Pernod Record travel retail hit hard in third quarter by China Cognac sales suspension

Global Travel Retail sales plummeted by -31% year-on-year in Q3 and -17% year to date, with the suspension of China Cognac sales a key factor.

Pernod Ricard today reported third-quarter and nine-month sales (to March 2025), with travel retail hit hard by the suspension of Cognac sales in China duty free. Global Travel Retail sales plummeted by -31% year-on-year in Q3 and -17% year to date.

Pernod Ricard said the sharp decline was “driven by suspension of the duty-free regime on Cognac in China Travel Retail, compounded with a high comparison basis in Q3.” More positively, travel retail showed continued growth in Europe, while numbers in the Americas and the cruise channel are also encouraging.

The technical suspension of duty-free on Cognac is related to tit-for-tat anti-dumping measures (click here for our original report) introduced on European brandies by China’s Ministry of Commerce last October. Cognac accounts for an estimated 90% of China Duty Free Group’s liquor sales.

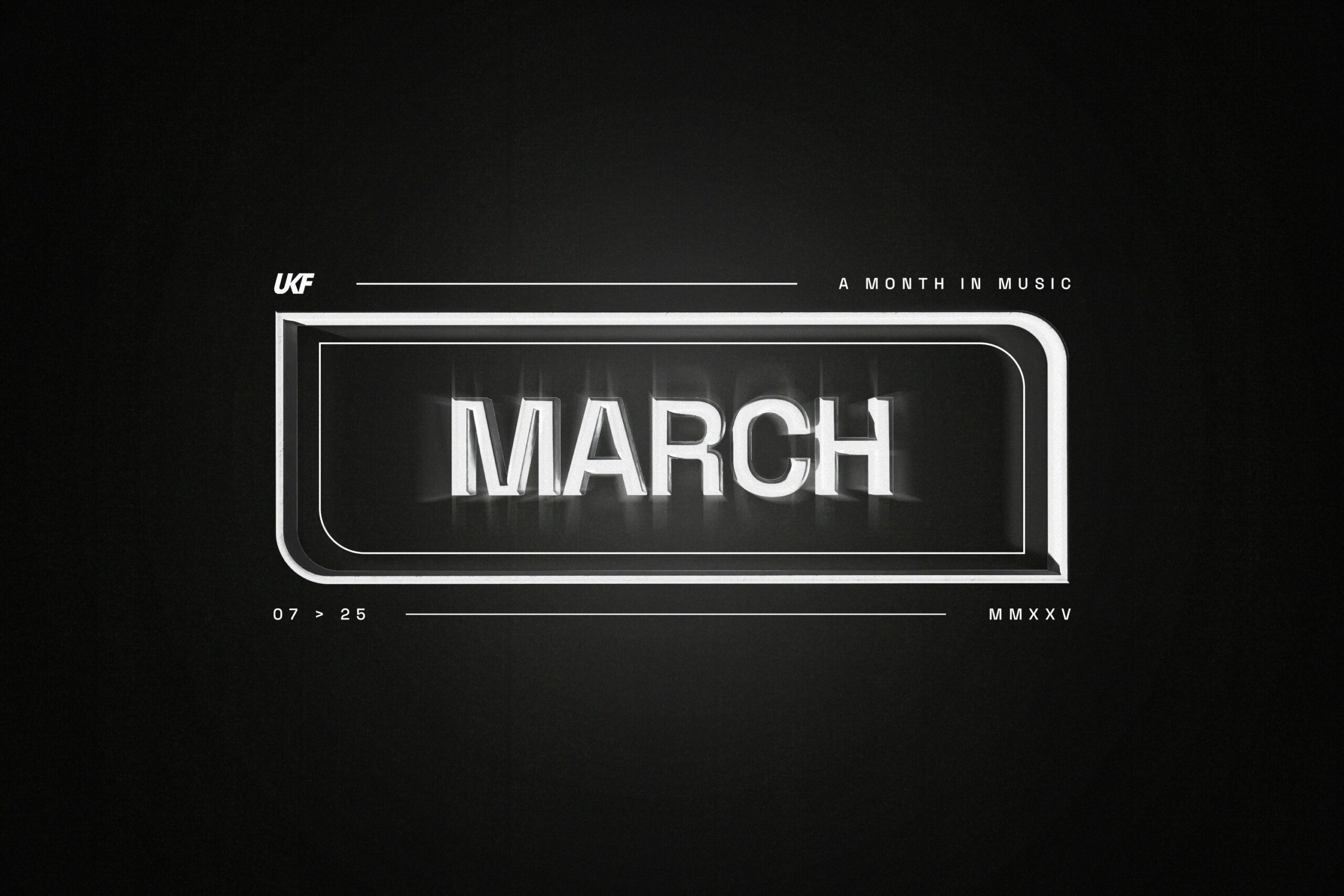

Group net sales fell by -3% to €2,278 million (both on a reported basis and in organic terms) in Q3. In the first nine months they reached €8,454 million, down by -5% reported and -4% in organic terms.

Despite the decline, Pernod Ricard termed this a “resilient net sales performance in a global macroeconomic and geopolitical environment which remains challenging and very fluid with regards to tariffs”.

The quarterly sales were impacted, said the company, by some phasing technicalities that will reverse in Q4. In India, these include the impact of new customs clearance procedures and temporary production interruption in one major state, which is now resolved; in travel retail, the high comparison base should change in Q4 while in some markets, the impact of the later Easter has also had an effect.

By region, the Americas posted a Q3 net sales rise of +3% (-2% YTD); Europe sales fell -7% in the quarter and -3% in the nine-month period; and in Asia/Rest of the World, sales slipped -6% both in Q3 and the year so far.

China sales fell by -5% in the quarter but -22% in the first nine months, with a soft Chinese New Year performance against the backdrop of a “challenging” macro market context.

Among the company’s Strategic International Brands sales fell -4% in Q3 and -6% YTD, with good growth for Jameson, Chivas Regal, Ballantine’s and Absolut, but sharp declines on Martell and Royal Salute.

Looking ahead, a statement said: “In a context that remains very volatile, we are confirming our FY25 outlook of low-single-digit decline in organic net sales while sustaining our organic operating margin, supported by our programme of continuous operational efficiencies. This outlook incorporates the impact of expected tariffs in China and in the US based on the information we have today.”

![You'll Probably Never Guess What Live Musical Performance Blew This Sinners Star Away [Exclusive]](https://www.slashfilm.com/img/gallery/youll-probably-never-guess-what-live-musical-performance-left-a-mark-on-this-sinners-star/l-intro-1745021921.jpg?#)

![It’s Unfair to Pay 100% for 50% of a Seat—Why Airlines Must Start Refunding Customers When They Fail To Deliver [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/broken-american-airlines-seat.jpeg?#)

![[Podcast] Unlocking Innovation: How Play & Creativity Drive Success with Melissa Dinwiddie](https://justcreative.com/wp-content/uploads/2025/04/melissa-dinwiddie-youtube.png)