American Airlines AAdvantage Complete Guide

American Airlines AAdvantage Overview American Airlines AAdvantage is the loyalty program for American Airlines. Given American’s extensive reach within the United Sates and abroad, they are the loyalty program of choice for many folks. A few years ago, American completely changed how elite status is earned with the introduction of Loyalty Points, making it possible […] The post American Airlines AAdvantage Complete Guide appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

American Airlines AAdvantage Overview

American Airlines AAdvantage is the loyalty program for American Airlines. Given American’s extensive reach within the United Sates and abroad, they are the loyalty program of choice for many folks. A few years ago, American completely changed how elite status is earned with the introduction of Loyalty Points, making it possible to earn all the way up to Executive Platinum status without flying.

American Airlines AAdvantage Pros and Cons

Pros

- It’s possible to earn systemwide upgrades, which can be quite valuable, via Priority Point Rewards (rewards earned when attaining various Loyalty Point thresholds).

- Basic economy flights earn toward status

- There are a number of supplementary ways to earn miles most of which now earn 1 Loyalty Point per mile earned, from credit cards with two different issuers to bank account bonuses, online shopping, SimplyMiles card-linked offers, and more. See more about what counts for Loyalty Points and what doesn’t in this section.

Cons

- Highly-variable pricing for AA flights as there is no longer an award chart for American Airlines-operated flights. The partner award chart still exists, for now.

- Fewer foreign airline partnerships than competitor United means slightly less reach in terms of award destinations (though note that you can still get to many, many destinations worldwide)

- Easier elite status may mean more difficulty getting upgrades (Loyalty Points totals now are the tie-breaker for upgrades)

How to earn American AAdvantage Miles

Earning by flying AA

- No status – 5 miles per dollar/2 miles per dollar on Basic Economy

- Gold – 7 miles per dollar (40% bonus)

- Platinum – 8 miles per dollar (60% bonus)

- Platinum Pro – 9 miles per dollar (80% bonus)

- Executive Platinum – 11 miles per dollar (120% bonus)

Exceptions:

- The following types of tickets earn no miles:

- All tickets issued as AAdvantage® awards

- Charter flight tickets

- Companion tickets

- Infant tickets

- Items occupying a purchased seat

- Other free ticket promotions including free or reduced rate tickets

- Tickets purchased through a travel agency where the airline is not disclosed prior to purchase, such as Priceline or Hotwire

- Tickets issued subject to special provisions

- Travel agency/industry reduced rate tickets

- Special fares like bulk fares, cruise fares, consolidator fares, and vacation packages earn earn miles and loyalty points as a percentage of the distance flown (percentages vary by fare code and are increased with class of service bonuses). Note that in these “special fares” instances, basic economy will not earn Loyalty Points. See this page for more details.

- Flights on partner airlines earn redeemable miles and Loyalty Points based on a percentage of distance flown and class of service bonuses. See this page for rates on individual partners.

It is worth noting that flights on most non-alliance partners will earn redeemable miles but will not earn Loyalty Points.

American Airlines AAdvantage credit cards

- Issued by Mastercard

- 25% inflight food and beverage discount (except the Silver card which offers $25 back per day)

- Earn 1 AA Loyalty Point per dollar spent (details about Loyalty Points can be found in the Elite Status section of our AA guide).

- No foreign transaction fees

- Free first checked bag and preferred boarding for you plus multiple companions on the same ticket

| Card | Annual Fee | Bonus Categories | Additional Perks |

|---|---|---|---|

| Citi AAdvantage MileUp Card | $0 | 2X AA, Grocery | None |

| Citi AAdvantage Platinum Select | $99 | 2X AA, Gas, Dining | $125 AA Flight Discount with $20K membership year spend |

| Barclays AAdvantage Aviator Red | $99 | 2X AA | $99 + tax domestic companion certificate after $20K membership year spend; $25 annual inflight Wifi Credit; |

| Barclays AAdvantage Aviator Silver | $195 | 3X AA, 2X Hotel, Car rental | $25 per day inflight food and beverage credit; $50 annual inflight Wifi credit; Companion certificate good for 2 guests at $99 each (plus taxes and fees) after $20K membership year spend. Up to 15K bonus Loyalty Points: 5K at $20K spend, 5K at $40K spend, and 5K at $50K spend during the status qualification period; $100 Global Entry application fee credit |

| Citi® / AAdvantage® Executive | $595 | 4X or 5X AA, 10X via AA.com/Hotels and AA.com/Cars | Admirals Club membership; 10K Loyalty Points when reaching 50K Loyalty Points during the status qualification period and another 10K when reaching 90K; Up to $120 Avis/Budget rebate per calendar year; Up to $10/Month Grubhub rebate; $100 Global Entry application fee credit |

| CitiBusiness AAdvantage Platinum Select | $99 | 2X AA, Gas, Telecom, Car rental | $99 plus taxes domestic companion certificate after $30K membership year spend |

Miles can be earned from credit card welcome bonuses and from credit card spend. In general, while we recommend earning lots of miles through new-card welcome bonuses, earning from spend is not usually a good idea. There are many other cards on the market that offer much better rewards for everyday spend.

