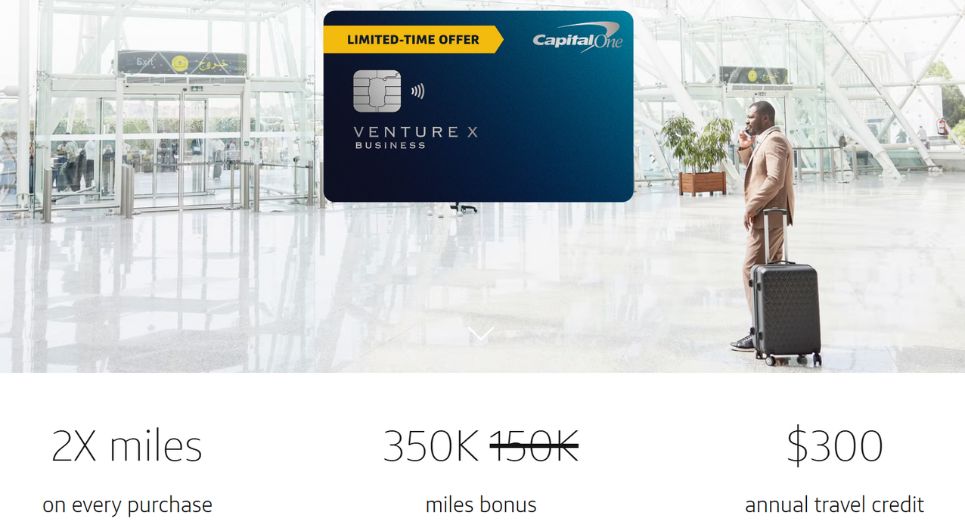

Capital One Venture X Business 350K welcome offer

This week, Capital One released an “increased” welcome offer for the Venture X Business card that awards new cardholders 350,000 Capital One Miles after spending $200,000 in the first 6 months. The offer is broken up into two parts: the first 150K is awarded after $30K spend in the first three months, while the second […] The post Capital One Venture X Business 350K welcome offer appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

This week, Capital One released an “increased” welcome offer for the Venture X Business card that awards new cardholders 350,000 Capital One Miles after spending $200,000 in the first 6 months. The offer is broken up into two parts: the first 150K is awarded after $30K spend in the first three months, while the second 150K drops after a total of $200k in spend over the first 6 months. Wowza, that’s a lot of points, but it’s also a lotta cheddah.

The Offer & Key Card Details

| Card Offer and Details |

|---|

ⓘ $2005 1st Yr Value Estimate85% of $300 in Capital One Travel portal reimbursements Click to learn about first year value estimates Up to 350K Miles ⓘAffiliateThis is an affiliate offer. Frequent Miler may earn a commission if you are approved for this offer Earn a one-time bonus of 150K miles after $30K spend in the first 3 months and an additional 200,000 miles once you spend $200,000 in the first 6 months. (Rates & Fees)$395 Annual Fee Recent better offer: Expired 3/31/23: 250K Miles after $50K in spend. FM Mini Review: Similar to the Venture X consumer card, the business version offers annual rebates that easily mitigate the fee for those who travel often and could be worth it for the lounge access and travel protections given the cost/benefit ratio. Unlike the Venture X, free authorized users do not get Priority Pass access. The card earns 2 "miles" per dollar on most purchases just like the Capital One Venture X Rewards card, which are worth exactly 1 cent each toward travel. This makes the return on most spend similar to a 2% cash back card (though in this case you must redeem your miles to offset travel in order to get 1 cent per mile). One big advantage over cash back: Capital One allows transfering their "miles" to airline miles & hotel points. Click here for our complete card review Earning rate: 10X miles on hotels and rental cars booked via Capital One's travel booking site ✦ 5x on flights and vacation rentals booked via Capital One's travel booking site. ✦ 2X everywhere else. Card Info: Visa issued by CapOne. This card has no foreign currency conversion fees. Noteworthy perks: $300 annual credit for bookings made through Capital One's travel booking site ✦ 10,000 bonus miles starting at first anniversary ✦ Up to $120 application fee credit for Global Entry or TSA PreCheck® ✦ Capital One Lounge Access ✦ Priority Pass ✦ Cell phone insurance ✦ Trip insurance ✦ Primary CDW coverage ✦ Redeem miles for travel at 1 cent per mile ✦ Convert "miles" to airline miles & hotel points |

Quick Thoughts

The Venture X Business is effectively the small business version of the Venture X card and is almost identical in terms of benefits and earnings, making it a compelling keeper card. While you have to pay a $395 annual fee, in my opinion the anniversary bonus and $300 travel credit more than offset it, and you also get access to the decent lounge benefits and 2x everywhere earning.

