LVMH Sales Fall 3% in Q1 2025

LVMH on Monday shared its financial results for the first quarter of 2025, revealing that sales fell 3% to €20.3 billion EUR in the three months ending March 31. Per Reuters, the results were well below analysts' expectations of 2% growth, as the conglomerate struggles to buoy amid the ongoing luxury slowdown.The group's key fashion and leather goods division, which houses heavyweight names like Louis Vuitton, LOEWE, Dior, and Fendi, saw sales fall 5%. Notably, analysts forecasted a 0.55% decline in the category, which makes up 75% of LVMH's overall profit. Elsewhere, the company's wine and spirits division saw sales decline by 9%, while perfume and cosmetics both dropped by 1%. Watches and jewelry, meanwhile, remained constant.The cause of such sluggish numbers is one part caused by post-pandemic spending fatigue, another the product of high inflation rates, and a third the product of a slowing economy, mounting debt crisis, and real estate crash in China, a target market for high-end labels. In the US, President Donald Trump's tariff announcements have eliminated any hopes that American shoppers would spend more on luxury this year."Investor concerns around underlying demand recovery are likely to be amplified based on these results," analysts at RBC told Reuters, adding that tariff-related risks will likely contribute to additional earnings cuts.See LVMH's full financial report for Q1 2025 here.Click here to view full gallery at Hypebeast

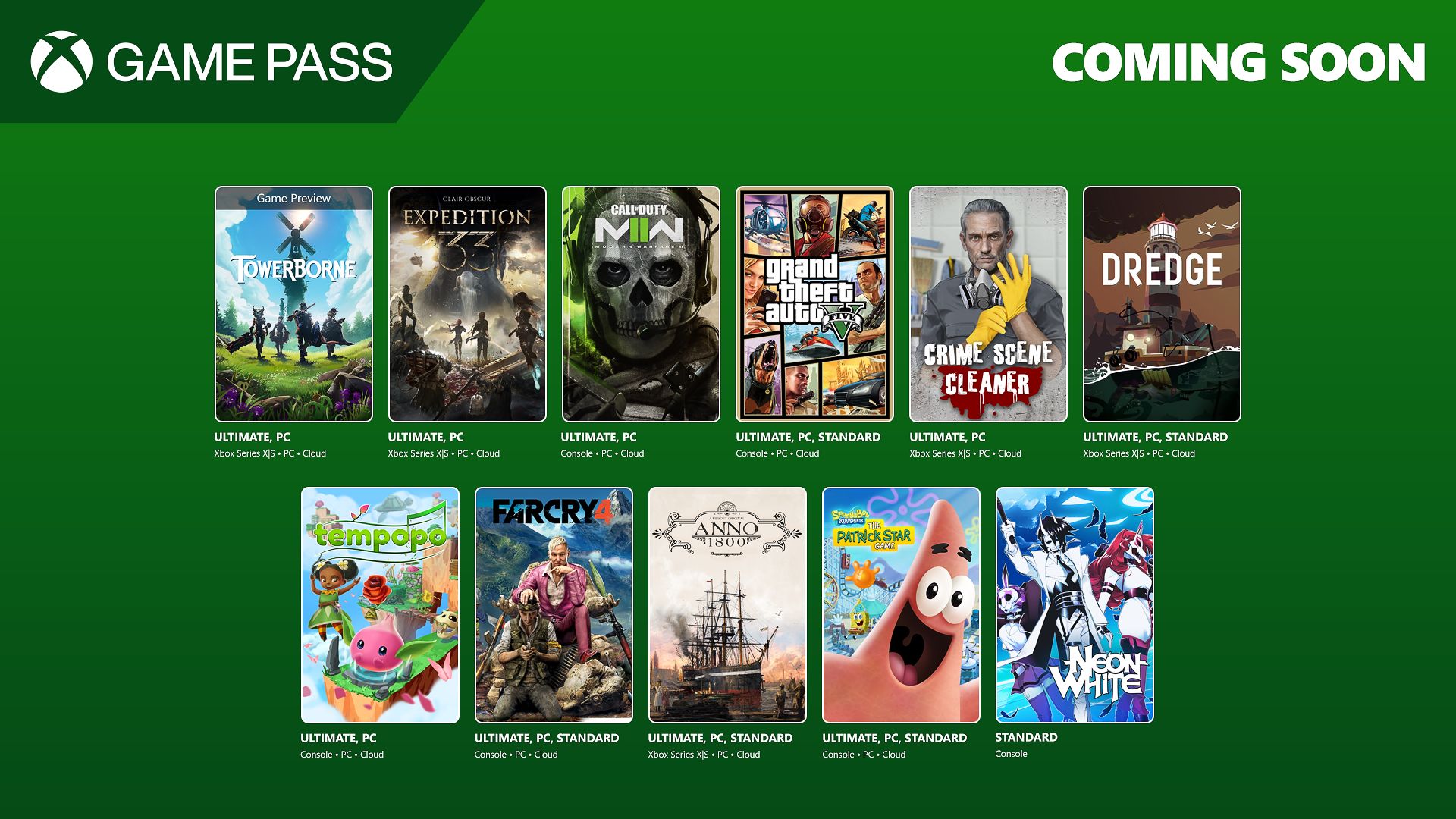

LVMH on Monday shared its financial results for the first quarter of 2025, revealing that sales fell 3% to €20.3 billion EUR in the three months ending March 31. Per Reuters, the results were well below analysts' expectations of 2% growth, as the conglomerate struggles to buoy amid the ongoing luxury slowdown.

The group's key fashion and leather goods division, which houses heavyweight names like Louis Vuitton, LOEWE, Dior, and Fendi, saw sales fall 5%. Notably, analysts forecasted a 0.55% decline in the category, which makes up 75% of LVMH's overall profit. Elsewhere, the company's wine and spirits division saw sales decline by 9%, while perfume and cosmetics both dropped by 1%. Watches and jewelry, meanwhile, remained constant.

The cause of such sluggish numbers is one part caused by post-pandemic spending fatigue, another the product of high inflation rates, and a third the product of a slowing economy, mounting debt crisis, and real estate crash in China, a target market for high-end labels. In the US, President Donald Trump's tariff announcements have eliminated any hopes that American shoppers would spend more on luxury this year.

"Investor concerns around underlying demand recovery are likely to be amplified based on these results," analysts at RBC told Reuters, adding that tariff-related risks will likely contribute to additional earnings cuts.

See LVMH's full financial report for Q1 2025 here.

![How That Shocking Death in the “Daredevil: Born Again” Season Finale Came Together [Spoilers]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/04/OTK-109-59461_R-scaled.jpg?fit=2560%2C1707&ssl=1)

![‘Haruki Murakami Manga Stories Vol. 3’ Gives Foreboding Fiction a Macabre Makeover [Review]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/04/Haruki-Murakami-Manga-Stories-Vol-3-Car-Attack.jpg?fit=1400%2C700&ssl=1)

![THE NUN [LA RELIGIEUSE]](https://www.jonathanrosenbaum.net/wp-content/uploads/2019/12/TheNun-300x202.jpg)

![Courtyard Marriott Wants You To Tip Using a QR Code—Because It Means They Can Pay Workers Less [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/tipping-qr-code.jpg?#)