However, Citi in particular is known to periodically send targeted spending offers (by email or postal mail) and is also known to sometimes offer excellent retention offers, so there are times when everyday spend might make sense given such an offer.

Keep in mind that base miles earned from credit card spend also earn 1 Loyalty Point per base point earned. In other words, you’ll earn 1 Loyalty Point for every $1 spent on an AAdvantage credit card. Note that new cardmember intro bonuses and category or other spending bonuses do not count as Loyalty Points.

Transfer to AAvantage from other points programs

Marriott Bonvoy

Marriott points can be transferred to American Airlines at a rate of 3 Marriott points to 1 American mile. There is no longer a 5,000 mile bonus for transferring 60,000 points.

Other options for earning AAdvantage miles and Loyalty Points

Now that American Airlines is awarding Loyalty Points for each mile earned through many of its partners, the many ways of earning American Airlines miles beyond flight activity have become much more interesting.

AAdvantage Business

The AAdvantage Business program launched in late 2023 (replacing the old Business Extras program). AAdvantage Business provides a way for both businesses and their employees to earn additional rewards on business travel.

Eligible business owners can register their business and then the business will earn 1 redeemable mile per dollar spent on airfare by their employees (so long as the employees enter the AAdvantage Business number during the booking process and book directly with American Airlines). Employees will earn 1 additional Loyalty Point per dollar spent (that’s in addition to the Loyalty Points they ordinarily earn as members of the AAdvantage program). A business that has a Citibusiness AAdvantage Platinum Select credit card will earn an additional redeemable mile (2 total redeemable miles per dollar spent on airfare). Those bonus redeemable miles can be transferred to a designated AAdvantage member for no fee and redeemed like any other AAdvantage miles.

To qualify for the AAdvantage business program, your business needs 5 unique travelers who have cumulatively credited at least $5,000 worth of flights to American Airlines AAdvantage over the previous year or be a Citibusiness AAdvantage Platinum Select cardholder (in which case you do not need any minimum number of travelers or revenue fares).

Shopping

The options below earn both redeemable miles and loyalty points:

- Online Shopping: You can earn both redeemable miles and Loyalty Points when you shop through the AAdvantage eShopping portal. You’ll generally earn 1 Loyalty Point per redeemable mile earned through these channels except when the shopping portal is offering a general spending bonus like “spend a cumulative $500 through AAdvantage eShopping from Date A to Date B and get 2,000 bonus miles”. While the miles earned from your purchases themselves will count as Loyalty Points, the additional 2,000-mile bonus will not. In cases where the reward is a set number of miles (i.e. subscribe to the Wall Street Journal and get 2,500 miles) you will earn that number of redeemable miles and Loyalty Points.

- In-Store and Online Shopping: SimplyMiles is a unique card-linked program offered to all US members with a valid Mastercard (note that it does not need to be an American Airlines Mastercard). These offers often provide a fixed number of miles for meeting a specified spend threshold and can sometimes represent a significant return. Many of these offers can be completed in-store or online. See Card-Linked Programs & The Networks They Run On (AKA Which Programs Stack) for ideas about how to stack extra savings.

Dining

- Dining: You can earn miles for dining at local restaurants via the AAdvantage Dining program. Note that you may even be able to stack these bonus miles with rewards earned in another card-linked program.

Credit Card spend

- Credit card spend: One mile per dollar spent on the Citi and Barclays co-branded cards. Welcome bonuses, category bonuses, and temporary spending bonuses will not earn Loyalty Points — you’ll just earn 1 mile per dollar spent on your card (some cards issued in foreign countries earn 1.5 or 2 base miles per dollar spent and in those cases Loyalty Points will be earned based on the base earning rate of the card).

Hotel booking

- AAdvantage Hotels: This booking site powered by “Rocket Hotels” essentially replaced earning via Rocketmiles. Earnings on the AAdvantage Hotels platform can be very attractive given the (at-times) generous mileage payouts. You won’t earn elite credit or hotel points through this platform, but it is worth considering in when elite credits and hotel points are not available or not important.

- Hotels credited to American Airlines: Many hotel programs let you forgo hotel earnings to credit to an airline program. That usually isn’t an attractive deal, but it could be useful when you don’t care about hotel rewards.

Rental Cars

- Rental Cars: You can book rentals through American Airlines or book through most of the major US companies and credit the rental to American, earning both redeemable miles and Loyalty Points.

Vacation packages

- Vacations and cruises booked through American Airlines. We’ve written before about how vacation packages can sometimes be a great way to build your own business class fare sale. Now you can earn Loyalty Points, too.

