Suntory Global Spirits records steady revenue growth despite challenging 2024

Despite a challenging macroeconomic landscape, the Japanese spirits company achieved +4% increase in year-on-year revenue, +3.7% increase in operating income and +2% profit increase in FY2024.

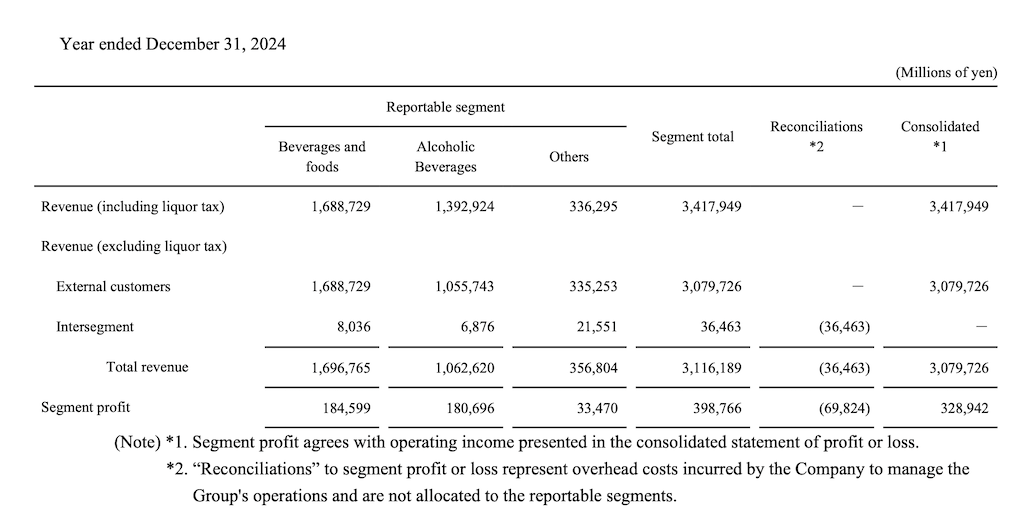

Suntory Group’s alcohol beverage division (including Suntory Global Spirits) reported a +1.1% rise year-on-year in FY2024 revenue, which reached ¥1,392 billion (US$9.2 billion), including liquor tax. Excluding liquor tax, revenue was ¥1,055 billion (US$6.9 billion) up +1%, while operating income rose +2.9% year-on-year to ¥180.7 billion (US$1.2 billion).

Suntory Group reported a record year of revenue across the company’s three primary business segments, Alcoholic Beverages (Suntory Global Spirits), Beverages and Foods, and Others. Including liquor tax, overall group revenue reached ¥3,417 billion (US$22.5 billion), reflecting a +4% year-on-year increase. Excluding liquor tax, revenue stood at ¥3,079 billion (US$20.2 billion), a +4.3% rise.

Suntory Holdings President & Chief Executive Officer Takeshi Niinami commented: “2024 was a challenging year, as global cost increases and inflation persisted, leading to economic stagnation in many countries. As a result, market conditions and the competitive environment deteriorated across multiple regions and businesses.

Suntory Holdings President & Chief Executive Officer Takeshi Niinami commented: “2024 was a challenging year, as global cost increases and inflation persisted, leading to economic stagnation in many countries. As a result, market conditions and the competitive environment deteriorated across multiple regions and businesses.

“However, even under such challenging conditions, Suntory Group leveraged its strengths as a global, multifaceted beverages company, and achieved record-high revenue and operating income for the full year.”

Spirits division overcomes challenging year

Suntory Global Spirits achieved steady revenue growth, including and excluding liquor taxes, despite a challenging macroeconomic environment. The segment demonstrated strength in key product categories, including Ready-To-Drink (RTD) beverages, Japanese whisky and American whiskey.

Jim Beam saw low-single-digit growth in both sales and volume. Within the House of Suntory portfolio, Japanese craft gin Roku experienced low-single-digit sales growth, while premium whisky brands Hibiki and Yamazaki recorded double-digit growth.

