Guide to Credit Scores, Reports, and Free Monitoring

If you often apply for credit cards in order to earn welcome bonuses (or even if you don’t), then you’ve probably realized that managing your credit is important. But, it’s not just your credit score that’s important — it’s also good to be alerted when new inquiries are made and to know the details of […] The post Guide to Credit Scores, Reports, and Free Monitoring appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

If you often apply for credit cards in order to earn welcome bonuses (or even if you don’t), then you’ve probably realized that managing your credit is important. But, it’s not just your credit score that’s important — it’s also good to be alerted when new inquiries are made and to know the details of your credit report.

In this post you’ll find a summary of what your credit report is made up of, what affects it and how to keep track of what’s on it without having to reach into your wallet.

The Basics of Credit Reporting

Credit Bureaus

In the US, there are three credit bureaus that banks can use to request your credit report: Equifax, Experian, and TransUnion. Some banks pull from just one bureau. Some pull from two. Some pull from all three (we see you, Capital One). They’re not always consistent and, depending upon where you live, banks may vary which credit bureau(s) they pull from.

What makes up my credit score?

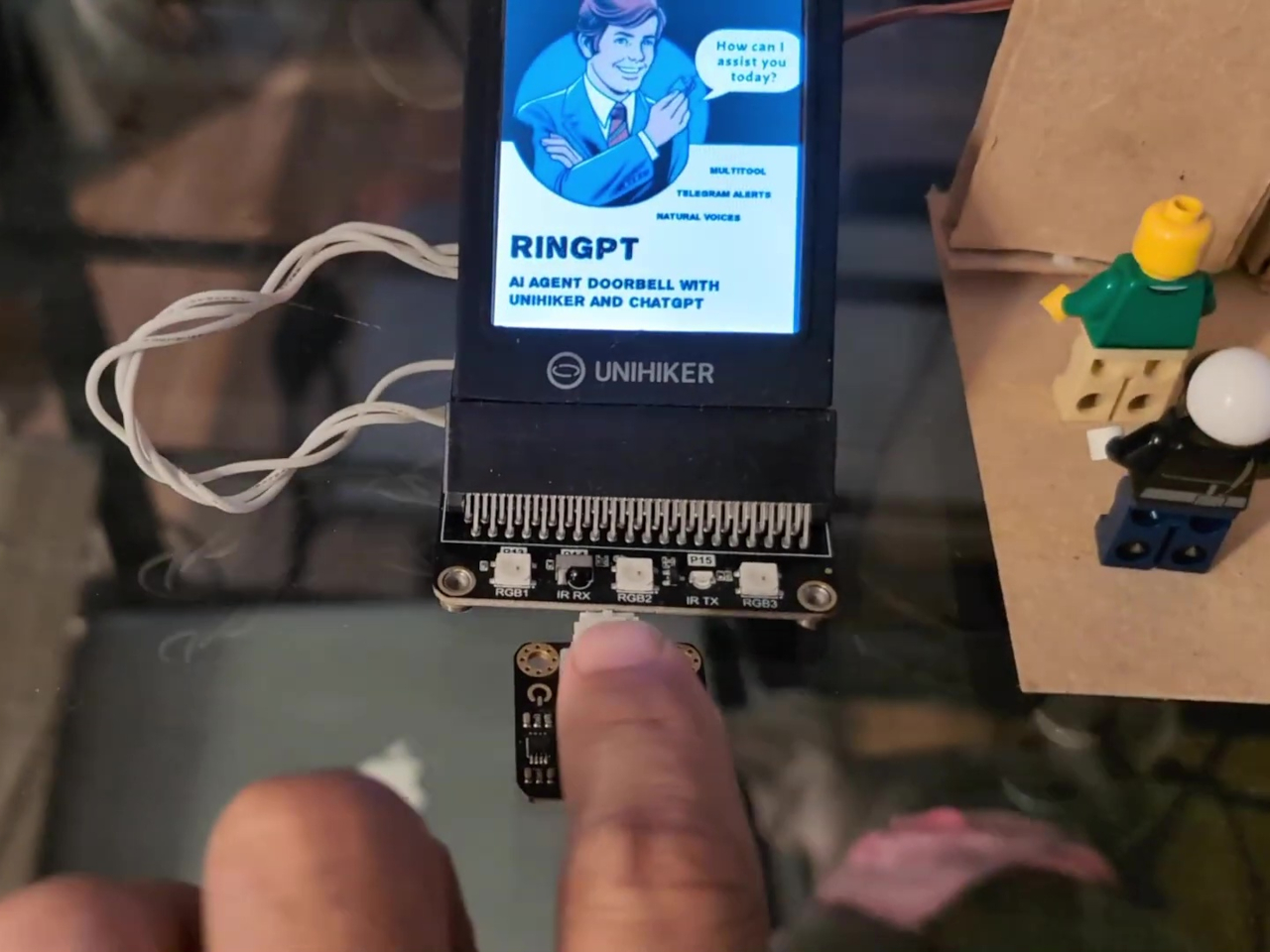

Most lenders use your FICO Score to help determine whether or not to extend new credit to you. According to myFICO, scores take into account the following factors:

- 35% Payment History: Always pay your bills on time!

- 30% Amounts Owed: Try not to use anywhere near all of your available credit.

- 15% Length of Credit History: The longer the better. Don’t get rid of your oldest cards!

- 10% New Credit: When you open many new accounts, it can affect your score negatively

- 10% Credit Mix: It’s good to have a mix of loans: credit cards, car loan, mortgage, etc.