Gas

- Fueling up: Members can earn miles for filling up their gas tanks via the Shell Gas partnership, though the returns here are quite small.

Others

- Sharing your opinions: American Airlines offers the chance to earn both redeemable miles and Loyalty Points through Miles for Opinions.

- Buying event tickets: It is possible to earn additional miles per dollar spent on event tickets like concerts, sporting events, and more through AAdvantage Tickets. Prices can be roughly comparable to what you’ll find elsewhere.

- Other earning options: American lists other options for earning miles through partnerships here.

Other options for earning miles that do not count as Loyalty Points

Bank accounts

Bask Bank offers American Airlines AAdvantage miles instead of cash interest on savings. They currently award 2 miles per dollar saved annually (note that this can vary with interest rates). This is how Bask explains it:

The Bask Savings Account awards 2 AAdvantage® miles for each dollar saved annually. Miles are accrued daily and awarded monthly based on your average monthly balance.

Depending on how you value the miles, that may not be a bad deal. For tax purposes, Bask values the miles at 0.42c per mile, meaning that every 1,000 miles earned counts as $4.20 in interest income. Additionally, Bask sometimes offers up to 10,000 miles for opening and funding an account. Read more and open an account at Bask Bank.

Note that Citi has also periodically offered up to 60,000 American Airlines miles for opening a checking account, though these offers are often targeted and we haven’t seen this as frequently in recent years.

In either case (Bask Bank or Citi), miles earned from bank accounts will not earn Loyalty Points.

How to spend American AAdvantage Miles

Booking flights with American miles is easy. On AA.com, simply check the box to “Redeem miles” when searching for flights. American defaults to showing results for one week at a time, but you can then click “View Calendar” to see results for a month at a time.

Award Booking Tips

Here are a few miscellaneous tips:

- Usually, no round-trip advantage. While Delta often charges fewer miles for round-trip awards, we rarely see the same pattern with American.

- Scroll down or sort. American won’t always show the best priced award at the top, especially when partner flights are involved.

- All awards can be cancelled for free.

- Sometimes adding an extra leg can drop the price. See this post for more detail.

- Know that searching for awards can be like playing a slot machine. Sometimes, you’ll search a route and see a high price and then re-search the same route a few minutes later and see a much lower price. It can be worth trying again to see if you hit the jackpot.

