Kering Group posts sharp decline in sales and profits but Eyewear division shines

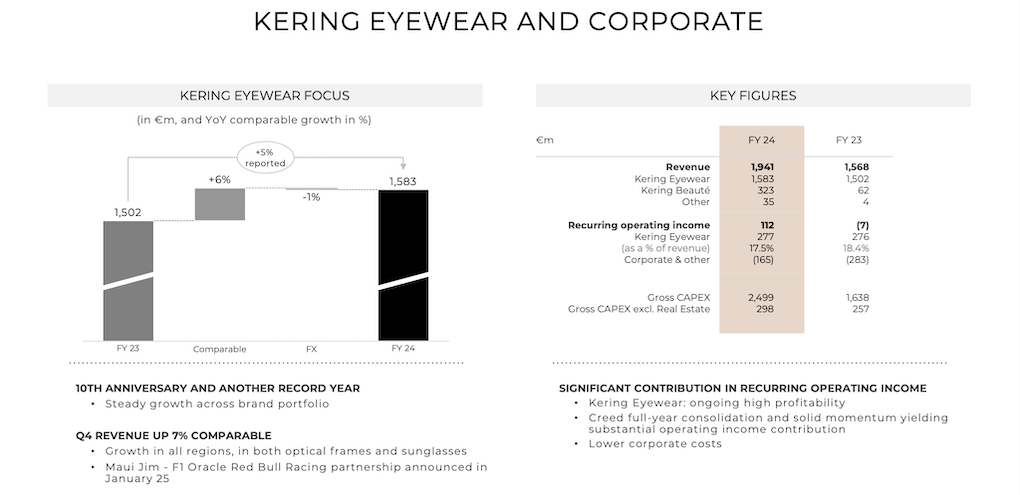

Kering Eyewear, which celebrated its tenth anniversary in 2024, was one of the shining stars in the group’s performance amid an otherwise tough trading year.

