CitiBusiness AAdvantage Platinum Card: 75K Welcome Offer (last week)

5/15/25: Public offer pages are showing that this increased, 75K offer will be ending in one week (h/t: DOC) ~~~ There is another increased offer for the CitiBusiness AAdvantage Platinum card: earn 75,000 miles after $5,000 in purchases within the first 5 months. In addition, the annual fee is waived for the first year. This is […] The post CitiBusiness AAdvantage Platinum Card: 75K Welcome Offer (last week) appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

5/15/25: Public offer pages are showing that this increased, 75K offer will be ending in one week (h/t: DOC)

~~~

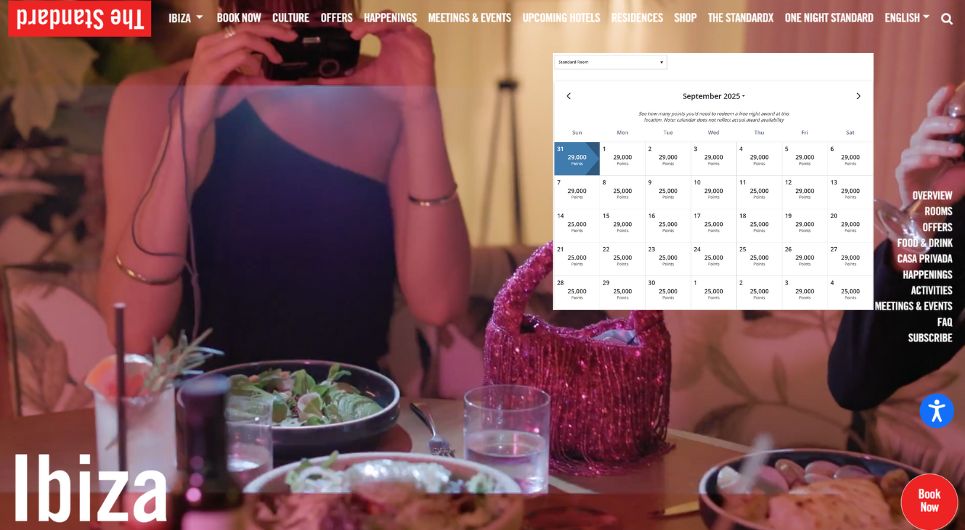

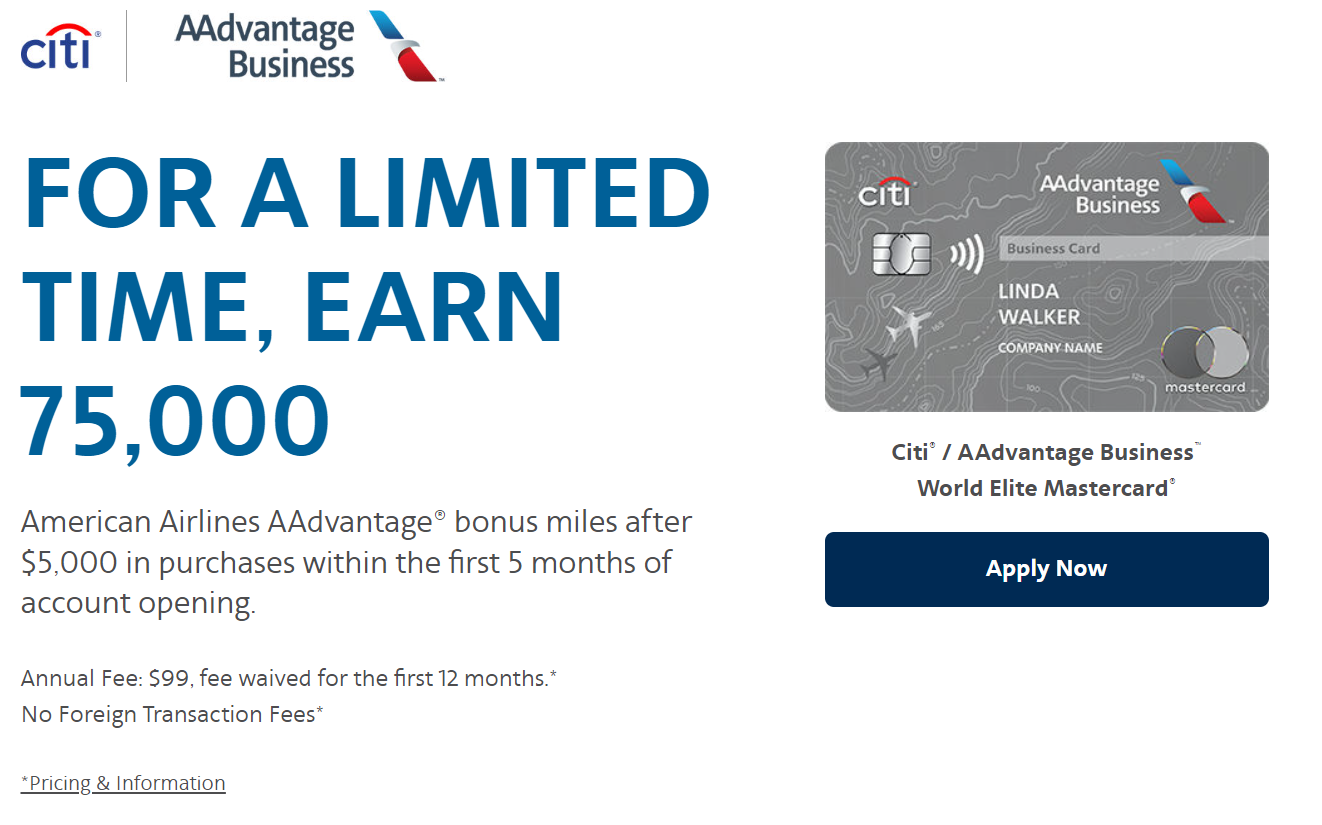

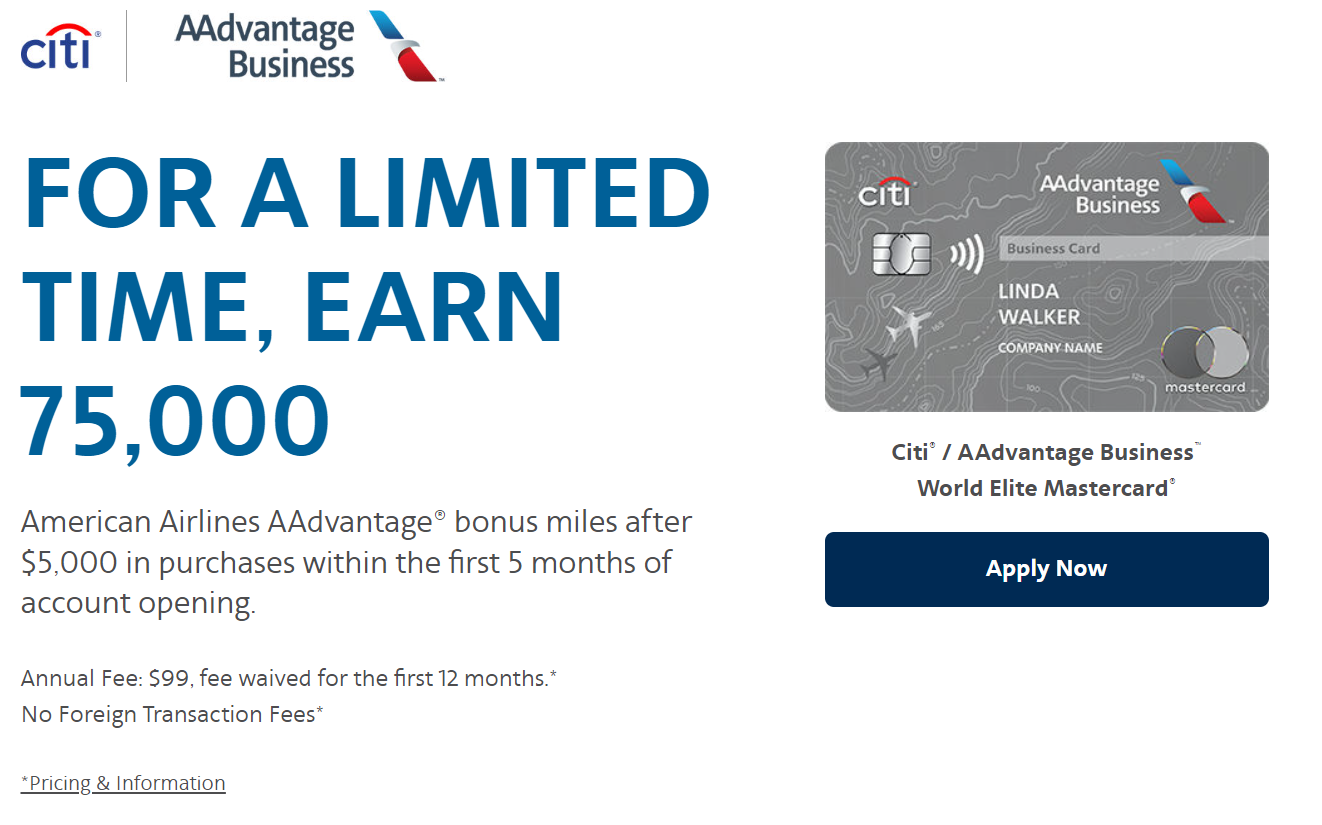

There is another increased offer for the CitiBusiness AAdvantage Platinum card: earn 75,000 miles after $5,000 in purchases within the first 5 months. In addition, the annual fee is waived for the first year. This is a 10K increase from the previous offer and matches the best that we’ve ever seen on this card (in terms of total miles).