Best Uses of American AAdvantage Miles

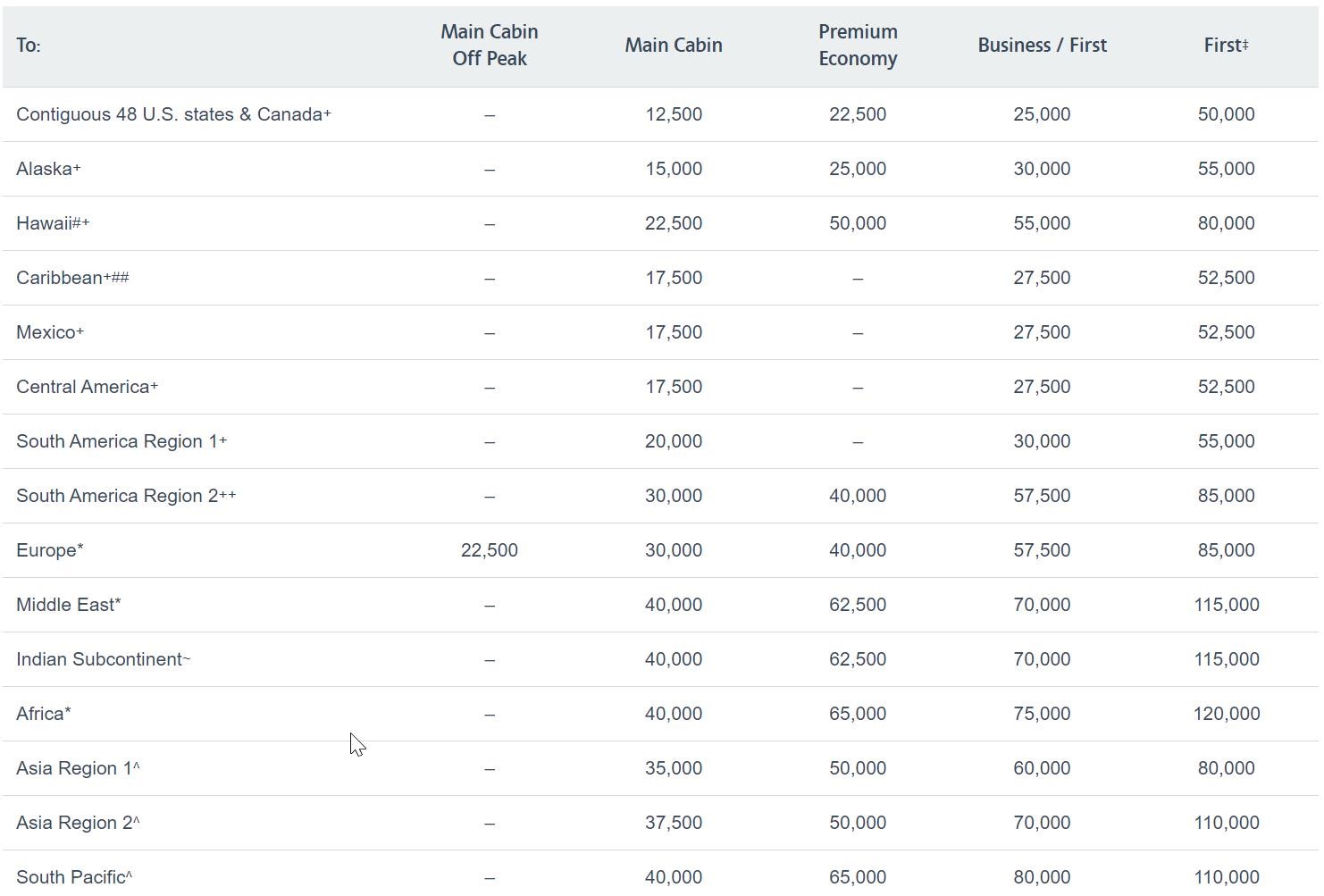

- The US to Europe in business class for 57.5K each way

- The US to Asia in business class (60K each way to Japan or Korea or 70K to most of the rest of Asia)

- The US to Japan or Korea in first class for 80K each way

- The US to the Indian Subcontinent in business class for 70K each way

American Airlines Award Partners

Flights on partner airlines can be booked with American Airlines AAdvantage miles as long as the partner has saver-level award space available for the given flight. Note that not all partner airlines can be booked online; you will need to book via a call center for award flights on some partner airlines. Note also that in some cases, foreign AAdvantage call centers may be better equipped to assist. For example, in the past, the Australian call centers were able to book Etihad award flights that US agents were unable to see as available. Google Voice can be a cheap way to phone overseas call centers when necessary.

Here are American’s partner airlines:

- Alaska Airlines

- British Airways

- Cathay Pacific

- Finnair

- Iberia

- Japan Airlines

- Malaysia Airlines

- Qantas

- Qatar Airways

- Royal Air Maroc

- Royal Jordanian Airlines

- SriLankan Airlines

- Air Tahiti Nui

- Cape Air

- China Southern Airlines

- Etihad Airways

- Fiji Airways

- GOL Airlines

- Hawaiian Airlines

- IndiGo Airlines

- JetSMART (note that JetSmart now uses the AAdvantage program)

Award Change & Cancellation Fees

American Airlines no longer charges award change or cancellation fees. You can cancel your award ticket any time and AA will reinstate your miles up to 1 year after the ticket issue date as long as you cancel your ticket before the first flight departs. Some awards must be cancelled via a call center.

Upgrade with miles

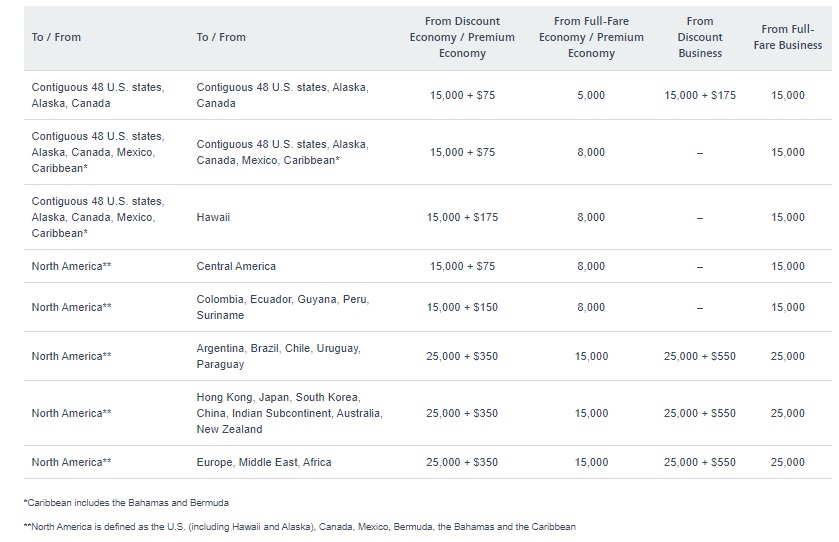

American Airlines AAdvantage offers members the chance to request an upgrade with miles on most revenue tickets marketed and operated by American Airlines. It is also possible to use miles to upgrade on British Airways, Iberia, and Qantas, but note that you will need to have booked a full-fare ticket in your cabin in order to upgrade with miles on partners (in other words, one can only upgrade tickets on partner airlines when traveling on the most expensive economy / premium economy / business class fares). In most cases, you will also need to pay a cash co-pay. The number of miles and amount of co-pay required depends on the route and cabin class. This is the award chart for upgrade requests:

As you can see above, you will pay both miles and a fee ranging from $75 to $350 to upgrade from discount economy or premium economy to business class. Discount economy class includes fares booked in H,K,M,L,V,G,Q,N,O,S fare buckets and Military or Government fares booked in Y and discount premium economy includes fares booked in P fare buckets. In other words, all but full-fare economy and premium economy fares will be subject to the cash component plus the miles. Note that if your flight departs a market where there are additional taxes on premium-cabin tickets (like the UK or France), you will also have to pay those mandatory taxes.

