‘Inaccessibility’ of Chinese duty free dents Rémy Cointreau Q4 performance

It’s a case of buy while stocks last in China’s duty-free stores as retailers and brands pin their hopes on a resolution to the bitter China-France tariff dispute that has hit Cognac sales in the key China travel retail sector hard.

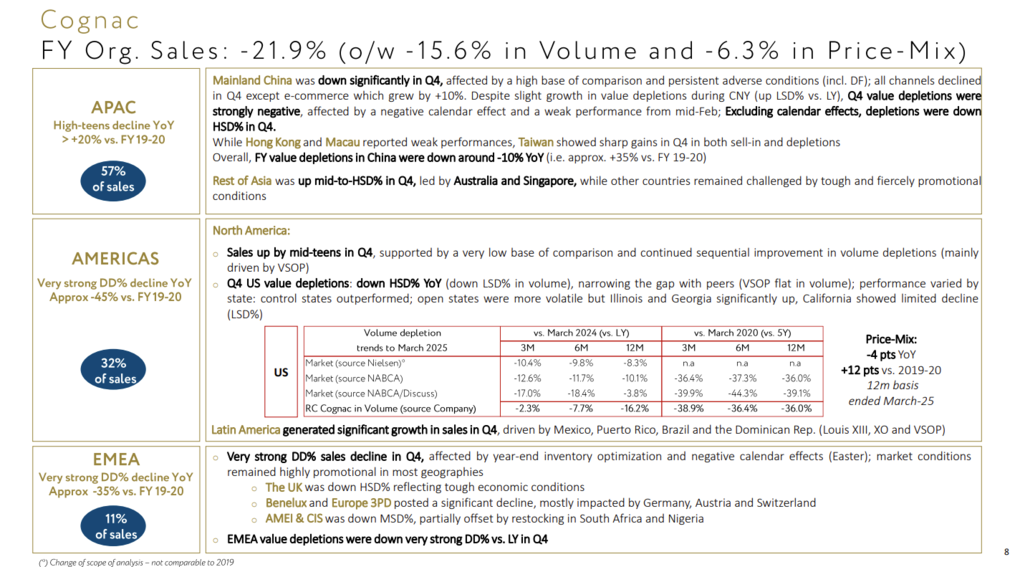

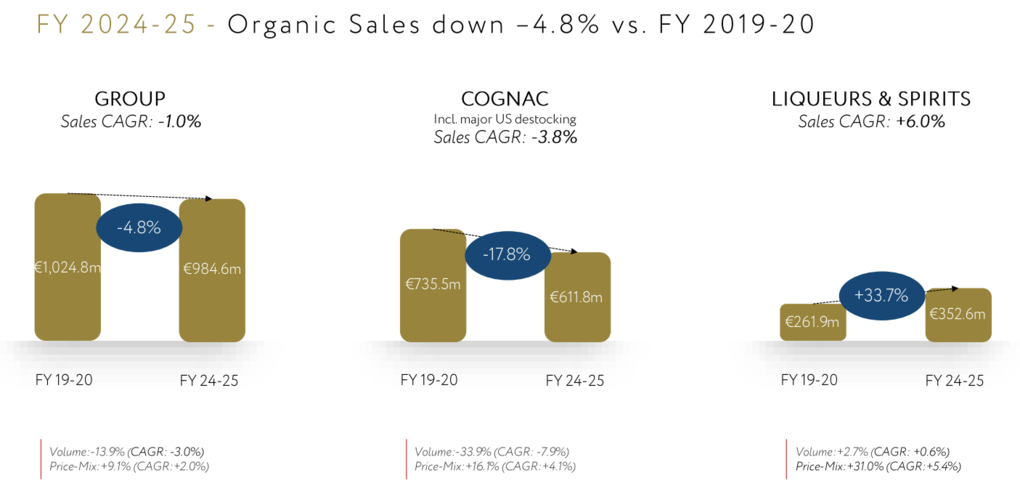

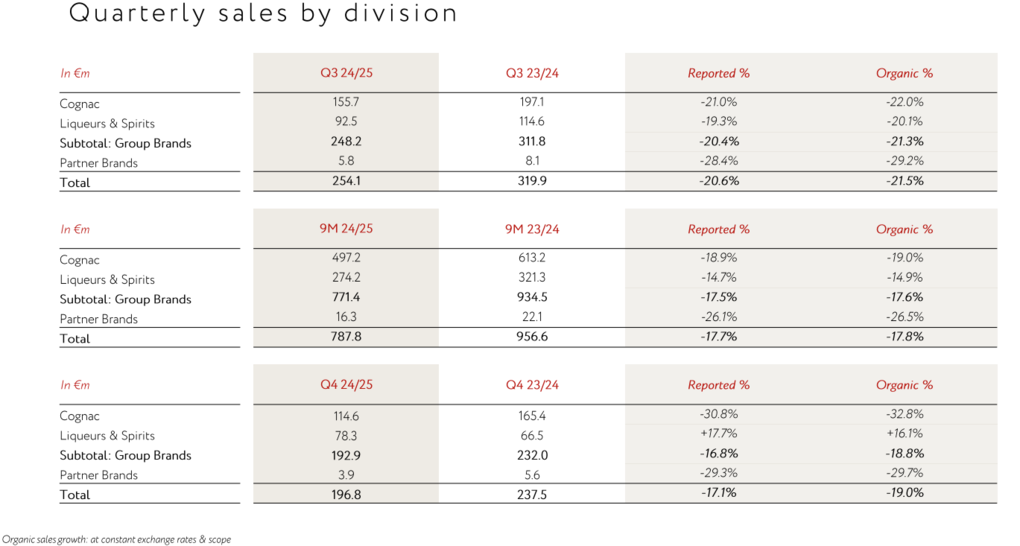

The ongoing tit for tat tariff row between China and the European Union (EU) is hitting French drinks group Rémy Cointreau hard, contributing significantly to a -32.8% year-on-year slump in Q4 Cognac sales to €114.6 million for the period ended March.