In the RTD category, On The Rocks delivered double-digit sales and volume growth, supported by the introduction of new flavours. The -196 brand, which expanded into Europe, the USA and Southeast Asia in 2024, achieved high-single-digit growth in both sales and volume.

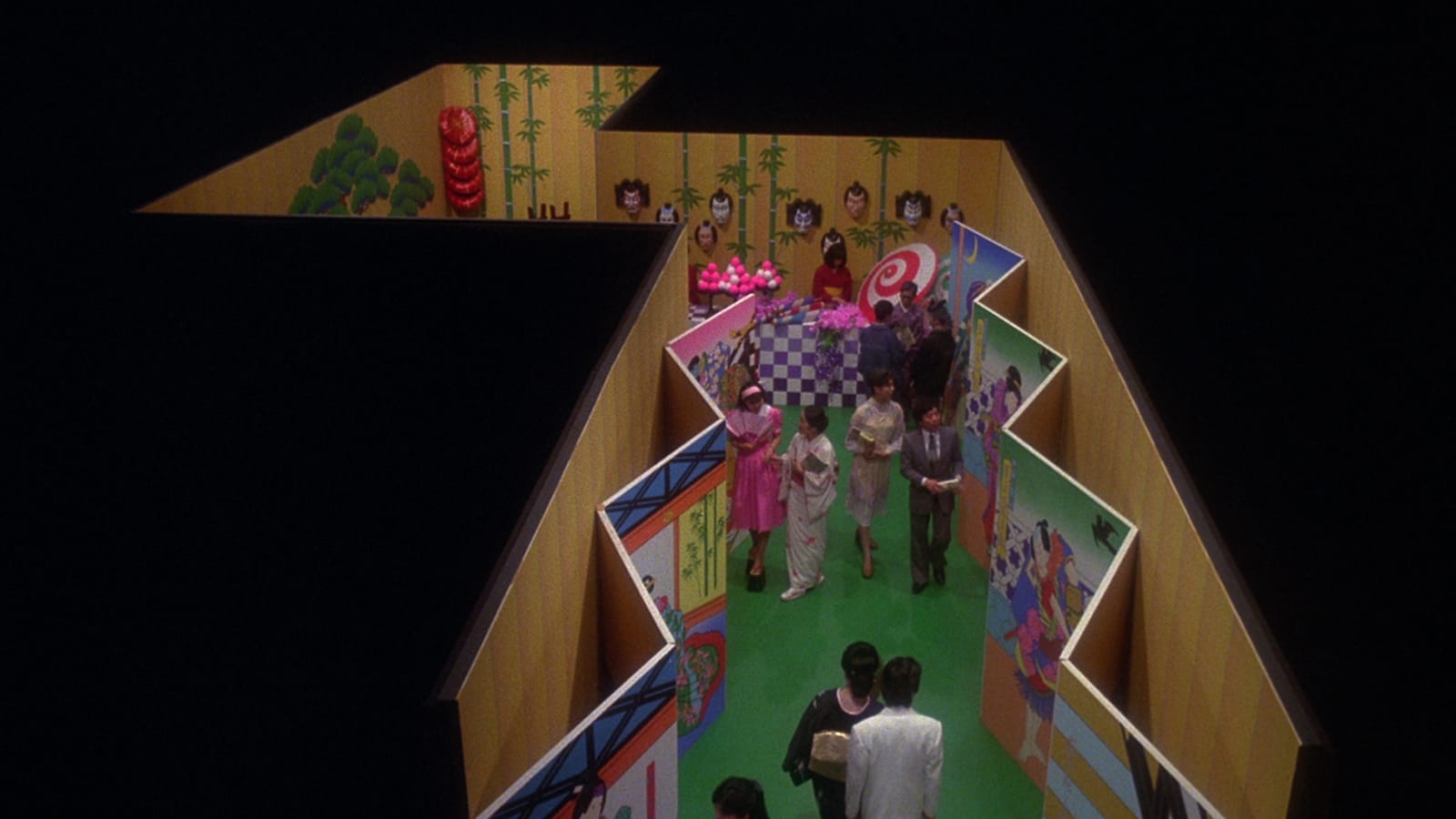

Asia Pacific was a key growth driver, with strong performances in South Korea and Japan. In the latter, Suntory continued to cultivate Western liquor culture through whisky and gin.