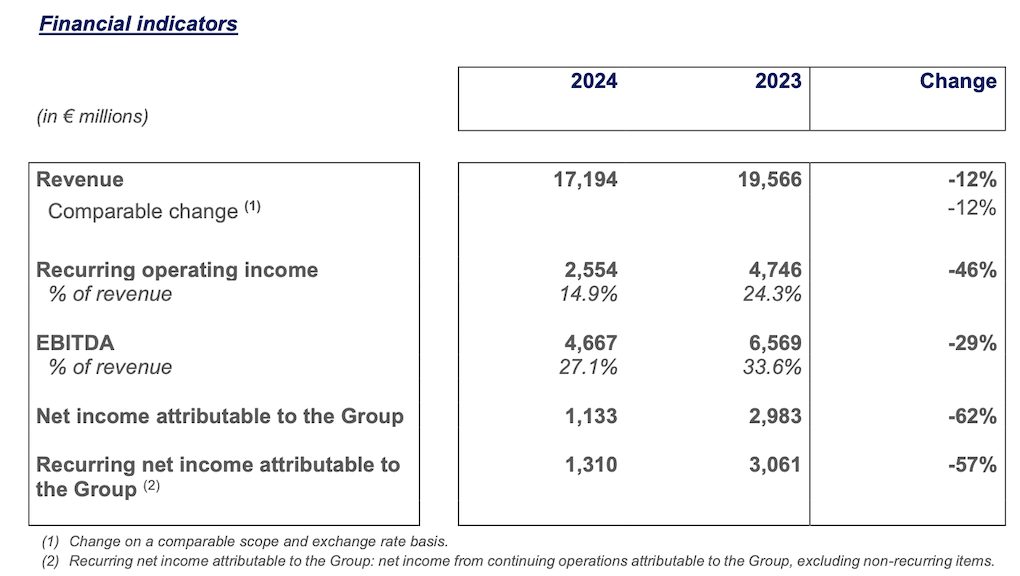

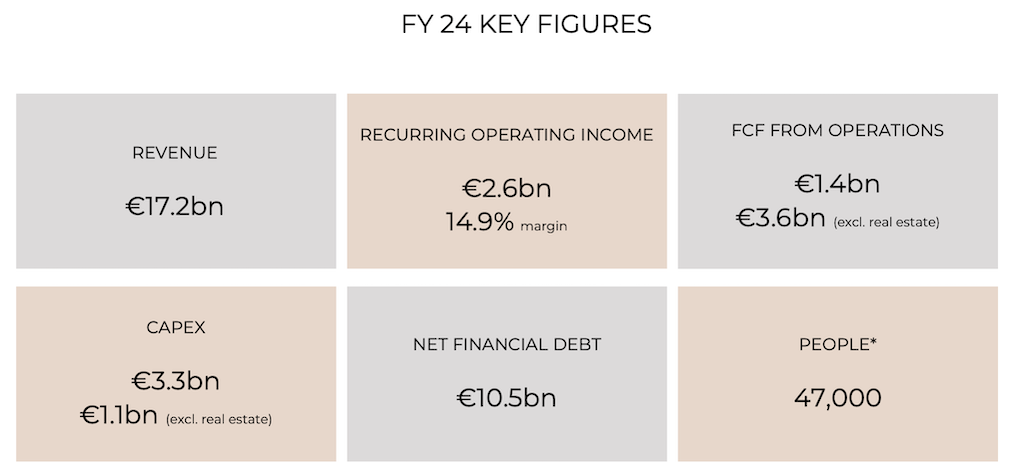

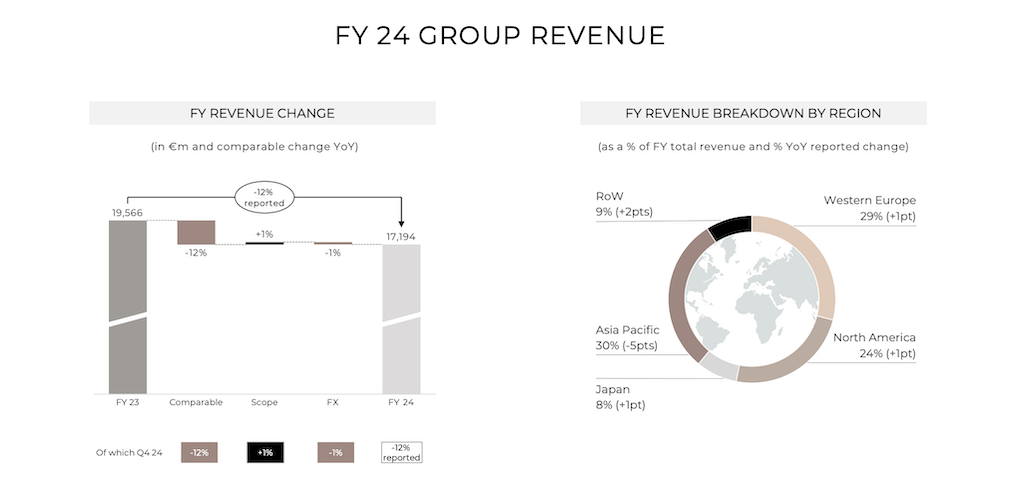

Leading luxury goods group Kering today reported a -12% decline in revenues to €17.2 billion in 2024. EBITDA fell by -29% to €4.66 billion while net income attributable to the group plunged -62% to €1.13 billion.

Kering’s recurring operating income in 2024 totalled €2.6 billion, down -46% from 2023. Recurring operating margin was 14.9% (a decrease of -9.4% year-on-year).

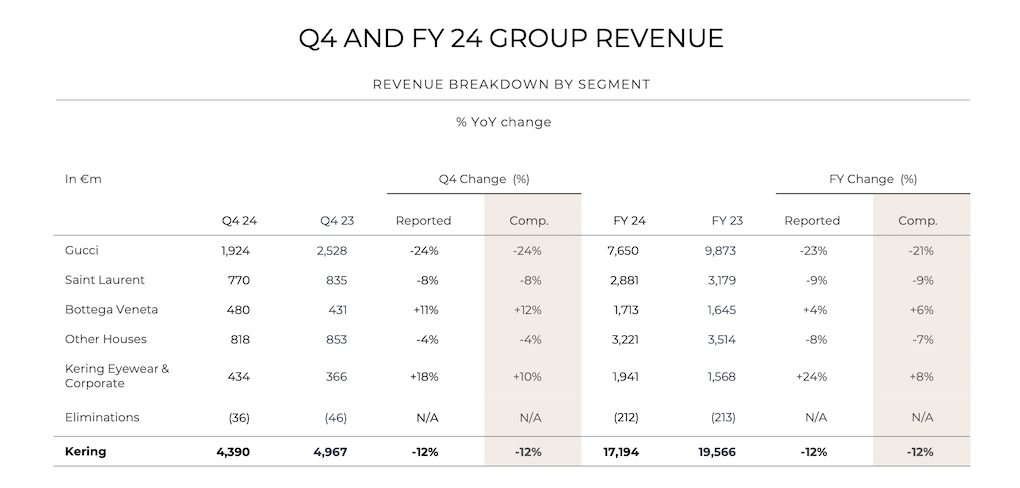

The performance was partially offset by positive results from the Kering Eyewear division (marking its tenth year in 2024), which posted €1.6 billion in sales in FY 2024, up +6% on a comparable basis (see below for full details).

