Travel retail and China headwinds weigh on Coty’s Q2 performance

Despite strong demand for prestige fragrances, Q2 net revenue declined due to continued weakness in the mass beauty market and ongoing challenges in APAC, notably in China and Asian travel retail.

A slowdown in the China and Asia travel retail markets weighed on Coty’s revenue for the second quarter and first half of fiscal year 2025, reflecting softer consumer demand and retailer inventory reductions.

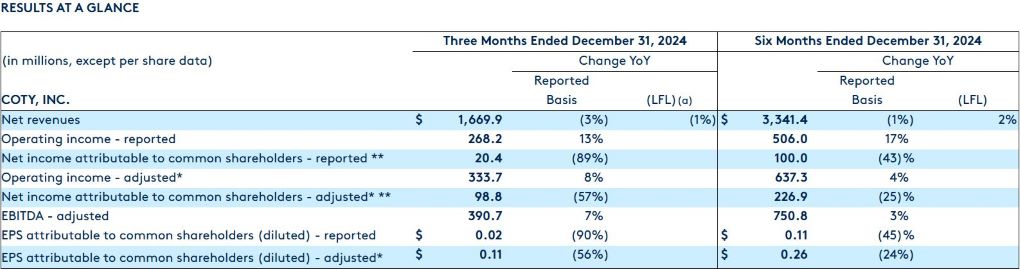

Announcing its results yesterday for the first half and Q2 FY2025 ended 31 December, the French-American beauty powerhouse reported H1 net revenue of US$3,341.4 million, down -1% on a reported basis, impacted by a 2% FX headwind and a -1% drag from the Lacoste licence divestiture.

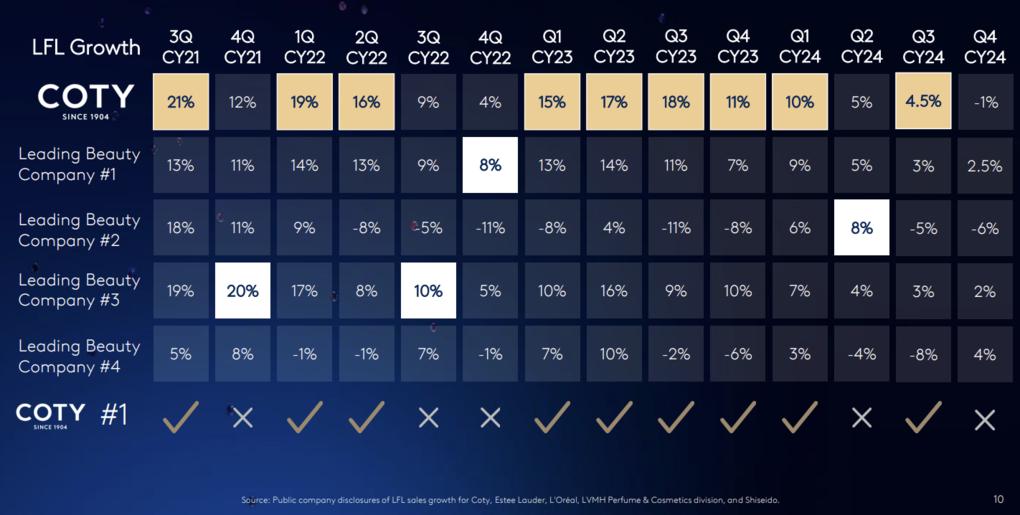

Like-for-like revenue was up +2%, coming off a strong +14% increase in the prior year. Growth in prestige and mass fragrances, along with mass skincare, helped offset declines in cosmetics and bodycare.

In Q2, reported net revenue was down -3% to US$1,669.9 million, including a 2% FX headwind, while like-for-like revenue dropped -1%.

Despite a strong demand for prestige fragrances, the decline was driven by a continued slowdown in the mass beauty market, particularly in colour cosmetics and sustained challenges in APAC, notably in China, Asia travel retail and Australia.

Across both periods, the company delivered solid gross and operating margin growth while maintaining investments in its brands and executing its strategic priorities.

H1 operating income (reported) rose +17% to US$506 million, with a 220-bps margin expansion to 15.1%. In Q2, operating income grew +13% to US$268.2 million, with a 240-bps margin expansion to 16.1%.

