Q3 travel retail down -28% for The Estée Lauder Companies as internal share slips to low teens

President and Chief Executive Officer Stéphane de la Faverie says, “Travel retail declined -28% organically [in Q3], and it continues to shrink as a percentage of our business towards the low teens.” Worse is to come in Q4, he adds but lower base comparisons and a “strategic reset” underway will help in fiscal 26.

The Estée Lauder Companies has spelled out the stern challenges facing the group’s travel retail business following a -28% year-on-year Q3 slump in the channel, saying that worse is to come in Q4.

However, the US beauty group believes a “strategic reset” of its operations in the channel to focus on experience-led retail – as opposed to reseller-related activity – linked to less onerous year-on-year comparisons will steady the ship.

Speaking on a post-Q3 results earnings call yesterday, President and Chief Executive Officer Stéphane de la Faverie said, “Travel retail declined -28% organically [in Q3], and it continues to shrink as a percentage of our business towards the low teens.” [Editor’s note: Between fiscal years 2004 and 2021, global travel retail’s share of group sales, largely driven by the Hainan offshore duty-free business created in 2011 and South Korea, rose from around +6% to circa +28%].

Commenting on the fiscal outlook for the group’s fourth quarter and financial year ended June, de la Faverie commented, “We expect the headwind we faced in our travel retail business in the third quarter to be even greater in the fourth quarter.”

He added, “Outside of travel retail, we expect organic sales decline to moderate further and retail sales growth to continue. One of the primary drivers of the gap between organic and retail is weakened consumer sentiment in the US, in areas of Europe, and prolonged weak consumer sentiment in China and Korea.

“This is resulting in tighter inventory management as retailers manage their working capital. With the strategic reset of our travel retail business well underway to better reflect recent industry trends and market conditions and provided there is a meaningful resolution of the recently enacted tariffs to mitigate potential related negative impact, we are confident in our ability to return to sales growth in fiscal 2026.” {Main story continues following the sidebar below}

On the record with Stéphane de La Faverie

On the Profit Recovery and Growth Plan: We’re making a lot of progress from the gross margin improvement, from the reduction of our employee workforce, especially in the middle management. We are accelerating our outsourcing project. We are accelerating our procurement project. So all of that is creating a lot of efficiency in the model. On agility: We move where the consumer is going. The move that we did on Amazon Prestige Beauty, the move that we’ve done on Shopee, and the moves that we are doing on TikTok Shop around the world, are another indicator of our ability to just put our brand where the consumer is and really recapture our fair share of the market. On efficiencies: There’s no stone that we are leaving unturned when it comes to how we can operate the company in a much more agile and leaner way. |

Righting the inventory imbalance

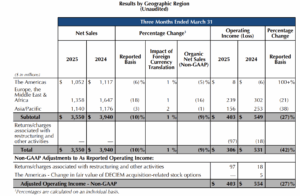

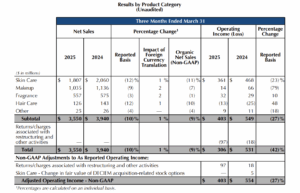

Executive Vice President and Chief Financial Officer Akhil Shrivastava observed, “In February, we indicated that growth in our travel retail business would decline strong double digits in the second half of the fiscal year. And that we would maintain appropriate trade inventory levels.

“Retail softness has persisted since then, and we expect a steeper decline in net sales in the fourth quarter compared to the -28% we saw in the third. However, despite this pressure, we continue to align shipments with demand and still expect to end the year at appropriate inventory levels.

“Our assumptions for the full year are total organic net sales to decrease in the range between -9% to -8% compared to last year. This reflects the continued softness in our global travel retail business, as well as ongoing pressure in Asia Pacific, despite the recent improvements we saw in our Mainland China third-quarter results.”

Shrivastava highlighted particular improvements in the group’s inventory position in the key North Asian markets of Hainan and South Korea. “Our biggest challenge was in travel retail, and we have significantly improved our position there,” he said.