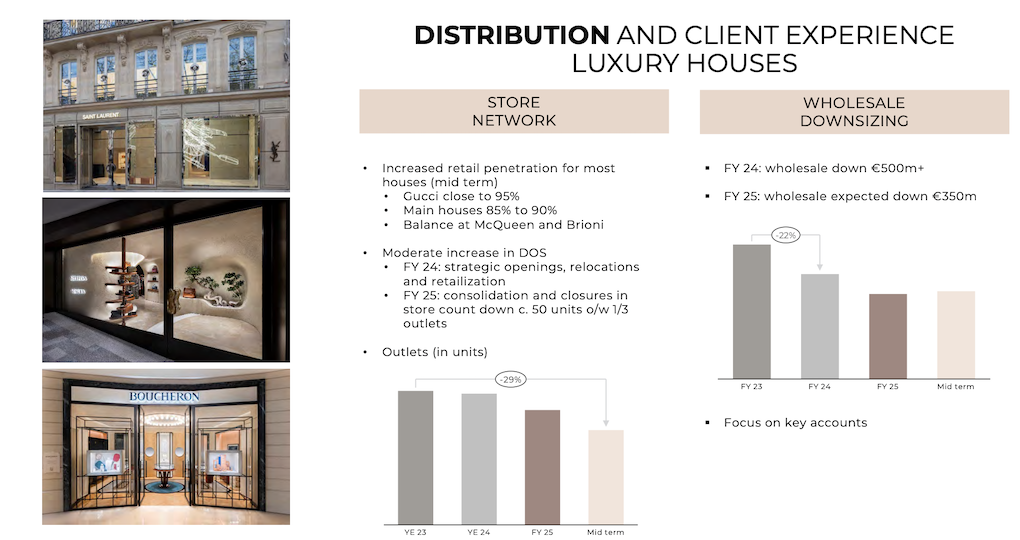

Sales from the Kering Group’s directly operated retail network, including ecommerce, declined -13% like-for-like due to weaker store traffic. Wholesale revenues from Kering’s houses saw a sharper -22% decline like-for-like.

In the fourth quarter, revenue fell -12% (reported and like-for-like) with a -13% drop in sales from Kering’s directly operated retail network. Wholesale and other revenue declined -10%, with wholesale revenue from the houses decreasing -25%.

The downturn reflects a challenging luxury environment anchored by softer consumer demand. It was also driven by a weak performance from the group’s largest brand Gucci, which recorded a -23% reported and -21% like-for-like decline in revenues at €7.7 billion.

The decline was also driven by a renewed focus on exclusivity and elevation as several Kering houses – including Gucci, Yves Saint Laurent and Bottega Veneta – have adopted a more selective approach to partnerships and continued to streamline their distribution channels.

Kering is increasing the share of directly operated stores and reducing its wholesale network with an expected €500 million hit in FY2024 and €350 million in FY2025.

Kering Eyewear stands out

Kering Eyewear’s healthy performance helped offset some of the group losses. The division generated €1.6 billion in total revenues, up +6% increase in like-for-like terms, as noted above.

Kering Eyewear and Corporate (including Kering Beauté) reached €1.9 billion in revenues for FY2024, up +24% reported and +8% like-for-like.

Kering Beauté’s revenue amounted to €323 million in 2024, as Creed was consolidated over the full year.

Recurring operating income for Kering Eyewear amounted to €277 million, while the entire segment, including Beauté and corporate costs, posted recurring operating income of €112 million (more below).

Kering Group Chairman and Chief Executive Officer François-Henri Pinault commented: “In a difficult year, we accelerated the transformation of several of our houses and moved determinedly to strengthen the health and desirability of our brands for the long term.

“Across the group, and at Gucci first and foremost, we made critical decisions to raise the impact of our communications, sharpen our product strategies and heighten the quality of our distribution, all in the respect of the creative heritage that distinguishes our brands.

“We secured our organisation, made key hirings, sped up execution and intensified the efficiency of our operations. Our efforts must remain sustained and we are confident that we have driven Kering to a point of stabilisation, from which we will gradually resume our growth trajectory.”

