DFWC KPI Monitor highlights +110% growth in international departures as Asia Pacific air traffic returns

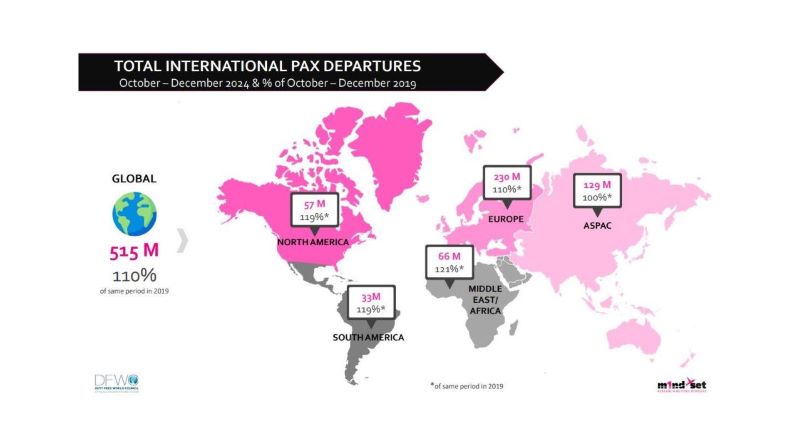

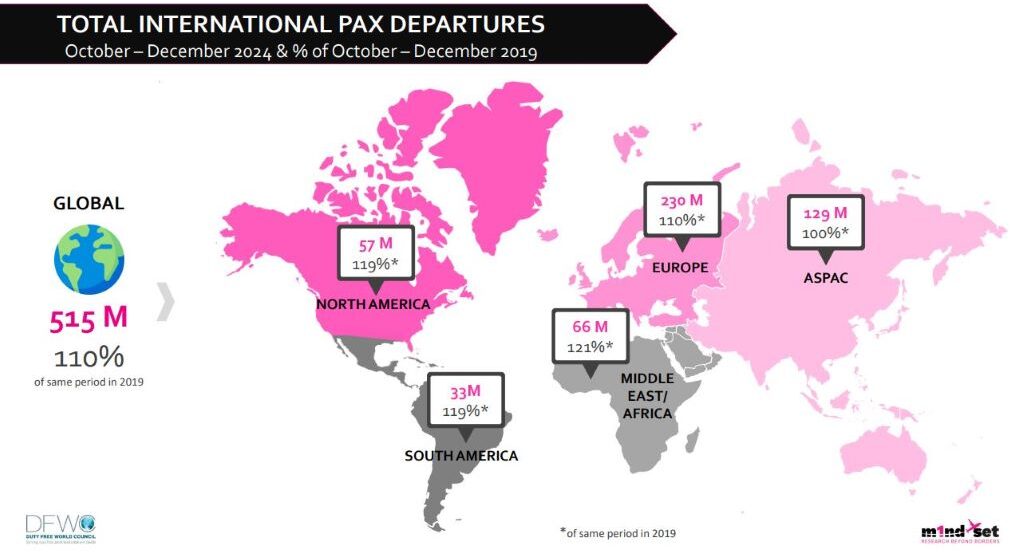

Traveller volume surged to 129 million, reflecting a +110% increase compared to the same period in 2019, with a total of 515 million international departures recorded from October to December.

The Duty Free World Council (DFWC) quarterly KPI Monitor, produced by research agency m1nd-set, has highlighted a strong recovery in international outbound travel in Q4 2024.

Traveller volume surged to 129 million, reflecting a +110% increase compared to 2019, with a total of 515 million international departures recorded from October to December.

Europe’s air traffic was in line with the global average of 110%, totalling 230 million passengers, compared to the same period in 2019.

North and South America both reported +119% growth in departures, with North America reaching 57 million and South America 33 million.

The Middle East & Africa emerged as the top-performing region with international departures up +121%, totalling 66 million.

European airports led the top ten rankings for international departures, claiming five spots, while Asia Pacific followed with four.

Dubai Airport recorded the highest number of passengers with 12.3 million, just ahead of London Heathrow with 12.1 million.

Singapore Changi Airport secured the third spot with 10.4 million international departures, followed by Seoul Incheon with 10 million and Amsterdam Schiphol at 9.4 million.

Also in the top ten were Paris Charles de Gaulle (9.3 million international travellers), Frankfurt (8.1 million), Hong Kong (8 million) and Bangkok (6.6 million).

Airport shopper insights

Alongside airport traffic growth, the DFWC’s quarterly KPI Monitor presents an update on key shopper trends.

The latest research revealed that key purchase drivers for duty-free shoppers remained stable between Q3 and Q4 2024. “Good value for money” emerged as the leading factor, with its importance increasing moderately among global shoppers, rising from 25% in Q3 to 27% in Q4.

Convenience in purchase decisions edged down from 19% to 18% over the two quarters, while self-indulgence grew, with both “suitability as a self-treat” and “to indulge myself” rising +1%.

While shoppers still prioritise value for money, the role of price has noticeably weakened in recent years.

m1nd-set Owner and CEO Dr Peter Mohn said: “We are witnessing a clear shift in shoppers’ perception of price in duty free. Price advantage is becoming less of a determining factor, while the in-store experience is becoming more important.

