Bilt Rewards Complete Guide (2025)

Bilt Rewards is a program in which you can earn points by paying your rent, dining out, shopping, and/or using the Bilt Mastercard. You can then use those points in a variety of ways, including transferring them to one of Bilt’s industry-leading portfolio of travel partners. Bilt’s program has changed quite a bit over the […] The post Bilt Rewards Complete Guide (2025) appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

Bilt Rewards is a program in which you can earn points by paying your rent, dining out, shopping, and/or using the Bilt Mastercard. You can then use those points in a variety of ways, including transferring them to one of Bilt’s industry-leading portfolio of travel partners.

Bilt’s program has changed quite a bit over the last year, and we updated this guide for 2025 with additional earning opportunities, program details, and transfer partners.

Bilt Rewards: a points program built for renters

Bilt Rewards is a program designed to enable those who rent their homes to earn points on the rent. This makes the program and associated card unique in offering an easy way to earn points on what is the largest monthly expenditure for those living in many markets.

There are several ways to earn and redeem Bilt Rewards points, each covered below.

Bilt Rewards Elite Status

Bilt Rewards has an elite status program that offers the chance to earn interest on rewards points, among other benefits. One of the biggest perks to elite status is having access to better promotions on Bilt’s monthly Rent Day promotion, where transfer bonuses and various other opportunities will be more generous the higher your status level is.

Here’s the current summary of Bilt elite levels:

You can qualify for elite status by total points earned or through several different channels, including:

- Bilt Mastercard (excluding rent)

- Shopping and dining with a card that’s linked to your Bilt wallet (Neighborhood Rewards)

- Booking trips through the Bilt Travel Portal

- Linking your Lyft account and using it for rideshare

Elite status thresholds are as follows:

- Blue – anyone enrolled in Bilt Rewards with under 50,000 points

- Silver – 50,000 points earned or $10K in non-rent spend

- Gold – 125,000 points earned or $25K in non-rent spend

- Platinum – 200,000 points earned or $50K in non-rent spend

Benefits as you move up status tiers include:

- Silver and higher

- Earn interest in the form of points to a member’s Bilt Rewards account every month based on average daily points balance for each 30-day period (rate is based on the FDIC published national savings rate)

- Bilt will deposit up to 50% bonus points on top of points issued by landlords to

members for signing for new tenant leases and lease renewal., depending on

member status.

- Gold and higher

- Bilt Homeownership Concierge: Members who redeem Bilt Points toward a home down payment can get help from a dedicated concierge who will walk the member through the home buying process.

- Access to BLADE lounges (even when not flying BLADE, although you’re limited to two beverages when in that case).

- Platinum

- Members will receive a complimentary gift from the Bilt Collection (apparently some type of home decor / art).

- One free BLADE helicopter ride each time you qualify (or re-qualify) for status.

- Air France/KLM Flying Blue Gold Status: Platinum members can receive 12 months of Flying Blue Gold status by registering and transferring 10,000 points to Flying Blue. This also get you Sky Team Elite Plus, which can be beneficial for partner lounge access.

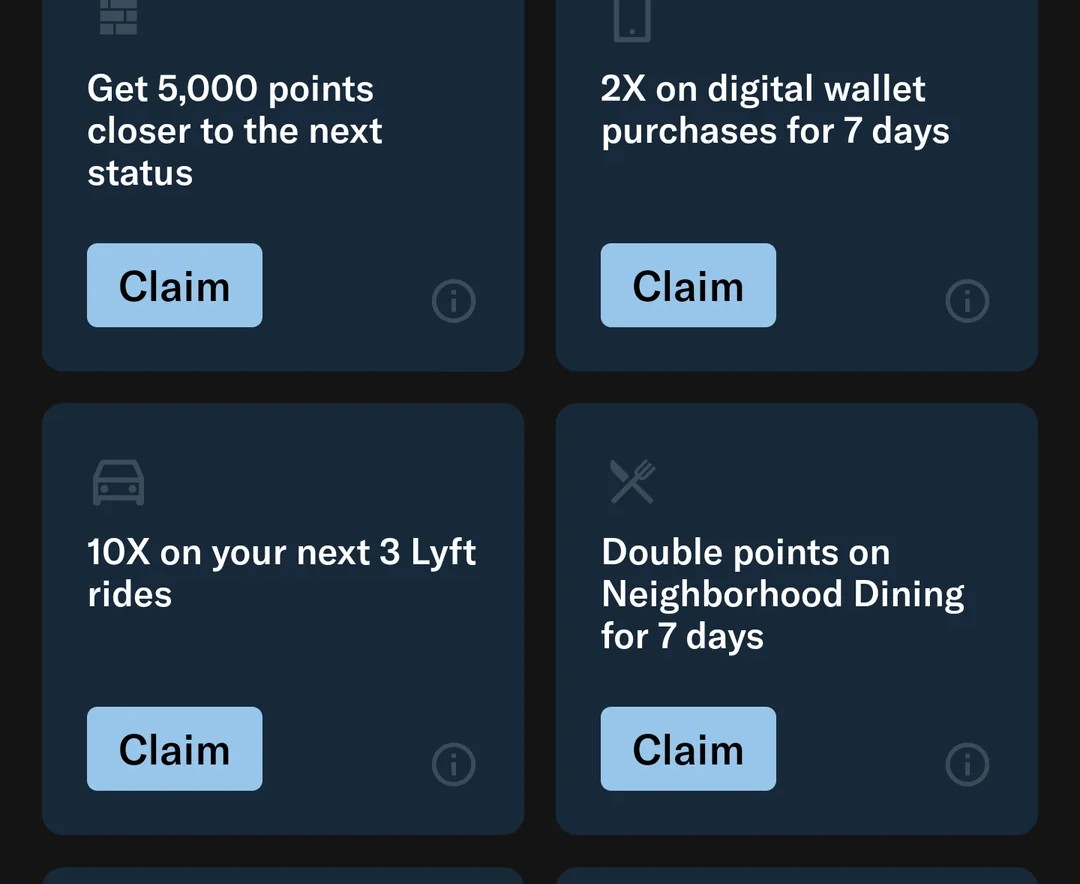

Bilt Milestone Rewards

In addition to elite status, Bilt awards a series of “Milestone Rewards” after reaching various levels of points-earning within a calendar year. There’s not much to them, but they’re (barely) better than a kick in the pants:

