Experience Report: Applying For The New Hilton Honors Mastercard In Germany

Last summer, I wrote about Hilton Honors changing their credit card partner in Germany, as after many years with DKB, a new bank (Advanzia) signed with Hilton and they designed a new credit card product. In 2023, Hilton/DKB sent out a notice that the existing […]

Last summer, I wrote about Hilton Honors changing their credit card partner in Germany, as after many years with DKB, a new bank (Advanzia) signed with Hilton and they designed a new credit card product.

In 2023, Hilton/DKB sent out a notice that the existing card will stop working on September 30, 2024, and that they are partnering with some other bank, which was announced as Advanzia Bank, and applications for the new Hilton Mastercard opened sometime later.

For more information about the Hilton Honors program, you can access the website here.

When this was first announced, I initially feared that it would be almost impossible for Hilton to find a financial institution in Germany willing to take on this task. I was wrong, as they now partnered with Advanzia Bank, which doesn’t have a very stellar reputation in Germany.

You can access the website for the new credit card here.

When applying for this card, customers can receive 6,000 welcome Hilton Honors Points. This is very mediocre, but remember that welcome bonuses for credit products in Germany aren’t really a thing aside from a small token amount.

Cards issued in Germany (and Austria in this case) aren’t really designed to keep balances, and hence the ability for banks to make a profit is minimal. However, this particular product does offer the option to keep a balance, as Advanzia is one of the few banks in Germany that is in the business of cut-throat APRs. There are no referral bonuses either for this product.

While the application process was very simple (I shot this application off while I was on the ICE train leaving from Frankfurt Airport to see my parents) there were a few anomalies with Advanzia the initially didn’t sit right with me.

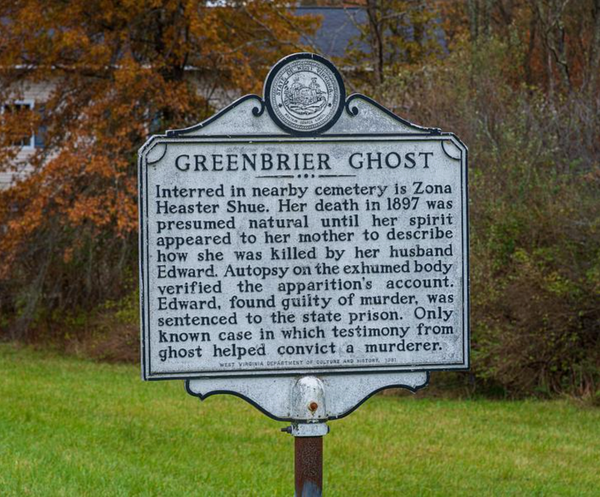

For example, less than a week after applying for the card and before activating, let alone receiving it I was already hit with the first bill for a six Euro monthly fee:

Not sure how they arrived at a 1,500 Euro card limit, but DKB had some curious internal formulas for that one as well (I have the DKB Lufthansa Mastercard with a 15,000 Euro limit, but then they only gave me 500 Euro on the Hilton Visa, which I cancelled a year later). Not that I’m using any of my German cards a lot anyway.

The card arrived by mail together with the Pin in a separate envelope ~ 10 days later.

As far as benefits are concerned, the card is pretty decent for the scarce German market:

The annual fee of 72 Euro includes Hilton Gold Status, free cash withdrawal on ATMs worldwide, and, most notably for German cards: No foreign transaction fee, which is extremely rare.

You can achieve Hilton Honors Diamond status with the reduced requirement of 40 qualifying nights per calendar year with your Hilton Honors credit card. In addition, you can earn five qualifying nights for every €5,000 you spend on eligible purchases with your Hilton Honors credit card, up to a maximum of 40 qualifying nights.

So far, so good. But before applying for this card, I suggest everyone do a quick Google search about Advanzia Bank to learn about their way of doing business and handling credit card accounts. For example, the first bill has to be paid by wire transfer, after which you can set up a direct debit. Probably the only real benefit that I had was getting billed before the card even arrived. At least now I’m all set.

Conclusion

Hilton Honors has a new credit card partner for Germany and Austria after the current issuer, DKB, parted ways with them on September 30th of last year. DKB will also cease issuing and maintaining the Lufthansa Credit Card sometime in 2025, and the M&M card will then be issued by Deutsche Bank.

In the case of the Hilton Card, applicants can obtain 6000 points for the new card and whats very interesting is that points for the transactions will be credited week by week instead of monthly. It should be highlighted that Advanzia Bank isn’t enjoying a stellar reputation, so take it with a grain of salt.

The annual fee is 72,00 EUR, which is slightly more than the previous DKB Hilton Visa (49,00 EUR). I ordered this card just to see how it goes, and I’ll see if I have a somewhat decent experience for the next 12 months. In any case, I can’t write about this product without trying it, so let’s give it a go.

![Non-VR Version of ‘Alien: Rogue Incursion’ Announced as ‘Evolved Edition’ [Trailer]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/05/evolvededition.jpg?fit=900%2C580&ssl=1)

![Hollow Rendition [on SLEEPY HOLLOW]](https://jonathanrosenbaum.net/wp-content/uploads/2010/03/sleepy-hollow32.jpg)

![It All Adds Up [FOUR CORNERS]](https://jonathanrosenbaum.net/wp-content/uploads/2010/08/fourcorners.jpg)

![Marvel Preview: Bucky And The Thunderbolts Take On Doctor Doom Long Before The New Avengers Movie [Exclusive]](https://www.slashfilm.com/img/gallery/marvel-preview-bucky-and-the-thunderbolts-take-on-doctor-doom-long-before-the-new-avengers-movie-exclusive/l-intro-1746661123.jpg?#)

![‘The Surfer’: Nicolas Cage & Lorcan Finnegan Dive Into Aussie Surrealism, Retirement, ‘Madden’ & ‘Spider-Man Noir’ [The Discourse Podcast]](https://cdn.theplaylist.net/wp-content/uploads/2025/05/08055648/the-surfer-nicolas-cage.jpg)

![Marriott Hotel Demanded Women Show ID To Prove Gender—While They Were Using The Restroom [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/05/liberty-hotel-boston.jpeg?#)

.png)