“Over the past few years, the percentage of global duty-free shoppers who view price advantage as a key purchase driver has dropped sharply from 30% to just 13%. In terms of net drivers, promotions and value for money now rank second at 44%, while in-store experiences have overtaken price as a purchase driver, with 45% of shoppers citing the overall experience as a primary influence on their purchasing decisions.”

Despite this, high prices continue to discourage duty-free purchases, with 17% of travellers opting not to buy due to “higher prices than at home”, while 15% cited “higher prices than at their destination”, an increase from 14% in Q3.

Of those not purchasing, 15% said they “had no intention of purchasing anything”, 14% pointed out to a “lack of interesting promotions” and 14% said they were “unwilling to carry more items”. Another 12% noted they had “purchased elsewhere”.

Reflecting the trends in purchase behaviour, self-purchases rose slightly from 53% to 55% between Q3 and Q4, while gifting purchases were down from 24% to 22%. Both sharing and on-request purchases showed a slight difference, with sharing purchases dropping from 17% to 16%, and on-request purchases rising from 6% to 7%.

The data also revealed a decrease in shoppers planning their purchases, from 29% in Q3 to 27% in Q4. This decline is linked to reduced exposure to key touchpoints, as only 30% of shoppers noticed duty-free offerings in Q4, down from 34% in Q3.

Online searches emerged as the main source of information on duty-free offerings, with shoppers turning to general internet searches, specific shopping sites, brand websites, social media and retailers’ own websites.

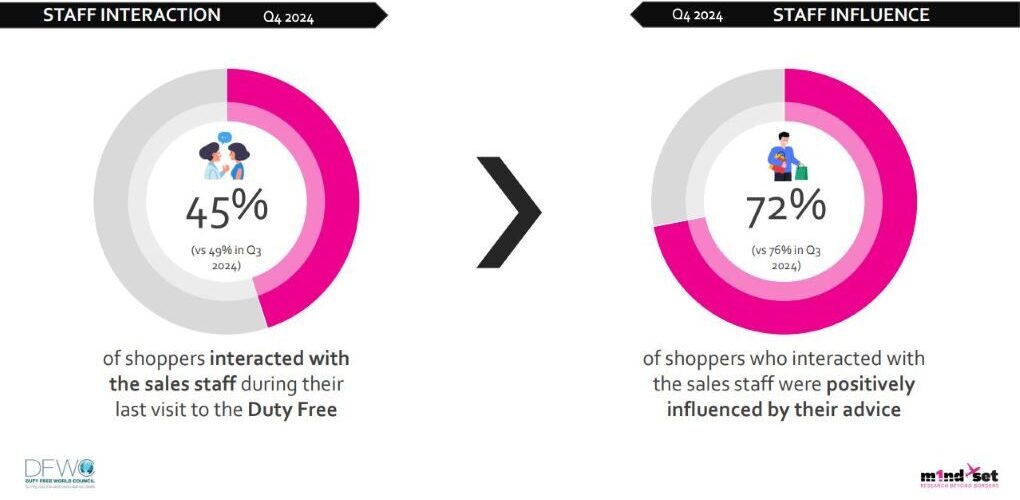

The role of in-store sales staff as a key touchpoint also saw a decline in importance and impact from Q3 to Q4, as only 45% of shoppers interacted with staff during their last duty-free visit in Q4, down from 49% in the previous quarter. Among those who engaged, 72% said the advice had a positive impact, marking a -4% drop from the previous quarter.

DFWC President Sarah Branquinho said: “To stay competitive retailers must prioritise enhancing the in-store experience, as it’s now the key driver of purchasing decisions. This means offering interactive displays, personalised services and exclusive, premium products.

“Transparent pricing strategies and stronger online engagement are also essential as many shoppers research the duty-free offer before they arrive at the airport. In-store staff training should also focus on providing personalised service, as customer interaction remains a key factor in influencing purchases.

“Finally, a stronger emphasis on tailored, time-sensitive promotions and loyalty programmes will appeal to both value-driven and experience-focused shoppers, ensuring they feel rewarded for their purchases and encouraged to return.”

![First-Person Psychological Horror Title ‘The Cecil: The Journey Begins’ Arrives on Steam April 3 [Trailer]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/03/cecil.jpg?fit=900%2C580&ssl=1)

![‘It Ends’ Review: The Kids Are Not Alright In Alex Ullom’s Evocative Existential Horror Debut [SXSW]](https://cdn.theplaylist.net/wp-content/uploads/2025/03/12223138/it-ends-sxsw.jpg)

![Silver Airways Can’t Pay for Planes—So It’s Firing Pilots Instead [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/01/silver-airways.jpg?#)

![[FINAL WEEK] Platinum Status And 170,000 Points: IHG’s New $99 Credit Card Offer Worth Getting And Keeping](https://viewfromthewing.com/wp-content/uploads/2016/06/IMG_3311.jpg?#)

.jpg?#)

![[Podcast] Should Brands Get Political? The Risks & Rewards of Taking a Stand with Jeroen Reuven](https://justcreative.com/wp-content/uploads/2025/03/jeroen-reuven-youtube.png)