Guest article – The duty-free categories and concepts that will count as we approach 2030

In the fourth article in a series about the future of European airport concessions compiled by Blueprint with data from ACI, we discover the categories and ideas that will rise above the rest as passengers look for a rebooted, re-energised duty-free offering.

In the fourth in a series about the future of European airport concessions compiled by Blueprint with data from ACI, we examine the categories and ideas that will rise above the rest as passengers look for a rebooted, re-energised duty-free offering. Click here for part one in the series, here for part two, and here for the third part.

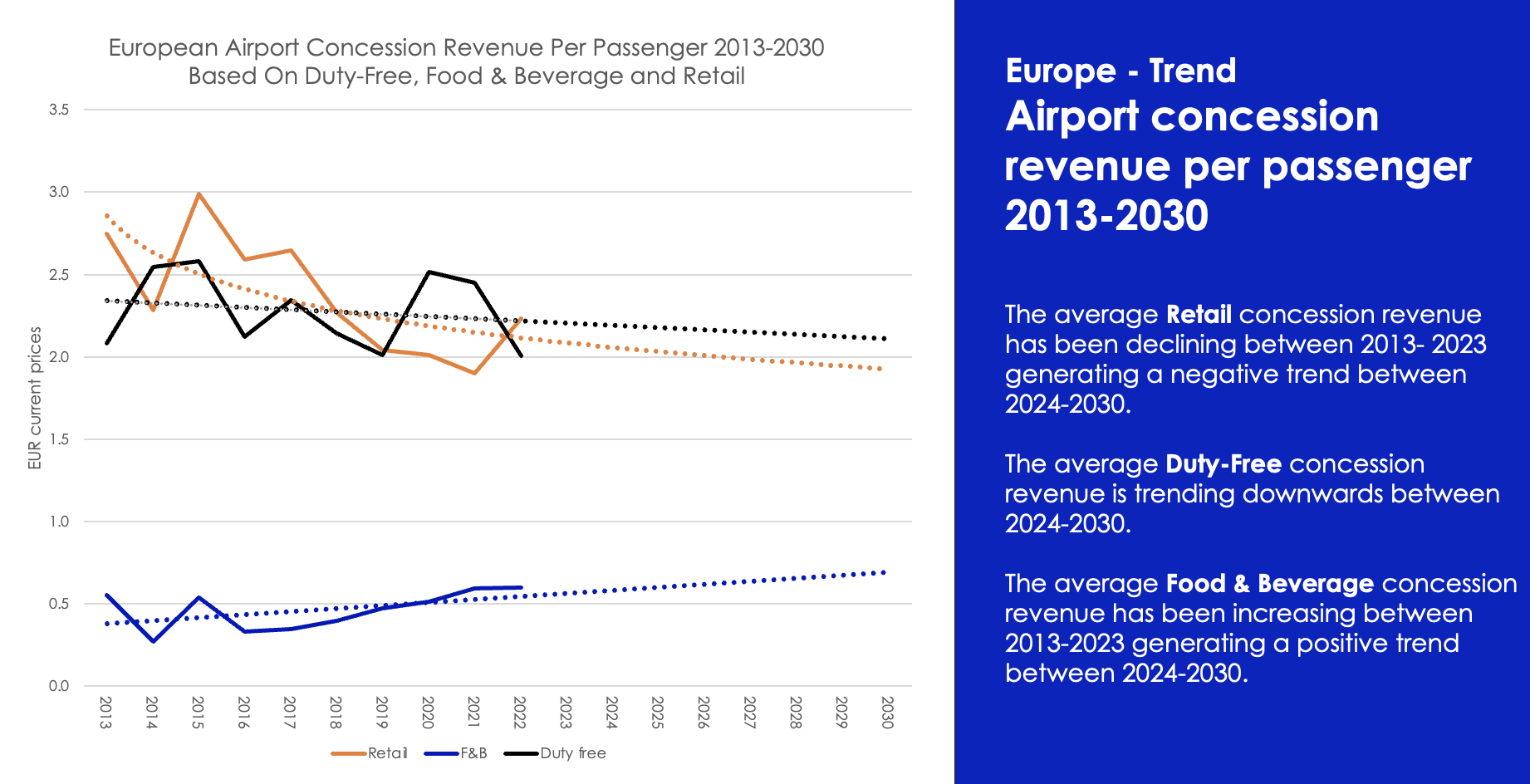

In a travel environment where passenger spend per head is falling, European airports must look more closely at their retail offers, in particular their pricing, product category mix and store layouts.

“It should send shivers down our spines, when airport duty-free concession per passenger continues to trend downwards,” comments Blueprint Partner Thomas Kaneko Henningsen. “Duty-free store concessions are a critical revenue channel for airports, but how to lift it needs some rethinking.”