Total group sales in Q4 fell -17.1% year-on-year.

As reported, China imposed tariffs on all EU brandy imports last October amid an inquiry into alleged dumping on the China market. The tariffs were widely read as a response to the EU placing punitive levies on Chinese-made electric vehicles.

As a result all EU brandy imports from October faced substantial security deposit requirements. This has meant that Chinese duty-free retailers have been unable to restock Cognac supplies over recent months.

Rémy Cointreau said the Cognac decline reflected an exceptionally high base of comparison, the “inaccessibility” of Chinese duty free from December 2024, a negative calendar effect (i.e. the phasing of Chinese New Year) and harsh market conditions overall.

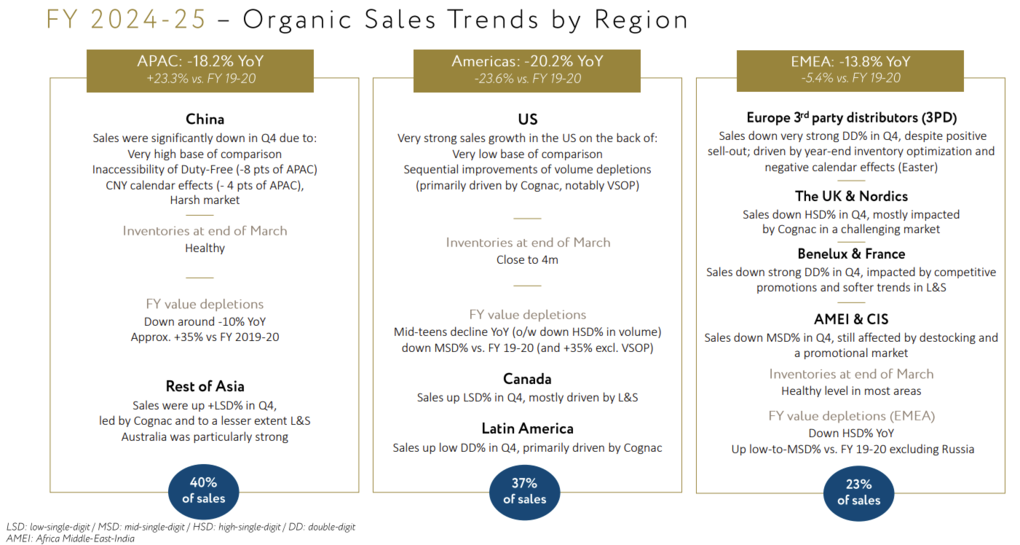

The Chinese woes were reflected in an -18.2% fall in the APAC region’s sales, impacted in particular by “complex” market conditions in China.

Excluding the impact of Chinese duty-free disruptions and calendar effects related to Chinese New Year, Cognac fell -23.7%. This decline was primarily driven by a strong drop in sales across the APAC region, especially in China.

Background to a tariff war

Since January last year, the Chinese government has been investigating whether French brandy is being sold in China at artificially low prices. This case, part of a broader trade dispute between the EU and China over tariffs on Chinese electric vehicles, has resulted in brandy imports facing substantial security deposit requirements.

Rémy Cointreau said it has taken note of the provisional decision by China’s Minister of Commerce (MOFCOM) to impose additional duties of 38.1% on Cognac imports starting 11 October 2024.

If these duties are confirmed, Rémy Cointreau will trigger an action plan to mitigate the effects, starting in fiscal 2025-26.

MOFCOM’s investigation is ongoing. On 2 April, it announced an extension of the inquiry to 5 July.

Also on 2 April, the US government announced plans to impose tariffs on all imports, effective 9 April. For Rémy Cointreau this would mean customs duties of 20% on all imports from the EU, 10% on those from the UK and 10% on imports from Barbados.

On 9 April, the US announced a 90-day suspension of so-called ‘reciprocal’ duties for countries/blocs open to negotiation (notably the European Union), while maintaining a minimum 10% tariff on all foreign goods except those from China.

The European Union declared a parallel 90-day suspension of its countermeasures to the US tariffs.

Rémy Cointreau said it has protected its current operating margin in organic terms as much as possible through continued tight cost controls and the deployment of a new cost-cutting plan totalling over €50 million.

![Blendo Games’ Immersive Sim ‘Skin Deep’ Is Hilarious and Exhilarating [Review]](https://bloody-disgusting.com/wp-content/uploads/2025/04/skindeep.jpg)

![Kyoto Hotel Refuses To Check In Israeli Tourist Without ‘War Crimes Declaration’ [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/war-crimes-declaration.jpeg?#)