How I accidentally paid taxes with my wife’s Business Platinum card

One of the great things about running a successful business (Frequent Miler) is that I get to pay a lot in taxes. I know, I know… “great” and “taxes” don’t usually go together, but since it’s possible to pay taxes with a credit card (see our guide here), I appreciate the opportunity to meet minimum […] The post How I accidentally paid taxes with my wife’s Business Platinum card appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

One of the great things about running a successful business (Frequent Miler) is that I get to pay a lot in taxes. I know, I know… “great” and “taxes” don’t usually go together, but since it’s possible to pay taxes with a credit card (see our guide here), I appreciate the opportunity to meet minimum spend requirements for new card welcome bonuses, to spend my way to elite status, or to simply earn a profit by using a card that earns more cash back than the tax payment fee. It ought to be easy… and it usually is… but I messed up this time. Here’s the story…

How I accidentally paid taxes with my wife’s card…

My intention was to pay most of my tax bill with my Bank of America Travel Rewards business card. Thanks to having Platinum Honors for Business, the card earns 2.62% back towards travel. But the rewards are not really just for travel: I can move the points to my Premium Rewards card and then cash them out as needed. So the card functions as a 2.62% cash back card for me.

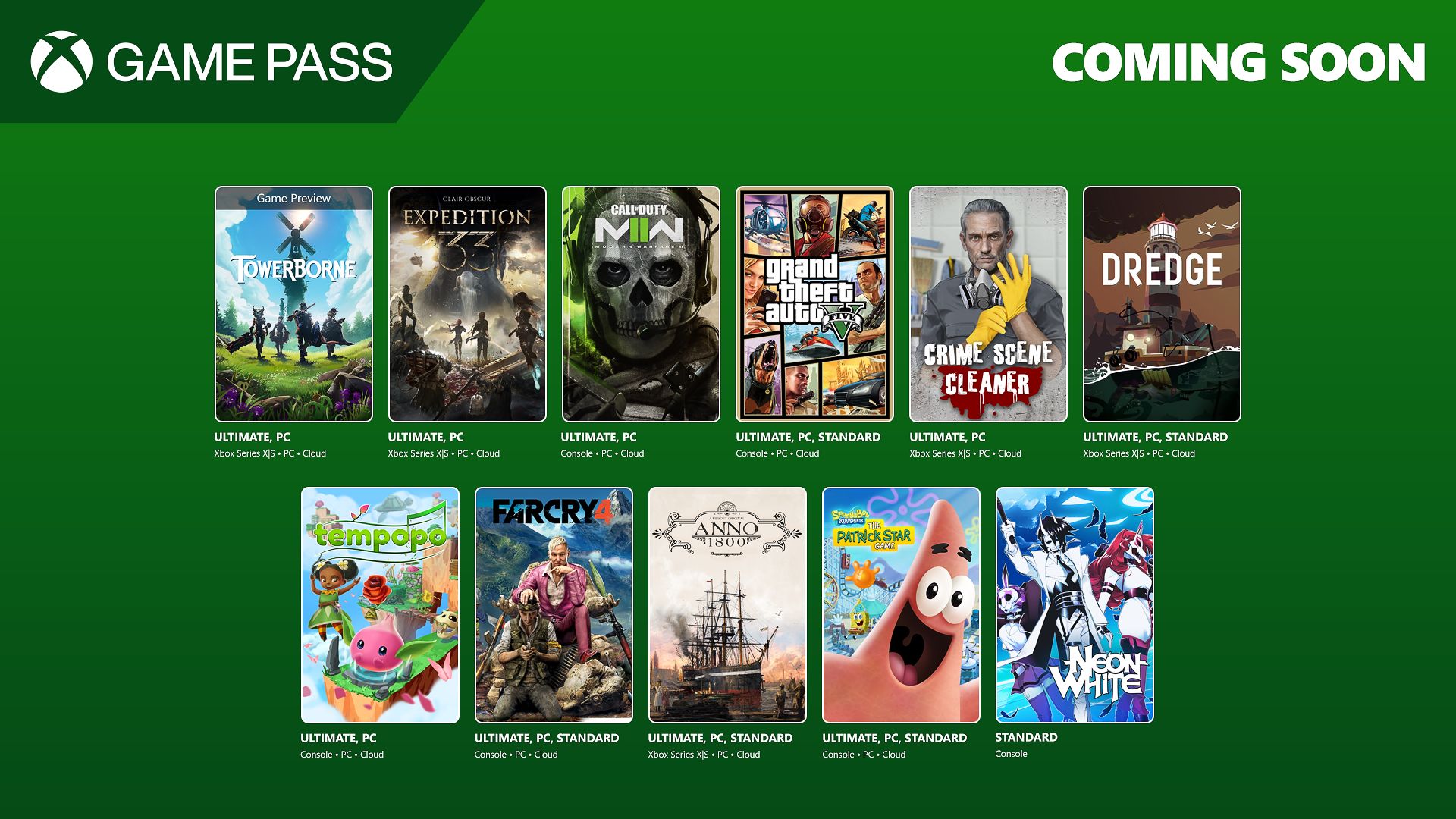

Currently, you can pay your taxes through two primary payment-processors with the following fees:

- Pay1040:

- Credit Card: 1.75%

- Commercial Credit Card: 2.89%

- ACI Payments:

- Credit Card: 1.85%

- Corporate Credit Card: 2.95%

In both of the above cases, when using my 2.62% back Bank of America card, I would earn a profit if charged the standard credit card fee (1.75% or 1.85%).

I started with Pay1040 since it has the lowest credit card fee of 1.75%. Unfortunately, Pay1040 treated my card as a Commercial Card. They wanted to charge 2.89%. No thanks! I tried paying through PayPal just in case that would make my card look like a consumer credit card. That didn’t work. Pay1040 still wanted to charge 2.89%.

