China’s Cognac crisis costs Rémy Cointreau €10 million in Q4 while US tariff concerns linger

Speaking during the Rémy Martin and Louis XIII Cognac owner’s earnings call on 30 April, Group CFO Luca Marotta said the crisis had “weighed heavily” on brand and overall company performance.

The “inaccessibility” of China’s duty-free channel – the result of a sustained tit for tat tariff row between the country and the European Union (EU) since last October – cost French drinks house Rémy Cointreau approximately four points of impact at group level or around €10 million for its Q4 ended 31 March.

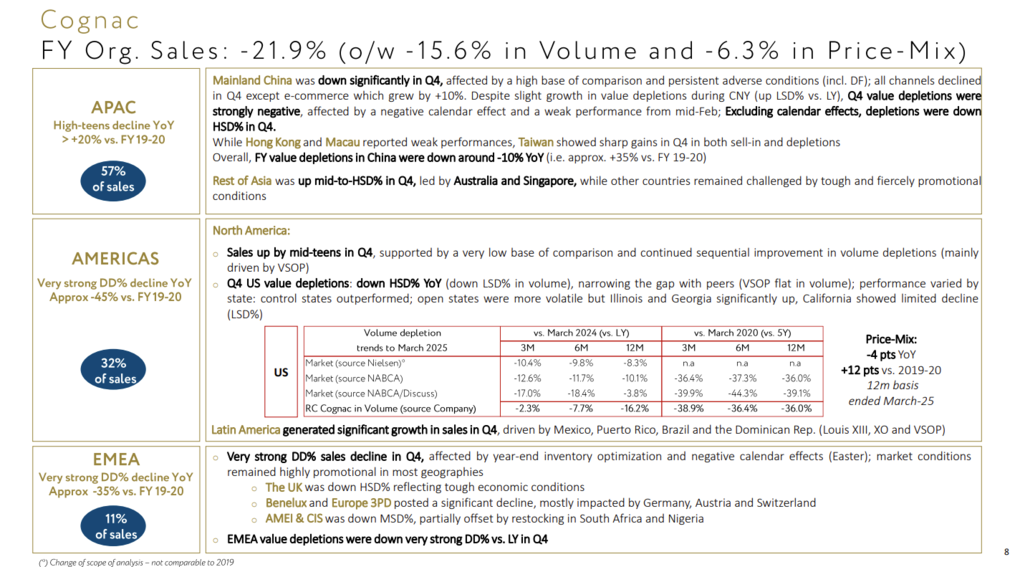

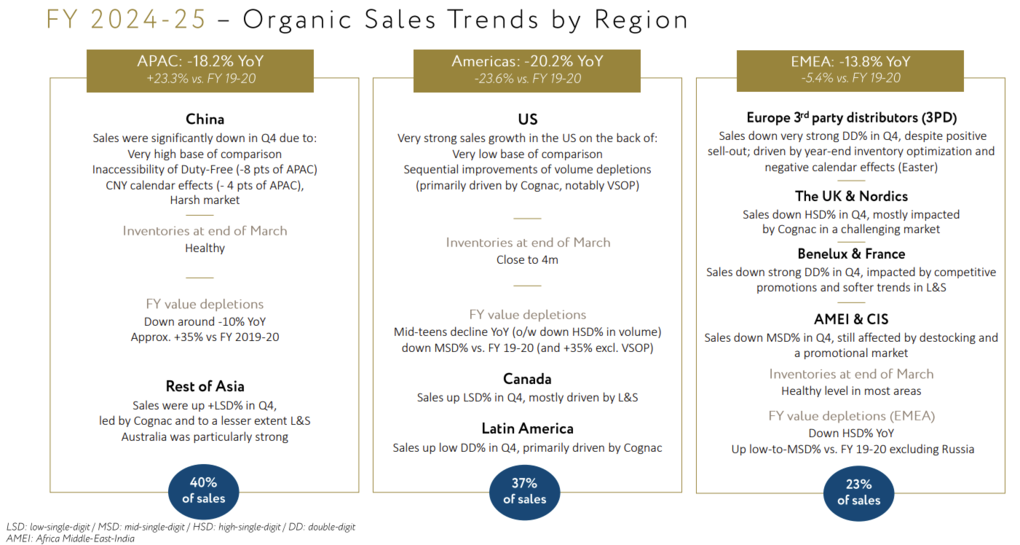

Speaking during the Rémy Martin and Louis XIII Cognac owner’s earnings call on 30 April, Group CFO Luca Marotta said the crisis had “weighed heavily” on brand and overall company performance.