“We exited last fiscal at elevated levels of inventory, which by December we had reduced significantly. Stéphane and I committed that we will maintain those levels and continue to work upon that. So frankly, on travel retail, we are in a much stronger position. Now given the retail ups and downs, this is a constant monitoring, which we are doing on a weekly and monthly basis.”

“Travel retail has been derisked,” added de la Faverie. Re-emphasising that travel retail’s internal share is now in the mid to low teens, he said, “This is basically like taking ten points of the mix of business that travel retail represented in our high period.

“Think about it. This is really taking a lot of volatility out of our business. This is one thing that we’ve done strategically in the course of the past few months to just make sure we can manage accordingly and really reflect the consumer demand. {Main story continues following the sidebar below}

Mitigating the impact of tariffsWith the tariff war still raging between the US and China, The Estée Lauder Companies is working hard to reduce any impact of its supplies to the key Mainland China market. Speaking on a post-Q3 results earnings call yesterday, President and Chief Executive Officer Stéphane de la Faverie said “Regarding the new tariffs, outsourcing and manufacturing are strategically regionalised around the world. Supply chain agility has always been and will remain a priority. This is a valuable asset, although there will still be pressures. “Our supply chain footprint affords us decision-making flexibility, and we’ve been working since last November on how to best leverage our existing regional capabilities and the multiple scenarios to partially cushion the direct impact of tariffs on profitability.”

He added: “We also accelerated plans to increase volume levels at our relatively new manufacturing facility [Sakura] in Japan to service our business in Asia Pacific. Our plant in Japan is our ninth manufacturing campus globally as we have five in North America and three in Europe.” Executive VP & CFO Akhil Shrivastava commented: “About 75% of what we sell in the US is either sourced from our manufacturing plants in the US and Canada or covered under existing trade agreements.

“Roughly 25% of what we sell in China is currently sourced from our manufacturing plants in the US but we have strategies to potentially reduce that to below 10%, including leveraging products made in our manufacturing plants in both Japan and Europe. Similarly, in EMEA, about 1/4 is sourced from our manufacturing plants in the US.” He continued: “Our task force is closely tracking developments and evaluating a range of scenarios to help mitigate some of the impact of tariffs. Scenarios include optimising a regionalised and third-party manufacturing network, leveraging available trade programmes and executing further mitigation strategies over the next 12 months, including expanding our local sourcing. “Based on what we know today and given our deferral period for certain manufacturing costs, we do not expect a material impact to fiscal ’25 profitability. However, unless meaningful resolution of trade negotiations is achieved, we do anticipate the high rate of tariffs to have a material impact in fiscal ’26.” De la Faverie concluded, “From a finished goods standpoint, we are in a place today that by the end of the fiscal year [end June 2025] we can mitigate a large part of the tariffs. “Since we started this task force in November… we’ve mitigated in excess of 40% of the initial impacts of the tariffs.” |

Asked how much progress the company could make in “laggard” areas such as travel retail, de la Faverie noted the high baseline comparatives will ease. “In travel retail, we are still anniversarying some really big numbers, and there’s a high double-digit negative.”

He said the company is generating market share gains in Hainan by being focused on driving pure retail [as opposed to the heavily resellers-influenced market of the past].

“We have a new leadership organisation in place in travel retail [led by Olivier Dubos*], which is doing a fantastic job and is really laser-focused on driving retail through eventing.”

He cited an example from Hainan in March where the travel retail team hosted a “massive” number of events for the Estée Lauder brand. “We were providing services on the floor… more than 200 services a month. So we’ve shifted the focus to be a retail organisation that meets the consumer demand where it is around the world.”

*Note: Look out for an interview with Olivier Dubos next week, conducted by Martin Moodie in Hainan last month.

![Salem Horror Fest 2025 Opening Night Raises Hell with Ashley Laurence [Event Report]](https://bloody-disgusting.com/wp-content/uploads/2025/05/IMG_0259-scaled.jpg)

![War-Horror Card Game ‘Deckline’ Coming to Steam on May 7 [Trailer]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/05/deckline.jpg?fit=900%2C580&ssl=1)

On the Beauty Reimagined rejuvenation programme:

On the Beauty Reimagined rejuvenation programme: