigand, who at great personal risk exposed how his former employer, Brown & Williamson, and others in the tobacco industry had consciously sought to mislead the public about the addictive effects of nicotine and dangers of their cancer-causing products.

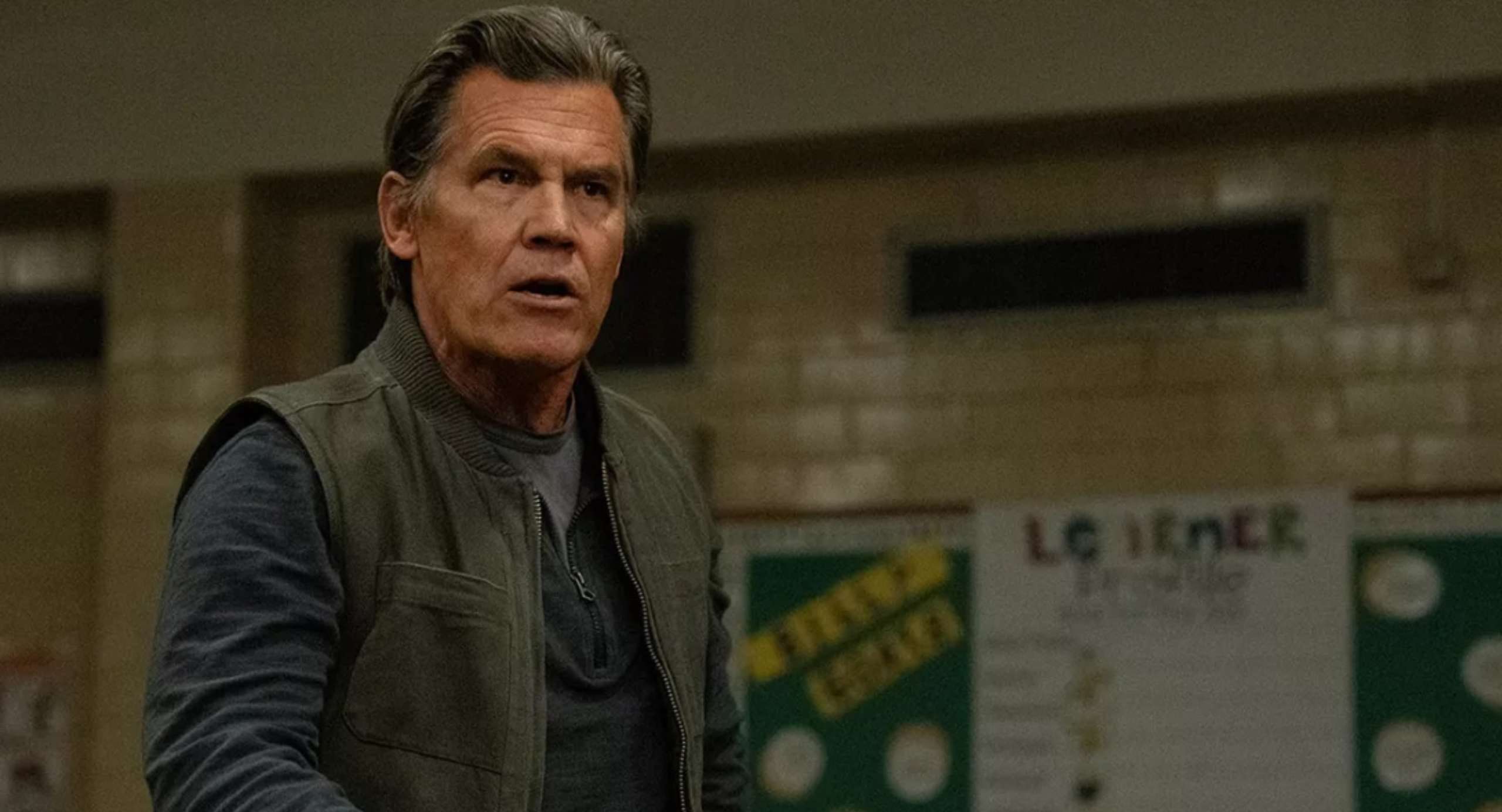

The events of that period were dramatic enough to inspire the 1999 Michael Mann-directed film “The Insider,” starring Al Pacino as CBS producer Lowell Bergman and Russell Crowe as whistleblower Wigand.

For those who see CBS’ possible capitulation to Trump as a major setback for the venerable newsmagazine, it’s a reminder that tension between corporate ownership and journalism has reared its ugly head before, and not always with a heroic “All the President’s Men”-style ending.

Indeed, in 2016, 20 years after the Wigand piece finally aired, then-“60 Minutes” executive producer Jeff Fager called it “probably the most important story that was ever reported by ’60 Minutes,’” and the decision to yank the segment “a low point in our history.”

If that was a low point, it could soon have company, as Paramount mulls a settlement with Trump in his lawsuit over what the president has maintained was misleading editing of a “60 Minutes” profile of Kamala Harris broadcast before the election, litigation that journalists and legal scholars both inside and outside of CBS News widely see as frivolous.

During a press conference Monday, FCC chairman Brendan Carr said that the Trump lawsuit had “nothing to do with the work that we’re doing at the FCC,” but those who have watched the commission under his stewardship could be forgiven for viewing those remarks with skepticism.

Last week, the longtime executive producer of “60 Minutes,” Bill Owens, took a principled stand in the face of corporate cowardice, leaving the program while referring to his “diminished independence” in overseeing the show. The news sent shock waves through the news division and beyond, given the prestige that the venerable newsmagazine still commands even in a hollowed-out linear-TV environment.

Like their predecessors, the current corporate brass under Paramount Global Chairwoman Shari Redstone also have bigger fish to fry — in this case, seeking to safeguard the merger with Skydance that the Trump administration has made clear will not happen without capitulation in the “60 Minutes” lawsuit.

Notably, the current “60 Minutes” team has already publicly pushed back more aggressively than key figures did on the Wigand story, with Scott Pelley delivering a bracing closing note to Sunday’s broadcast regarding Owens’ departure. Acknowledging the pending merger, Pelley said Paramount “began to supervise our content in new ways,” adding, “No one here is happy about it.”

There are some obvious distinctions from what transpired three decades ago, beginning with the fact that CBS feared litigation from a private company, not coercion from the federal government. Yet the question of a corporation buckling under pressure — and undermining the standing of “60 Minutes” in the process — is close enough in the broad strokes to feel eerily similar.

Conducted by the legendary Mike Wallace, the Wigand interview didn’t air as initially planned because the legal department feared a multibillion-dollar lawsuit for interfering with Wigand’s confidentiality agreement with tobacco giant Brown & Williamson. The pressure came after ABC — on the verge of its acquisition by the Walt Disney Co. — had faced, and settled, a $10 billion libel lawsuit by another cigarette maker, Philip Morris, against ABC News over a segment on one of its newsmagazines. (That, too, has echoes of Disney’s $15 million settlement of a Trump lawsuit against ABC’s news division, prompted by George Stephanopoulos’ references to Trump having been found liable in the case brought by E. Jean Carroll.)

CBS began its negotiations with Westinghouse in September 1995, a month after that settlement was announced, which clearly played on the minds of the network’s legal team and executives.

Surprisingly, given their reputations, neither Wallace nor the founding executive producer of “60 Minutes,” Don Hewitt, significantly fought back against the legal department, Bergman recalled in a 2012 interview, not long after Wallace’s death at the age of 93.

“I couldn’t understand why they folded,” Bergman said, citing the clout Wallace possessed within the organization. “I would say objectively that he didn’t agree with what they were doing, but he wasn’t willing to say, ‘I’m not going to let this stand.’”

As PBS’ “Frontline” noted in a documentary about the Wigand episode, CBS actually gave in without facing a formal lawsuit. The larger backdrop, however, was that then-CBS owner Laurence Tisch was seeking to finalize the network’s sale to Westinghouse, and the mere threat of a massive lawsuit could have potentially jeopardized the $5.4 billon deal.

The question raised by CBS’ actions then, as “Frontline” framed it, has echoed through the intervening years — namely, “As media companies increasingly come under the control of large corporations, what is the threat posed to news gathering and the public’s right to know?”

The fact “60 Minutes” has survived another 30 years underscores that the public-relations blow struck by the Wigand story wasn’t a fatal one, but the reputational damage — to Wallace and the larger franchise — did linger. It’s worth noting, too, that the era in which these cases played out in the mid-1990s marked what in hindsight can be seen as the beginning of the end for the dominance of the broadcast networks, as Fox, the WB and UPN joined the growing influence of cable to gradually chip away at their power.

“60 Minutes” has continued to produce laudable journalism, but the program operates today in a much different, more fragmented media environment. While Paramount management is clearly engaged in a calculation about the value of the merger versus whatever harm knuckling under to Trump might inflict on the CBS News brand, history will likely judge the prospect of caving in under these circumstances at least as harshly, and likely more so, than the network’s actions in 1995.

CBS eventually aired the Wigand interview almost a full year after the piece was originally scheduled and pulled. Ironically, a subsequent Vanity Fair article, titled “The Man Who Knew Too Much,” would be acquired by the studio that had essentially started it all, Disney, and become the foundation for “The Insider.”

In addition to media industry skittishness, Wigand’s story also reflected the enormous power the tobacco companies possessed in the 1990s, and the extent to which they would go to protect their product and profits — including their CEOs lying to Congress about whether nicotine qualified as an addictive substance.

In his two-decades-later appraisal, Fager concluded that no one at “60 Minutes” did anything wrong, and the situation was “just mishandled.”

Yet that assessment, understandably, came from his perspective as a newsman. Because based on the priorities of lawyers at CBS corporate, then and likely now, the situation was in fact “handled” in precisely the cover-your-assets manner they intended.

The post ‘60 Minutes’ vs. a Corporate Merger? You’ve Seen This Movie Before – in ‘The Insider’ appeared first on TheWrap.

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.png)

![[Podcast] Smarter Brand Growth: How to Align Marketing & Sales (with ABM/ABX) with Jennifer Mancusi](https://justcreative.com/wp-content/uploads/2025/04/jennifer-mancusi-26.png)