- After earning 25,000 points, you can select one of:

- 2x at grocery stores with Bilt Mastercard for 30 days, up to 1,000 points

- 2x at gas stations with Bilt Mastercard for 30 days, up to 1,000 points

- 2x at event tickets with Bilt Mastercard for 30 days, up to 1,000 points

- 1,000 points towards the Bilt Collection

- 2x points on Bilt Dining for 7 days, up to 1,000 points

- After earning 75,000 points, you can select one of:

- any of the 25K options

- 2x on digital wallet purchases with Bilt Mastercard for 30 days, up to 1,000 points

- 10x on up to 3 Lyft rides (or $25 total in spending)

- After earning 100,000 points, you can select one of:

- any of the 75K options

- 5,000 (non-redeemable) points towards elite status

- After earning 150,000 points, you can select one of:

- any of the 100K options

- $10 towards a fitness class

- After earning 175,000 points, you can select one of:

- any of the 150K options

- 4x at grocery stores with Bilt Mastercard for 30 days, up to 3,000 points

- 4x at gas stations with Bilt Mastercard for 30 days, up to 3,000 points

- After earning 225,000 points (and every 25K increment afterwards), you can select one of of the 175K options.

How to earn Bilt Rewards points

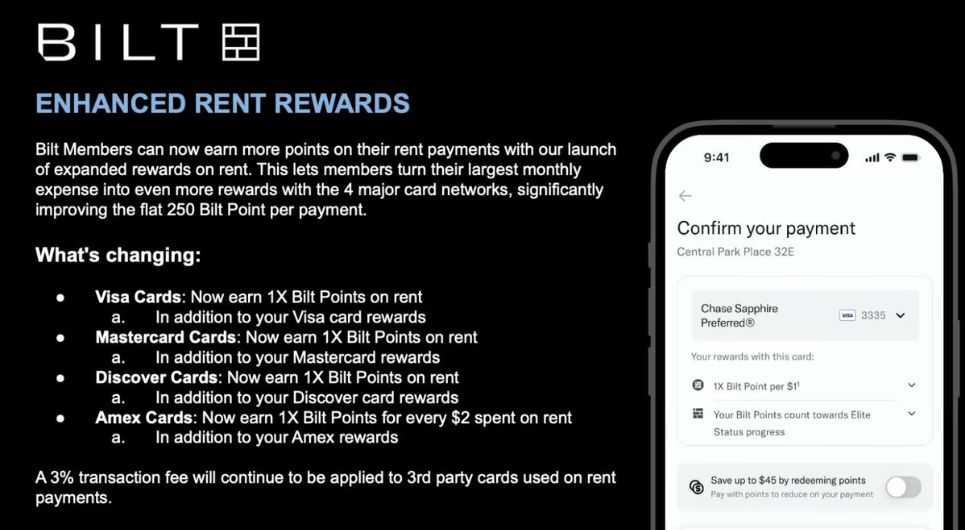

Pay rent (non-cardholders)

Almost anybody with a credit card can now earn 1 point/mile per dollar when paying rent via Bilt. However, non-cardholders will pay a 3% fee to do it. The earnings vary slightly depending on what type of card you use:

- Rent payments made via a Visa, Mastercard, or Discover credit card will earn 1 Bilt Point per $1 spent (in addition to credit card rewards)

- Rent payments made via an American Express® credit card will earn 1 Bilt Point per $2 spent (in addition to credit card rewards)

- The Alaska personal cardholders will earn 3x Alaska miles per dollar in addition to credit card rewards, but DO NOT earn additional Bilt points

- There is a 100K yearly maximum earning limit for Bilt points across all payment methods.

Essentially, you can look at it as through you’re buying points for 3 cents per dollar when paying rent. In most normal cases, that won’t be worth it. However, there are several where it could be: when meeting a new credit card welcome offer or when using a credit card whose rewards outweigh the 3% fee.

Non-cardholders are limited to paying rent via the Bilt portal or by ACH. Check payments are not an option if you don’t hold the Bilt Mastercard.