Regional performance

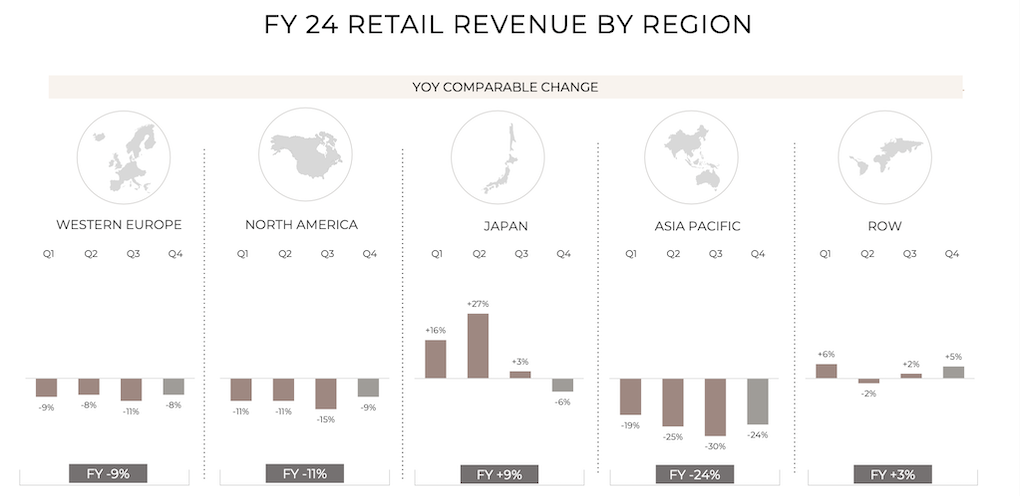

The impact of shifting consumer demand and macroeconomic conditions varied across key regions for Kering Group.

Japan was the strongest with revenues up +9% like-for-like, driven by increased tourist spending, particularly from the rest of Asia, due to the weak yen.

Revenues fell -24% in the rest of Asia Pacific (excluding Japan) as lower local demand in Greater China and shifting tourist purchasing patterns led to a drop in store footfall. The region’s share of total group revenue declined from 35% to 30%.

Western Europe revenues declined -9%, impacted by softer local demand and a normalisation of tourist traffic. Southern Europe outperformed Northern Europe, but a more exclusive wholesale strategy weighed on overall performance.

In North America, sales were down -11% as economic uncertainty led to weaker consumer spending. However, demand in the ultra-luxury segment remained resilient, with revenue still +35% higher than in 2019.

For the rest of the world, Kering recorded modest +3% growth, driven primarily by strong demand in the Gulf countries.

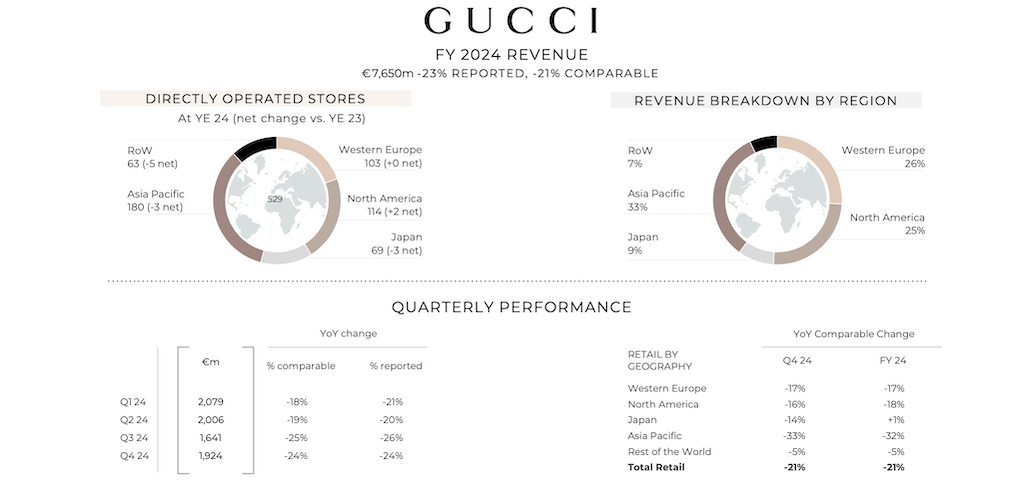

Performance by brand: Gucci

Gucci reported revenues of €7.7 billion in 2024, down -23% reported and -21% like-for-like. The brand’s directly operated retail network, which accounts for 91% of sales, declined -21%, while wholesale revenues contracted by -28%.