Coty CEO Sue Y. Nabi said: “The pressure in pockets of our business which we discussed at length on the last earnings call, namely in China, travel retail Asia, Australia and in Consumer Beauty US, impacted us even more significantly in Q2.

“And in our core markets, despite a seemingly strong holiday period, where beauty performed strongly and consumers engaged with the category, this did not translate into improved replenishment orders for Coty as retailers managed their inventory very tightly.

“As a result of these factors, our Q2 like-for-like sales trends were below our expectations. While we are prudently assuming these patterns will continue into the second half as well, the strong sell-out growth of our fragrance brands gives us confidence that these headwinds are temporary and we should return to stronger sales growth as we enter FY26.”

Sustained growth in prestige beauty

Prestige fragrances remained a key growth driver in travel retail, supported by strong sell-out trends. However, lower demand in China and broader Asia affected overall performance across the channel.

In 1H25, net revenue for the prestige segment reached US$2,230.2 million, accounting for 67% of the company’s overall sales. This reflected a +2% increase on a reported basis and +4% like-for-like, despite a high comparison base (+18% like-for-like) from the prior year.

Growth was fuelled by strong fragrance demand, while cosmetics sales declined, particularly in APAC, partly due to challenges in North Asian travel retail.

Coty’s key prestige fragrance brands posted mid-to-double-digit gains.

In Q2, prestige net revenue declined -1% on a reported basis to US$1,116.1 million, reflecting FX headwinds and the Lacoste divestiture. However, like-for-like revenue rose +1%, supported by continued fragrance demand, partially offset by softer prestige cosmetics sales.

Coty said the prestige fragrance category continued to outperform the overall beauty market, achieving high-single-digit growth in Q2. Sell-out for its prestige fragrances rose at an estimated high-single-digit percentage, building on a strong prior-year comparison.

However, sell-in was impacted by a gap between sell-in and sell-out, particularly in China, where beauty market pressures persisted, and in the USA, Europe and Australia, where retailers maintained strict inventory controls.

