Apple’s $95 Billion Sales Quarter Tops Wall Street Estimates as Tech Giant Stays Quiet on Tariffs

The world's most valuable company reports record revenue of nearly $27 billion for its sector that includes Apple TV+ and Apple Music The post Apple’s $95 Billion Sales Quarter Tops Wall Street Estimates as Tech Giant Stays Quiet on Tariffs appeared first on TheWrap.

Apple surpassed what Wall Street analysts were looking for on Thursday when it shared its Jan.-March earnings, with the world’s most valuable company reporting more than $95 billion in sales during the quarter.

The strong quarter was bolstered by a record $26.65 billion in revenue for Services, Apple’s wide-ranging sector that includes Apple TV+, Apple Music, and iCloud storage.

Conspicuously, the tech giant did not mention anything about artificial intelligence, tariffs, China, or President Trump in its press release accompanying its report. Apple has been in the spotlight lately, as investors and analysts have looked to see how the president’s new tariffs will affect the company, which makes most of its products in China.

Apple CEO Tim Cook, in a statement accompanying earnings, did take a moment to note the company had reduced its carbon footprint, though.

“Today Apple is reporting strong quarterly results, including double-digit growth in Services,” Apple CEO Tim Cook said in a statement. “We were happy to welcome iPhone 16e to our lineup, and to introduce powerful new Macs and iPads that take advantage of the extraordinary capabilities of Apple silicon. And we were proud to announce that we’ve cut our carbon emissions by 60 percent over the past decade.”

Here are the key results from Apple’s second quarter report, which covers its Jan. through March performance:

Revenues: $95.36 billion, up 5.10% year-over-year and more than the $94.26 billion that was projected by analysts, according to Zacks Investment Research.

Net income: $24.78 billion, up nearly 5% from last year’s $23.63 billion.

Heading into Thursday, it has been a relatively challenging year for the world’s most valuable company. Apple’s stock price is down 12% since the start of the year — a performance mirrored by the other Big Tech companies so far in 2025.

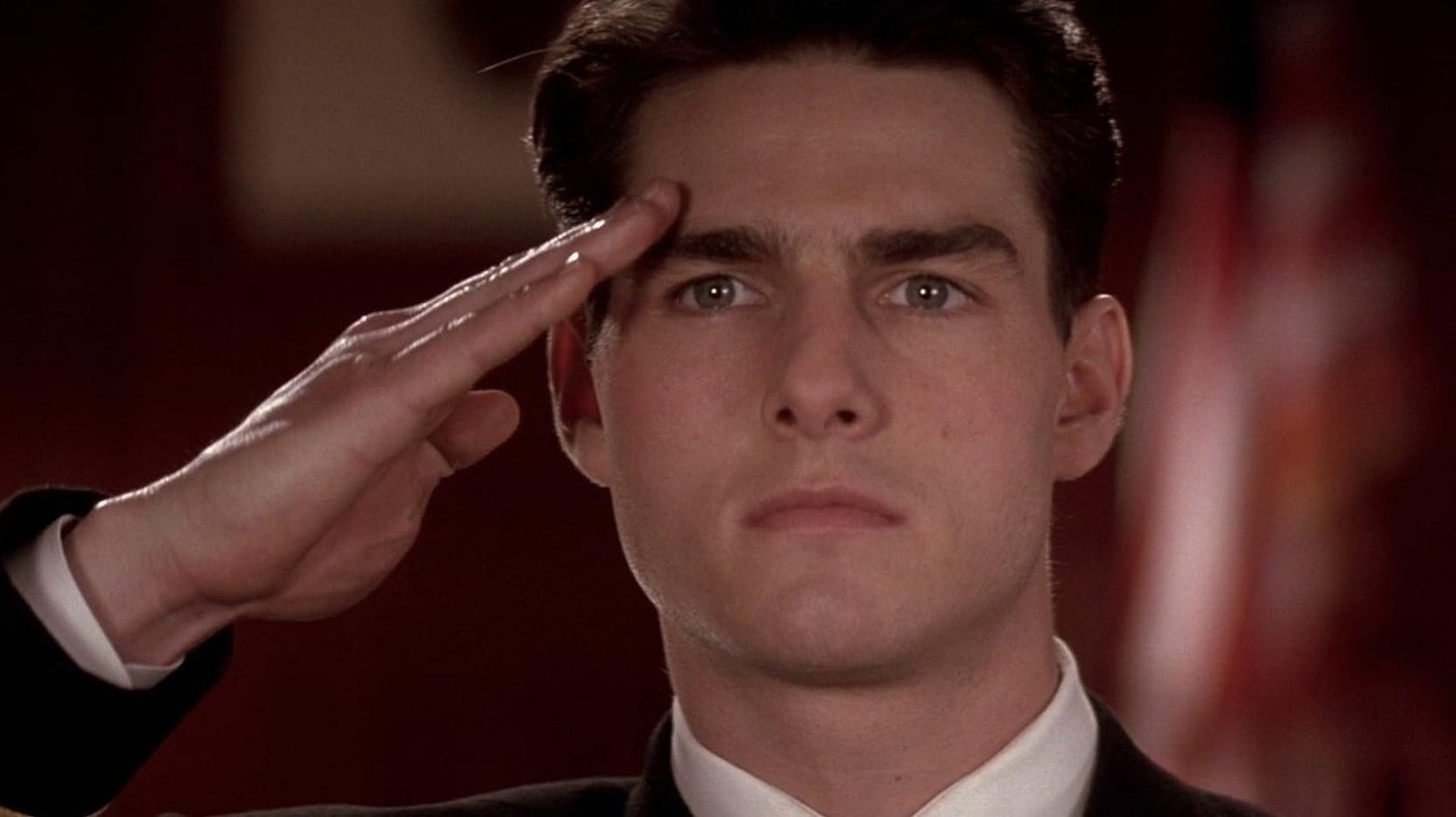

Notably, Apple CEO Tim Cook joined Elon Musk, Amazon Founder Jeff Bezos, Alphabet boss Sundar Pichai, and Meta CEO Mark Zuckerberg at President Trump’s inauguration in Jan.

The real action for Apple, though, started in April. Apple was rocked by the president’s announcement of his “Liberation Day” tariff plan on Apr. 2, with the company seeing its valuation drop by $1 trillion soon afterwards.

President Trump’s new tariffs — which now include a 145% tariff on most Chinese imports — has worried Apple analysts and investors since most of the company’s devices are made in China. Apple scrambled to get products into the U.S. before the tariffs went into effect, including flying in 1.5 million iPhones from India. Apple’s stock price has rebounded in recent weeks, recovering most of the $1 trillion that was shaved from its market cap; the company had a $3.20 trillion valuation when markets closed on Thursday.

Apple will hold a call at 2:00 p.m. PT to discuss its report.

More to come…

The post Apple’s $95 Billion Sales Quarter Tops Wall Street Estimates as Tech Giant Stays Quiet on Tariffs appeared first on TheWrap.

![‘Dangerous Animals’ Director Sean Byrne Used Real Sharks and Praises Jai Courtney’s Serial Killer Turn [Exclusive]](https://bloody-disgusting.com/wp-content/uploads/2025/04/Dangerous-Animals-scaled.jpg)

![Check Into Shudder’s ‘Hell Motel’ from the Creators of ‘Slasher’ [Trailer]](https://i0.wp.com/bloody-disgusting.com/wp-content/uploads/2025/05/hellmotel-still.jpg?fit=1280%2C720&ssl=1)

![Southwest’s Free Wi-Fi Trial Could Backfire—Here’s Why [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/04/southwest-airlines-jet.jpeg?#)