Gucci wholesale revenues plummeted -53% due to a sharper focus on selectivity in distribution.

Its recurring operating income stood at €1.6 billion, with a recurring operating margin of 21%, as cost efficiencies partially mitigated the impact of lower sales.

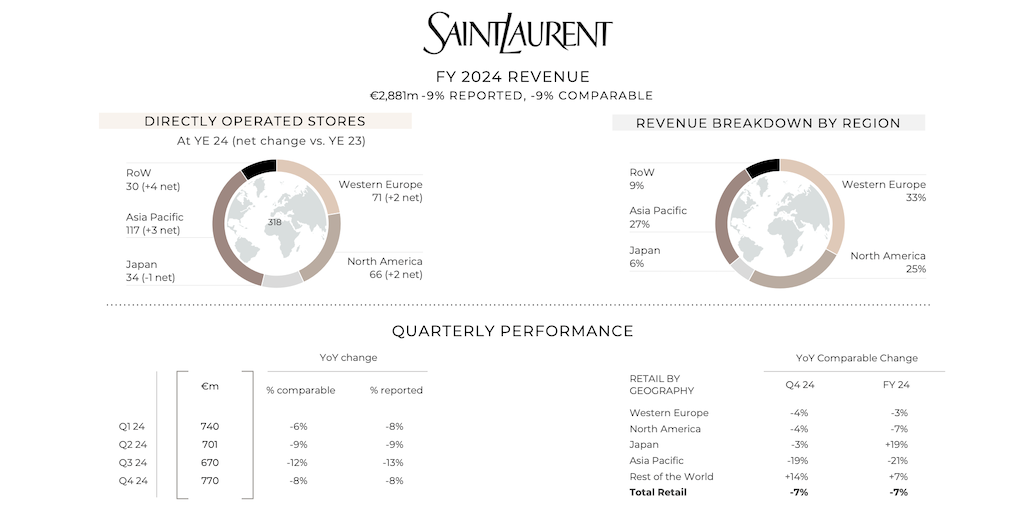

Yves Saint Laurent

Yves Saint Laurent recorded €2.9 billion in revenue for 2024, a -9% decrease both on a reported and like-for-like basis. Retail network sales declined -7%, while wholesale revenues fell -25%.

While the demand for Yves Saint Laurent leathergoods and refreshed classic handbags remained strong, wholesale revenues fell -35%, reflecting wider group efforts to streamline distribution.

Recurring operating income was €593 million, while recurring operating margin was 20.6%. This was supported by investments in collections, stores and clientelling initiatives.

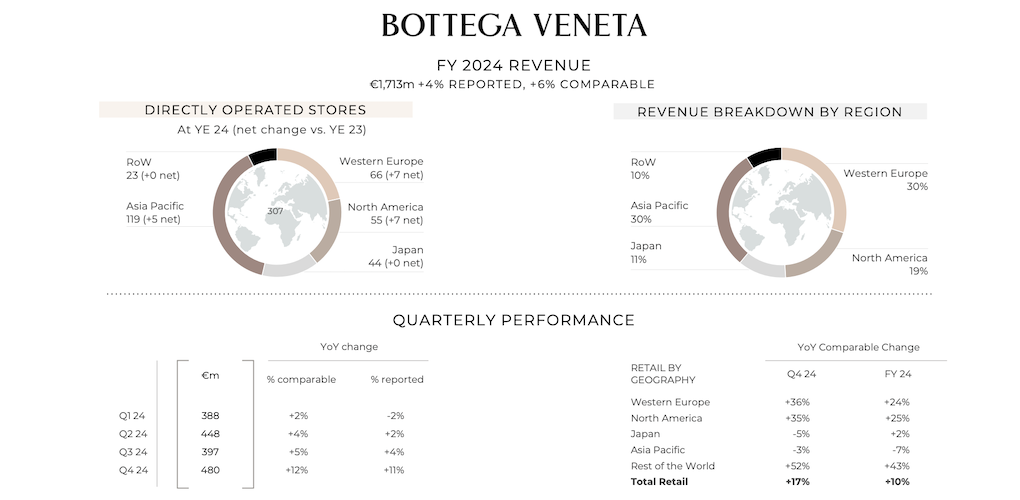

Bottega Veneta

Bottega Veneta delivered a positive performance in 2024, with revenue rising to €1.7 billion, up +4% reported and +6% like-for-like. Bottega Veneta’s directly operated retail network sales increased +10%, while wholesale revenue declined -15%, reflecting the highly selective approach to partnerships.