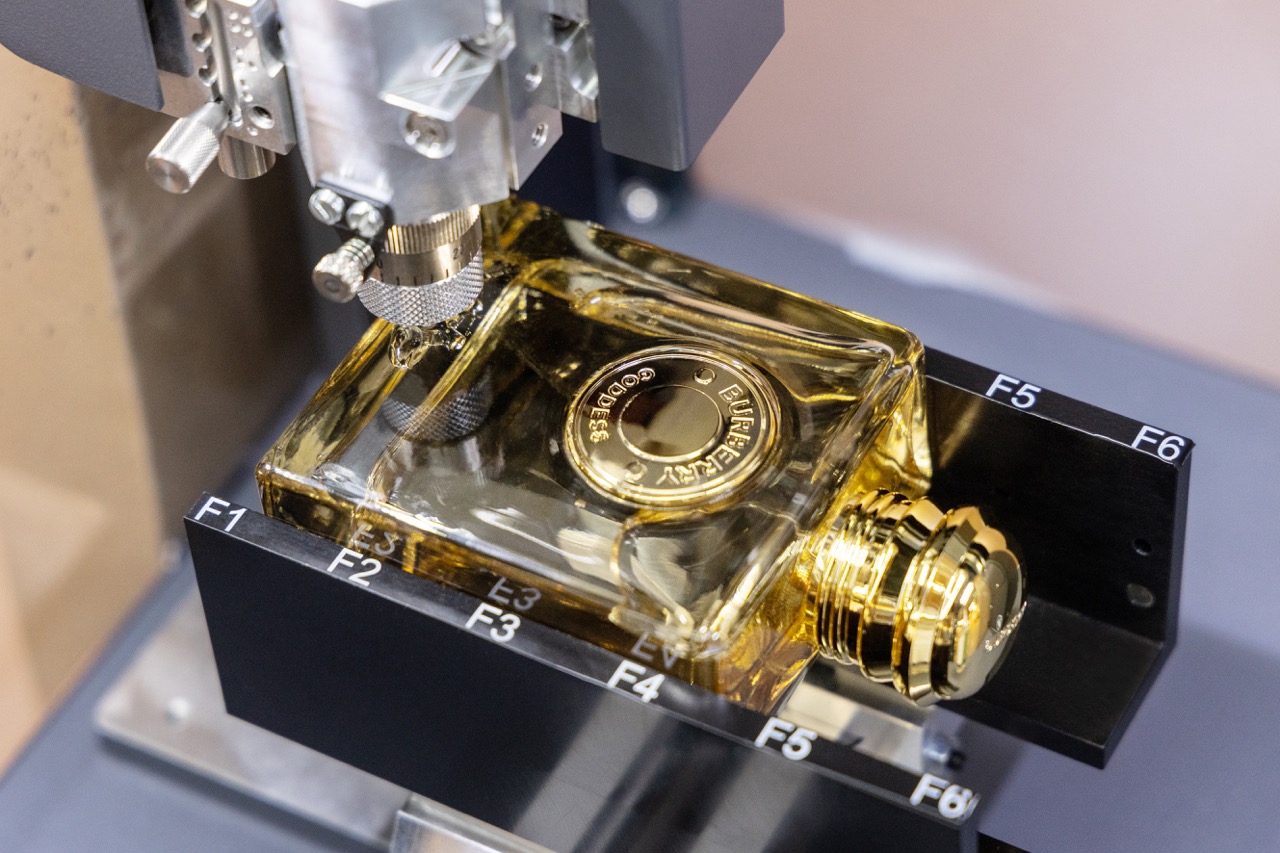

Among the top-performing brands was the Burberry Goddess franchise, contributing to strong double-digit percentage net revenue gains. In CY24, Burberry’s sell-out surged over +30%, outpacing the market threefold and reaffirming Coty’s strength in the fragrance sector.

Unlike strong demand in the fragrance category, prestige cosmetics revenue declined in both Q2 and 1H25, reflecting ongoing challenges in Mainland China and Asia travel retail.

Asia Pacific net revenue totalled US$381.7 million in H1, declining -8% on both a reported and like-for-like basis, with a sharper -11% drop in Q2 to US$191.5 million. The downturn was largely attributed to the persistent challenges in Mainland China and the regional travel retail sector, further strained by ongoing retailer inventory reductions.

Nabi highlighted the key changes in the beauty market since Coty first laid out its strategy and ambitions over three years ago. She said: “From a category perspective, fragrances have accelerated significantly supported by structural consumer behaviour shifts, while colour cosmetics is challenged by evolving channel preferences and new business models.

“At a market level, China is no longer a key short-term growth driver for beauty, while the US market remains very dynamic. With this backdrop, FY25 is shaping up to be a pivotal year for Coty, as we evaluate our operations to fuel Coty’s long-term success.”

Looking ahead, Coty expects ongoing pressures in APAC, driven by continued challenges in China and Asia travel retail.

The company projects like-for-like sales trends in H2 to remain broadly in line with Q2, ranging from -1% to -2%.

Talking points: On the record with Coty leadership

|

![‘It Ends’ Review: The Kids Are Not Alright In Alex Ullom’s Evocative Existential Horror Debut [SXSW]](https://cdn.theplaylist.net/wp-content/uploads/2025/03/12223138/it-ends-sxsw.jpg)

![Buy IHG Points with 100% Bonus Points [0.50¢ or ₹0.43/Point]](https://boardingarea.com/wp-content/uploads/2025/03/8d9a3be30fa909df78102ae69e1db191.jpg?#)

![Silver Airways Can’t Pay for Planes—So It’s Firing Pilots Instead [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/01/silver-airways.jpg?#)

![[FINAL WEEK] Platinum Status And 170,000 Points: IHG’s New $99 Credit Card Offer Worth Getting And Keeping](https://viewfromthewing.com/wp-content/uploads/2016/06/IMG_3311.jpg?#)

.jpg?#)

![[Podcast] Should Brands Get Political? The Risks & Rewards of Taking a Stand with Jeroen Reuven](https://justcreative.com/wp-content/uploads/2025/03/jeroen-reuven-youtube.png)

Coty CEO Sue Y. Nabi

Coty CEO Sue Y. Nabi