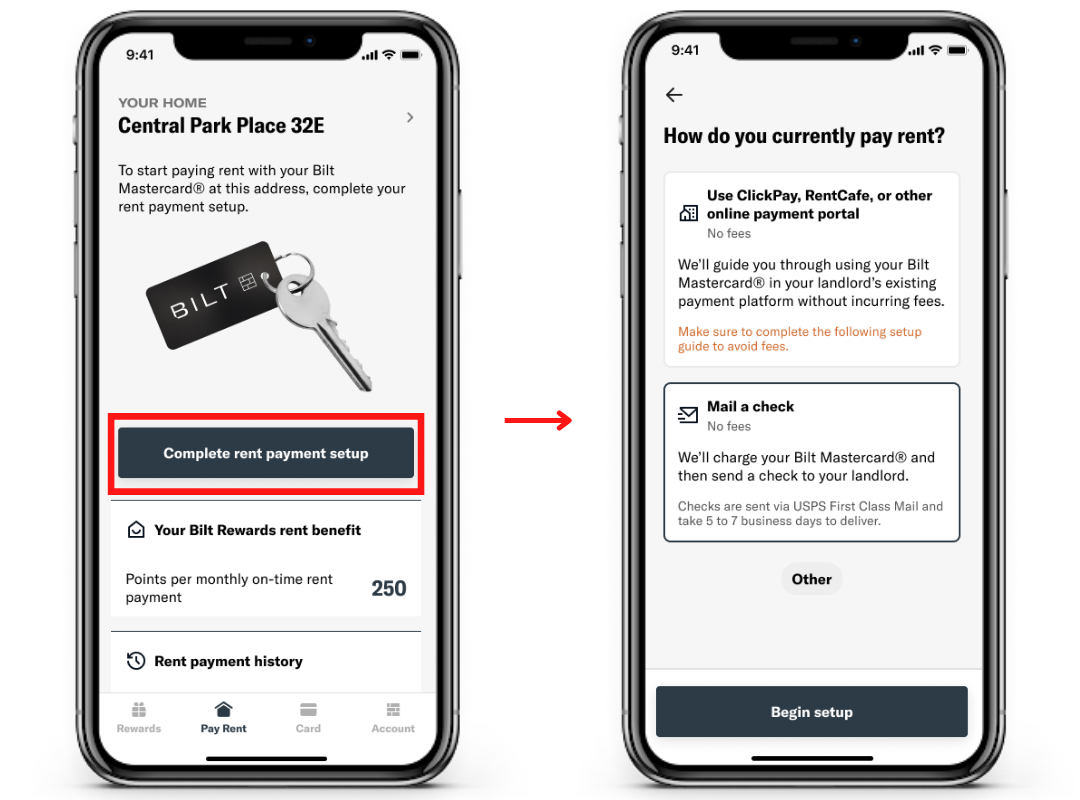

Pay Rent ( Bilt cardholders)

Even if your landlord doesn’t accept a credit card, Bilt Mastercard cardholders can pay rent via check or ACH and still earn 1x points on rent (up to 100,000 points per year). Whether you pay by check, ACH, or with your Bilt Mastercard, you’ll pay your rent through the Bilt app (or use the app to generate ACH account information that can be copied into your online rent payment portal). This makes it very easy for most people to earn 1 point per dollar on rent (up to 100,000 points per year). Keep in mind that you’ll need to make 5 total transactions per month with the Bilt Mastercard in order to earn points, so be sure to use it for more than just the rent.

In the Bilt Rewards app, cardholders have the option to send a rent payment by mailing a check or by ACH transfer using ClickPay, RentCafe, or other online payment portals.

Link Rewards Programs to Bilt

Bilt Rewards offers 100 points for every loyalty program you link to your Bilt Rewards account. This represents very low-hanging fruit for most members. Note that Bilt has occasionally run promotions with increased incentives for linking specific programs.

Use the Bilt Mastercard

| Card Name w Details & Review (no offer) |

|---|

FM Mini Review: If you pay rent and haven't been earning rewards, this card is a no-brainer as you can pay your rent and earn rewards with no annual fee. A surprisingly good set of transfer partners makes the rewards for using this for rent worth getting the card for that main purpose alone (as long as you remember to use the card 5 times per month). No Annual Fee Earning rate: Must use your card for 5 purchases per month, then: 3x Dining ✦ 3x Lyft ✦ 2x Travel ✦ 1x rent (one payment per month, up to 100,000 points per year) ✦ 1x on other purchases Card Info: Mastercard World Elite issued by Wells. This card has no foreign currency conversion fees. Noteworthy perks: Transfer points 1 to 1 to airline and hotel programs (including American Airlines, United, Hyatt, Aeroplan, and more) ✦ Redeem points for 1.25 cents each towards travel booked through Bilt's travel portal ✦ Cell phone insurance ✦ Primary rental car insurance ✦ Purchase protection ($10K/item, $50K/year) ✦ Travel insurance ✦ No transaction fee to pay rent and earn rewards |

The Bilt Mastercard offers rewards in the form of Bilt Rewards points as shown above so long as you use your card for at least 5 transactions per month. If you do not use your card for at least 5 transactions per month, you will not earn points based on your card activity.

Note that even though the Bilt Mastercard doesn’t officially have a welcome bonus, many people who sign up for the card report receiving an email from Bilt offering 5x rewards on all charges except for rent for five days (up to 50,000 points max). While that’s not as big of a bonus as you’ll get with many other cards, it can still be significant especially if you have large bills to pay during that timeframe.

The Bilt Mastercard offers two bonus categories: 2x travel and 3x dining. While those multipliers do not put it at the top of our list of best category bonuses, they do represent good return for a no annual fee card that earns transferable points, especially given Bilt’s strong set of transfer partners and the ability to book travel at a value of 1.25c per point through Bilt’s portal.

Where the card really shines is in offering 1x on rent payments — even if your landlord does not accept a credit card. That’s because cardholders gain the ability to pay any landlord by sending a check or by ACH transfer as outlined above.

Earning 1 point per dollar on most purchases is not a good return on spend. That said, if you would not otherwise earn points for paying your rent, the overall math may work out well for those looking for a single long-term card. You could earn far more points by focusing your spend toward excellent credit card welcome bonuses, but the Bilt Mastercard can be a reasonable choice for someone who rents and is looking for a single no-annual-fee credit card.

Bilt occasionally runs some spending promotions for the Mastercard, so it’s worth keeping an eye out for similar promotions.

