Q1 airport traffic growth slows across Europe amid post-COVID normalisation

Traffic growth at Europe’s airports slowed to +4.3% year-on-year in the first quarter, up +3.2% compared to the same period in pre-pandemic 2019.

EUROPE. The latest data from Airports Council International (ACI) Europe revealed that passenger traffic growth at Europe’s airports slowed to +4.3% year-on-year in the first quarter, reflecting a stabilisation in the post-COVID recovery phase.

Passenger traffic from January to March rose +3.2% compared to the same period in pre-pandemic 2019.

The overall increase was boosted by international traffic, up +5.7%, while domestic traffic remained unchanged from the same period last year.

The quarter marked a downward trend in year-on-year growth, starting at +6.9% in January, declining to +3.4% in February, and further to +3% in March, partly due to the Easter calendar shift.

ACI Europe Director General Olivier Jankovec said, “Our Q1 data shows that the post‑pandemic travel boom is fading as we are moving towards ‘normalised’ growth rates in passenger volumes, with demand generally remaining resilient so far.

“This reflects consumers prioritising experiences despite an increasingly challenging economic environment, along with the dynamism of aviation markets in the Eastern and Southern parts of our continent and Central Asia.”

He added, “While transatlantic demand is weakening, we expect the European part of that to shift to other markets, and remain confident about the summer season. The big question is what happens as of next winter given the unprecedented macroeconomic uncertainty we are now facing as a result of the Trump administration’s attack on the global multilateral trading system.

“This means that in addition to geopolitics and the current supply pressures coming from aircraft delivery and maintenance delays, as well as infrastructure capacity constraints, and airlines focusing on yields rather than capacity expansion, we could see downward demand pressures becoming a reality.”