This feature takes a closer look at what might be in store for price advantage, how the biggest product category – beauty – is trending, and new store layouts.

Why competing on pricing is no longer enough

Historically, airport duty-free stores’ value proposition has been based on offering travelling shoppers a price advantage – a legacy dating back to 1947 when the first duty-free store opened at Shannon Airport in Ireland. As airports evolved, duty-free stores became the very bedrock today’s travel retail is based on.

In the past decade, duty-free stores have been facing intense competition when it comes to maintaining price advantage and travel value positioning. Rival ecommerce platforms benefit from powerful price search engines and domestic markets often offer greater value for money and prioritise sell-through.

On top, the domestic market has succeeded at evolving factory outlet stores into highly sophisticated premium outlets where shoppers purchase quality brands at cheaper prices. Today’s domestic market shoppers are spoiled for choice when it comes to accessing great products at lower price points.

Adding to this equation is the fact that best-selling product categories within duty-free stores are facing other pressures. The speed and intensity at which US tariffs are arriving in the global market could not have been predicted just a few months ago. The comprehensive tariff announcement from the Trump administration on 2 April backtracked on the 200% tariff on alcohol from France and other European nations but has escalated global trade tensions.

In North America, Canada’s duty-free sector is already being hit hard with border stores facing sales declines of up to -80% as traffic between Canada and the USA stalls.

Whichever categories airport retailers focus on most towards 2030, they will all be underscored by the growing passenger expectation of more experiential retail. According to m1nd-set research, this preference has jumped from 12% in 2019 to 27% last year – more than double, and experiences are now considered more important than pricing advantage. During the same period the importance of price advantage dropped from 30% to 13% among travelling shoppers.

Is beauty still a safe bet?

“The beauty category combined with price advantage will continue to play an important role within duty-free stores, the reason being that impulse purchasing in airports remains high,” said Kaneko Henningsen. “Parallel to this, we will see experiential shopping stepping up and becoming an industry standard on a global scale. It is that long-lasting feeling of personal, immersive and emotional shopping experiences that will drive spend and revenue in duty free.”