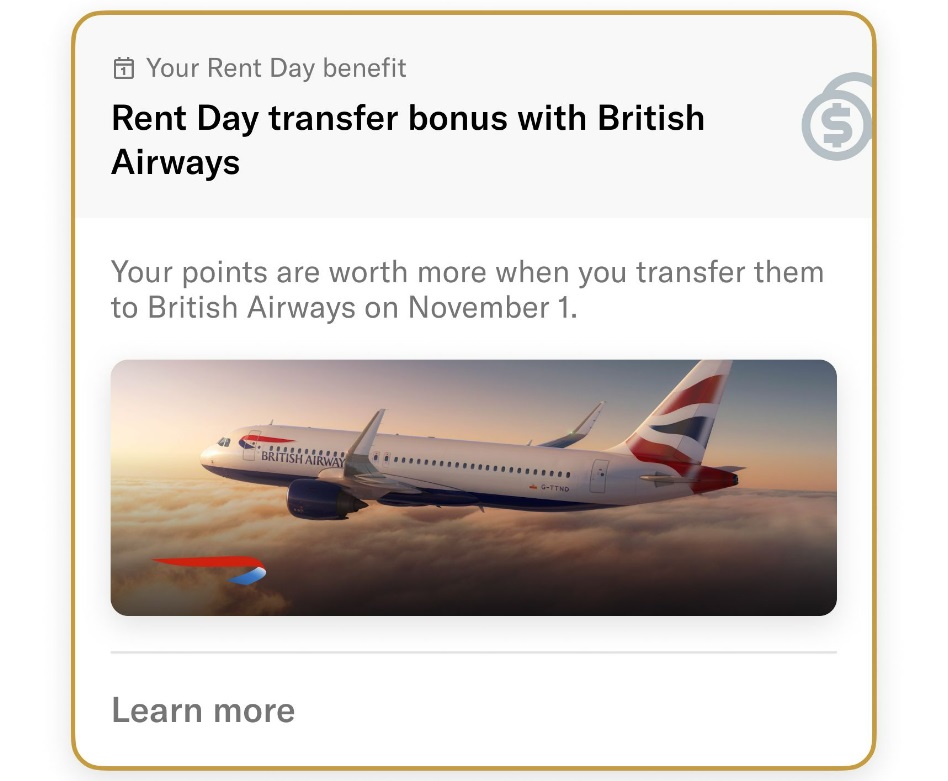

Bilt “Rent Day”

For a 24-hour period on the 1st of each calendar month, Bilt offers a promotion called “Rent Day” where members with the Bilt Mastercard earn double points on all non-rent purchases. Not only does this make the base earning rate 2x, it also doubles existing bonus categories, meaning that cardholders earn 6x dining and 4x travel. (but for one day only). That makes the first of the month a great day to buy a gift card at your favorite restaurant or to book pending travel (though it would likely be harder to plan that specifically for the first of the month given the fluidity of pricing).

Unfortunately, your earnings potential on Rent Day isn’t infinite: you can earn up to 1,000 maximum bonus points on rent day, a fairly modest ceiling given that it would take only $333.34 n dining purchases, $500 in travel or $1000 everywhere else to reach the 1K bonus point cap.

It’s also worth pointing out that, despite the name, you only earn 1x on when paying rent on “Rent Day.” The double rewards is for non-rent purchases only. In that regard, remember that you need to make 5 non-rent purchases per month in order to earn 1x on the rent. This double rewards deal on the first of the month should make it increasingly easy for cardholders to meet that threshold.

Bilt runs several promotions on Rent Day, in addition to the increased earnings on spend via the Bilt card. So far, offers that we’ve seen have included increased transfer bonuses, a monthly rent giveaway, free SoulCycle classes and a “Points Quest” trivia contest – a game within the Bilt Rewards app which gives you the chance to earn up to 250 points for completing a fairly simple task.

Referring friends to the Bilt Mastercard

Bilt offers a referral program for the Mastercard, but the normal rates aren’t stellar. For each person you successfully refer, you get 2,500 points. Every 5th successful referral gets you an additional 10,000 points – up to 2 million bonus points.

Note that you do not need to be a card holder in order to refer friends to the Bilt MasterCard. If you have friends who rent, this could be a way to earn some easy points. You can find your referral code by tapping the invite button in the app.

Bilt now limits you to a maximum of 50 lifetime referrals.

Link your Bilt account to Amazon (caution)

Bilt Rewards points can be used to buy things on Amazon. Don’t do it. It offers terrible value for your points. That said, you can earn 250 Bilt points by simply linking your Bilt account to your Amazon account. Still, we recommend proceeding with caution. we’re always hesitant to link rewards programs to Amazon for the fear of a Player 2 accidentally using points — or, worse yet, having an Amazon account hacked and a thief draining rewards points. The risk/reward calculation just isn’t worth keeping rewards programs linked long-term in most instances in our opinion.

Take Lyft rides (after linking your accounts)

Use any form of payment and earn 2X points on Lyft rideshare rides when your Bilt Rewards and Lyft accounts are linked, and Bilt is set as the active loyalty rewards partner. If you are a Bilt cardholder, you can earn 5X total points when paying with a Bilt Mastercard.

- Link to connect Bilt and Lyft accounts (Note: Frequent Miler may earn a commission if you link your Lyft account to Bilt through this hyperlink).

Bilt Neighborhood Rewards (card-linked offers)

Adding cards to your Bilt “wallet”

In order to earn Bilt points on card-linked offers, you must have the credit card that you’re using to pay with connected to your Bilt wallet. You can link credit cards (i.e. those from other issuers) to the Bilt Rewards app and then earn 100 points for each card you link to, up to three cards. After linking, you can earn extra points when using those cards to pay at restaurants or other merchants that participate in Bilt Neighborhood Rewards (such as Walgreens).

Link to manage your Bilt Wallet: frequentmiler.com/go/biltwallet/ (note that Frequent Miler may earn a commission if you add cards to your wallet through our link)

Dining

You can earn 2-10x points when paying with a card you have linked in the Bilt Rewards app at participating restaurants. The exact payout changes based on promotions run by each participating restaurant.

Note that the points you earn at these restaurants are in addition to the points earned using your chosen credit card (which does not have to be the Bilt card, but rather must be linked in the Bilt app).