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $965 1st Yr Value EstimateClick to learn about first year value estimates 75K miles Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 75K miles after $5K spend in first 5 months (Offer Expires 5/22/2025)$0 introductory annual fee for the first year, then $99 Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 75K miles after $5K spend in first 5 months (ended 1/21/25) FM Mini Review: This card usually has a great welcome bonus, but if you're looking for a card to keep long term, you'll find better options. Earning rate: ✦ 2X AA ✦ 2X certain telecommunications merchants ✦ 2X car rental merchants ✦ 2X gas Card Info: Mastercard World issued by Citi. This card has no foreign currency conversion fees. Big spend bonus: Earn $99 plus taxes domestic companion certificate after $30K spend Noteworthy perks: ✦ First checked bag free ✦ Priority Boarding ✦ Save 25% on inflight purchases |

Quick Thoughts

Marriott Bonvoy is the only points program that transfers to American Airlines, making AA credit cards the primary way to quickly accumulate a large stash of miles. The good news is that, for now, both Barclays and Citi issue American Airlines credit cards. That means there are several possible bonuses to collect.

When looking at this offer, keep in mind that the Barclays-issued Aviator Red card currently gives 70,000 miles after one purchase and paying the annual fee, while the Citi business card requires $5,000 in purchases within the first 5 months. That might make the Barclays card more appealing for many folks, but if you already signed up for that and/or need a business card to stay under 5/24, this could be a worthwhile option.

Citi Application Tips

- 48 Month Rule: With most Citi cards, you can only receive a welcome offer every 48 months. This applies to the same exact card, not families of cards and is counted from the date that you receive the welcome offer, not from when you're approved.

- Velocity Limits: Citi allows a maximum of one card per 8 days and a maximum of two cards per 65 days (includes both business and personal).

- Inquiries: Citi is thought to be more credit inquiry-sensitive than other issuers. We've heard reports that it's difficult to be approved for a new Citi card if you've had more than 6 hard inquiries within the last 6 months. That said, data points abound of people being approved despite being above that, so it's certainly not a hard and fast rule.

- Card Limits: Citi doesn't have a strict limit on the amount of cards that you can have, but it does place limits on the total amount of credit that they will issue you across all cards. Unfortunately, unlike most banks, Citi does not allow you to move credit from one existing card to the another card.

- Application Status: Call (866) 606-2787 or go here to check your application status. For Costco cards, call (877) 343-4118.

- Reconsideration: If denied, call (800) 695-5171 for personal cards or (866) 541-7657 for business cards.

The post CitiBusiness AAdvantage Platinum Card: 75K Welcome Offer (last week) appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

![Pieces of Masterpieces [MEDEA & SUNDAY]](https://jonathanrosenbaum.net/wp-content/uploads/2011/04/medea.jpg)

![Invitation to the Trance [SLEEPWALK]](https://jonathanrosenbaum.net/wp-content/uploads/2010/01/sleepwalk2.png)

![‘Left-Handed Girl’ Review: Taipei-Set Drama Co-Written By Sean Baker is a Poignant Intergenerational Triptych [Cannes]](https://cdn.theplaylist.net/wp-content/uploads/2025/05/15150441/%E2%80%98Left-Handed-Girl-Review-Taipei-Set-Drama-Co-Written-By-Sean-Baker-is-a-Poignant-Intergenerational-Triptych-Cannes.jpg)

![‘The Last Class’ Trailer: American Economist Robert Reich Gets The Spotlight In New Education Documentary [Exclusive]](https://cdn.theplaylist.net/wp-content/uploads/2025/05/15115633/the-last-class-film.jpg)

![[Expired] 100K Chase Sapphire Preferred Card offer](https://frequentmiler.com/wp-content/uploads/2025/04/100K-points-offer.jpg?#)

![[June / July ’25 added!] Baseball fans: Capital One once again has great seats for 5,000 miles each](https://frequentmiler.com/wp-content/uploads/2022/07/NY-Mets-seat-location-for-Capital-One-cardholder-seats.jpg?#)

![Air Traffic Controller Claps Back At United CEO Scott Kirby: ‘You’re The Problem At Newark’ [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/05/scott-kirby-on-stage.jpg?#)

.jpg)

![[Podcast] Making Brands Relevant: How to Connect Culture, Creativity & Commerce with Cyril Louis](https://justcreative.com/wp-content/uploads/2025/05/cyril-lewis-podcast-29.png)

World Elite Mastercard®

World Elite Mastercard®