Trevolution surpasses $1.2 Billion in Gross Bookings in 2024

The post Trevolution surpasses $1.2 Billion in Gross Bookings in 2024 appeared first on TD (Travel Daily Media) Travel Daily Media. Trevolution, a division of travel companies under the Dyninno Group, has announced its commercial results for 2024, marking another year of steady growth. The post Trevolution surpasses $1.2 Billion in Gross Bookings in 2024 appeared first on Travel Daily Media.

The post Trevolution surpasses $1.2 Billion in Gross Bookings in 2024 appeared first on TD (Travel Daily Media) Travel Daily Media.

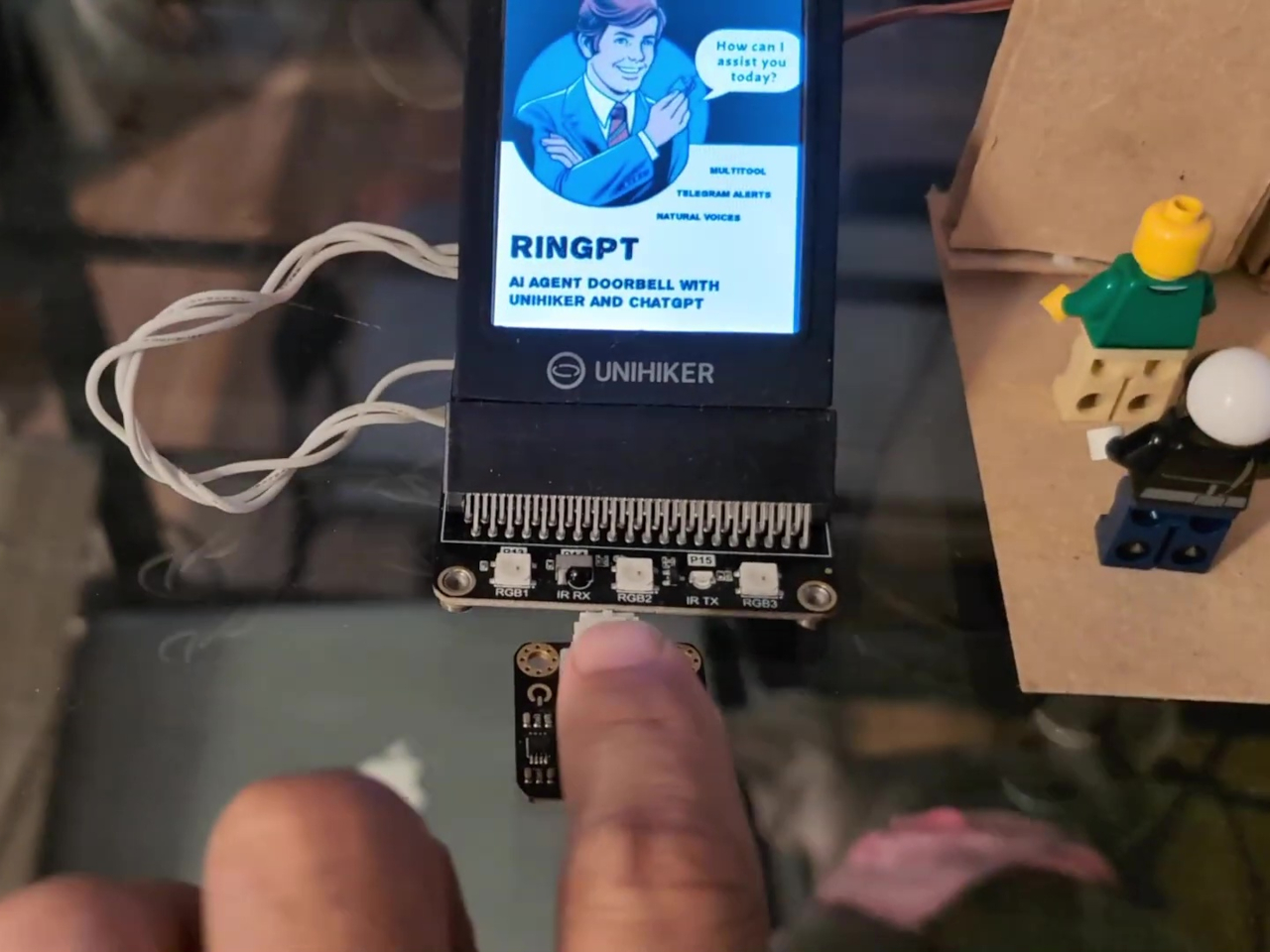

Trevolution, a division of travel companies under the Dyninno Group, has announced its commercial results for 2024, marking another year of steady growth. The company’s reported gross bookings reached $1,238.64 billion, resulting in a 5% increase compared to the previous year. The group sold nearly one million airline tickets, with a total of 980,092. Alongside strengthening its market presence, in 2024 Trevolution Group launched several new initiatives and innovations, which include the introduction of Dreampass, a new travel app available on both the App Store and Google Play, and the launch of Dreampass Plus, a subscription membership feature within the app. The group also launched Vagamo, a new travel platform that combines flexible online booking with expert support, and introduced cryptocurrency payment options for flight bookings at Skylux Travel.

Trevolution Group has been a global leader in the travel industry for more than two decades, leveraging its expertise in the Visiting Friends and Relatives (VFR) segment, which continues to see strong growth to this day. In 2024, the company placed a strategic focus on its Online Travel Agency, Oojo, successfully launching it in Germany and achieving an impressive Net Promoter Score (NPS) of 60—well above the industry average of 35.