In addition to earning points, some restaurants will send targeted offers to specific area customers via the Bilt app. These offers can, at times, provide significant savings.

Fitness Classes

You can earn up to 10 Bilt points per dollar spent for taking classes at a Neighborhood Fitness gym. Neighborhood Fitness partners include CycleBar, Pure Barre, Soul Cycle, YogaSix and many others. In order to earn points, classes must be booked through the Bilt app or website.

Walgreens

Bilt Rewards members can earn points when shopping at Walgreens, and it’s not even necessary to use the Bilt Mastercard. As long as you shop with a card that’s saved to your Bilt Wallet, you’ll earn points in addition to credit card rewards (like 3x Ultimate Rewards on the Chase Freedom Unlimited card).

Bilt also offers a service to identify purchases that are eligible for reimbursement by a Flexible Spending Account (FSA) or Health Savings Account (HSA). After flagging eligible items, it will then help by transferring funds to your credit card from a linked FSA/HSA payment card.

Earnings are as follows:

- 1x on in-store and online Walgreens purchases

- 2x on Walgreens-branded items

- 100 points on up to 26 prescription refills per year

In order to earn rewards, you have to save a credit card to your Bilt Wallet and then use that card at Walgreens. In order to earn the 100 points prescription bonus, you’ll have “enable rewards” in the Bilt app by going to the “Neighborhood” section of and selecting “Pharmacy” from the top menu option.

How to use Bilt Rewards points

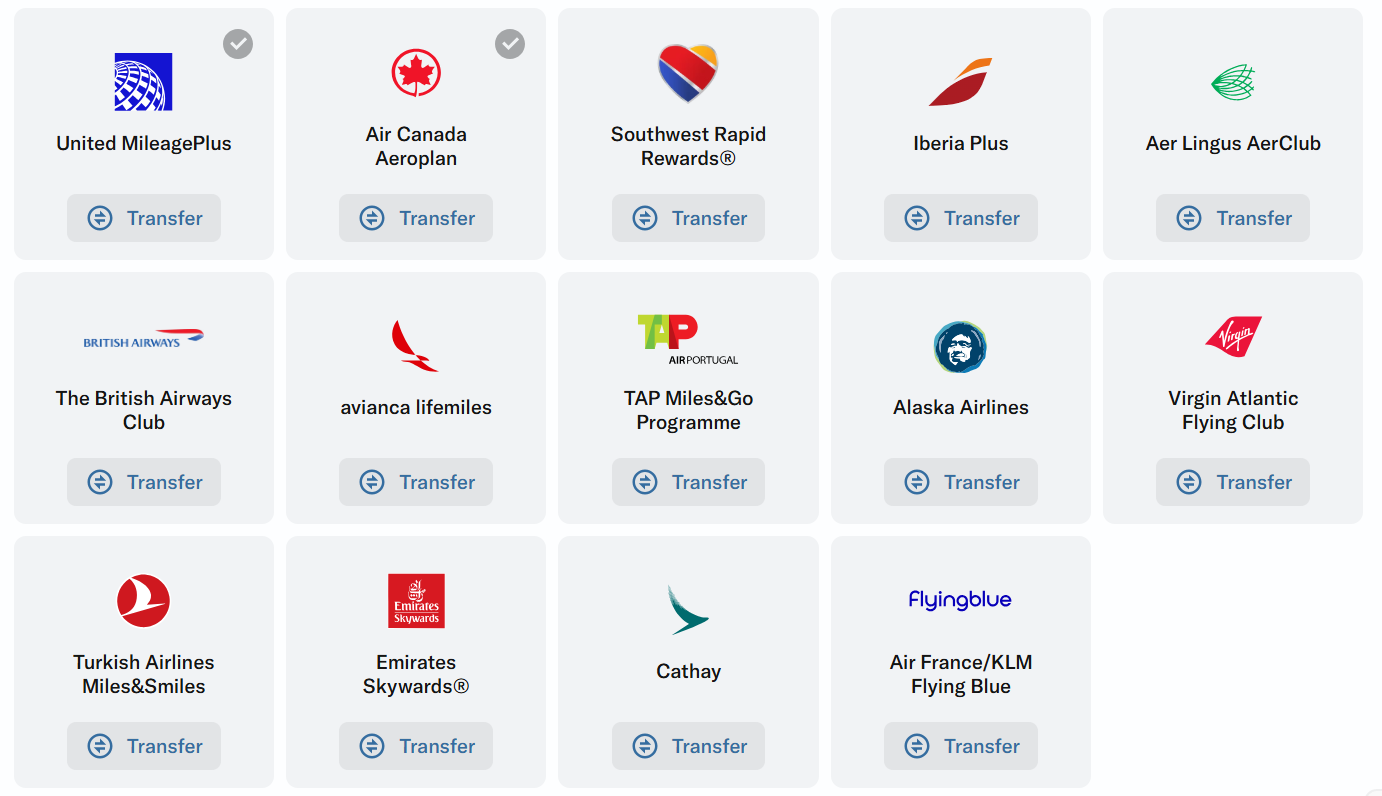

Transfer Bilt Rewards points to airline and hotel partners

Bilt has a very unique set of transfer partner that makes the program surprisingly strong. Outside of Accor Live Limitless, points transfer 1:1 to partners, with most transfers occurring almost instantly. Partner programs can provide opportunities for far outsized value.