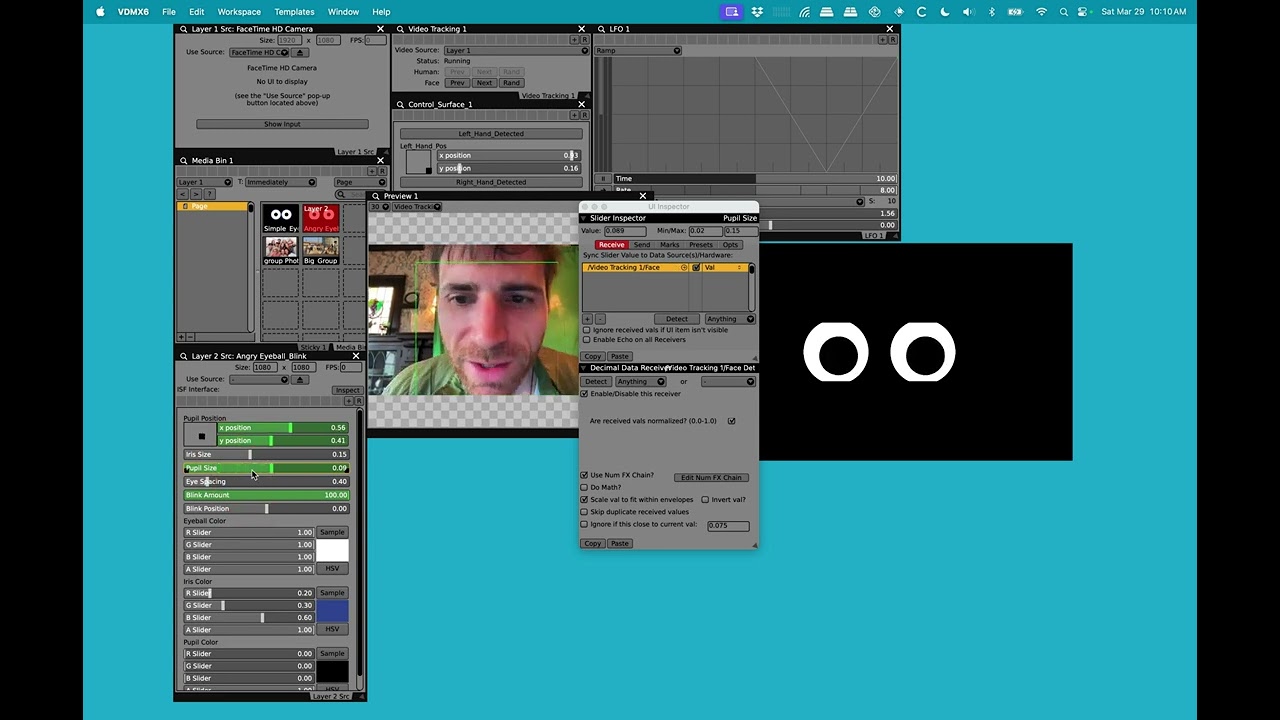

Next, I tried ACI Payments. On my first attempt, the system simply refused to process my payment due to it being a business card. That’s OK, our guide to tax payments has the answer: pay via PayPal. So, that was my next attempt…

By selecting to pay with my Bank of America business card via PayPal, ACI Payments was fine with the card and showed that it would charge me only 1.85%. Perfect. I clicked the button to process the payment and received an error message. The payment didn’t go through. The payment amount was very close to the available credit on my card so I figured that maybe I had gone over the limit.

I tried again with a slightly smaller tax payment. This time I got a text message from Bank of America saying that the payment was declined and asking if I had used my card for that amount. I replied Yes and it said to reattempt the charge. Fine…

After clearing the fraud alert, I attempting the charge yet again. This time, there was no message from Bank of America, and ACI Payments said that the purchase was successful, but I got texts from three other banks saying that the charge was declined. Whaaaat!!!? It took me a beat to realize what had happened. PayPal apparently decided on its own initiative to march through the credit cards in my PayPal wallet and charged each one until the charge went through. The one that accepted it was my wife’s Business Platinum card. And the card that accepted the 1.85% fee was my Hilton Surpass card.

Next time: Clear PayPal wallet first!

Over time I’ve added credit cards to my PayPal Wallet for whatever random reasons there were at the time. Now I need to clear them all out, especially before making any more purchases through PayPal! If the card I intend to charge declines a purchase, I want to know about it. I don’t want those charges going to other cards!

