JetBlue Sells Venture Capital Subsidiary, JetBlue Ventures

This seems like a sensible move, and I’m surprised it took this long…

This seems like a sensible move, and I’m surprised it took this long…

SKY Leasing acquires JetBlue Ventures subsidiary

In 2016, JetBlue founded JetBlue Ventures, a subsidiary that has been investing in early-stage startups in emerging enterprise technology and frontier tech solutions, across the travel and transportation ecosystem.

Over nearly a decade, JetBlue Ventures has invested in 55 startups, and has made over 40 follow-on investments, resulting in eight exits, in the form of acquisitions and public offerings. There’s an update when it comes to this side hustle…

The airline has today announced that it’s dumping JetBlue Ventures, and that it has been acquired by SKY Leasing, an aviation investment manager. As it’s described, this “will usher in the next era of growth for JetBlue Ventures, with expanded opportunities to support founders and scale game-changing technologies by leveraging SKY’s deep industry relationships, global reach, and access to capital.”

JetBlue will continue to serve as a strategic partner to JetBlue Ventures and its portfolio companies. JetBlue Ventures will also continue to be led by Amy Burr, as before. JetBlue Ventures will keep the same branding as part of a licensing agreement, and will continue to manage all current and future investments, with JetBlue continuing to hold positions in all existing portfolio companies. The terms of the transaction were not disclosed.

Here’s how JetBlue CEO Joanna Geraghty describes this move:

“We founded JetBlue Ventures to invest in, incubate, and partner with early-stage startups that would shape the future of travel, and by all measures it’s been an incredible success. As we look at the needs of our airline today, we are fully focused on our JetForward strategy to get JetBlue back to profitability and set us up for long-term success as we compete against the legacy carriers. This transaction enables us to focus on our core airline operations, while maintaining our access to the innovations and opportunities of current and future portfolio companies through our ongoing strategic partnership with JetBlue Ventures.”

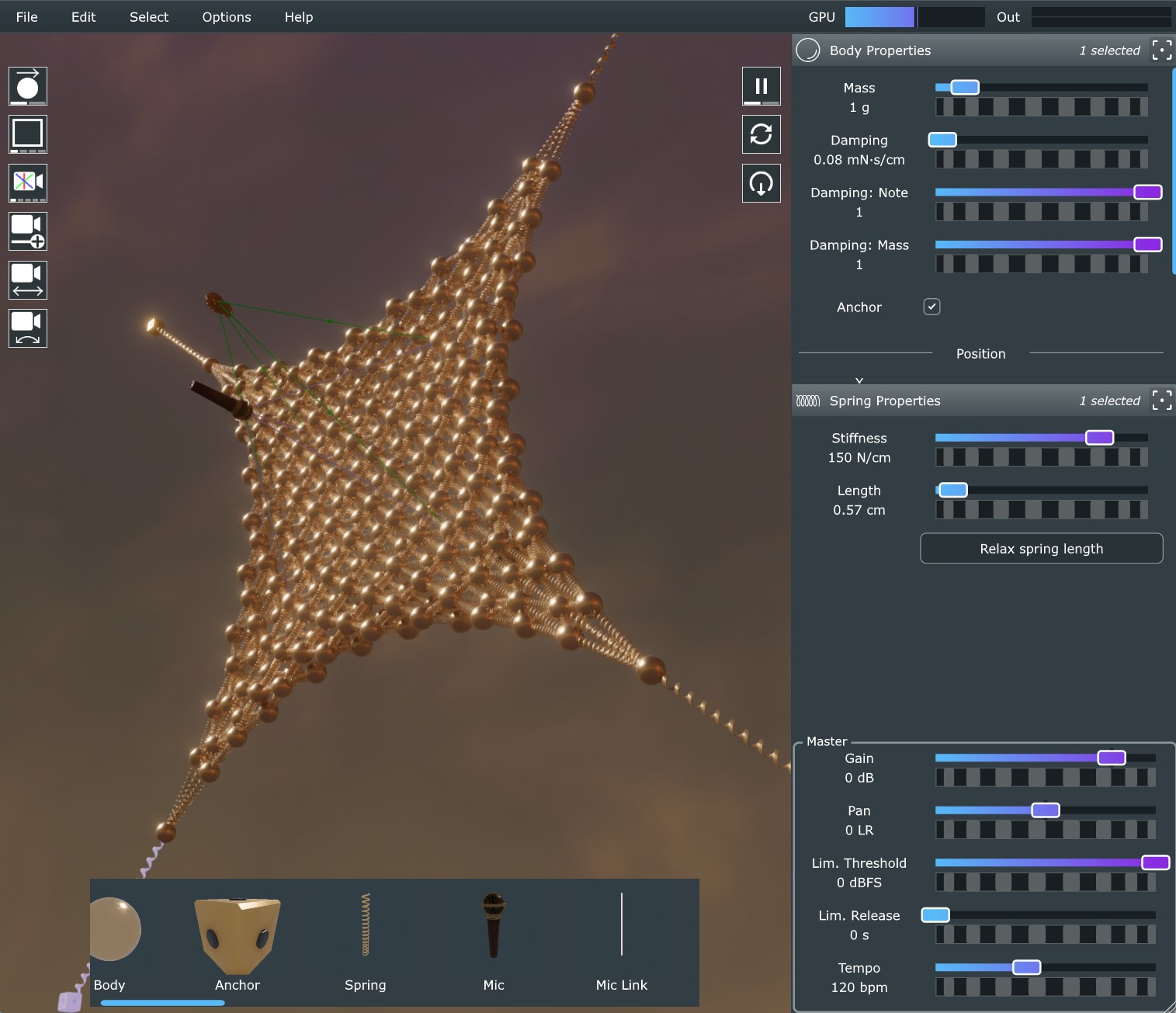

Below is a promotional video about JetBlue Ventures from a couple of years back.

It seems logical for JetBlue to not focus on this

It’s not uncommon to see airlines set up subsidiaries to invest in new technology. However, this has seemed a bit odd in recent years, given JetBlue’s efforts to return to profitability, and focus on the core of its business. JetBlue should be investing in itself to ensure it has a future, rather than investing in other parties.

JetBlue’s current management team is doing a good job focusing on the core of the operation, and I think that’s important. Meanwhile former CEO Robin Hayes was just all over the place, and focused on all kinds of shiny things, from a big push for (questionable) transatlantic flying, to trying to acquire Spirit, without much regard for the bottom line.

It is interesting that under new ownership, JetBlue Ventures will continue to have the same management team and branding as before. I’d be fascinated to know about the economics of this subsidiary, and how successful the investments have been.

Bottom line

JetBlue has dumped its JetBlue Ventures subsidiary, as it has been taken over by SKY Leasing. Given JetBlue’s struggles with profitability, it seemed a bit odd that the airline kept investing in other companies, even while claiming to be focused on going back to the basics, and restoring profitability. JetBlue’s current management team is willing to make those tough decisions, and I think that’s probably the right move.

What do you make of JetBlue selling its JetBlue Ventures subsidiary?

![2025 Best Credit Card Bonus Offers [May]](https://viewfromthewing.com/wp-content/uploads/2015/03/credit-cards.jpg?#)

.jpeg?#)