Partners include:

Bilt Transfer Partners

Hotels

| Rewards Program | Best Uses | Bilt Transfer Ratio (and transfer time) |

|---|---|---|

| Accor Live Limitless | Use to pay hotel bill with value of 2 Euro cents per point. In some cases (such as hotel to airline transfer bonuses) it may make sense to convert Accor points to the following airline miles at a 1 to 1 ratio: Finnair, Iberia, Qantas, or Virgin Australia | 3 to 2 (Unknown) |

| Hilton | 5th Night Free awards. Best value is usually found with very low end or very high end Hilton hotels. Bonus: award nights are not subject to resort fees. Note that Hilton points often go on sale for half a cent each and so its rare for point transfers to Hilton to be a good value. | 1 to 1 (Unknown) |

| Hyatt | Use for Hyatt free nights, free suite nights, lounge upgrades, or suite upgrades. Hyatt points are often worth more than 2 cents each. Bonus: award nights are not subject to resort fees. | 1 to 1 (Instant) |

| IHG | IHG dynamically prices their awards and sometimes offer very good value. IHG Premier and IHG Premier Business cards offer the fourth night free on award stays. | 1 to 1 (Instant) |

| Marriott Bonvoy | 5th Night Free awards. Opportunities to get outsized value exist but can be hard to find. | 20K to 25K (Instant) |

Airlines

| Rewards Program | Best Uses | Bilt Transfer Ratio (and transfer time) |

|---|---|---|

| Aer Lingus Avios | Fuel surcharges are sometimes lower when booking with Aer Lingus rather than British Airways, Qatar, or Iberia. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| Air Canada Aeroplan | Redeem for Star Alliance flights and/or flights with Air Canada partners (such as Etihad). No fuel surcharges; $39 CAD award booking fee; 5,000 points to add stopover on one-way award. See: Air Canada Aeroplan: Everything you need to know. | 1 to 1 (Instant) |

| Air France KLM Flying Blue | Monthly Air France Promo Awards often represent very good value. Air France miles can be used to book Sky Team awards, including Delta awards. Air France often offers very good business class award pricing between the US and Europe & Israel. | 1 to 1 (Instant) |

| Alaska MileagePlan | Alaska Airlines offers decent oneworld award pricing, excellent short-distant pricing, and uniquely allows free stop-overs one one-way awards. Additionally, Alaska allows free award changes and cancelations (although they do have a small non-refundable partner award booking fee) | 1 to 1 (Instant) |

| Avianca LifeMiles | Avianca LifeMiles can be decent for Star Alliance awards. They offer reasonable-ish prices and no fuel surcharges on awards. Best of all, their mixed-cabin pricing can lead to fantastic first-class award prices. See this post for details. | 1 to 1 (Instant) |

| British Airways Avios | While flights on British Airways itself often incur outrageously high fuel surcharges, many BA partners charge low or no fuel surcharges. Excellent value can often be had in redeeming BA points for short distance flights outside the US. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| Cathay Pacific Asia Miles | Cathay Pacific has a decent distance based award chart, but they don't allow stopovers longer than 24 hours. Cathay Pacific Asia Miles can be a good option for booking American Airlines flights with a distance based award chart, especially if other OneWorld Alliance miles aren't available. For long distance flights, it is possible to reduce the cost of a premium cabin award by adding on a lower cabin segment. See this post for details. | 1 to 1 (Instant) |

| Emirates Skywards | The best use of Emirates miles has been to fly Emirates itself. Unfortunately fuel surcharges can be extremely steep. One workaround is to book select routes such as JFK to Milan or Newark to Athens. See: How to find and book Emirates first class awards. | 1 to 1 (Instant) |

| Finnair Plus+ | Finnair points are now "Avios" and points can be moved to/from other Avios programs. Finnair uses zone based award charts rather than distance based. As a result, Finnair sometimes has better (and sometimes worse) pricing than other Avios programs. | 1 to 1 via BA (Instant) |

| Iberia Avios | On their own flights, Iberia offers low award prices and a very reasonable 25 Euro cancellation fee. Partner awards can offer good value under some circumstances as well, but these are usually nonrefundable. Fuel surcharges are sometimes lower when booking with Iberia rather than British Airways, Aer Lingus, or Qatar. It's possible to move points (Avios) between Iberia, British Airways, Aer Lingus, and Qatar. See also: Avios Sweet Spots for Award Tickets. | 1 to 1 (Instant) |

| Qatar Privilege Club Avios | Qatar has reasonable award prices for flying Qatar itself. Points are now transferable 1 to 1 to British Airways (and from there to Aer Lingus or Iberia). It is now also possible to book JetBlue flights with Qatar Avios. | 1 to 1 via BA (Instant) |

| Southwest Rapid Rewards | Award flights are fully refundable. Point values vary. Lower demand flights and those with higher taxes tend to offer better value. | 1 to 1 (~12 hours) |

| TAP Air Portugal | Surcharge-free Emirates redemptions. Increased availability on TAP flights between US and Europe. | 1 to 1 (Unknown) |

| Turkish Airlines Miles & Smiles | Miles & Smiles offers a number of awesome sweet-spot awards including 7.5K one-way anywhere within the US, even to Hawaii. Many awards cannot be booked online but can be booked via phone or email. See: Turkish Miles & Smiles Complete Guide and Turkish business class sweet spots from the US. | 1 to 1 (Instant) |

| United MileagePlus | United offers free award changes and free cancelations. Like Avianca and Aeroplan, United never charges fuel surcharges for awards. Unfortunately, United charges many more miles for international first class awards. Good uses of miles include United's Excursionist Perk awards and (sometimes) dynamically priced United economy awards. | 1 to 1 (Instant) |

| Virgin Atlantic Flying Club | Virgin Atlantic offers a few excellent sweet spot awards. See: Best uses for Virgin Atlantic points (Sweet Spot Spotlight). | 1 to 1 (Instant) |

Current Transfer Bonuses

If Bilt Rewards is running any transfer bonuses, details will appear here:

| Transfer Bonus Details | Start Date | End Date |

|---|

Point.me access for partner flight searches

Bilt Rewards includes a free integration to search for award space with their transfer partners through Point.me, a search engine that allows you to search multiple sites for award availability across numerous programs with a single click.

