United MileagePlus Elite Status (PQPs) With Credit Card Spending: Worth It?

The ”big three” US carriers make a large percentage of profits from their loyalty programs, and in particular, their lucrative co-brand credit card agreements. As part of this, we’re increasingly seeing airlines offer ways to earn elite status through credit card spending.

The “big three” US carriers make a large percentage of profits from their loyalty programs, and in particular, their lucrative co-brand credit card agreements. As part of this, we’re increasingly seeing airlines offer ways to earn elite status through credit card spending.

Chase and United have a portfolio of co-branded credit cards, and thanks to a recent refresh of the cards, it’s possible to earn MileagePlus Premier elite status either partly or entirely through credit card spending.

This is an area where United has followed both American and Delta. The AAdvantage Loyalty Points system lets you earn AAdvantage elite status with credit card spending, while the SkyMiles Medallion Qualifying Dollar system lets you earn SkyMiles elite status with credit card spending.

In this post, I want to take a closer look at how credit card spending counts toward status with United, and talk about whether it’s worth it.

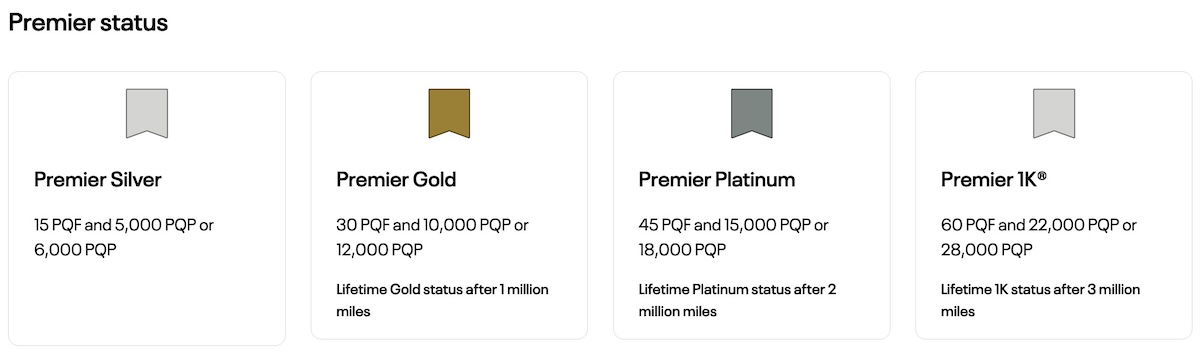

United MileagePlus Premier status requirements

United MileagePlus has four published Medallion elite tiers (in addition to Global Services). Elite status is earned on an annual basis, and can be earned either exclusively through Premier Qualifying Points (PQPs), or through a combination of PQPs and Premier Qualifying Flights (PQFs).

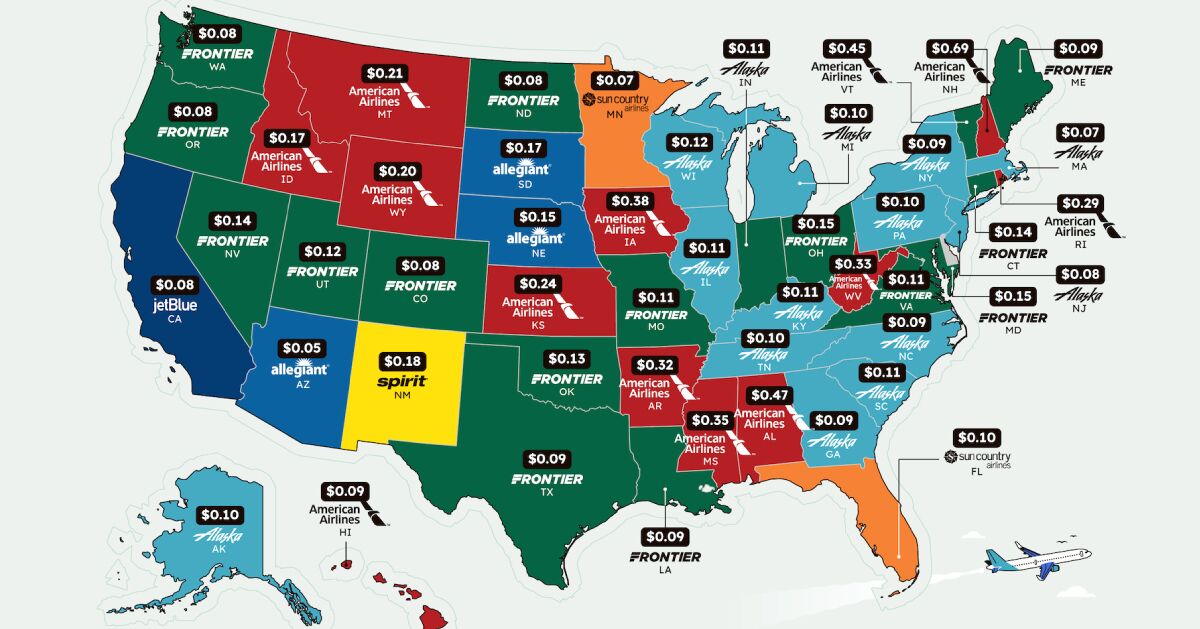

For the 2025 program year, United MileagePlus elite requirements are as follows:

- Premier Silver requires 15 PQFs and 5,000 PQPs, OR just 6,000 PQPs

- Premier Gold requires 30 PQFs and 10,000 PQPs, OR just 12,000 PQPs

- Premier Platinum requires 45 PQFs and 15,000 PQPs, OR just 18,000 PQPs

- Premier 1K requires 60 PQFs and 22,000 PQPs, OR just 28,000 PQPs

You generally earn one PQP per eligible dollar spent on airfare, and you generally earn one PQF per eligible flight taken.