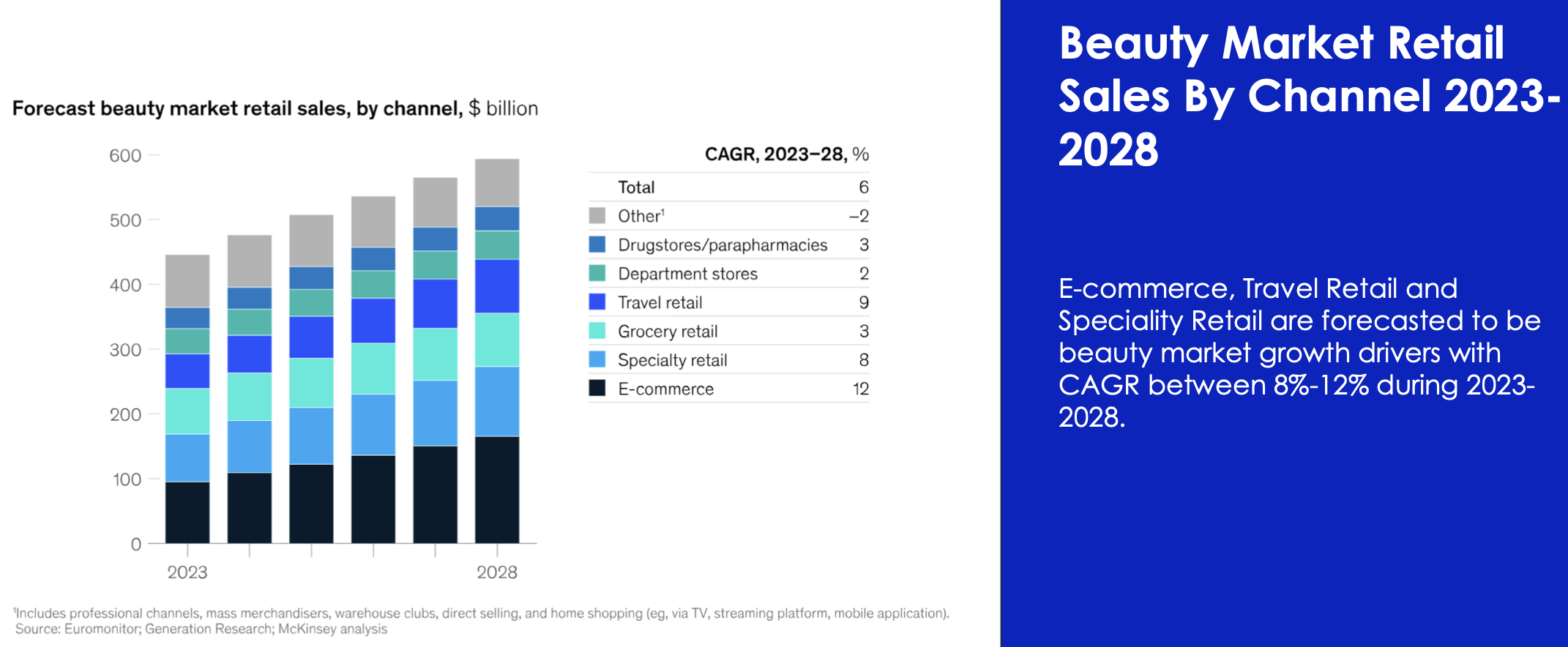

Beauty is travel retail’s biggest category, and in the global domestic consumer market it is expected to be a growth leader. According to McKinsey, perfumes and fragrances hit US$446 billion in 2023 and will have a CAGR of +6% to 2028, though some regions such as the Middle East & Africa are projected to reach +10%.

While skincare takes the biggest share of sales, and will continue to do so in 2028, the current smallest sub-sector of fragrances will grow at +7% CAGR, outpacing the rest. Travel retail stakeholders will know that fragrances have been a powerful sales driver in recent years. McKinsey says the sub-sector posted the highest growth (+14%) in 2023. This is going to moderate in the coming years, but fragrances will still lead beauty’s growth.

Much of the beauty market’s forecasted growth will be propelled by younger generations embracing beauty products at an increasingly younger age. According to Forbes and Grand View Research, the global children personal care market is projected to hit CAGR of +6.2% between 2022 and 2030. In 2021, this market sector was valued at US$7.5 billion driven by high disposable incomes, heightened focus on personal grooming and the influence of social media platforms.

Within the beauty category, travel retail and speciality retail channels are forecasted to hit CAGR of +9% and +8%, respectively, between 2023 and 2030. Ecommerce is projected to lead with +12% CAGR, underlining how shoppers continue to lean on availability, accessibility, convenience and above all price transparency.

Other categories set for high CAGRs in the domestic market include eyewear, projected to grow at +8.4% annually (Allied Analytics LLP). Sunglasses, and eyewear in general, are in vogue thanks to so many celebrities on social media donning shades, often to avoid the spotlight, but giving brands great publicity in the process.

A third category to consider in terms of growth is fashion accessories. This encompasses everything from jewellery and watches to handbags and leathergoods. While it is not a core category in travel retail it is enormous in the domestic market, worth more than US$750 billion in 2023 and forecasted to reach US$1,292 billion in 2030 (Grand View Research).

The biggest appeal here is the CAGR of almost +8%, but digging down, handbags and purses are expected to reach +9.3%. Again, social media and celebrity culture are having a significant influence via platforms such as Instagram, TikTok and Pinterest, with fashion jewellery benefitting particularly well.

