Seatrade 2025 in review – Where next for the key categories at sea?

At the Seatrade Cruise Global retail sessions in Miami in April, senior figures assessed the way forward for the leading product sectors.

INTERNATIONAL. Among the highlight retail-related sessions at Seatrade Cruise Global in Miami (8-9 April) was a discussion about the opportunities for the key product categories in the cruise channel.

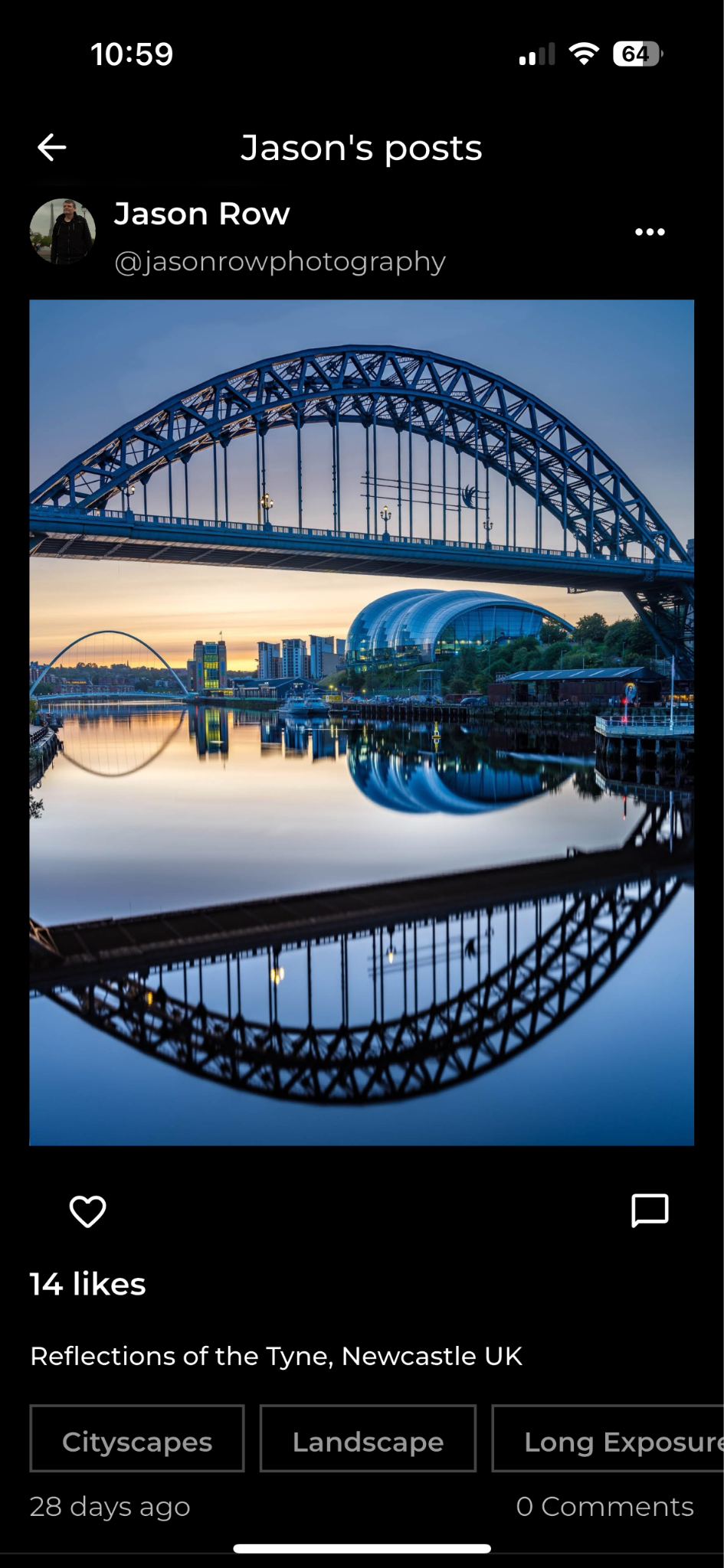

Seatrade is the world’s leading annual gathering of the cruise industry. Last year and this, The Moodie Davitt Report has organised and led a series of discussions at the event focused around retailing onboard, with input from the cruise retail Trinity of cruise lines, concessionaires and brand owners.