Niinami added: “In April last year, on the tenth anniversary of our integration with Beam Inc., we changed the company name to Suntory Global Spirits. This represents the culmination of our corporate integration efforts, and it serves as proof that Suntory Group successfully came together as one to overcome the immense challenge of such an integration.

“Suntory’s broad portfolio spanning both alcoholic beverages and soft drinks is rare, not just in Japan but globally, and is a unique strength of Suntory. Leveraging our deep expertise and high quality in both categories, we are aiming to become the number one leader and ‘gold medalist’ in the globally promising growth market of the RTD category.

“As consumer values become more diverse, we will leverage our strength of having a broad product portfolio to revitalise the market and create new demand in alcoholic beverages. In particular, we will accelerate growth in the non-alcoholic beverages category, where we have newly established a dedicated department,” he added.

Fiscal year 2025 outlook

Suntory Group forecasts continued revenue growth across its segments in the coming financial year. It projects alcohol beverage sales (including liquor tax) to reach ¥1,418 billion (US$9.3 billion), a +1.8% increase year-on-year. Excluding liquor tax, it expects the segment to reach ¥1,081 billion (US$7.1 billion) representing a +2.4% rise year-on-year.

In the whisky category, Suntory will continue to leverage its diverse brand portfolio to drive demand for premium offerings, with a strong emphasis on Japanese whisky, including Kakubin.

In the gin segment, Suntory intends to enhance consumer engagement and drive further demand by elevating quality and introducing new dining experiences with its Roku and SUI brands.

For FY2025, total group revenues including liquor tax are forecast to reach ¥3,560 billion (US$23.4 billion) reflecting a +4.2% year-on-year increase. Excluding liquor tax, revenue is projected at ¥3,210 billion (US$21.1 billion), also up +4.2%.

Niinami said: “In 2025, Suntory Group will continue its offensive and take on challenges, united under the spirit of One Suntory, One Family, and achieve sales that surpass last year. Meanwhile, operating profit is expected to decline due to factors including the impact of last year’s business divestitures.

“Nevertheless, we will set ambitious goals, and all employees in the Group will come together to take the offensive to achieve them.

“Suntory Group’s purpose is ‘To inspire the brilliance of life’, by creating rich experiences for people, in harmony with nature. Through our products, services and all our activities, we strive to bring smiles to as many people as possible around the world.”

![First-Person Psychological Horror Title ‘The Cecil: The Journey Begins’ Arrives on Steam April 3 [Trailer]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/03/cecil.jpg?fit=900%2C580&ssl=1)

![‘It Ends’ Review: The Kids Are Not Alright In Alex Ullom’s Evocative Existential Horror Debut [SXSW]](https://cdn.theplaylist.net/wp-content/uploads/2025/03/12223138/it-ends-sxsw.jpg)

![Silver Airways Can’t Pay for Planes—So It’s Firing Pilots Instead [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/01/silver-airways.jpg?#)

![[FINAL WEEK] Platinum Status And 170,000 Points: IHG’s New $99 Credit Card Offer Worth Getting And Keeping](https://viewfromthewing.com/wp-content/uploads/2016/06/IMG_3311.jpg?#)

.jpg?#)

![[Podcast] Should Brands Get Political? The Risks & Rewards of Taking a Stand with Jeroen Reuven](https://justcreative.com/wp-content/uploads/2025/03/jeroen-reuven-youtube.png)