The chart above also shows rates to upgrade from discount or full-fare business to first class, though keep in mind that American Airlines has few routes that offer a true first class cabin and they intend to phase out first class in the long-term.

Note that if you want to upgrade a partner flight (such as a ticket on British Airways or Iberia), you’ll need to be traveling on a full-fare ticket. For instance, the only economy fare classes eligible to upgrade on British Airways or Iberia are Y and B.

When you request a mileage upgrade, your upgrade will clear immediately if there is confirmable upgrade space available, but in most cases your upgrade will be waitlisted and may clear any time up until departure.

Mileage upgrades can only be requested over the phone, so you’ll need to call American Airlines AAdvantage if you want to request a mileage upgrade. You can request it at the time of booking or after booking your ticket.

In terms of upgrade priority, mileage upgrades are prioritized over complimentary upgrades and they are then prioritized by elite status levels and Loyalty Points earned over the past rolling 12 months. You can request a mileage upgrade for anyone.

American Airlines Elite Status

Most airlines offer extra benefits to their most valuable customers. This is usually handled through elite status. If you fly enough with an airline, you can become “elite”. Of course, not all elites are equal. Most airlines have multiple elite tiers to differentiate their valuable customers from their really valuable customers. And, of course, airlines offer the best perks to their highest tier elites.

American does the same. They offer published elite tiers ranging from Gold status to Executive Platinum status (and they also offer an invitation-only Concierge Key status). Gold status perks are only slightly better than those you get from holding a American Airlines branded credit card. Executive Platinum perks, though, can be very nice indeed.

In addition to benefits you get from holding a level of elite status, AA offers benefits (“Loyalty Point Rewards”) whenever you earn targeted numbers of Loyalty Points during the status qualification period (e.g. March through Feb). Benefits range from Preferred seating all the way to lounge access to systemwide upgrade certificates.

General American Airlines AAdvantage benefits

American Airlines AAdvantage members enjoy some benefits simply by being a member of the program. Some key benefits include:

- Trip credits extended longer for AAdvantage members than for non-members (12 months vs 6 months)

- Only AAdvantage members can buy one-day Admirals Club passes

- AAdvantage members will be able to buy a single-visit Flagship First lounge pass

- Only AAdvantage members will be able to put flights on hold free of charge for up to 24 hours

- Starting in January 2026, American Airlines is offering free in-flight WiFi to AAdvantage members

- Cancel non-refundable Basic Economy fare tickets and receive a partial trip credit (less a $99 fee) if your trip is domestic, travel hasn’t started yet, and you booked directly through American Airlines. Note that Basic Economy tickets booked through third-party online travel agencies (like Expedia, Priceline, etc) cannot be canceled for a trip credit. Note that your AAdvantage number must be associated with the reservation before you cancel.

- AAdvantage members can request same-day standby for an earlier flight on AA.com or in the American Airlines app starting 24hrs before departure (regardless of status).

American Airlines elite status requirements

- Gold: 40,000 Loyalty Points

- Platinum: 75,000 Loyalty Points

- Platinum Pro: 125,000 Loyalty Points

- Executive Platinum: 200,000 Loyalty Points

Elite Benefits

| AAdvantage elite status | Gold | Platinum | Platinum Pro | Executive Platinum |

|---|---|---|---|---|

| Loyalty Points Required | 40K | 75K | 125K | 200K |

| Mileage Bonus | 40% | 60% | 80% | 120% |

| Preferred Seating | Y | Y | Y | Y |

| Main Cabin Extra Seating | Upgrade at Check In | Y | Y | Y |

| Domestic First Class Upgrade | 24 hour window | 48 hour window | 72 hour window | 100 hour window |

| Upgrade on Alaska Airlines | Y | Y | Y | Y |

| Free checked bags | 2 | 2 | 3 | 3 |

| OneWorld Status | Ruby: Access to biz class check-in, preferred seating | Sapphire: Access to OneWorld Business Class lounges | Emerald: Access to OneWorld First and Business Class lounges | |

Hyatt benefits for those with AA elite status

Those who have earned enough Loyalty Points or have high enough status can redeem AAdvantage miles for Hyatt certificates:

- 40,000 Loyalty Points or Gold status: redeem 25,000 AAdvantage miles for a category 1-4 Hyatt certificate

- 125,000 Loyalty Points or Gold status: redeem 60,000 AAdvantage miles for a category 1-7 Hyatt certificate

Redeeming 25,000 or 60,000 miles for category 1-4 or 1-7 certificates respectively is poor value, so this isn’t something that we’d recommend.