Key 2024 Highlights:

- Gross travel bookings, which refers to the total dollar value, generally inclusive of taxes and fees, reached $1,238.64 billion, reflecting a 5% increase compared to the previous year;

- The total number of unique tickets issued totalled 980,092, marking a 16% increase compared to 2023;

- With a 34% growth, one-way tickets represented 29% of the total tickets sold;

- The number of auxiliary products and services increased by 21% in number of purchases compared to 2023;

- Dreampass, an all-in-one travel app, was launched, along with Dreampass Plus – a subscription loyalty program within the Dreampass app;

- Vagamo, a new travel platform offering flexible online booking with expert support, was introduced to the market.

The most popular travel destinations of the year for the Group’s travellers were the United States, the Philippines, India, Italy and Canada, with Canada being the only newcomer to the top 5 rankings.

| Top Destination Countries | % of change 2024

vs. 2023 |

avg. Economy ticket price | avg. Business ticket price |

| United States | 14% | $583 | $2,452 |

| Philippines | 5% | $1,203 | $4,255 |

| India | 26% | $951 | $3,911 |

| Canada | 189% | $424 | $2,063 |

| Italy | 90% | $925 | $3,770 |

Demand for travel to Canada surged by 189%, while trips to Italy increased by 90%, with demand for Italy showing a consistent upward trend, maintaining the same growth rate as the previous year. Other destinations also experienced significant growth, with Argentina leading the way at a 146% increase, followed by Saudi Arabia (117%), Egypt (85%), Thailand (77%), and Pakistan (58%).

A similar trend was observed among top departure countries, with the United States, the Philippines, India, Canada, Italy, Nigeria and Turkey ranking among the most common starting points for global travellers.

| Top Departure Countries | % of change 2024 vs. 2023 |

| United States | +11% |

| Philippines | +2% |

| India | +22% |

| Canada | +161% |

| Italy | +85% |

In 2024, the Economy class remained the top choice among travellers, with total sales reaching 869,183 tickets, resulting in $828,52 million (66% of the overall gross booking). Business class also saw an increase, reaching 88,961 tickets and $357,67 million (34% of the overall gross booking), respectively.

Round-trip travel continued to dominate charts, accounting for 626,648 tickets—more than twice the number of one-way tickets, which totalled 285,328. While round-trip sales grew by 10%, one-way sales surged by 34%, highlighting a growing trend toward flexibility and last-minute travel decisions among most of the Group’s passengers. The average fare for Economy class air travel decreased by 13%, while Business-class air travel stayed at nearly the same level, declining by 1%. In addition, the average ticket price declined by 16% for one-way tickets and by 8% for round-trip tickets.

| Trip Type | Demand Change 2024 vs. 2023 |

| One Way | 34% |

| Round Trip | 10% |

In 2024, the top preferred airlines among Trevolution Group’s customers were Turkish Airlines, United Airlines, Lufthansa, American Airlines, British Airways, and Philippine Airlines. Notably, Qatar Airways saw a remarkable surge in demand, with ticket sales soaring by 48%.

According to the latest sales data, there has been a shift towards longer advance purchase periods. The highest demand occurred for bookings made more than three months in advance, with over 30% of travellers opting for this window. At the same time, 17% of customers booked their flights within 10 days of departure. This trend highlights a growing divide in travel behaviour, with passengers increasingly booking well in advance or opting for last-minute travel due to urgent needs.

| Advance Purchase Days | % of Total Tickets in 2024 |

| 0-10 | 17% |

| 11-20 | 11% |

| 21-30 | 9% |

| 91+ | 30% |

Meanwhile, the average length of stay for customers shortened by two days in Economy class, and by one day in Business class, compared to the previous year, resulting in an average stay of 27 days for Economy and 23 days for Business; a shorter stay indicates increased travel efficiency and potential work and travel integration.

When it comes to purchasing auxiliary products and additional in-flight services, Trevolution Group experienced a 247% surge in demand for its lost baggage protection, making it one of the fastest-growing auxiliary products offered.

“In 2024, we embarked on a year of structural transformations, advancing the travel experience, building a comprehensive ecosystem, and securing greater benefits through industry partnerships. We launched Dreampass, a super-app, and Dreampass Plus, a premium subscription with perks like international data roaming and exclusive travel benefits. The all-in-one app resonated strongly with travellers, resulting in over 13,000 membership sales and generating $1.6 mln in revenue from the Dreampass Plus membership product within less than six months. We also initiated market expansion with our OTA, Oojo, which quickly gained traction and proved to be a major success story. Furthermore, we developed Vagamo, a next-generation hybrid travel platform that empowers travellers to book flights their way—whether by searching online for the best deals, receiving live support from expert travel agents, or accessing exclusive offline prices. These developments mark a significant step forward for Trevolution,” said Alex Weinstein, founder of the Dyninno Group of companies.

The post Trevolution surpasses $1.2 Billion in Gross Bookings in 2024 appeared first on Travel Daily Media.

![First-Person Psychological Horror Title ‘The Cecil: The Journey Begins’ Arrives on Steam April 3 [Trailer]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/03/cecil.jpg?fit=900%2C580&ssl=1)

![‘It Ends’ Review: The Kids Are Not Alright In Alex Ullom’s Evocative Existential Horror Debut [SXSW]](https://cdn.theplaylist.net/wp-content/uploads/2025/03/12223138/it-ends-sxsw.jpg)

![Silver Airways Can’t Pay for Planes—So It’s Firing Pilots Instead [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/01/silver-airways.jpg?#)

![[FINAL WEEK] Platinum Status And 170,000 Points: IHG’s New $99 Credit Card Offer Worth Getting And Keeping](https://viewfromthewing.com/wp-content/uploads/2016/06/IMG_3311.jpg?#)

.png)

![[Podcast] Should Brands Get Political? The Risks & Rewards of Taking a Stand with Jeroen Reuven](https://justcreative.com/wp-content/uploads/2025/03/jeroen-reuven-youtube.png)