Delta Reports Financial Results, Warns Of Uncertainty, Criticizes Trump

Delta Air Lines has just become the first US airline to report its quarterly financial results for Q1 2025. This is obviously something with a lot of implications, since Delta often sets the tone for what we can expect from the rest of the industry. The company’s results are… roughly what you’d expect, given everything going on, but could definitely be worse.

Delta Air Lines has just become the first US airline to report its quarterly financial results for Q1 2025. This is obviously something with a lot of implications, since Delta often sets the tone for what we can expect from the rest of the industry. The company’s results are… roughly what you’d expect, given everything going on, but could definitely be worse.

Delta Q1 2025 financial results meet lowered expectations

In early January 2025, Delta CEO Ed Bastian stated that he expected 2025 to be the company’s most profitable year ever. However, the vibes quickly changed. Two months later, in March, Delta significantly slashed its guidance for Q1 2025, warning of sinking consumer confidence. That was before markets totally crashed as a result of tariffs.

With Delta now reporting its Q1 2025 results, how did the airline do? The bottom line is that pre-tax income was $382 million, just marginally higher than last year’s pre-tax income of $380 million.

For Q1 2025, Delta reported operating revenue of $13 billion, 3.3% higher than it was last year, and operating income of $591 million (a 4.6% margin).

For what it’s worth, Delta initially expected a 6-8% margin for the quarter, and the updated guidance several weeks back was for a 4-5% margin. Meanwhile Delta initially expected revenue growth of 7-9%, but updated that guidance to 3-4%. So the actual results were in line with those updated expectations, which were admittedly very disappointing to investors at the time.

I don’t think that should be a surprise, since the updated guidance came just a few weeks before the end of the quarter, and during the busy spring break travel period.

Here’s how Delta CEO Ed Bastian describes these results:

“While the first quarter unfolded differently than initially expected, we delivered solid profitability that was flat to prior year and is expected to lead the industry. I would like to thank our people for their outstanding performance and hard work during the quarter.”

“With broad economic uncertainty around global trade, growth has largely stalled. In this slower-growth environment, we are protecting margins and cash flow by focusing on what we can control. This includes reducing planned capacity growth in the second half of the year to flat over last year while actively managing costs and capital expenditures.”

Delta CEO criticizes Trump tariffs for causing uncertainty

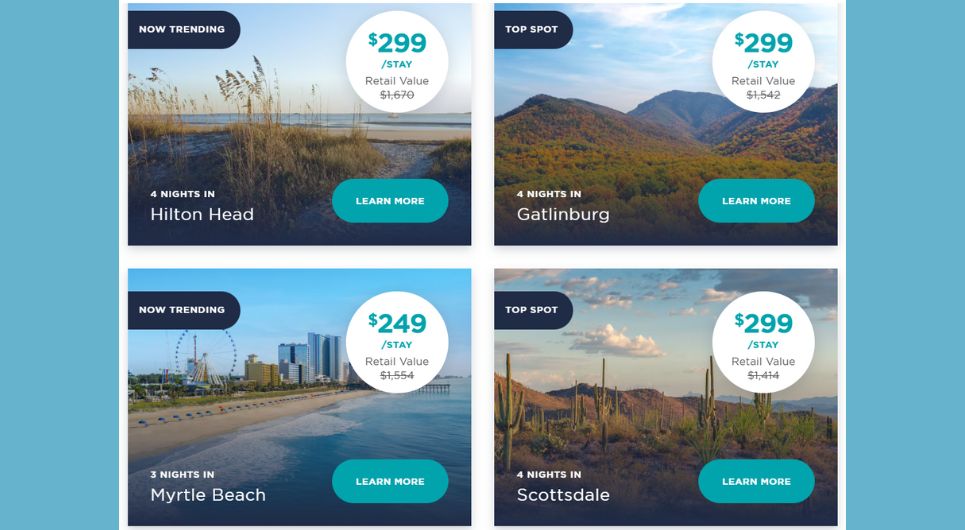

Delta has provided its guidance for Q2 2025, and it’s quite a range. The airline expects year over year revenue growth to be anywhere from down 2% to up 2%, with an operating margin of 11-14%. Keep in mind that the second quarter is typically strong for airlines, as it’s also when we see the start of the transatlantic summer rush. With the current uncertainty, Delta’s focus is on controlling capacity in order to maintain margins.

However, the airline is stating that it’s too early to issue an updated guidance for the entire year, given the level of uncertainty. As Bastian describes this:

“We expect June quarter profitability of $1.5 to $2 billion. Given the lack of economic clarity, it is premature at this time to provide an updated full-year outlook. Given our position of strength, our bias toward action and the decline in fuel prices, Delta remains well positioned to deliver solid profitability and free cash flow for the year. I expect that our financial results will continue to lead the industry and validate our strategy to create differentiation and greater financial durability.”

In an interview with CNBC, Bastian has called Trump’s tariff policy “the wrong approach.” In the same interview, Bastian indicated that “in the last six weeks, we’ve seen a corresponding reduction in broad consumer confidence and corporate confidence,” and that while January was “quite good,” things “really started to slow down” in mid-February.

Bottom line

Given that it sort of feels like the world economy is tanking, Delta’s financial results are about as good as we could’ve expected. Admittedly many investors were shocked several weeks back, when Delta updated its guidance to warn of a significant reduction in revenue and margins for the quarter, compared to previous forecasts. But that’s exactly what Delta delivered.

At the same time, the outlook remains relatively strong, or at least it could seem worse, given all that’s going on. It’s anyone’s guess how everything is about to play out. Delta futures are trading up slightly, so I think that sums up the vibe of these results.

What do you make of Delta’s Q1 2025 results, and outlook?

![Never Too Late [on a Carl Dreyer retrospective]](https://jonathanrosenbaum.net/wp-content/uploads/2012/04/dayofwrath2.jpg)

![[ENDS SOON] 200,000 Points & Platinum Status—IHG’s Biggest-Ever Card Offer Just Dropped](https://boardingarea.com/wp-content/uploads/2025/04/789c3532c415696c664d4984f455ed5f.jpg?#)

![“You’re Driving Too Slowly”: Delhi ATC Snaps At American Airlines Pilot, Sends Flight To Penalty Box [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/pilot-in-american-airlines-787-9-cockpit.jpg?#)