Additional earning options were added starting March 1, 2025:

- 100,000 Loyalty Points: select Hyatt Discoverist status

- 175,000 & 250,000 Loyalty Points: select Hyatt Explorist status

- 400,000, 550,000 & 750,000 Loyalty Points: select category 1-4 Hyatt certificate

- 1 million, 3 million & 5 million Loyalty Points: select category 1-7 Hyatt certificate

While the benefits at the 40,000 and 125,000 Loyalty Point levels require the redemption of miles for the free night certificates, that is not the case for the above milestone bonuses. Instead, those will be options you can select as your reward for hitting that Loyalty Points Rewards level without needing to redeem miles. Whether that’ll be worth doing is another matter though.

Loyalty Point Rewards

Independent from elite status levels, benefits are earned when reaching various Loyalty Point levels during the status qualification period (e.g. March through Feb):

| Loyalty Points Earned | Loyalty Point Rewards |

|---|---|

| 15K | Automatic Benefit: Group 5 Boarding Choose 1: • Priority privileges & Group 4 boarding for a trip • 5 Preferred seat coupons • 1,000 Loyalty Points |

| 40K | Automatic Benefit: AAdvantage Gold Status |

| 60K | Automatic Benefits: • 20% Loyalty Point Bonus (AA Vacations, SimplyMiles, AAdvantage eShopping, AAdvantage Dining, and AA Hotels) • Avis Preferred Plus |

| 75K | Automatic Benefit: AAdvantage Platinum Status |

| 100K | Automatic Benefits: • 30% Loyalty Point Bonus (AA Vacations, SimplyMiles, AAdvantage eShopping, AAdvantage Dining, and AA Hotels) • Avis President's Club • Hyatt Discoverist Status |

| 125K | Automatic Benefit: AAdvantage Platinum Pro Status |

| 175K | Choose 1: • 2 systemwide upgrades • 20K bonus AA miles (25K w/ AA credit card) • 6 Admirals Club One-Day Passes • $200 Trip Credit ($250 w/ AA credit card) • Carbon offset • $250 donation to select nonprofit organization • 15% award rebate • 2 gifts of AAdvantage Gold status • 35K AA miles towards a Mastercard Priceless Experience • 5,000 Loyalty Points • World of Hyatt Explorist status |

| 200K | Automatic Benefit: AAdvantage Executive Platinum Status |

| 250K | Choose 2: • 2 systemwide upgrades • 20K bonus AA miles (30K w/ AA credit card) • 6 Admirals Club One-Day Passes • Admirals Club membership (requires 2 choices • $200 Trip Credit ($250 w/ AA credit card) • Carbon offset • $250 donation to select nonprofit organization • 2 gifts of AAdvantage Gold status • Bang & Olufsen product (requires 2 choices) • 1 Flagship lounge single visit pass (2 passes w/ AA credit card) • 35K AA miles towards a Mastercard Priceless Experience • 15,000 Loyalty Points • World of Hyatt Explorist status |

| 400K | Choose 2: • 1 systemwide upgrade • 25K bonus AA miles • Admirals Club membership (requires 2 choices) • $200 Trip Credit ($250 w/ AA credit card) • Carbon offset • Gift of AAdvantage Platinum status • Bang & Olufsen product (requires 2 choices) • 2 Flagship® Lounge Single Visit Passes • 1 Flagship First Dining pass • 40K AA miles towards a Mastercard Priceless Experience •World of Hyatt Category 1-4 Free Night Award |

| 550K | Choose 2: • 1 systemwide upgrade • 25K bonus AA miles • Admirals Club membership (requires 2 choices) • $200 Trip Credit ($250 w/ AA credit card) • Carbon offset • Gift of AAdvantage Platinum status • Bang & Olufsen product (requires 2 choices) • 2 Flagship lounge single visit passes • 1 Flagship First Dining pass • 40K AA miles towards a Mastercard Priceless Experience • World of Hyatt Category 1-4 Free Night Award |

| 750K | Choose 2: • 1 systemwide upgrade • 25K bonus AA miles • Admirals Club membership (requires 2 choices) • $200 Trip Credit ($250 w/ AA credit card) • Carbon offset • Gift of AAdvantage Platinum status • Bang & Olufsen product (requires 2 choices) • 2 Flagship lounge single visit passes • 1 Flagship First Dining pass • 40K AA miles towards a Mastercard Priceless Experience • World of Hyatt Category 1-4 Free Night Award |

| 1M | Choose 1: • 4 systemwide upgrades • Carbon offset • Gift of AAdvantage Platinum Pro status • Up to 100K miles back on award redemptions • 150K AA miles towards a Mastercard Priceless Experience • World of Hyatt Category 1-7 Free Night Award |

| 3M | Choose 1: • 6 systemwide upgrades • Carbon offset • Gift of AAdvantage Executive Platinum status • Up to 300K miles back on award redemptions • 350K AA miles towards a Mastercard Priceless Experience • World of Hyatt Category 1-7 Free Night Award |

| 5M | Choose 1: • 10 systemwide upgrades • Carbon offset • Gift of AAdvantage Executive Platinum status • Up to 500K miles back on award redemptions • 550K AA miles towards a Mastercard Priceless Experience • World of Hyatt Category 1-7 Free Night Award |

