Fraport Group retail revenue maintains growth ahead of passenger traffic in 2024

Net retail revenue per passenger reached €3.35, a slight improvement on €3.30 in the previous year.

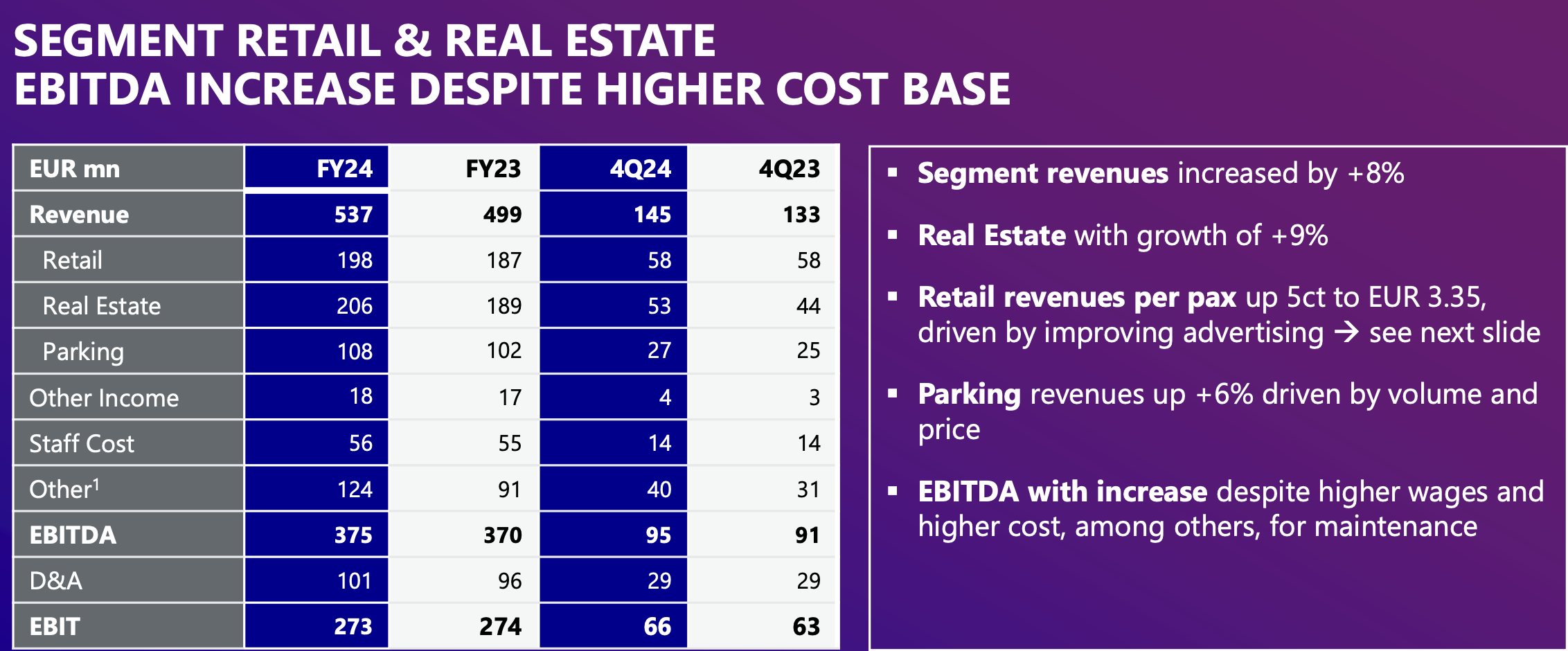

GERMANY. Fraport Group today reported annual results for 2024, with Retail & Real Estate revenue climbing +7.6% year-on-year to €536.7 million. The rise was attributed mainly to to higher retail and car parking revenue.

Net retail revenue per passenger reached €3.35, a slight improvement on €3.30 in the previous year.

