Kering Q1 sales weakened by economic headwinds but eyewear business grows

The luxury powerhouse has reported a sharp -14% year-on-year decline in first-quarter revenue to €3.9 billion, on both a reported and comparable basis.

Leading luxury goods company Kering Group has reported a sharp -14% year-on-year decline in first-quarter revenue to €3.9 billion, on both a reported and comparable basis.

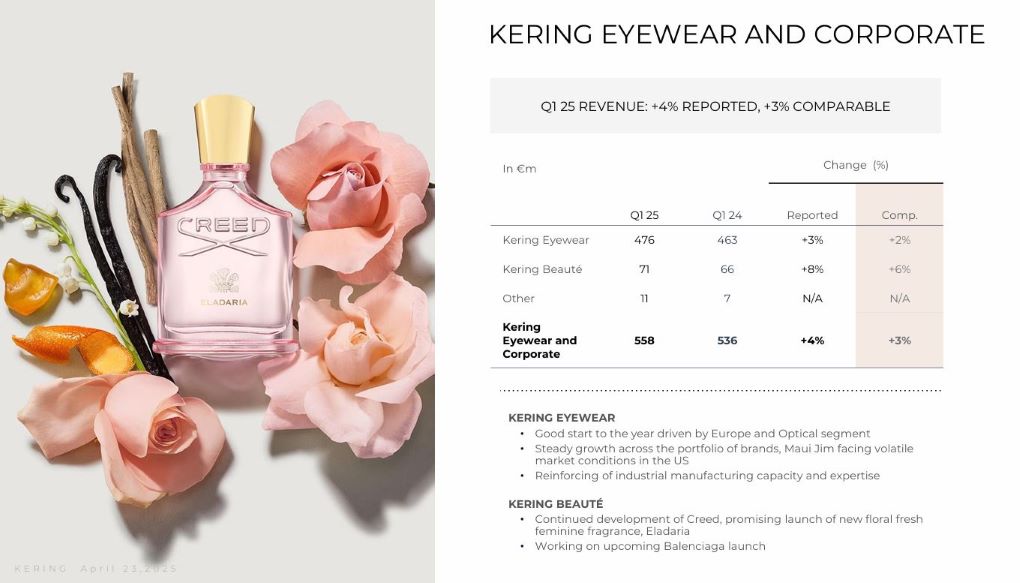

The Group’s weaker performance was partially offset by Kering Eyewear, which posted +2% revenue growth to €476 million.

Kering Chairman and CEO François-Henri Pinault said, “As we had anticipated, Kering faced a difficult start to the year. In this environment, we are fully focused on executing on our action plans to reach our strategic and financial objectives and strengthen the positioning of our houses on all our markets.

“We are increasing our vigilance to weather the macroeconomic headwinds our industry faces, and I am convinced that we will come out stronger from the present situation.”

Revenue from the group’s beauty arm Kering Beauté also grew +6% on a comparable basis to €71 million, supported by Creed’s steady growth and additions to the brand’s feminine fragrance portfolio.

During the period, the luxury group reduced its retail footprint by 25 stores on a net basis, ending the quarter with 1,788 directly operated locations.

Q1 sales from the group’s directly operated network dropped -16% on a comparable basis.

Across its geographic markets, Asia Pacific continued to experience a steep decline (-25%), in line with the previous quarter, while the downturn in Western Europe (-13%), North America (-13%) and Japan (-11%) deepened when compared to Q4.

The negative trend was also evident in the Wholesale and Other business segment, with revenue down -9%, while wholesale revenue from the group’s houses was down -23% on a comparable basis, as a result of the group’s push for more exclusive distribution.

Performance by brands

The Q1 performance was hit hard by a -24% reported (-25% like-for-like) sales slump in its flagship brand, Gucci, which reached €1.6 billion.

The house’s directly operated retail network saw comparable revenues drop -25%, reflecting challenges in store traffic, while wholesale revenue also slipped -33% on a comparable basis.

Yves Saint Laurent registered €679 million in quarterly revenue, reflecting weaker performance with an -8% reported and -9% comparable decline.

Comparable sales in the brand’s directly operated network fell -8%, while performance in other regions improved, led by the Middle East, the Americas and Europe. Wholesale revenue plunged -24% on a comparable basis, while royalties and other revenue surged +20% (comparable basis).

Breaking away from the group-wide slump, Bottega Veneta delivered €405 million in revenue, a +4% rise in both reported and comparable basis.

Bottega Veneta’s directly operated retail network posted a +7% comparable revenue increase, building on an already strong base. Growth spanned all product categories, with key regions such as Western Europe, North America and the Middle East delivering double-digit gains. Wholesale revenue dropped -13% on a comparable basis.

Revenue from Other Houses stood at €733 million, down -11%% both as reported and on a comparable basis, with directly operated network dropping -9% (comparable basis).

Balenciaga’s leathergoods business delivered strong results despite lower store traffic. McQueen’s sales softened, while Brioni sustained growth with double-digit retail gains, led by Western Europe and North America.

The group’s Jewelry Houses saw notable improvement, with Boucheron registering strong results over a high comparison base, Pomellato making progress with its Nudo line innovations, and Qeelin posting significant growth.

Wholesale revenue from the Other Houses fell -17% on a comparable basis.

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![[Podcast] Unlocking Innovation: How Play & Creativity Drive Success with Melissa Dinwiddie](https://justcreative.com/wp-content/uploads/2025/04/melissa-dinwiddie-youtube.png)