Earning Loyalty Points on flights

On American marketed flights, elite earnings are straightforward: you earn 1 Loyalty Point per 1 mile earned. Typically, this means that you earn at least 5 Loyalty Points per dollar spent on American Airlines fares with additional bonuses based on status. Basic Economy fares only earn 2 base Loyalty Points per dollar spent (and the additional status boosts).

Exceptions to mileage earning based on ticket price:

- Special fares like bulk fares, cruise fares, consolidator fares, and vacation packages earn earn miles and loyalty points as a percentage of the distance flown (percentages vary by fare code and are increased with class of service bonuses). Note that in these “special fares” instances, basic economy will not earn Loyalty Points. See this page for more details.

- Flights on partner airlines earn redeemable miles and Loyalty Points based on a percentage of distance flown and class of service bonuses. See this page for rates on individual partners.

- Note that members will not earn Loyalty Points for flights on non-alliance partners except with JetBlue and Gol.

Earning Loyalty Points with credit cards

Both Citi and Barclays offer both business and consumer American Airlines credit cards. The following are current bonus offers, card benefits, and earning structures. Keep in mind that bonuses do not count as Loyalty Points. Base earnings (1 mile per $1 spent) do count as Loyalty Points.

Consumer

| Card Offer and Details |

|---|

ⓘ $202 1st Yr Value EstimateClick to learn about first year value estimates 15K miles Non-AffiliateThis is NOT an affiliate offer. Earn 15K AA miles after $500 spend in 3 monthsNo Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Not bad for grocery spend if you highly value AA miles Earning rate: 2X grocery ✦ 2X AA ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Citi. This card imposes foreign transaction fees. Noteworthy perks: Save 25% on inflight food and beverage purchases |

| Card Offer and Details |

|---|

ⓘ $658 1st Yr Value EstimateClick to learn about first year value estimates 50K Miles Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 50K miles after $2,500 spend in first 3 months $0 introductory annual fee for the first year, then $99 Alternate Offer: There may be an alternative offer of 30K + $400 AA credit that can be found when doing a dummy booking on aa.com. Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 75K miles after $3,500 spend in 3 months (ended 10/14/24) FM Mini Review: Excellent choice for a great intro bonus. Plus it offers the usual collection of perks for flying AA (free checked bag, priority boarding, etc.) Earning rate: 2X restaurants ✦ 2X gas ✦ 2X AA Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Big spend bonus: $125 AA Flight Discount with $20K membership year spend Noteworthy perks: ✦ First checked bag free ✦ Priority Boarding ✦ Save 25% on inflight food and beverage purchases |

| Card Offer and Details |

|---|

ⓘ $328 1st Yr Value EstimateClick to learn about first year value estimates 75K miles Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 75K miles after $7,500 spend in first 3 months$595 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: Good choice for those who need Admirals Club® access and those who value the Loyalty Points boosts at 50K and 90K Loyalty Points earned. Plus, it offers the usual collection of perks for flying AA (free checked bag, priority boarding, etc.) and some handy credits for Avis or Budget rentals and GrubHub. Earning rate: 4X AA ✦ 10X hotels booked through AA.com/Hotels ✦ 10X car rentals booked through AA.com/Cars ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Citi. This card has no foreign currency conversion fees. Noteworthy perks: ✦ First Checked Bag Free ✦ Admirals Club® access for both primary and authorized users ✦ Up to $120 per 12 monthly billing cycles for GrubHub purchases (up to $10 per monthly billing cycle) ✦ Up to $120 back on eligible Avis or Budget prepaid car rentals every calendar year ✦ $10 monthly Lyft credit after you take 3 Lyft rides that calendar month ✦ 10K bonus Loyaty Points after earning 50K Loyalty points through all channels and another 10K bonus Loyalty Points after earning 90K Loyalty Points through all channels ✦ 25% savings on eligible in-flight purchases on American Airlines flights ✦ Up to $120 Global Entry or TSA PreCheck application fee credit every 4 years |