Bilt Rewards members have access to the Point.me engine to search for available awards (no Point.me subscription required). This makes award programs much more accessible for the average consumer. Note that searches are limited to Bilt’s transfer partners only and searches are very, very slow.

Use points to pay for travel at 1.25c per point

Bilt offers the ability to use points at a value of 1.25 cents per point when booking travel through their new travel portal. The portal is baked into the Bilt app (simply select the “Travel” tab) or members can browse to: travel.biltrewards.com.

Like many other travel portals, Bilt’s portal is powered by Expedia. This means that most flights will probably be the same price that you can find elsewhere, but rental cars, hotels, and activities may cost a bit more. Still, this can be a good way to get decent value for points when booking hotels or certain experiences (like tickets for Disney World).

While you can often get far more value by transferring points to airline and hotel programs, the ability to alternatively get decent value when redeeming for travel directly is a strength for those who don’t intend to learn the intricacies of booking award flights using airline miles.

Use points for home purchases

Bilt Rewards members can use points toward their down payment at a value of 1.5c per point when redeemed towards a down payment on a home purchase in the US, but only one redemption per home purchase.

There is a form you full out that requires proof of purchase a home, so it’s best to redeem points after you have a sales contract to purchase, but before closing.

Use points for student loan repayments

You can redeem Bilt Rewards points towards student loan repayments serviced by the following providers at a rate of 1 cent per point:

-

- Sallie Mae

- MOHELA

- Nelnet

- Navient

- Aidvantage

Use points for rent

Bilt allows you to redeem points for rent. The value here is very poor as you will get less than 1c per point. If you intend to use credit card rewards to pay for rent, you would likely be better off with a credit card that earns 2% cash back everywhere and using that cash back toward your rent.

Use points for fitness classes

Bilt has partnerships with several popular exercise class brands, so you can redeem your points for popular classes like Soul Cycle, Rumble boxing, Solidcore, and Y7. These redemptions generally don’t provide maximum value.