Wholesale revenue declined -10%, however trends in Asia Pacific improved and the demand for the house’s leathergoods remained strong.

The brand achieved recurring operating income of €255 million, with a recurring operating margin of 14.9%, as it continued investments in communications and store expansion.

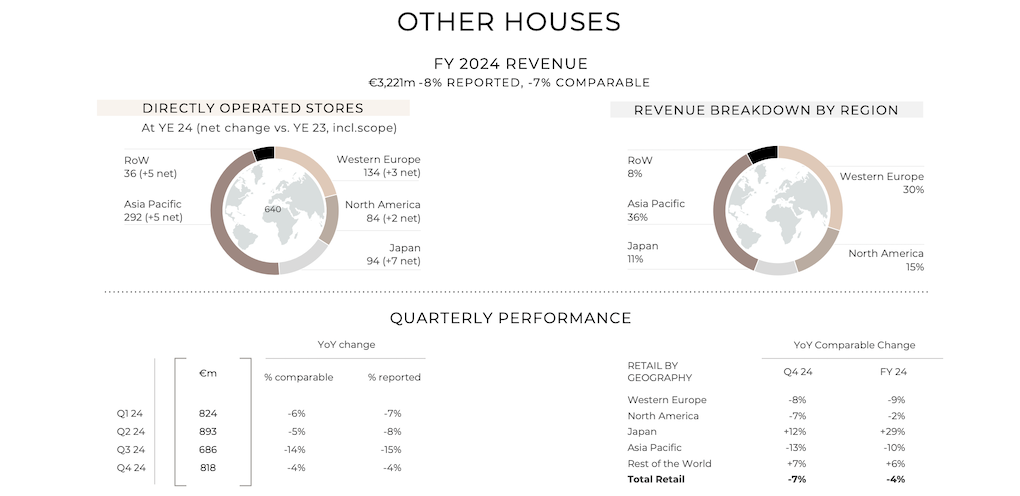

Other houses

Revenue from other houses reached €3.2 billion, down -8% reported and -7% like-for-like. Retail sales contracted -4%, while wholesale revenues declined -17%. Balenciaga’s leathergoods segment performed well, while Alexander McQueen experienced challenges due to a brand transition. Brioni posted double-digit growth, while the group’s jewellery houses, particularly Boucheron, saw strong performances.

Other houses recorded a recurring operating loss of €9 million, reflecting negative operational leverage at the couture and leathergoods divisions.

Outlook

Looking ahead, Kering said it remains committed to its long-term strategy of strengthening brand desirability and exclusivity while balancing creative innovation and heritage.

Kering plans to enhance efficiency through disciplined cost control, selective investments and prudent balance sheet management while supporting the long-term expansion of its houses.

Focus on Kering Eyewear Kering Eyewear generated total revenue of €1.6 billion in FY2024, as it marked its tenth anniversary. The performance was led by flagship brands Gucci, Maui Jim, Cartier and Saint Laurent. Key distribution channels, including local chains and the ‘Three Os’ (Opticians, Optometrists and Ophthalmologists), accounted for 50% of sales, with additional growth in brand-owned stores and travel retail. Kering Eyewear recorded a recurring operating margin was 17.5%, slightly less than in 2023 because of increased investments at Maui Jim, aimed particularly at continuing its development in new markets including travel retail. Kering Eyewear continues its notable investments in Maui Jim and other key acquisitions such as LINDBERG. Its Q4 revenues were up +8% reported and +7% on a comparable basis at €326 million. Balanced growth across optical frames and sunglasses positions it strongly for continued leadership in the luxury eyewear segment.

|

![Silver Airways Can’t Pay for Planes—So It’s Firing Pilots Instead [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/01/silver-airways.jpg?#)

![[FINAL WEEK] Platinum Status And 170,000 Points: IHG’s New $99 Credit Card Offer Worth Getting And Keeping](https://viewfromthewing.com/wp-content/uploads/2016/06/IMG_3311.jpg?#)

.jpg?width=1920&height=1920&fit=bounds&quality=80&format=jpg&auto=webp#)

![[Podcast] Should Brands Get Political? The Risks & Rewards of Taking a Stand with Jeroen Reuven](https://justcreative.com/wp-content/uploads/2025/03/jeroen-reuven-youtube.png)