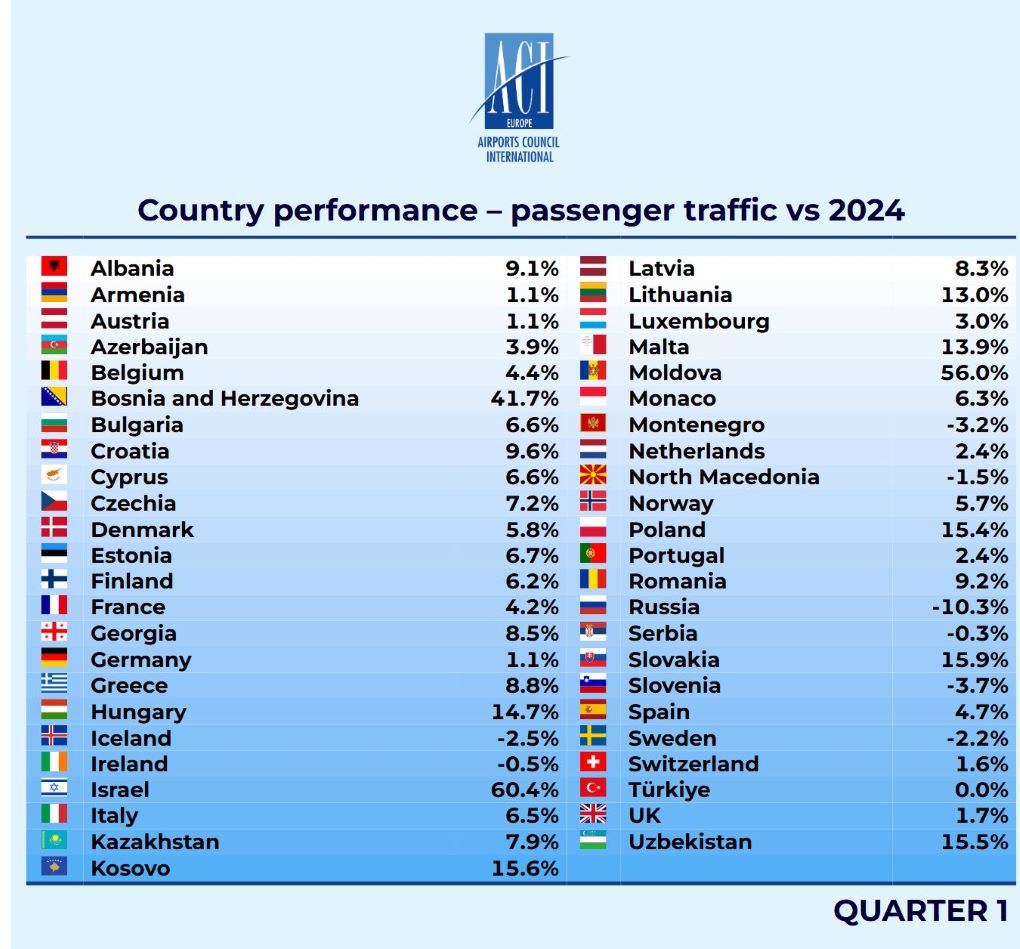

The highest passenger traffic growth was recorded in airports outside the EU+ market, up +5.7% year-on-year. This increase was fuelled by the ongoing recovery in Israel’s airports (+60.4%) and strong performances in rapidly expanding markets, including Moldova (+56%), Bosnia & Herzegovina (+41.7%), Kosovo (+15.6%), Uzbekistan (+15.5%), Albania (+9.1%) and Georgia (+8.5%).

Passenger traffic was unchanged at Türkiye’s airports and remained notably weak across Russia.

Within the EU+ markets, passenger volumes rose +4.1%, with significant variation across countries. Sharp increases were recorded at airports in Slovakia (+15.9%), Poland (+15.4%), Hungary (+14.7%), Malta (+13.9%) and Lithuania (+13%), along with those in Croatia (+9.6%), Romania (+9.2%) and Greece (+8.8%).

In contrast, passenger traffic fell in Iceland (‑2.5%), Sweden (‑2.2%) and Ireland (‑0.5%), while minimal growth was seen at airports in Germany and Austria (both at +1.1%) as well as in Switzerland (+1.6%) and the UK (+1.7%).

Italy (+6.6%) was the top performer among the larger EU+ markets, followed by Spain (+4.5%) and France (+4.2%).

ACI also highlighted notable year-on-year variations across different airport industry segments, driven by rising competitive pressures from post-pandemic changes in the aviation market.

This trend is further evidenced by the fact that passenger traffic remained below pre-pandemic levels at 44% of Europe’s airports.

