Sphere Shares Jump on Debt Negotiation News, Music Stocks Up Overall as Tariffs Confusion Eases

Cumulus Media shares fell 16% after the company announced it would be de-listed from the Nasdaq exchange.

Proving that the best way to get stock prices to rally is to first bury them deep underground, markets surged this week as President Trump eased his tone on U.S. Federal Reserve chair Jerome Powell and said tariff negotiations with China are ongoing (although China denied the claim).

The 20-company Billboard Global Music Index surged 6.1% to 2,595.95, marking its third consecutive weekly gain after falling 10.9% in the two-week period ended April 4. The spoils of a less chaotic global market were felt by nearly all music stocks. Of the 20 stocks in the index, 16 finished the week in positive territory, and two — Anghami and Sphere Entertainment Co. — had gains exceeding 10%.

Major indexes improved this week as investor sentiment regarding U.S. tariff policy improved and President Trump said he would not fire Powell. The Nasdaq composite rose 6.7% to 17,382.94 and the S&P 500 gained 4.6% to 5,525.21. The U.K.’s FTSE 100 improved 1.7% to 8,415.25. South Korea’s KOSPI composite index rose 2.5% to 2,546.30. China’s SSE Composite Index rose 0.6% to 3,295.06.

After investors’ confusion about the U.S. tariff policy put a damper on stocks in recent weeks, markets seemed to find comfort in reports that said the U.S. Trade Representative was quickly working with some trading partners under a streamlined process. Jay Hatfield, founder/chief investment officer of InfraCap, told CNBC, “We’ve reached peak tariff tantrum” and believes the worst of the uncertainty has passed. In fact, the market could have been due for a rebound. Thomas Martin, senior portfolio manager at GLOBALT in Atlanta, told Reuters the stock market “was oversold by virtually all measures.”

