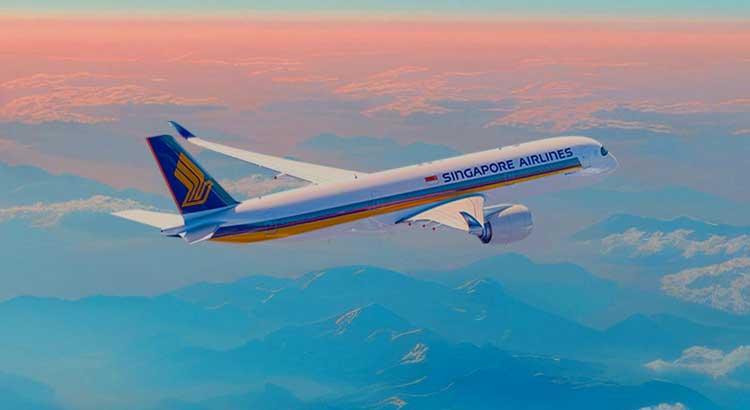

DFS Group sales still “held back by prevailing international conditions” in first quarter

The travel retailer’s revenue performance continues to reflect low levels of visitor traffic in Hong Kong and Macau, noted co-parent LVMH.

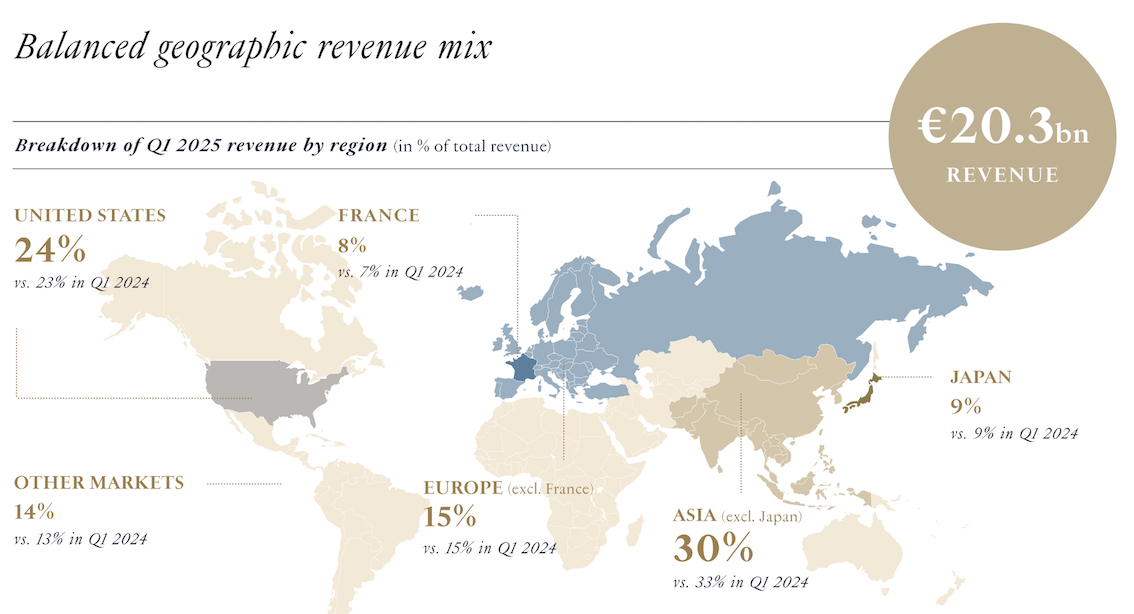

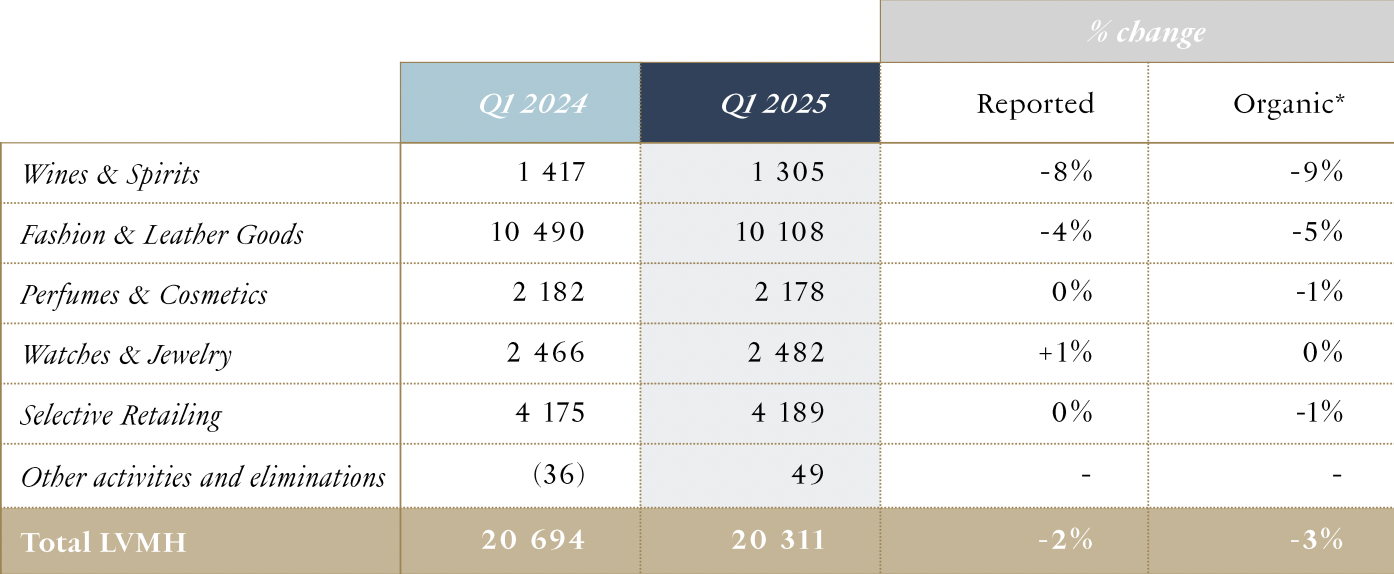

INTERNATIONAL. LVMH Moët Hennessy Louis Vuitton today reported first-quarter revenues of €20.3 billion, down year-on-year by -2% on a reported basis and -3% in organic terms.

Within this, Selective Retailing, which includes DFS Group (co-owned by LVMH and Co-Founder Robert Miller) posted flat reported revenue (-1% organic) of €4,189 million.

LVMH said in a statement that DFS performance was “again held back by prevailing international conditions”. The travel retailer’s revenue performance continues to reflect low levels of visitor traffic in Hong Kong and Macau, noted LVMH. As we reported last November, DFS Group is to cease trading at its upscale Fondaco dei Tedeschi store in Venice as it opted not to renew the lease that ends by September 2025.

More broadly, LVMH said the wider business showed “good resilience and maintained its powerful innovative momentum despite a disrupted geopolitical and economic environment”.

Among other business units, The Wines & Spirits segment saw revenue decline -9% on an organic basis (-8% reported), with Champagne down slightly, reflecting a normalisation of demand.