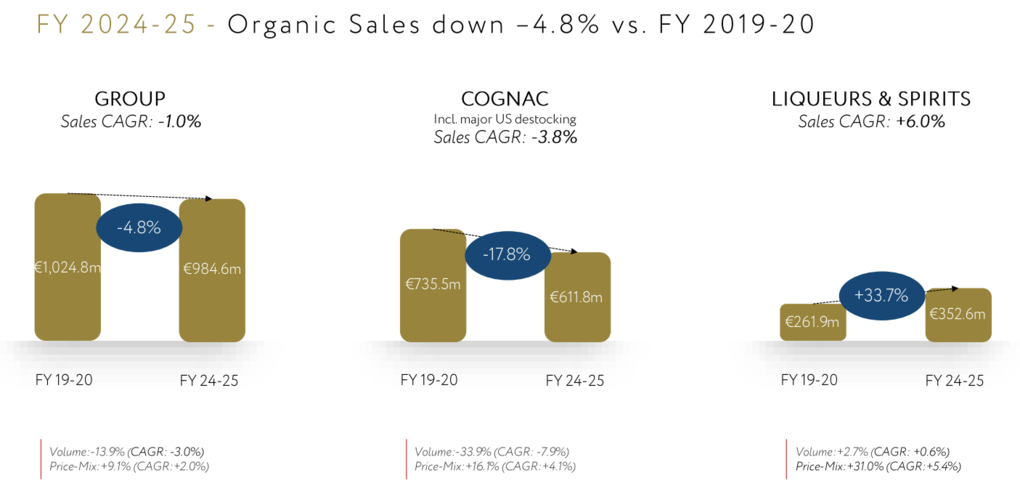

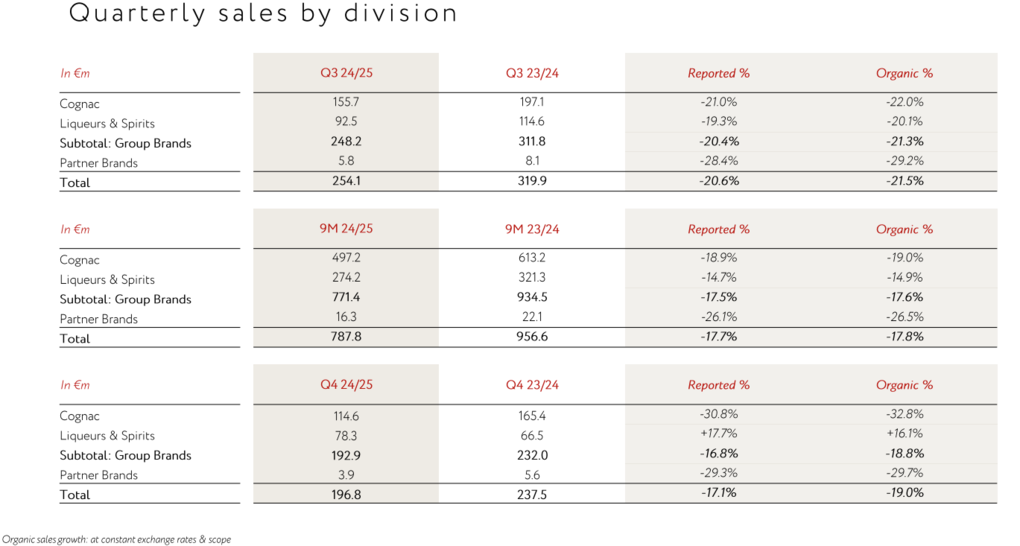

As reported, Rémy Cointreau suffered a -32.8% year-on-year slump in Q4 Cognac sales to €114.6 million, contrbuting to a -17.1% decline in group revenues.

China imposed tariffs on all EU brandy imports last October amid an inquiry into alleged dumping on the China market. The tariffs were widely read as a response to the EU placing punitive levies on Chinese-made electric vehicles.

As a result all EU brandy imports from October faced substantial security deposit requirements. This has meant that Chinese duty-free retailers have been unable to restock Cognac or EU brandies such as Rémy Cointreau-owned French brandy St-Rémy) supplies over recent months.