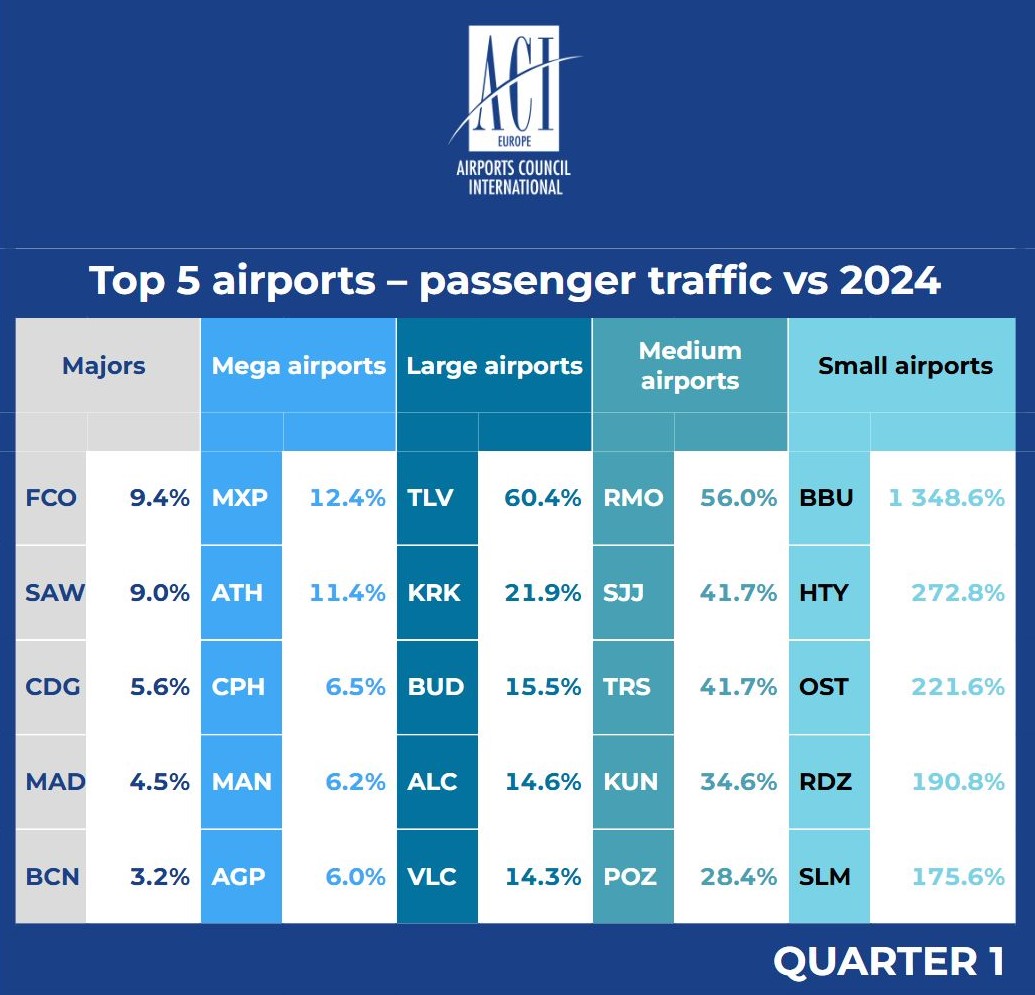

By size, airports handling over 40 million passengers recorded slower growth at +3%, with Rome-Fiumicino (+9.4%) and Istanbul Sabiha Gokçen (+9.0%) leading the category.

London-Heathrow (-1.5%) retained its status as the busiest airport in the region, despite power disruptions in March. Istanbul (+1.6%) ranked second, followed by Paris-CDG (+5.6%) and Madrid (+4.5%), which outperformed Amsterdam-Schiphol (+3%). Frankfurt (-0.9%) took the sixth spot despite traffic declines.

While small airports (under 1 million passengers) led growth with +13.4% growth, traffic remained 34.5% below 2019 levels as airlines favoured larger, more lucrative markets.

Airports handling 25-40 million passengers grew +6.1%, led by Tel Aviv Airport with a surge of +60.4%. Kraków (+21.9%) and Budapest (+15.5%) also posted strong gains, along with Spanish airports in Alicante (+14.6%) and Valencia (+14.3%).

Traffic results by airport groups

Passenger traffic growth in Q1 highlighted notable differences across airport size categories. Airports with over 40 million passengers (Majors) posted a modest +3% increase, while those serving 25-40 million (Mega) grew +3.9%. Airports with 10-25 million passengers (Large) saw a +6.1% rise, surpassing airports with 1-10 million passengers (Medium) at +3.6%. Small airports (under 1 million) posted a notable increase of +13.4%, despite still lagging behind in post-COVID recovery.

Majors: Rome Fiumicino (+9.4%), Istanbul (+9.0%), Paris CDG (+5.6%), Madrid (+4.5%), Barcelona (+3.2%)

Mega airports: Milan (+12.4%), Athens (+11.4%), Copenhagen (+6.5%), Manchester (+6.2%), Málaga (+6.0%)

Large airports: Tel‑Aviv (+60.4%), Krakow (+21.9%), Budapest (+15.5%), Alicante (+14.6%), Valencia (+14.3%)

Medium airports: Chișinău (+56.0%), Sarajevo (+41.7%), Trieste (+41.7%), Kaunas (+34.6%), Poznan (+28.4%)

Small airports: Bucharest (+1,348.6%), Antakya (+272.8%), Ostend (+221.6%), Rodez (+190.8%), Salamanca (+175.6%)

-Assassin's-Creed-Shadows---How-to-Romance-Lady-Oichi-00-06-00.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)