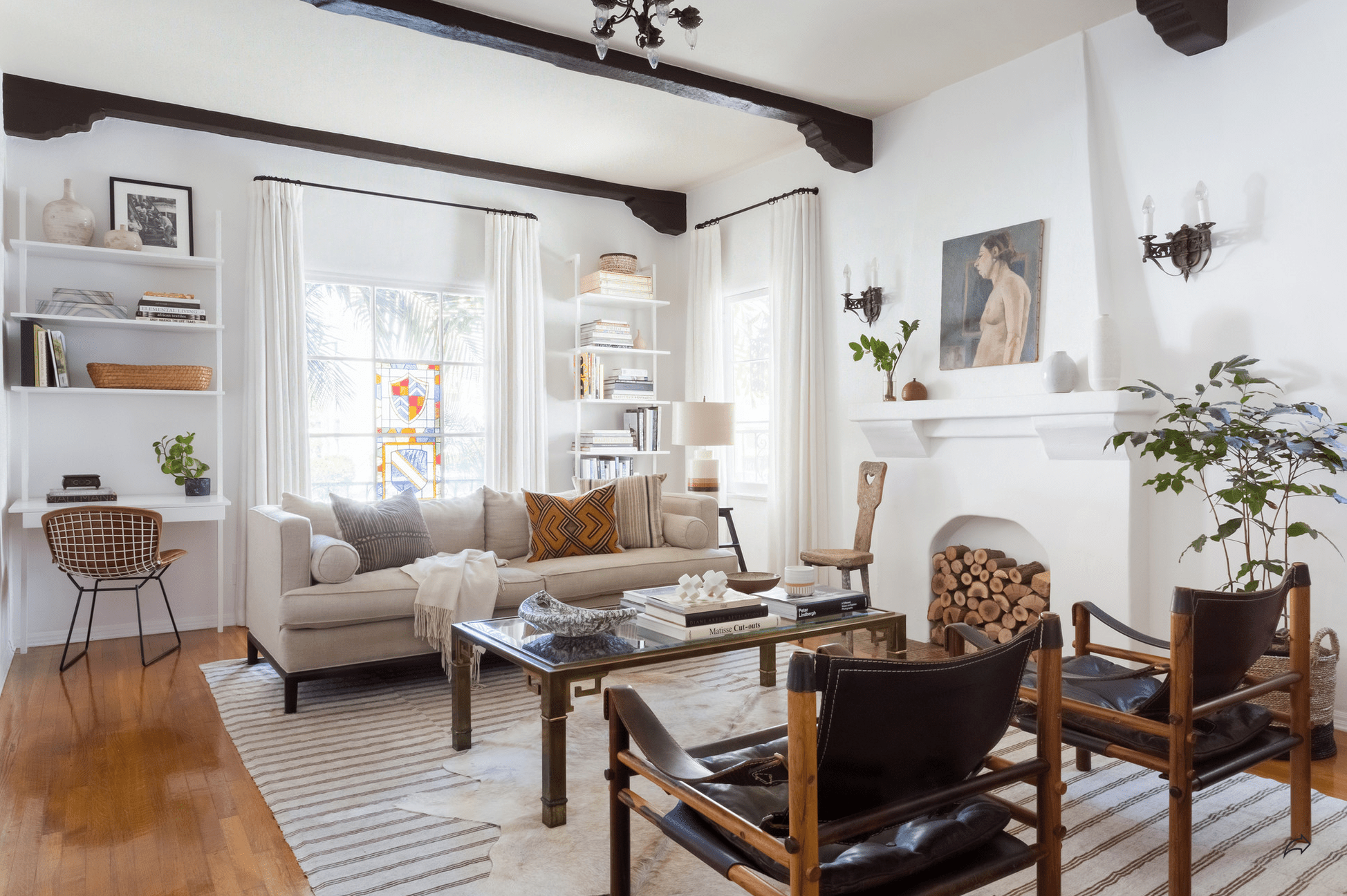

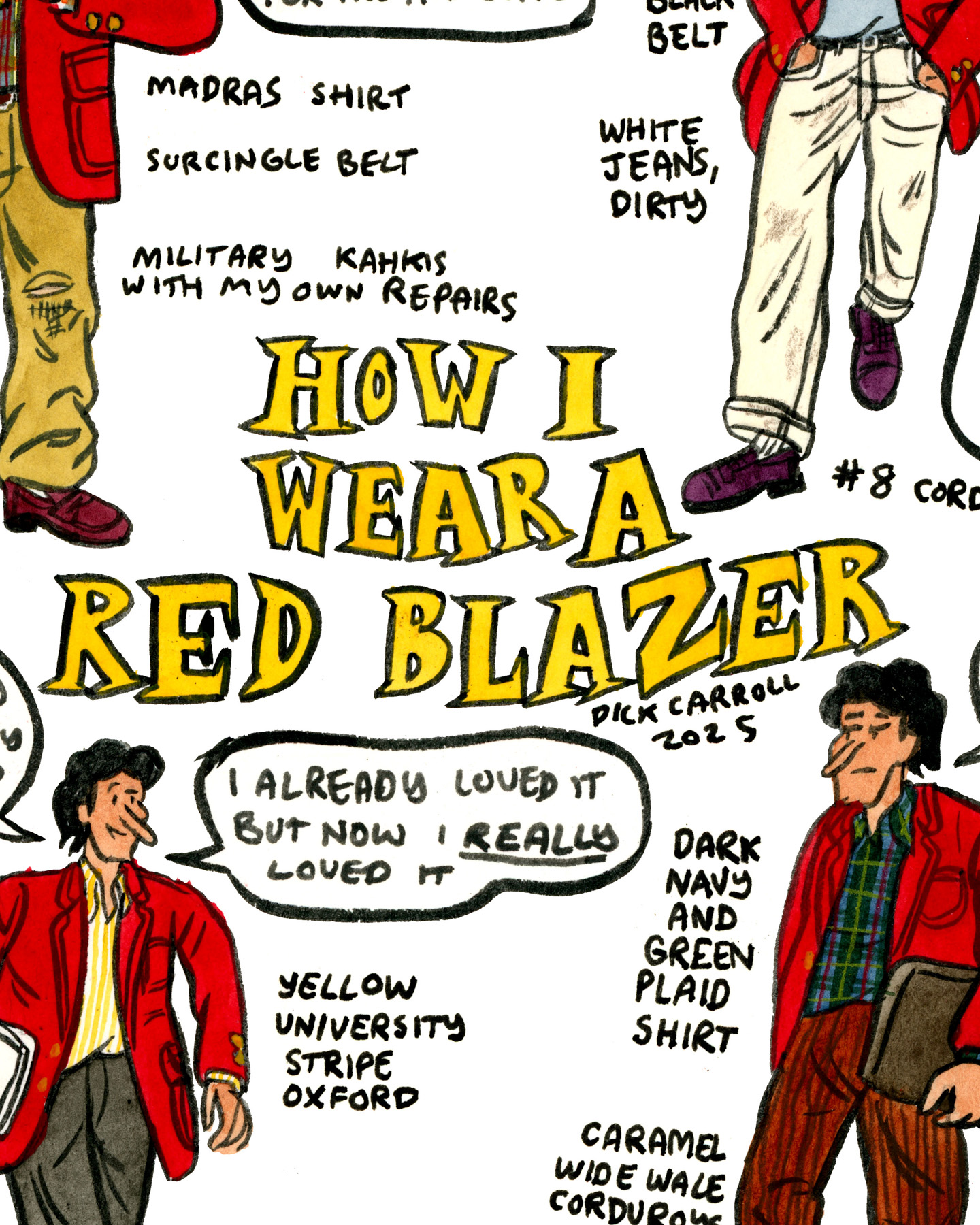

Use points for art, home décor and more

Bilt offers the Bilt Collection, a curated selection of limited-edition art and home décor. Redemptions start at 5,000 points. Whether or not these redemptions make sense is a matter of personal taste, but be sure to compare what the cash price of a similar item would be.

Use points to cover Amazon purchases

You can use Bilt Rewards points at checkout to cover purchases at Amazon.com. This yields very poor value for points at 0.7c per point and should be avoided.

Use points for Lyft rides

This also falls under the category of “Don’t do it” because you’ll only get 0.7c of value per point – see more here.

Use points for statement credits

You can use Bilt Rewards points to receive a statement credit towards charges on the Bilt Mastercard. This is even worse than Amazon as points are worth only 0.55c each when redeeming them this way. Don’t do it.

The post Bilt Rewards Complete Guide (2025) appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

![Witness The Gory Action in the ‘DOOM: The Dark Ages’ Launch Trailer [Video]](https://bloody-disgusting.com/wp-content/uploads/2025/05/doomdarkages.jpg)

![Hollow Rendition [on SLEEPY HOLLOW]](https://jonathanrosenbaum.net/wp-content/uploads/2010/03/sleepy-hollow32.jpg)

![It All Adds Up [FOUR CORNERS]](https://jonathanrosenbaum.net/wp-content/uploads/2010/08/fourcorners.jpg)

![Natasha Rothwell Pitched Belinda’s Big Moment In ‘The White Lotus’ Season 3 [Interview]](https://cdn.theplaylist.net/wp-content/uploads/2025/05/09171530/NatashaRothwellWhiteLotusSeason2.jpg)

![Southwest Passenger Breaks Down In Tears After Unexpected Kindness—Then So Does The Agent [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/05/upscalemedia-transformed-1.jpeg?#)