Live music stocks crash due to Donald Trump’s tariffs – with “damage” to instrument market warned

Last week the US President imposed tariffs on imports from a number of countries The post Live music stocks crash due to Donald Trump’s tariffs – with “damage” to instrument market warned appeared first on NME.

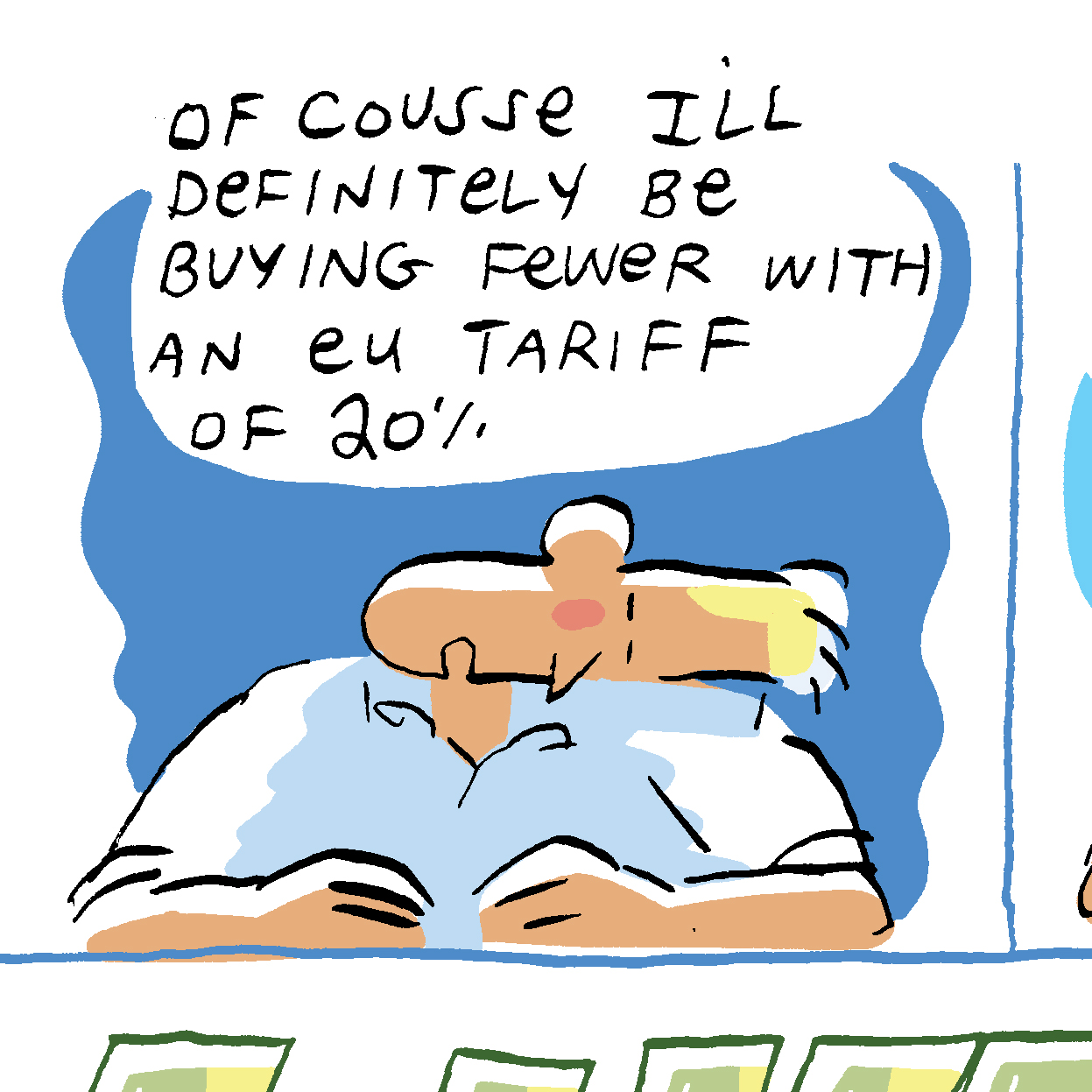

Donald Trump‘s tariffs have caused live music stocks to crash and inflicted “damage” on the instrument market.

Back in February, President Trump signed an executive order to impose tariffs on imports from a number of countries but due to backlash, he delayed the majority of them.