Assessing wines & spirits, the group noted “uncertainties remain surrounding tariffs” and said that it had held stock in anticipation of disruption.

The Fashion & Leather Goods business group posted a -5% slide in revenues year-on-year (-4% reported) while Perfumes & Cosmetics delivered a similar performance to Q1 2024. The Watches & Jewelry arm was flat in organic terms and up +1% on a reported basis.

By region, Europe achieved growth on a constant consolidation scope and currency basis. The USA saw a slight decline, despite a good performance in Fashion & Leather Goods and in Watches & Jewelry. Japan was down compared to a high basis in the first quarter of 2024, which had been boosted by strong growth in Chinese consumer spending. The rest of Asia saw trends comparable to 2024, with organic sales falling -11%

In what it described as a “disrupted geopolitical and economic environment”, LVMH said it remains “vigilant and confident at the start of the year”.

![‘Haruki Murakami Manga Stories Vol. 3’ Gives Foreboding Fiction a Macabre Makeover [Review]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/04/Haruki-Murakami-Manga-Stories-Vol-3-Car-Attack.jpg?fit=1400%2C700&ssl=1)

.png?format=1500w#)

![THE NUN [LA RELIGIEUSE]](https://www.jonathanrosenbaum.net/wp-content/uploads/2019/12/TheNun-300x202.jpg)

![Courtyard Marriott Wants You To Tip Using a QR Code—Because It Means They Can Pay Workers Less [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/tipping-qr-code.jpg?#)