Taking part in the category conversation were Effy Jewelry Executive Vice President Jennifer Patience, Heinemann Americas Managing Director Nicolas Hoeborn, Starboard Group Director, Merchandising Karla Nedeski and Norwegian Cruise Line VP Onboard Revenue Craig Steyn.

The panel discussed the positioning and evolution of the key categories and how they fit within the wider consumer offer.

Assessing the climate for business in the fine jewellery sector, Effy’s Jennifer Patience said: “I feel very good about the industry and specifically luxury. I have seen many ebbs and flows in the industry over 20 years, and I feel good about how the market looks.”

On the consumer and how Effy is engaging with travellers, Patience said that the first-time initiative to create a seven-day Alaska Charter Cruise, in partnership with Holland America Line last year, had proven a success. “We set ourselves a US$45 million sales goal, which we didn’t quite reach, but we were very happy overall.

“We were able to use that charter as a testing ground for new concepts, which we are now rolling out fleet-wide on Seaborn and Holland America.”

Describing one of these, she said: “One of the challenges we all face is port days as we can only sell when the ship’s at sea. How do we use the time well?

“We decided to do a gamified activation in Juneau, Alaska, where people got cruise cash that they could use later. About half the ship came along after their shore break. What that showed is that people who are experienced and well travelled are always looking for something new and different, and through that activation, we were able to translate it later into revenue.”

Another opportunity to break down lack of onboard space is to blend categories, for instance through customised logo apparel. “People crave customisation so it solves a problem and it creates a unique offering for the guest.”

Nicolas Hoeborn echoed the importance of jewellery & watches in driving spending, while Karla Nedeski noted that for merchandisers, it’s important to distinguish between cruise lines and avoid a ‘one-size-fits-all’ strategy.

“We need to be able to adapt our offerings and to define what luxury really means in each case. Because luxury is no longer defined just by a price tag. It’s about exclusivity, the guest experience and really building that emotional connection.”

For Craig Steyn, adapting to varying views of what luxury means is a key element when NCL operates across three cruise brands (Norwegian, Oceania and Regent) and audience types.

“In luxury we have the challenge of space onboard Oceania and Regent where we have the many of those high-end consumers,” he said. “The big-name watch brands want their space, they want a certain footprint and they want to turn over in retail.

“We know those consumers have a lot of luxury items already, so it’s about putting the right things in front of them at the right price. And no matter how affluent they are, they like a bargain.

“What we are seeing add significantly to our bottom line now are the pre-loved items from bags to watches.”

Steyn said these pre-owned categories are taking more space today, while NCL is also enhancing its assortments of logoed goods and apparel, which he said has under-indexed in performance terms until recently.

Hoeborn also identified logo as a growth opportunity. “Logo has such big potential. And the good thing about it is you are building the brand for the cruise line. Spends are strong, there is good margin for the retailer and the return we got from that category is much higher than we expected, so it is something that we continue to push.”

Hoeborn expressed concern about the trajectory for liquor given the category’s wider performance, notably in domestic markets, but said cruise remains a strong brand-building environment. “We did a great activation with The Macallan in one of our liquor stores, which tapped into everything we try to achieve onboard. We are educating the guests, we are giving good space to the brand, which can bring in exclusive collections and the results can match or even exceed what you see at airports.

“And that is a key message for any brand. Cruise is a big channel. It’s growing much faster than the rate of passenger development at airports. It is an area you want to play in, but you need to go all in on it.”

Elaborating, he said: “The brands are looking for adjacency. They are looking for the common brand environment they see in domestic, but this is not domestic, it is not airports, it is cruise, and it’s a very particular environment with a lot of potential. So the brands need to adjust and we need brands that have a common interest in driving the top line.”

Touching on the place of beauty in the mix, Nedeski highlighted the role of exclusive and the power of technology. An example of the latter is the roll-out of the SkInsight service developed with augmented-reality and artificial-intelligence services specialist Perfect Corp.

“What begins as an activation converts to increased basket size. It is the result of putting the guest first.”

On beauty spending behaviour, Nedeski said the pandemic changed habits. “Wellness is a big topic and a big trend. Colour makeup has been on the downturn on the other hand. Where we see a big rise, fuelled by social media, is in fragrances. We see double-digit growth aided by the brands. And there is room for a good, better, best approach here with fragrances an entry point to the world of luxury.”