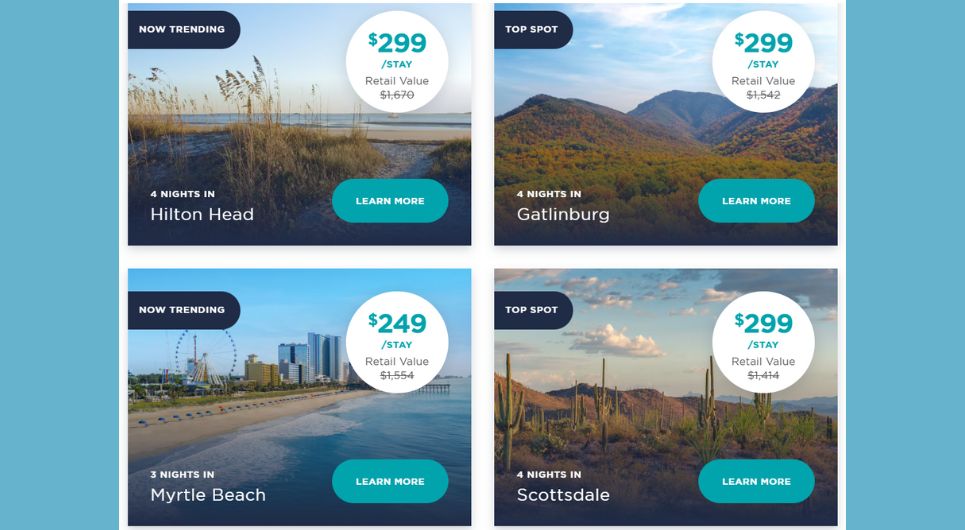

As far as the welcome offer goes, even the first-tier spend will be a non-starter for many…$30K is a big number. Our Reasonable Redemption Values lists Capital One miles at 1.45 cents per point, so that 150,000 points is “worth” ~$2,175. With the Amex Business Platinum still hanging out at 150K Membership Rewards points for 33% less minimum spend, it’s certainly worth comparison shopping to make sure that the C1 card card is the best fit for your situation. It’s also worth noting that, since the Venture X Business does earn 2x on all spend, you’ll actually end up with 210,000 C1 Miles after completing that first $30K.

As for the second tier, it’s not often that we see a six-digit minimum spend requirement, let alone $200,000. That will be out reach for most, but those who have large amounts of business spend can probably hit it without too much trouble. It could especially be appealing for businesses that have several authorized users and can’t change cards frequently based on bonused spend or welcome offer opportunities. After six months, they’d have a total of 750,000 C1 Miles, with a conservative value of around ~$10,800. That works out to ~5.4% back on that $200,000 in spending, which is fairly competitive.

For most other folks, there’s little reason to commit to that kind of spending for only 200K bonus miles.

Reports indicate that this card will not appear on your personal credit report, so this won’t affect your Chase 5/24 status and the spend won’t be reported on your credit utilization. It’s worth noting that Spark Cash Plus primary cardholders are not eligible for the Venture X Business card.

Capital One Application Tips

- 48 Month Rule: Existing or previous cardholders are not eligible for the same personal card if they have received a new cardmember bonus for the same product within the last 48 months. This doesn't apply to business cards.

- 2 card limit no more? Conventional wisdom and user experience used to be that you can have at most 2 Capital One cards. However, there are now frequent data points of some people having many more.

- 1 Charge Card Limit: Capital One only allows cardholders to be have one business charge card, so it's not possible to be the primary cardholders on both the Venture X Business and Spark Cash Plus. This doesn't apply to authorized users.

- Hard inquiries often get issued through all 3 credit bureaus.

- Velocity Limits? It used to be thought that Capital One will only approve you for one card every six months. While this is still many people's experience, we've now frequently seen data points of approvals for a second card within that timeframe.

- Application Status: Call (800) 903-9177 to check your application status.

- Reconsideration: If denied, call (800) 625-7866 for reconsideration.

The post Capital One Venture X Business 350K welcome offer appeared first on Frequent Miler. Frequent Miler may receive compensation from CHASE. American Express, Capital One, or other partners.

![You'll Probably Never Guess What Live Musical Performance Blew This Sinners Star Away [Exclusive]](https://www.slashfilm.com/img/gallery/youll-probably-never-guess-what-live-musical-performance-left-a-mark-on-this-sinners-star/l-intro-1745021921.jpg?#)

![It’s Unfair to Pay 100% for 50% of a Seat—Why Airlines Must Start Refunding Customers When They Fail To Deliver [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/broken-american-airlines-seat.jpeg?#)

![[Podcast] Unlocking Innovation: How Play & Creativity Drive Success with Melissa Dinwiddie](https://justcreative.com/wp-content/uploads/2025/04/melissa-dinwiddie-youtube.png)