Double-digit leap in duty-free and food & beverage revenue buoys TAV Airports in 2024

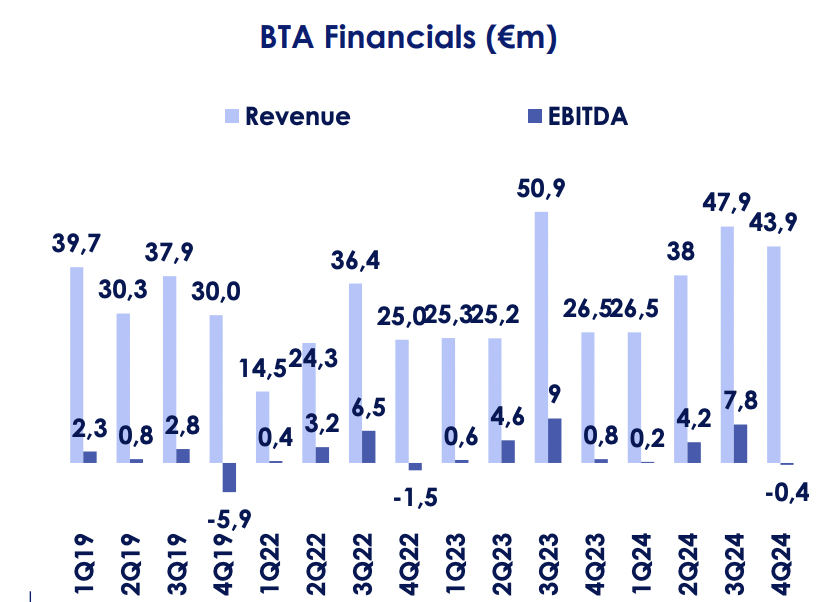

TAV Airports today reported a +27% year-on-year rise in revenue to €1.66 billion in 2024, outpacing an +11% rise in passenger traffic.

TÜRKIYE. TAV Airports, a member of Groupe ADP, today reported a +27% year-on-year rise in revenue to €1.66 billion in 2024, outpacing an +11% rise in passenger traffic across its estate to 107 million.

Revenue growth was supported by a +32% surge in duty-free revenues – TAV a 50% partner in ATÜ Duty Free with Gebr. Heinemann – to €79.7 million. Duty-free spend per passenger climbed by +2% compared to 2023, reaching €9.10.

F&B income reached €184.4 million, up by +27% year-on-year.

EBITDA climbed by +27% to €489.4 million but net profit fell -27% to €183 million, reflecting comparisons with a series of one-off gains made in FY23, according to the company.

TAV Airports CEO Serkan Kaptan said: “2024 was another remarkable year for us, both operationally and financially. We closed the year with a total of 107 million passengers, reflecting an 11% year-over-year growth, and served 71 million international passengers, marking a +13% increase over 2023.

“Several key factors contributed to this growth, including fleet expansion by major airlines operating at our airports, strong travel demand, increasing accessibility of aviation through fuel-efficient aircraft, the expansion of the global middle class, and an extended summer season.”

The post-pandemic recovery drove sharp increases in passenger traffic across key airports. Compared to 2019, passenger volumes at TAV Airports locations have surged from key markets: Germany (+29%), UK (+98%), Poland (+121%), UAE (+59%), France (+46%), Egypt (+73%), and Kazakhstan (+113%)

Kaptan added: “Our long-term growth drivers remain strong, giving us confidence to pursue an ambitious investment programme initiated in 2021 which is now nearing completion. By the end of 2025, our total investment—including the acquisition of Almaty Airport, upfront rent payments to the Turkish State Airports Authority (DHMI), and other investments—will exceed €2.5 billion. This programme has extended our average EBITDA-weighted concession duration to 32 years in 2025 in contrast to nine years in 2019, reinforcing our long-term commitment to aviation.”

At Almaty Airport, the new international terminal opened in June 2024 following a €252 million investment. TAV said it expects passenger traffic to double in 2025 compared to 2021.

At Antalya Airport, an €850 million investment is 96% complete, with the opening scheduled in April. This expansion will increase capacity from 38 million to 65 million passengers, “enhancing passenger experience and commercial opportunities” said TAV. “Our service subsidiaries are actively preparing to deliver TAV’s renowned service standards, as the retail area being tripled in size will bring a substantial increase in shopping, dining and lounge options.”

At Ankara Airport, airside expansion investments of €210 million are 98% complete and will be finalised in Q2 2025.

For 2025, management anticipates that TAV locations will serve between 110 and 120 million passengers and achieve an EBITDA between €520–590 million.

![First-Person Psychological Horror Title ‘The Cecil: The Journey Begins’ Arrives on Steam April 3 [Trailer]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/03/cecil.jpg?fit=900%2C580&ssl=1)

![‘It Ends’ Review: The Kids Are Not Alright In Alex Ullom’s Evocative Existential Horror Debut [SXSW]](https://cdn.theplaylist.net/wp-content/uploads/2025/03/12223138/it-ends-sxsw.jpg)

![Silver Airways Can’t Pay for Planes—So It’s Firing Pilots Instead [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/01/silver-airways.jpg?#)

![[FINAL WEEK] Platinum Status And 170,000 Points: IHG’s New $99 Credit Card Offer Worth Getting And Keeping](https://viewfromthewing.com/wp-content/uploads/2016/06/IMG_3311.jpg?#)

.jpg?#)

![[Podcast] Should Brands Get Political? The Risks & Rewards of Taking a Stand with Jeroen Reuven](https://justcreative.com/wp-content/uploads/2025/03/jeroen-reuven-youtube.png)