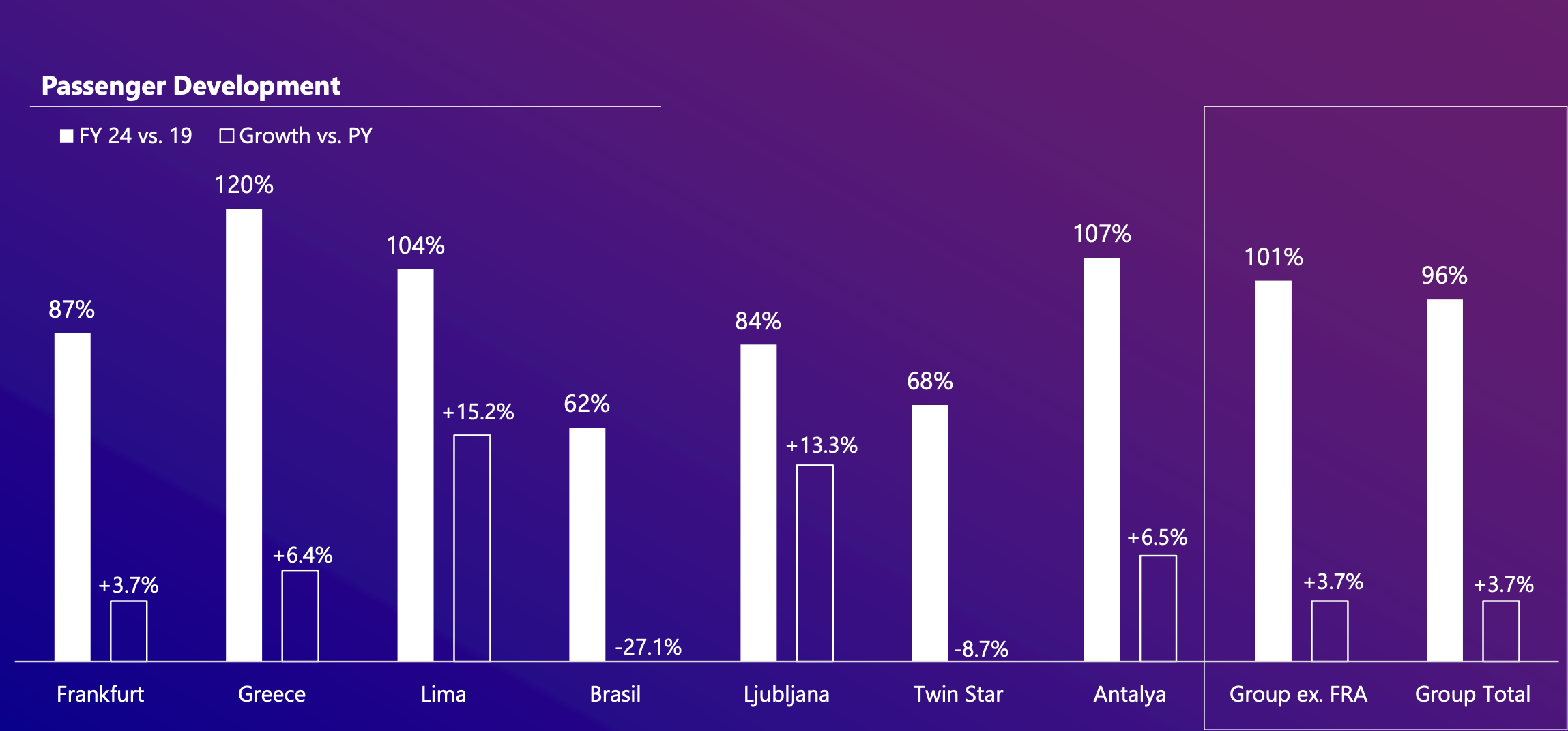

Retail growth was ahead of a +3.7% passenger traffic increase at Frankfurt Airport, to 61.6 million, a figure that was around 87.3% of pre-pandemic year 2019. Fraport noted that passenger traffic in Germany is lagging other markets where Fraport is present, with most now exceeding 2019 levels.

Fraport said the sluggish growth at its home airport was partly down to strikes and weather-related flight cancellations at the beginning of last year. Business travel showed signs of growth but with “subdued momentum”. European traffic increased +4.2% while intercontinental traffic grew +3.4%. Within this, traffic on Asian routes increased +13.3%, mainly due to China traffic, which recorded the highest absolute increase. The rising volume of Indian destinations also contributed to the result.

Group revenue climbed +10.7% to €4,427 million, with EBITDA up +8.1% to €1,302 million and net profit up +16.6% to €501.9 million.

Looking ahead, Fraport Group noted that the planned new Frankfurt Airport Terminal 3 will deliver 12,000sq m of additional retail space, taking the airport total to 42,000sq m by 2026.

On the commercial outlook, Q3 2026 will be the first quarter with T3 in full operation and carriers shifted from T2. In turn these moves will buoy T2 with an improved offering and smoother processes, and deliver an estimated +50% uplift in retail income from T2 in 2027.

Alongside T3, other big group projects are nearing completion. A new terminal is set to open soon in Lima, which will almost double passenger capacity to 40 million. At Antalya Airport, a comprehensive expansion will also soon be completed before this summer season, taking capacity to 65 million passengers a year.

Passenger numbers in Frankfurt are forecast to reach up to 64 million in 2025. Group EBITDA is projected to see a moderate increase while the group result (net profit) is expected to remain stable or decline slightly, due to the non-recurrence of a one-off effect from 2024, when the sale of a minority stake in St. Petersburg Pulkovo Airport contributed more than €40 million to the bottom line.

Fraport CEO Dr Stefan Schulte said, “Despite headwinds, we’ve achieved a solid result. While at the start of 2024 we were still seeing growth rates of around +10%, passenger volumes gradually declined as the year went on. In addition to bottlenecks in the delivery of new aircraft, excessively high regulatory costs continue to be a major factor.

“If no political action is taken, costs imposed by regulators will further increase in 2025, with airlines facing an additional €1.2 billion burden. On the positive side, our international subsidiary airports largely presented a better performance, with many of them achieving dynamic growth rates. Our group airports in Lima, Ljubljana, Antalya and Greece all performed particularly strongly.”

![Battle Hordes of Alien Horrors in Survival Shooter ‘Let Them Come: Onslaught’ [Trailer]](https://bloody-disgusting.com/wp-content/uploads/2025/03/letthemcome.jpg)

![Please Watch Carefully [THE HEART OF THE WORLD]](http://www.jonathanrosenbaum.net/wp-content/uploads/2018/05/the-heart-of-the-world-5-300x166.jpg)

![Passenger Pops Open Champagne Mid-Flight—That Didn’t Go Over Quietly [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/03/passenger-pops-champagne.jpg?#)

![[Podcast] Should Brands Get Political? The Risks & Rewards of Taking a Stand with Jeroen Reuven Bours](https://justcreative.com/wp-content/uploads/2025/03/jeroen-reuven-youtube-1.png)

![[Podcast] Should Brands Get Political? The Risks & Rewards of Taking a Stand with Jeroen Reuven](https://justcreative.com/wp-content/uploads/2025/03/jeroen-reuven-youtube.png)