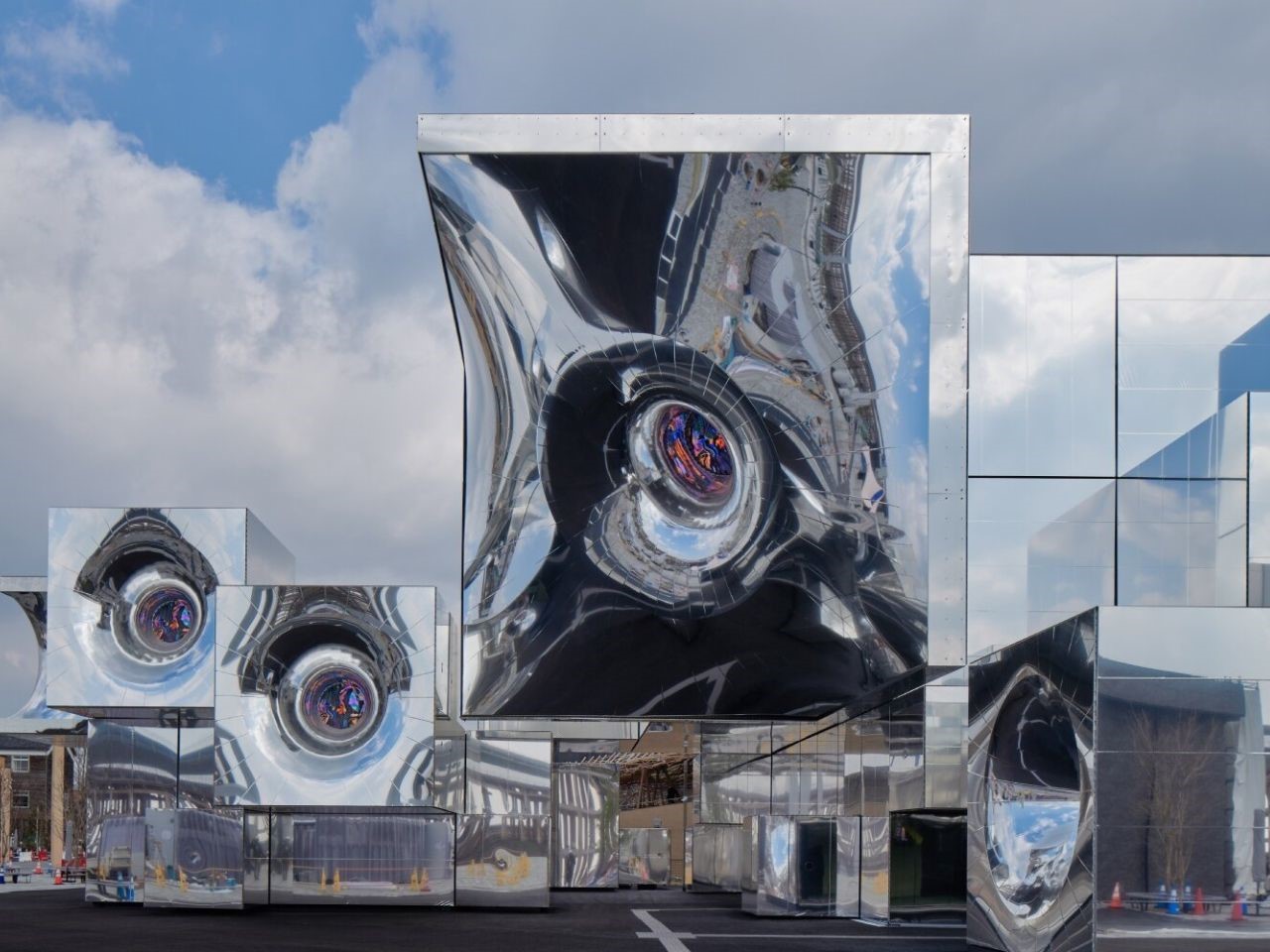

Sphere Entertainment Co. was one of the week’s winners, rising 13.8% to $28.88. On Friday, Sphere Entertainment subsidiary MSG Networks announced it had negotiated a $514 million reduction in its debt and lower fees to broadcast New York Knicks and New York Rangers games. The news sent Sphere’s share price up 9.1%.

Spotify, which reports first quarter earnings on Tuesday (April 29), rose 8.1% to $620.72, giving the streaming giant a 23.3% gain over the past three weeks. This week, UBS lowered its price target to $680 from $690 and Wolfe Research raised its outlook on SPOT to “outperform” from “peer perform.”

Live Nation gained 4.4% to $132.76. Wolfe Research lowered its price target to $158 from $165 and maintained its “outperform” rating.

Warner Music Group (WMG) improved 2.4% to $29.83. Morgan Stanley lowered WMG shares to $32 from $37 and dropped the rating to “equalweight” from “overweight.” Universal Music Group (UMG), which also reports earnings on Tuesday, rose 3.5% to 24.79 euros ($28.28), bringing its year-to-date gain to 3.7%.

K-pop stocks had an unremarkable week after performing well during the tariff-driven chaos. HYBE, which, like Spotify and UMG, reports first-quarter earnings on Tuesday, rose 0.9%. SM Entertainment and JYP Entertainment improved 0.6% and 0.2%, respectively. YG Entertainment dropped 4.9%. Still, K-pop stocks are outperforming most music stocks this year. Collectively, the four South Korean music companies have posted an average year-to-date gain of 27.1%.

Cumulus Media shares dropped 16.0% to $0.21 after the company announced on Wednesday (April 23) it will de-list from the Nasdaq exchange on May 2 and immediately begin trading over the counter. The radio broadcaster’s shares are down 72.7% in 2025 and have fallen 92.2% over the last 52 weeks.

![Stephanie Arcila On ‘Fire Country’ [Spoiler] & Gabriela’s Future After Season 3 Finale](https://deadline.com/wp-content/uploads/2025/04/Stephanie-Arcila.jpg?#)

![‘Scream’ Meets ‘Sleepwalkers’ in Shot-on-Video Slasher ‘Screamwalkers’ [Trailer]](https://bloody-disgusting.com/wp-content/uploads/2025/04/screamwalkers.jpg)

![Your New Found Footage Obsession ‘Project MKHEXE’ Hits SCREAMBOX Tuesday [Trailer]](https://bloody-disgusting.com/wp-content/uploads/2025/04/ProjectMkhexe-still.jpg)

![Havoc Director Gareth Evans Knows The Movie's Shootouts Are Unrealistic, But There's A Logic To Them [Exclusive]](https://www.slashfilm.com/img/gallery/havoc-director-gareth-evans-knows-the-movies-shootouts-are-unrealistic-but-theres-a-logic-to-them-exclusive/l-intro-1745607088.jpg?#)

![Goodbye, ‘You’: Show Bosses on Penn Badgley’s ‘Horrific’ Finale Moment, [SPOILER] Returning and Wanting Viewers to See Who Joe Really Is: ‘He’s a F—ing Monster’](https://variety.com/wp-content/uploads/2025/04/Penn-Badgley-Joe-Goldberg-You-S5.png?#)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![[Podcast] Unlocking Innovation: How Play & Creativity Drive Success with Melissa Dinwiddie](https://justcreative.com/wp-content/uploads/2025/04/melissa-dinwiddie-youtube.png)