For the assortment to be optimised, partnerships also need to be win-win. Patience said, “We see that cruise lines are more open to a margin-sharing model and they understand that it’s not in everyone’s best interest to fill the store with high-margin but low-quality product.

“When the cruise line and the retailer work are in it together, the selection gets better, the customer experience gets better, and it leads to more innovation.”

She added, “This also leads to more synergies. With Norwegian for example, we do a Gemstones & Vineyards event, where we partner with the F&B department. They get to promote their wines and we promote our gemstones, and those kind of collaborations create an amazing customer experience. It is a winning formula.”

Further on partnership, Hoeborn said that the biggest step change that can be made is for the retailer to be involved earlier in the planning process for new ships.

“It’s not just about the space execution, it’s about where the stores are located and how they are planned out.”

Nedeski noted that for brands keen on this sector, it’s vital to recognise that “more space is not necessarily equivalent to more dollars”. She added, “Together we can bring to life a beautiful space that is profitable for all, but only through flexibility. Cruises are not airports. Once brands really understand that differentiation in dwell time and shopper behaviour then it becomes a game changer.”

For small brands that find it difficult to enter a space-constrained market, Nededski said: “You have to curate an assortment and a brand line-up tailored to each of the ships and each of the cruise lines and their itineraries. That means the possibilities are endless including for new brands.”

Hoeborn said there are chances for brands to enter this channel.

“In the end, the consumer dictates the assortment. Tik Tok and other media are creating brands overnight. We need to be flexible, we need to be agile, and we need to have some dedicated space left to bring in new brands, because that’s what the market demands.”

Steyn said there are other ways to encourage newness, which is key when many travellers are repeat guests.

“Our team has done a great job in laying out our ships for pop-up locations. It’s not easy to take a chance on a start-up brand or to give up margin associated with an existing offer. We have flexible spaces that can be changed over every couple of weeks or even months where these brands can come in and test the market. And on many occasions they like the results, as do we, and we can grow that partnership.”

*Click here for highlights of a panel of leaders talking consumer-centricity in cruise retail; click here for an interview with Azamara Cruises CEO Dondra Ritzenthaler.

![Pieces of Masterpieces [MEDEA & SUNDAY]](https://jonathanrosenbaum.net/wp-content/uploads/2011/04/medea.jpg)

![‘Left-Handed Girl’ Review: Taipei-Set Drama Co-Written By Sean Baker is a Poignant Intergenerational Triptych [Cannes]](https://cdn.theplaylist.net/wp-content/uploads/2025/05/15150441/%E2%80%98Left-Handed-Girl-Review-Taipei-Set-Drama-Co-Written-By-Sean-Baker-is-a-Poignant-Intergenerational-Triptych-Cannes.jpg)

![‘The Last Class’ Trailer: American Economist Robert Reich Gets The Spotlight In New Education Documentary [Exclusive]](https://cdn.theplaylist.net/wp-content/uploads/2025/05/15115633/the-last-class-film.jpg)

![[Expired] 100K Chase Sapphire Preferred Card offer](https://frequentmiler.com/wp-content/uploads/2025/04/100K-points-offer.jpg?#)

![[June / July ’25 added!] Baseball fans: Capital One once again has great seats for 5,000 miles each](https://frequentmiler.com/wp-content/uploads/2022/07/NY-Mets-seat-location-for-Capital-One-cardholder-seats.jpg?#)

![Air Traffic Controller Claps Back At United CEO Scott Kirby: ‘You’re The Problem At Newark’ [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/05/scott-kirby-on-stage.jpg?#)

![Artist Shocked To Find Her Poster Designs From 2017 In Bungie's Marathon: 'A Major Company Has Deemed It Easier To Pay A Designer To Imitate Or Steal My Work Than To Write Me An Email' [Update]](https://i.kinja-img.com/image/upload/c_fill,h_675,pg_1,q_80,w_1200/4ce7afff77473c3cccca9cc349c42790.jpg)

.jpg)

![[Podcast] Making Brands Relevant: How to Connect Culture, Creativity & Commerce with Cyril Louis](https://justcreative.com/wp-content/uploads/2025/05/cyril-lewis-podcast-29.png)