Lyft Acquires European Taxi Hailing App FreeNow

Lyft, the Uber competitor in the United States and Canada that has so far failed to expand overseas, has decided to acquire the German-based FreeNow. FreeNow, which mainly works with existing taxis and is therefore more expensive than its rivals, operates in 9 countries in […]

Lyft, the Uber competitor in the United States and Canada that has so far failed to expand overseas, has decided to acquire the German-based FreeNow.

FreeNow, which mainly works with existing taxis and is therefore more expensive than its rivals, operates in 9 countries in Europe.

FreeNow’s Email To Its Users:

Lyft’s Press Release:

Lyft Expands in Europe, Diversifies by Acquiring FREENOW

Lyft poised for growth in an attractive market, with FREENOW’s premier taxi-first business and local expertise

Together, will operate in 11 countries across Europe, the United States, and Canada

SAN FRANCISCO & HAMBURG, Germany–(BUSINESS WIRE)– Lyft, Inc. (Nasdaq: LYFT), a leading ride hailing marketplace, today announced it has entered into a definitive agreement to acquire FREENOW, a leading European multi-mobility app with a taxi offering at its core, from BMW Group and Mercedes-Benz Mobility for approximately €175 million or $197 million* in cash. FREENOW will continue operating as it does today, with its talented leadership team and employees in place to drive growth across 9 countries and over 150 cities across Ireland, the United Kingdom, Germany, Greece, Spain, Italy, Poland, France, and Austria. The transaction is expected to close in the second half of 2025, subject to customary closing conditions.

Lyft found in FREENOW a partner to immediately fuel its growth strategy, unlock potential for partners, and level up the experience for drivers and riders alike. This marks Lyft’s most significant expansion outside North America, nearly doubling Lyft’s total addressable market to more than 300 billion personal vehicle trips per year, increasing annualized Gross Bookings by approximately €1 billion, diversifying revenue streams, and supporting Lyft’s multi-year targets.

“We’re on an ambitious path to build the best, most customer-obsessed mobility platform in the world, and entering Europe is an important step in our growth journey,” said David Risher, CEO of Lyft. “We found the perfect partner in FREENOW and can learn a lot from the team. FREENOW’s local-first approach mirrors Lyft’s values and embodies our purpose — to serve and connect.”

FREENOW brings market-leading European taxi expertise, fleet technology and strong relationships with regulators, unions and taxi fleet operators in every market. Lyft brings best-in-class marketplace expertise and customer-obsessed features. The business models are complementary and together will serve over 50 million combined annual riders, with plans to deliver a better product experience, improve service levels, strengthen fleet management capabilities, and bring greater global opportunities to existing and potential partners.

In Europe, the taxi aggregation business is strong and growing. Approximately 50% of taxi bookings in Europe still happen offline, but customers are hungry for more online bookings. FREENOW is primed to capitalize on that opportunity. FREENOW is the leading taxi platform in several major European cities, including Dublin, London, Athens, Berlin, Barcelona, Madrid, and Hamburg, with luxury vehicles making up a significant portion of its fleet. Taxis accounted for approximately 90% of FREENOW’s Gross Bookings in 2024 and will continue to be the backbone of FREENOW’s business.

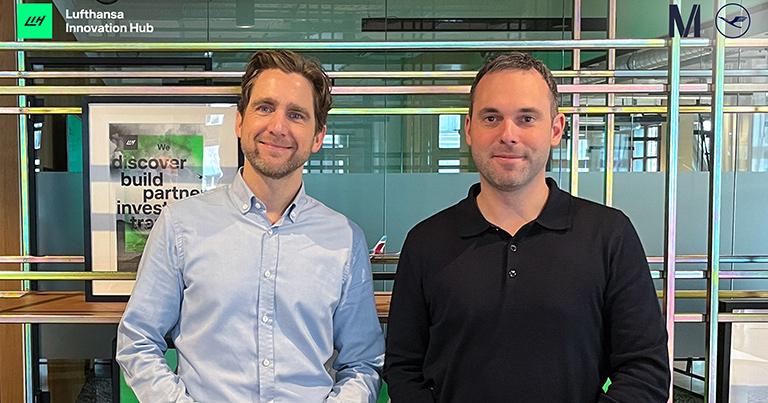

“Joining forces with Lyft is a powerful step forward for FREENOW and marks the beginning of an ambitious new phase—one where we strengthen our role as a leading force in European mobility,” said FREENOW CEO Thomas Zimmermann. “Lyft’s strong, customer-first track record aligns perfectly with our deep roots in the taxi industry, and together we will push boundaries and raise expectations for fleet owners, taxi drivers, and riders across the continent. We stand with the industry—not above it—and remain proud partners of the community. This collaboration is about combining our strengths, learning from each other, and scaling what works best. We sincerely thank our former shareholders for their trust and enduring partnership throughout the years.”

The strategic acquisition is aligned with Lyft’s disciplined capital allocation strategy of investing in attractive growth opportunities with a customer-obsessed bias. The announcement follows a record-breaking year in 2024 for Lyft, with industry-leading service levels in Q4, record Gross Bookings, GAAP profitability, and record cash flow generation.

What’s next

While there will be no immediate changes to FREENOW’s customer experience, over time, new benefits will be made available to FREENOW drivers and riders. For drivers in many markets, that may look like more transparency around their earnings such as when to expect incentives and real-time information on the best times to drive. For riders, that may look like more consistent pricing, faster matching, and new features and modes. The companies will also focus on integration for riders to seamlessly use either app across the Atlantic, whether they’re in North America or Europe.

*$197 million is based on the EUR/USD foreign exchange rate on the date of signing.

Conclusion

I have about 30 ride-hailing and taxi apps installed on my phone, and FreeNow is one of the least used in my case, in the markets it operates in, as their pricing tends to be awful. Why would I use FreeNow to order taxis?

The service is misnamed as it is neither FREE nor NOW.

The service that has recently expanded to more markets is the Estonian-based Bolt, and their pricing tends to be quite good.

I just used Yango for the first time in about a year (the last time I used them was in Bolivia), here in Abu Dhabi, where they have teamed up with local taxis.

Cabify is also useful in some markets, such as Spain and Argentina. The China-based Didi and its Brazilian brand, 99, are also good in many countries.

I am not using any of these services exclusively, and I always compare prices, as they can vary significantly.

Uber used to have a much better app than its competitors, but it seems that all the companies are quickly copying its features, and they are now pretty much identical in all aspects.

![‘Ready or Not 2’ Cast Announce Includes Sarah Michelle Gellar and David Cronenberg! [Video]](https://bloody-disgusting.com/wp-content/uploads/2019/07/ready-or-not-movie-1024x591.png)

.png?format=1500w#)

.png?format=1500w#)

![Mouse Invades United Club at LaGuardia on the Eve of $1,400 Fee Hike [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/united-club-lga.jpg?#)

![Caught on Video: “He Busted Through!” Frontier Airlines Passenger Storms Closed Las Vegas Gate [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/Screenshot-2025-04-20-140707.png?#)

![It’s Unfair to Pay 100% for 50% of a Seat—Why Airlines Must Start Refunding Customers When They Fail To Deliver [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/broken-american-airlines-seat.jpeg?#)

.jpg?#)

.jpg?#)

![[Podcast] Unlocking Innovation: How Play & Creativity Drive Success with Melissa Dinwiddie](https://justcreative.com/wp-content/uploads/2025/04/melissa-dinwiddie-youtube.png)