Credit Inquiries: Hard vs. Soft

When you request a new card, the credit issuer almost always issues a “hard” inquiry rather than a soft inquiry. A hard inquiry (a “hard pull”) will usually have a small temporary negative effect on your credit score. Even if your score doesn’t decrease, too many hard inquiries can hurt your chances of getting a new credit card because it looks like you’re desperate for credit. Soft inquiries have no effect.

Tip 1: Hard Inquiries appear only on the credit report of the bureau that handled the inquiry. This means that you will likely have different numbers of inquiries showing on each credit report. By keeping track of which credit bureau each bank uses for your applications, it may be possible to spread out the inquiries across bureaus so that no single bureau shows too many.

Tip 2: Inquiries “hurt” much less as time goes by. After 90 days, the negative effect is minimal. After 6 months, hard inquiries are barely considered. And, after 24 months they fall off your credit report altogether.

Accounts on a Credit Report

When you are approved for a new card, it becomes a new account on your credit reports. Most if not all major banks report accounts to all three bureaus. They report the open date, close date (if applicable), current balance each month, current credit limit, whether or not you missed payments, etc.

Tip 1: The status of your revolving credit accounts is much more important to your credit score than number of inquiries. Make sure to pay your all of your accounts on time.

Tip 2: Having more accounts can help your credit score. 30% of your score is your credit utilization ratio. The larger your total credit limit, the better your utilization ratio should be. In most cases, more cards means having a higher limit and therefore a better utilization ratio.

Tip 3: Unlike inquiries, accounts usually show up on all three credit bureaus.

FREE Credit Scores, Reports, and Monitoring

In a perfect world, you would have ready access to your scores, accounts (credit report details), and inquiries from all three bureaus. Ideally, all three bureaus would be monitored and you would be alerted when new inquiries are made or new accounts added to your reports. Also, all of this should, of course, be free.

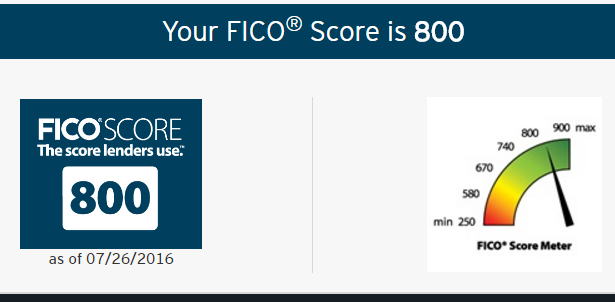

In most cases there are a number of options for free scores, reports, and/or monitoring. Many tools offer free FAKO credit scores (these are estimates of FICO scores), but it’s possible to find free options for real FICO scores. Below, we’ve picked the options that I think will be most accessible to most readers.

Equifax

- FICO Credit Score

- Credit Report and Credit Monitoring

- Credit Karma provides both reports and monitoring for free

- Credit Report without Monitoring

- Annual Credit Report.com provides free weekly reports

Experian

- FICO Credit Score:

- Credit Report and credit monitoring

- FreeCreditScore.com (also offers free credit scores to some customers, but not all. You may have to sign up via a private/incognito window to get free scores — yes, weird)

- Experian Smart Phone App

- ProtectMyID via AAA membership (Available to most, but not all AAA areas)

- Credit Report without Monitoring

- Annual Credit Report.com provides free weekly reports

TransUnion

- FICO Credit Score:

- Free for Barclaycard cardholders (log into your account to view)

- Discover offers free FICO credit scores for customers and non-customers

- Also available free for Discover cardholders (log into your account to view)

- Credit Report and credit monitoring

- WalletHub provides full details and monitoring for free. Unlike other services which update weekly or monthly, this one provides daily updates.

- Credit Karma provides both reports and monitoring for free

- Chase Credit Journey provides summary information and monitoring

- SoFi provides free credit monitoring for members

- Credit Report without monitoring

- Annual Credit Report.com provides free weekly reports

Recommendation

For most people, monitoring all three credit bureaus is probably overkill. In our opinion, WalletHub is an excellent choice for those who want to subscribe to just one free service which provides credit monitoring (where you get alerted when there are any changes to your report), full credit details, and a FAKO credit score (which is good enough for most needs). Alternatively, if you want to use a similar service that also makes it possible to count your Chase 5/24 status (via the trick described here), consider Credit Karma.

With either WalletHub or Credit Karma, if you then also want to look up your actual credit score, look to your credit card issuer: Citi for Equifax, Discover for Experian, and Amex, Barclays, or Discover for TransUnion.

The post Guide to Credit Scores, Reports, and Free Monitoring appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

![First-Person Psychological Horror Title ‘The Cecil: The Journey Begins’ Arrives on Steam April 3 [Trailer]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/03/cecil.jpg?fit=900%2C580&ssl=1)

![‘It Ends’ Review: The Kids Are Not Alright In Alex Ullom’s Evocative Existential Horror Debut [SXSW]](https://cdn.theplaylist.net/wp-content/uploads/2025/03/12223138/it-ends-sxsw.jpg)

![Silver Airways Can’t Pay for Planes—So It’s Firing Pilots Instead [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/01/silver-airways.jpg?#)

![[FINAL WEEK] Platinum Status And 170,000 Points: IHG’s New $99 Credit Card Offer Worth Getting And Keeping](https://viewfromthewing.com/wp-content/uploads/2016/06/IMG_3311.jpg?#)

.png)

![[Podcast] Should Brands Get Political? The Risks & Rewards of Taking a Stand with Jeroen Reuven](https://justcreative.com/wp-content/uploads/2025/03/jeroen-reuven-youtube.png)