Last Wednesday (April 2) he shared his new, revised plan with imports from most countries (including the United Kingdom) being subject to a 10 per cent tax while others will be taxed at a much higher rate, with China (54 per cent), Vietnam (46 per cent) and Japan (24 per cent) all affected.

Trump said the measures were payback for unfair trade policies, adding that he had been “very kind” in his decisions. He believes the move will “make America wealthy again” but the news triggered a slump in the global stock market, with US markets having their worst day since COVID (via the BBC News). China also retaliated by announcing plans to add an additional 34 per cent tax on all imports from the US.

As a result of the tariffs, stocks in the music industry also took a major hit. According to Billboard, radio giants particularly got rocked the hardest with iHeartMedia stocks falling more than 13 per cent, Cumulus Media dropping over 10 percent, followed closely by SiriusXM.

Streaming and podcast companies also took a hit with LiveOne – which is behind several music and podcast services – dropping nearly 13 per cent. PodcastOne, which is part of the same group, also fell by around 10 per cent.

Live music also took a blow too with Sphere Entertainment’s stocks, which staged the recent U2 and Phish gigs in Las Vegas, dropping almost 14 per cent but it has since rallied.

MSG Entertainment and Live Nation saw their stocks fall as well, while Vivid Seats and Eventbrite also lost value, which means they could face increased costs and potentially softer consumer demand.

Despite that, companies that tend to focus on recorded music and publishing held up better due to them having global audiences and multiple income streams. Universal Music Group and Warner Music Group for example only slipped slightly, while Spotify barely took a hit.

Elsewhere, the music instrument market was also hit by Trump’s tariffs, with Shadows Fall frontman Brian Fair sharing some of his first-hand observations of the “damage” already being caused due to heavy reliance on overseas production.

Posting via his Threads account, Fair, who also works for instrument distributor St. Louis Music – one of the largest distributors of musical instruments and accessories in North America – said the tariffs have already resulted in higher cost which would inevitably lead to higher prices for consumers.

“I work for a company that owns a variety of instruments brands: guitars, percussion, orchestral strings, brass, woodwinds etc. our landing costs have sky rocketed and those costs are being turned into higher prices that will be unfortunately be handed down to the consumers,” he wrote.

“We have tried to avoid increases where ever possible but a lot of it is unavoidable. Some of these brands used to be made in the US but that priced them entirely out of the market so production shifted to overseas many years ago.”

He continued: “I work directly with Main St. brick and mortar music stores, some that are barely scraping by. These increases, no matter how small, will make it even more difficult for these stores to survive. I am by no means an expert on international trade but I am seeing the damage caused by these tariffs first hand and this is just the beginning. Hope there is still a market left once the dust clears.”

Fair went on to say that domestic manufacturers and those unaffected by the tariffs will likely raise their prices accordingly to match the inflated post-tariff market.

He added: “Also, the idea that domestic or other manufacturers that are NOT affected by tariffs won’t raise their prices to match the market have not paid attention to history. We saw prices increased by those unaffected as soon as they were announced and as we see with inflation, once prices go up they do not come down for any reason. The market resets, everyone jumps on board to maximise profits regardless of their costs and keeps it moving.”

Elsewhere, it was also recently revealed appears that Trump’s range of ‘Make America Great Again’ guitars were in fact being made in China.

The post Live music stocks crash due to Donald Trump’s tariffs – with “damage” to instrument market warned appeared first on NME.

![‘Scream’ Meets ‘Sleepwalkers’ in Shot-on-Video Slasher ‘Screamwalkers’ [Trailer]](https://bloody-disgusting.com/wp-content/uploads/2025/04/screamwalkers.jpg)

![Your New Found Footage Obsession ‘Project MKHEXE’ Hits SCREAMBOX Tuesday [Trailer]](https://bloody-disgusting.com/wp-content/uploads/2025/04/ProjectMkhexe-still.jpg)

![A good deal dies, 750K miles for big spenders, and is Wells Fargo a wannabe? [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/04/Two-Hawaiian-cards-dead.jpg?#)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

![[Podcast] Unlocking Innovation: How Play & Creativity Drive Success with Melissa Dinwiddie](https://justcreative.com/wp-content/uploads/2025/04/melissa-dinwiddie-youtube.png)