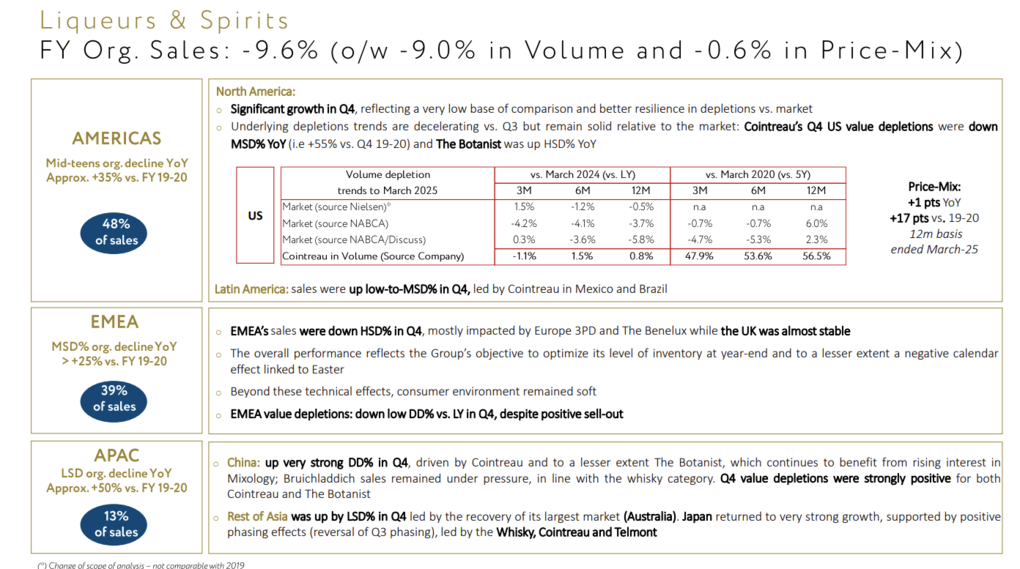

Marotta said: “APAC region sales decreased by -18.2% in full year 24/25 This performance includes a sharp sales drop in Q4 impacted in China by an exceptionally high base of comparison, disruption in the duty-free channel and Chinese New Year timing effect, representing on APAC region level 12 points or €15 million… at the group level because they [the negative factors] all belong to APAC.”

Marotta expressed hope that the duty-free challenge in China will be solved but said the company remains “very cautious”.

Tariff uncertainty weighs on China and US prospectsCommenting on the impact of tariffs (current and threatened) in the key Cognac markets of China and US, Rémy Cointreau Group CFO Luca Marotta said there will be no organic improvement in Cash Operating Profit (COP) margin for ‘25/26’ if imports to both countries suffer from tariff burdens. He said it is “quite impossible” to project precisely what will happen but held out some hope that the China-EU row would be resolved. “I don’t know if it is true, but there seems to be a little bit more of a positive attitude on the China level, considering the dialogue between Europe and China at this stage,” Marotta commented. |

Background to a tariff war

Since January last year, the Chinese government has been investigating whether French brandy is being sold in China at artificially low prices. This case, part of a broader trade dispute between the EU and China over tariffs on Chinese electric vehicles, has resulted in brandy imports facing substantial security deposit requirements.

Rémy Cointreau said it has taken note of the provisional decision by China’s Minister of Commerce (MOFCOM) to impose additional duties of 38.1% on Cognac imports starting 11 October 2024.

If these duties are confirmed, Rémy Cointreau will trigger an action plan to mitigate the effects, starting in fiscal 2025-26.

MOFCOM’s investigation is ongoing. On 2 April, it announced an extension of the inquiry to 5 July.

Also on 2 April, the US government announced plans to impose tariffs on all imports, effective 9 April. For Rémy Cointreau this would mean customs duties of 20% on all imports from the EU, 10% on those from the UK and 10% on imports from Barbados.

On 9 April, the US announced a 90-day suspension of so-called ‘reciprocal’ duties for countries/blocs open to negotiation (notably the European Union), while maintaining a minimum 10% tariff on all foreign goods except those from China.

The European Union declared a parallel 90-day suspension of its countermeasures to the US tariffs.

Rémy Cointreau said it has protected its current operating margin in organic terms as much as possible through continued tight cost controls and the deployment of a new cost-cutting plan totalling over €50 million.

![‘Omukade’ Trailer – Thai Monster Movie Unleashes an Insane Giant Centipede Nightmare! [Exclusive]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/05/image-30.jpg?fit=1713%2C931&ssl=1)

![‘Sally’ Trailer: Acclaimed Sundance Doc About Trailblazing First Woman To Blast Into Space [Ned]](https://cdn.theplaylist.net/wp-content/uploads/2025/05/02065833/unnamed-2025-05-02T065720.586.jpg)

![100K strategy and powering up with the right cards [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/05/powering-up-credit-cards-1.jpg?#)