US Bank checking account fees no longer waived with credit card

Yesterday, we wrote about the not-so-smart changes that appear to be happening with the US Bank Smartly Visa card, where the bank is evidently trying to stop the bleeding that comes with offering an uncapped, 4% cashback credit card. But that’s not the only “Smartly” product that the bank has been monkeying around with lately. […] The post US Bank checking account fees no longer waived with credit card appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

Yesterday, we wrote about the not-so-smart changes that appear to be happening with the US Bank Smartly Visa card, where the bank is evidently trying to stop the bleeding that comes with offering an uncapped, 4% cashback credit card.

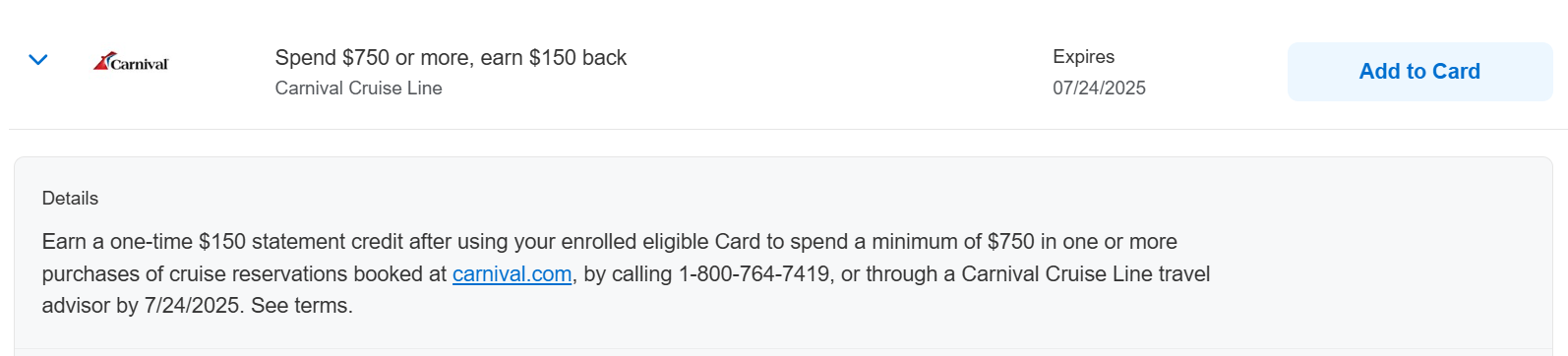

But that’s not the only “Smartly” product that the bank has been monkeying around with lately. For years, monthly maintenance fees on its Smartly checking accounts could be waived in several ways, perhaps the simplest of them being to simply hold a US Bank credit card.

Many people, including me, have a Smartly checking account, due in no small part to the steady stream of bonuses that US Bank offers to new customers. They’ve been fairly lucrative and, once the minimum requirements are fulfilled, it’s easy to let it hang out for a bit without worry so long as you have one of the bank’s credit cards.

That worry-free existence is about to end, though. Starting May 19th, US Bank will be raising the monthly maintenance fee on Bank Smartly checking accounts to $12 and will no longer be offering a waiver if you have a credit card. (h/t: DOC)

What Happening

- Starting May 19th, US Bank will be raising the monthly fee for it’s Smartly checking accounts to $12/month, and removing the ability to waive that fee with a credit card.

- Monthly fees will still be waived by customers who:

- Have combined monthly direct deposits totaling $1,500 or more

- Keep a minimum average account balance of $1,500 or more

- Have a small business checking account

- Are Seniors age 65+ or active duty military

- Have Gold tier status with Smart Rewards

Quick Thoughts

This is more of an annoyance than anything else. Both my wife and I have Smartly checking accounts left over from past welcome bonuses, and they’re still open since they’ve got lightning-fast bank-to-bank transfers and there’s no maintenance fee thank to our credit cards. Additionally, you can only get a US Bank checking bonus once every 12 months so there was no reason to close it earlier. Now, it’s about to be a little trickier.

The nice thing about this change is that having a business checking account waives the fee on your personal account, a new option that didn’t exist before. My wife has both, and this will be the nudge to get me to apply for one and take advantage of the current welcome offer.

For those that don’t want to or can’t apply for a business checking account, the easiest ways to get around the monthly fee will be through keeping $1500 in the account, or scheduling $1500/month in direct deposits (here’s a list of what US Bank counts as direct deposits).

The post US Bank checking account fees no longer waived with credit card appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

![First-Person Psychological Horror Title ‘The Cecil: The Journey Begins’ Arrives on Steam April 3 [Trailer]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/03/cecil.jpg?fit=900%2C580&ssl=1)

![‘It Ends’ Review: The Kids Are Not Alright In Alex Ullom’s Evocative Existential Horror Debut [SXSW]](https://cdn.theplaylist.net/wp-content/uploads/2025/03/12223138/it-ends-sxsw.jpg)

![Silver Airways Can’t Pay for Planes—So It’s Firing Pilots Instead [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/01/silver-airways.jpg?#)

![[FINAL WEEK] Platinum Status And 170,000 Points: IHG’s New $99 Credit Card Offer Worth Getting And Keeping](https://viewfromthewing.com/wp-content/uploads/2016/06/IMG_3311.jpg?#)

![[Podcast] Should Brands Get Political? The Risks & Rewards of Taking a Stand with Jeroen Reuven](https://justcreative.com/wp-content/uploads/2025/03/jeroen-reuven-youtube.png)

![[Mar / Apr ’25 added!] Baseball fans: Capital One once again has great seats for 5,000 miles each](https://frequentmiler.com/wp-content/uploads/2022/07/NY-Mets-seat-location-for-Capital-One-cardholder-seats.jpg?#)