| Card Offer and Details |

|---|

ⓘ $881 1st Yr Value EstimateClick to learn about first year value estimates 70K Miles Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 70K miles after 1st purchase and paying the annual fee within 90 days $99 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: Up to 75K: 60K miles after first purchase and 15K after adding an authorized user and making one purchase on that card [Expired 2/24/24] Earning rate: 2X AA ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Earn $99 + tax domestic companion certificate with $20K membership year spend. Noteworthy perks: First checked bag free ✦ Preferred boarding for the primary cardmember and up to 4 companions traveling on the same reservation ✦ 25% off in-flight purchases ✦ $25 wifi credit per membership year ✦ Flight cents: round up purchases to earn more miles |

| Card Offer and Details |

|---|

ⓘ $-195 1st Yr Value EstimateClick to learn about first year value estimates Available by invitation only $195 Annual Fee Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. FM Mini Review: $25 per day of in-flight food & beverage credits is pretty interesting. If you fly AA enough to make good use of this, this card is well worthwhile. Earning rate: ✦ 3X AA ✦ 2X hotel and car rentals ✦ 1X everywhere else Card Info: Mastercard World Elite issued by Barclays. This card has no foreign currency conversion fees. Big spend bonus: Earn $99 + tax domestic companion certificate for up to 2 companions with $20K membership year spend. ✦ Earn up to 15,000 bonus Loyalty Points per status qualification period: Earn 5K bonus points at $20K spend, $40K spend, and $50K spend Noteworthy perks: $25 per day in-flight food & beverage credit ✦ First checked bag free ✦ Priority Boarding ✦ $120 Global Entry application fee credit ✦ 25% off in-flight purchases ✦ $50 wifi credit per membership year ✦ Round up purchases to earn more miles |

Business

| Card Offer and Details |

|---|

ⓘ $965 1st Yr Value EstimateClick to learn about first year value estimates 75K miles Non-AffiliateThis is NOT an affiliate offer. We always present the best offer even when it means less revenue for Frequent Miler 75K miles after $5K spend in first 5 months$0 introductory annual fee for the first year, then $99 Information about this card has been collected independently by Frequent Miler. The issuer did not provide the details, nor is it responsible for their accuracy. Recent better offer: 75K miles after $5K spend in first 5 months (ended 1/21/25) FM Mini Review: This card usually has a great welcome bonus, but if you're looking for a card to keep long term, you'll find better options. Earning rate: ✦ 2X AA ✦ 2X certain telecommunications merchants ✦ 2X car rental merchants ✦ 2X gas Card Info: Mastercard World issued by Citi. This card has no foreign currency conversion fees. Big spend bonus: Earn $99 plus taxes domestic companion certificate after $30K spend Noteworthy perks: ✦ First checked bag free ✦ Priority Boarding ✦ Save 25% on inflight purchases |

Enhance with Miles

American Airlines offers a relatively new program called “Enhance with Miles.” This is a completely separate program from Loyalty Points Rewards, where members select free perks when crossing various Loyalty Points thresholds. Instead, Enhance with Miles lets elite members redeem miles for “status for a day” perks as they pass above certain Loyalty Point thresholds (according to the schedule below):

- 40,000 Loyalty Points – gift someone else AAdvantage Gold status for a day, or give yourself AAdvantage Executive Platinum status for a day

- 75,000 Loyalty Points – gift someone else AAdvantage Platinum status for a day, or give yourself AAdvantage Executive Platinum status for a day

- 125,000 Loyalty Points – gift someone else AAdvantage Platinum Pro status for a day, or give yourself AAdvantage Executive Platinum status for a day

- 200,000 Loyalty Points – gift someone else AAdvantage Executive Platinum status for a day

Each threshold reward can be redeemed twice.

Members with Platinum Pro status or higher have the ability to use miles to access to Flagship First Dining for the following numbers of miles:

- Platinum Pro: 24,000 miles

- Executive Platinum: 20,000 miles

Note that Platinum Pro members can redeem for Flagship First dining twice per year. Executive Platinum members can redeem an additional two times per year. It is worth knowing that Flagship First Dining is only available at Dallas-Fort Worth, Miami International Airport, and Los Angeles (LAX). My lone experience with Flagship First Dining was excellent, but the mileage price is steep.

The full (and extensive) terms of the Enhance with Miles program can be found here. It’s worth taking a look before using it. Once a redemption has been made, it’s non-refundable.

The post American Airlines AAdvantage Complete Guide appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

![‘Omukade’ Trailer – Thai Monster Movie Unleashes an Insane Giant Centipede Nightmare! [Exclusive]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/05/image-30.jpg?fit=1713%2C931&ssl=1)

![‘Sally’ Trailer: Acclaimed Sundance Doc About Trailblazing First Woman To Blast Into Space [Ned]](https://cdn.theplaylist.net/wp-content/uploads/2025/05/02065833/unnamed-2025-05-02T065720.586.jpg)

World Elite Mastercard®

World Elite Mastercard®

![A good deal dies, 750K miles for big spenders, and is Wells Fargo a wannabe? [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/04/Two-Hawaiian-cards-dead.jpg?#)