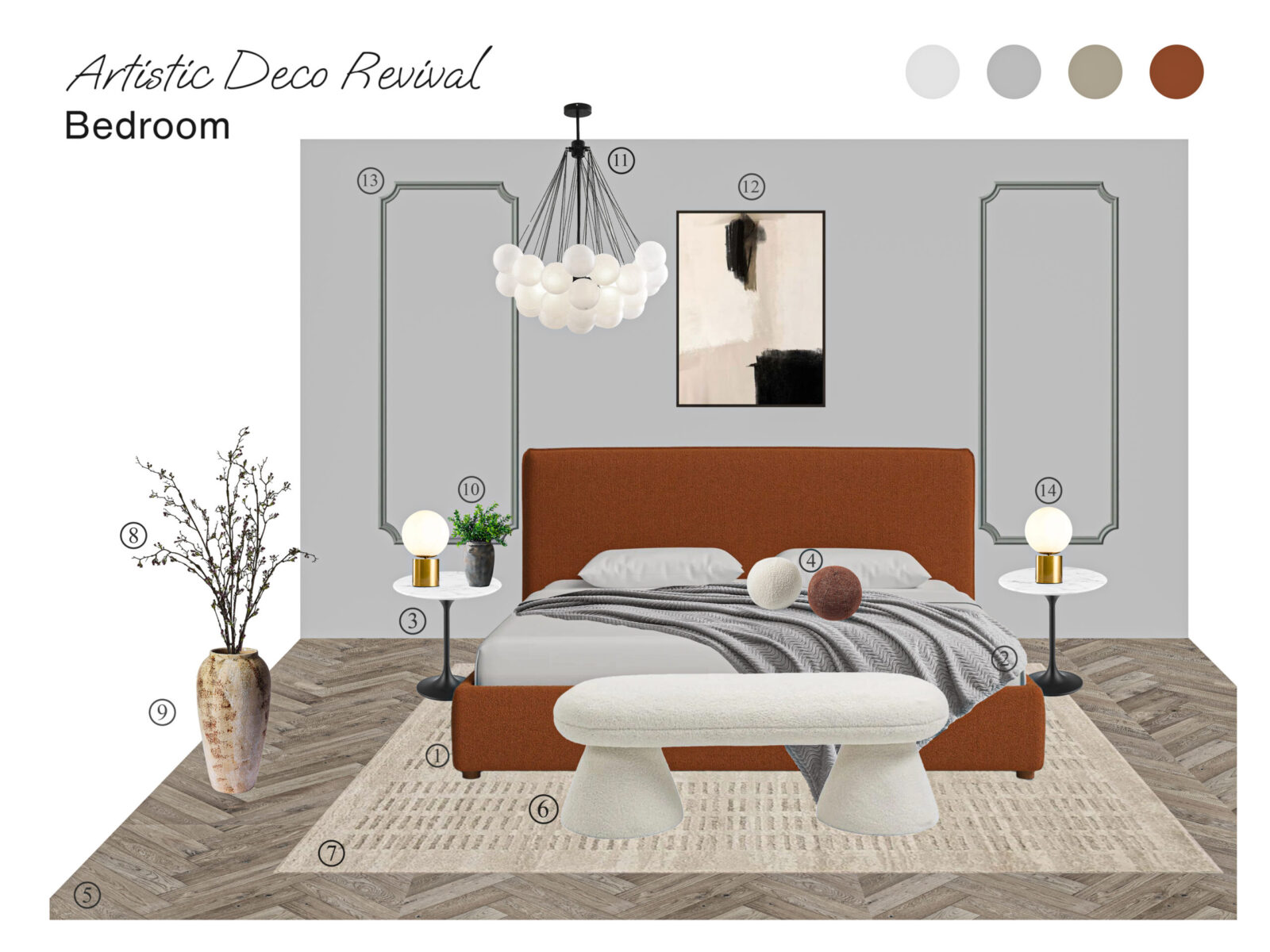

Will the duty-free store layout need to adapt?

“Airports, operators and brands will continue to push duty-free store layouts in new directions. Ten years from now they will gravitate towards the end of the spectrum where the highly experiential store format thrives. For this to happen, duty-free shopping needs to become more memorable so that products, brands and whole categories, literally come to life,” said Kaneko Henningsen.

ARI’s new-format stores in Portugal are a lighthouse example of what the future holds for the duty-free shopping experience. The shops exude the country’s essence offering over 1,000 locally produced products of which 250 are exclusive to ARI. The Sabores de Portugal in-store concept celebrates the finest Portuguese cuisine, including location-specific products such as Pasteis de Nata pastries, delivered daily to the airport. The Port Cellar concept carries the country’s best port wine offering, with over 230 showcased in an immersive cellar-style experience.

On a category level, we will see product offerings become more memorable, personalised and digitalised. At Haneda Airport the duty-free stores are championing authentic Japanese food items and turning these into best-selling categories.

Experiential pop-ups such as LEGO in Australia, or tech-driven services such as the one from Lancôme with DFS Group in Los Angeles, are creating essential engagement. In similar fashion, Shilla Duty Free has introduced SkinCeutical’s SkinScope 2.0 technology at Singapore Changi Airport, bringing futuristic medical professional diagnostic services to travellers and offering anti-ageing solutions backed by scientific research.

The duty-free store format and Gen Z

“The customer landscape is changing dramatically,” commented Kaneko Henningsen. “By 2028, Gen Z will become the biggest shopper profile, representing up to 1.2 billion travellers. The tech-savvy Gen Z lifestyle is influenced by social media algorithms and embraces artificial intelligence. Gen Z shoppers vote with their wallets when it comes to sustainability and geopolitics; this lifestyle – not just age group – is changing market dynamics.”

With more than 40% of travellers likely to post their airport experiences on social media, we are seeing a behaviour which is converting billions of travellers into independent influencers, each one posting comments, pictures and videos of what they like and dislike. In turn, this shapes public perception of airport duty-free stores, their layouts, and their product offers.

”The speed and intensity of change has accelerated to a level where airports, operators and brands must revisit their travel retail playbook,” added Kaneko Henningsen. “As traditional duty-free reinvents itself, moving away from price advantage and more towards experience-based shopping, I believe travelling shoppers are in for a treat the coming years.”

![Never Too Late [on a Carl Dreyer retrospective]](https://jonathanrosenbaum.net/wp-content/uploads/2012/04/dayofwrath2.jpg)

![Prole Models [CITIZEN RUTH & INVENTING THE ABBOTTS]](https://jonathanrosenbaum.net/wp-content/uploads/2009/07/citizenruthposter1-209x300.jpg)

![Delta Seat Snaps, Passenger Vomits, Rushed to ER—Ceiling Panels Collapse on Two Other Flights [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/delta-air-lines-ceiling-panel.webp?#)