It could have been worse

With many cards in my PayPal Wallet, I would have earned only 1 point per dollar from this spend, but I earned 1.5x instead. The Business Platinum card earns 1.5 points per dollar on purchases of $5,000 or more and the tax payment easily qualified for that. With the 1.85% fee, it was like buying Membership Rewards points for around 1.2 cents each. Since we’re already flush with Membership Rewards points, that’s not a price that I’d go out of my way to pay, but I’m also not too upset about it.

Even the fact that the 1.85% fee was charged to my Hilton Surpass card turned out fine. I want to complete $15K of spend on that card this year in order to earn a free night certificate. This got me a little bit closer to that goal.

The post How I accidentally paid taxes with my wife’s Business Platinum card appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

![‘Haruki Murakami Manga Stories Vol. 3’ Gives Foreboding Fiction a Macabre Makeover [Review]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/04/Haruki-Murakami-Manga-Stories-Vol-3-Car-Attack.jpg?fit=1400%2C700&ssl=1)

.png?format=1500w#)

![THE NUN [LA RELIGIEUSE]](https://www.jonathanrosenbaum.net/wp-content/uploads/2019/12/TheNun-300x202.jpg)

![Courtyard Marriott Wants You To Tip Using a QR Code—Because It Means They Can Pay Workers Less [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/tipping-qr-code.jpg?#)

![[Mar / Apr ’25 added!] Baseball fans: Capital One once again has great seats for 5,000 miles each](https://frequentmiler.com/wp-content/uploads/2022/07/NY-Mets-seat-location-for-Capital-One-cardholder-seats.jpg?#)