How credit card spending counts toward United elite status

It’s possible to earn United MileagePlus PQPs with United’s credit cards. The earnings rates depend on which card you have, as follows:

- The New United Club℠ Card (review) and United Club Business Card earn one PQP for every $15 spent, up to 28,000 PQPs per year

- The New United Quest℠ Card (review) earns one PQP for every $20 spent, up to 18,000 PQPs per year

- The New United℠ Business Card (review) earns one PQP for every $20 spent, up to 4,000 PQPs per year

- The New United℠ Explorer Card (review) earns one PQP for every $20 spent, up to 1,000 PQPs per year

A few things to note:

- These PQP limits are cumulative, so you could always max out the PQP limits on multiple cards (not that you’d need to)

- Starting in 2026, the United Club Card will offer a head start of 1,500 PQPs per year, while the United Quest Card will offer a head start of 1,000 PQPs per year

- As you can see, the United Club Card can earn you enough PQPs to earn 1K status, while the United Quest Card can earn you enough PQPs to earn Platinum status

If you’re going to be serious about earning PQPs through credit card spending, there’s a significant advantage to using the United Club Card. It offers the best PQP earning rate for spending, and also has the highest cap, so that you can spend your way all the way to 1K status, should you want to.

Just to crunch the numbers on spending with the United Club Card (not factoring in the head start of 1,500 PQPs, since that only kicks in as of 2026), if you’re earning one PQP for every $15 spent, Silver status requires $90,000 in spending, Gold status requires $180,000 in spending, Platinum status requires $270,000 in spending, and 1K status requires $420,000 in spending.

Opportunity cost of United credit card spending

Is there merit to spending $90,000 to $420,000 per year on a United credit card to qualify for one of these status tiers? Let me crunch some numbers, based on my valuation of points:

- United MileagePlus miles are worth 1.1 cents each

- Points with the major transferable currencies are worth 1.7 cents each

Assuming you’re spending in a non-bonused category (which would generally have the lowest opportunity cost, compared to dining, groceries, or gas, for example):

- You could be earning 1x United MileagePlus per dollar spent, which I value at a 1.1% return

- You could be earning up to 2x transferable points on some other cards, which I value at a 3.4% return

Specifically, you could earn 2x transferable points with the following cards:

- The Capital One Venture X Business (review) offers 2x Capital One miles per dollar spent, with no caps

- The Citi Double Cash® Card (review) offers 2x ThankYou points per dollar spent, in conjunction with the Citi Strata Premier℠ Card (review)

- The Blue Business® Plus Credit Card from American Express (review) offers 2x Membership Rewards points on the first $50,000 spent every calendar year (and then 1x points)

Now, people may have different valuations of points currencies, and that’s fine, as you can adjust the math accordingly. But by my math, the opportunity cost of using a co-branded United credit card is ~2.3%.

In other words, spending $420,000 on a United credit card (which would outright earn you 1K status) would “cost” you $9,660, not factoring in annual fees.

Even those who mostly earn United status through credit card spending are probably at least partly earning status through flying, and are using some sort of a hybrid approach. After all, it doesn’t make sense to spend so much to earn elite status if you’re not actually going to use the perks.

Is it worth pursuing United elite status this way?

Now that we’ve covered the amount of effort that it takes to earn United MileagePlus elite status through credit card spending, I think the logical question is whether it’s worth it. For example, if you go for 1K status, what are the benefits, really?

- You get unlimited complimentary first class upgrades within North America; the catch is that United sells a vast majority of first class seats, so actually getting upgraded isn’t easy

- There are some lounge access perks, though nowadays there are many ways to access United Clubs, and if you have the United Club Card, you get access anyway

- You get Star Alliance Gold status, which gets you recognition across the Star Alliance

- You can 320 PlusPoints if you make it to 1K, which you can redeem for upgrades, including to Polaris business class on long haul flights

Personally I’d struggle to make the math work on the value proposition of this. The exception is if you’re a frequent United flyer, and you make it most of the way to status without credit card spending, and simply use cards to top off your PQP total. If you usually find a way to fly in a premium cabin, there aren’t many incremental perks to having elite status, really.

I think it’s also worth emphasizing that United requires a lot more spending to earn status than American and Delta do. And we’re not just talking by a little, but by a lot…

Bottom line

Nowadays United MileagePlus Premier status can be earned primarily based on how many Premier Qualifying Points (PQPs) you rack up. You can earn one PQP per dollar spent with United, or one PQP per $15-20 spent on select United credit cards, up to certain limits.

With the United Club Card, it’s possible to earn 1K status exclusively through credit card spending, though it’ll be costly. You earn one PQP per $15 spent, and need 28,000 PQPs, so that translates to $420,000 in spending. That’s way more than American or Delta require to earn their top status.

I’d say that earning United status through credit card spending typically isn’t worth it, unless you’re just topping off your account, and getting most of the way there with flying.

What’s your take on spending to earn United MileagePlus Premier status?

![Until Dawn Director David F. Sandberg Had To Convince His Colleagues To Attempt In-Camera Special Effects [Exclusive]](https://www.slashfilm.com/img/gallery/until-dawn-director-david-f-sandberg-had-to-convince-his-colleagues-to-attempt-in-camera-special-effects-exclusive/l-intro-1745417437.jpg?#)

![Last Chance Before Southwest Ends Open Seating: 90s Legend Kato Kaelin’s Barf Bag Hack Scores Empty Middle Seat [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/kato-kaelin-southwest.jpg?#)

.jpg)

![[Podcast] Unlocking Innovation: How Play & Creativity Drive Success with Melissa Dinwiddie](https://justcreative.com/wp-content/uploads/2025/04/melissa-dinwiddie-youtube.png)