Amsterdam Schiphol duty-free joint venture names Bruno Gouisset as CEO and sets out ambitious plans

As the duty-free joint venture between Schiphol Group and Lagardère Travel Retail prepares to take over the business on 1 May, we speak to the JV’s newly-appointed CEO about pricing, partnership and planning for the stores.

THE NETHERLANDS. Schiphol Group and Lagardère Travel Retail say they can double the size of the duty-free business at Amsterdam Airport Schiphol over the decade ahead, as their joint venture to operate core category stores begins on 1 May. The JV has also named experienced Lagardère Travel Retail executive Bruno Gouisset as Chief Executive.

As reported, the joint-venture contract covers more than 20 stores and combines perfumes & cosmetics and sunglasses spaces with those dedicated to liquor, tobacco & confectionery.

Under the agreement, Lagardère Travel Retail owns 70% of the company that will operate the business, with the remaining 30% held by Amsterdam Schiphol Airport.

A key project will be to create fewer but larger stores that combine the core categories under one roof, addressing the relative lack of space and the fragmented nature of the duty-free stores at Schiphol today. A template for this will be set in the new-look Lounge 1 store which opens on 20 June, with Lounges 2 and 3 to follow amid refurbishment over the next two years.

A handover of the existing business to the JV partners takes place on the night of 30 April, with The Moodie Davitt Report on location in Amsterdam to cover the occasion.

Speaking to us soon after being named to his new role, Bruno Gouisset said his many years of retailing experience positioned him well to lead the new company.

Gouisset was previously Lagardère Travel Retail Executive Vice President Merchant Duty Free Global (from mid-2018) and later Deputy CEO at Extime Duty Free (the retailer’s joint venture with Groupe ADP in Paris). Before entering travel retail he worked in senior buying roles with Sephora and previously, French grocery chain Groupe Casino.

Gouisset says: “I was involved in the Amsterdam bid and project and also to an extent in the last-mile discussion phase with Schiphol Airport so I know what is expected and what we at Lagardère Travel Retail have committed to. My experience should help as we re-engineer the offer and the customer pathway.

“I also know the world of joint ventures from my time at Extime Duty Free. This one is different but it still involves two shareholders that must align on a shared vision, listen to each other and build a relationship based on trust. So far the signs are positive.”

On the coming together of the two parties to date – even if the formal JV only comes to life on 1 May – Schiphol Group Director Commercial Terminal Tim de Bie says: “We have had a close and strong collaboration since we began in January. Our teams are working together across seven different implementation streams from logistics to IT to people to marketing and digital, alongside a steering committee to coordinate all of these actions with fast decisions taken on where we go next.”

Gouisset notes that the process is more complex than most other airport concession changeovers. “You have the takeover of different companies, each with their own DNA, identity, know-how and culture, in this case in Kappé (beauty & sunglasses) and Schiphol Airport Retail (LTC, led by Gebr. Heinemann). So to the operational transition you add the human and organisational change. There is no such thing as a smooth handover, but the people are passionate and committed and a pleasure to work with, that is a good starting point.”

The immediate task when the partnership took effect was to ensure business continuity and minimise any risk to continuing operations.

Gouisset says: “The back office was an immediate priority. Kappé was a self-standing company operating by themselves, and they could continue to operate whatever happened. They had their own logistics, own cash till, own bond contract and so on.

“Schiphol Airport Retail (SAR) was a Heinemann operation, which stops from 1 May, including supply, cash till management and everything else. So from that date SAR comes into the Lagardère eco-system. So there will be a requirement for staff to learn about the new systems on the SAR side, and it’s more or less business as usual on the Kappé side.”

Price promise

Beyond this focus on continuity of back office systems, the customer will see some big changes in the short term, even before the major store investments are completed.

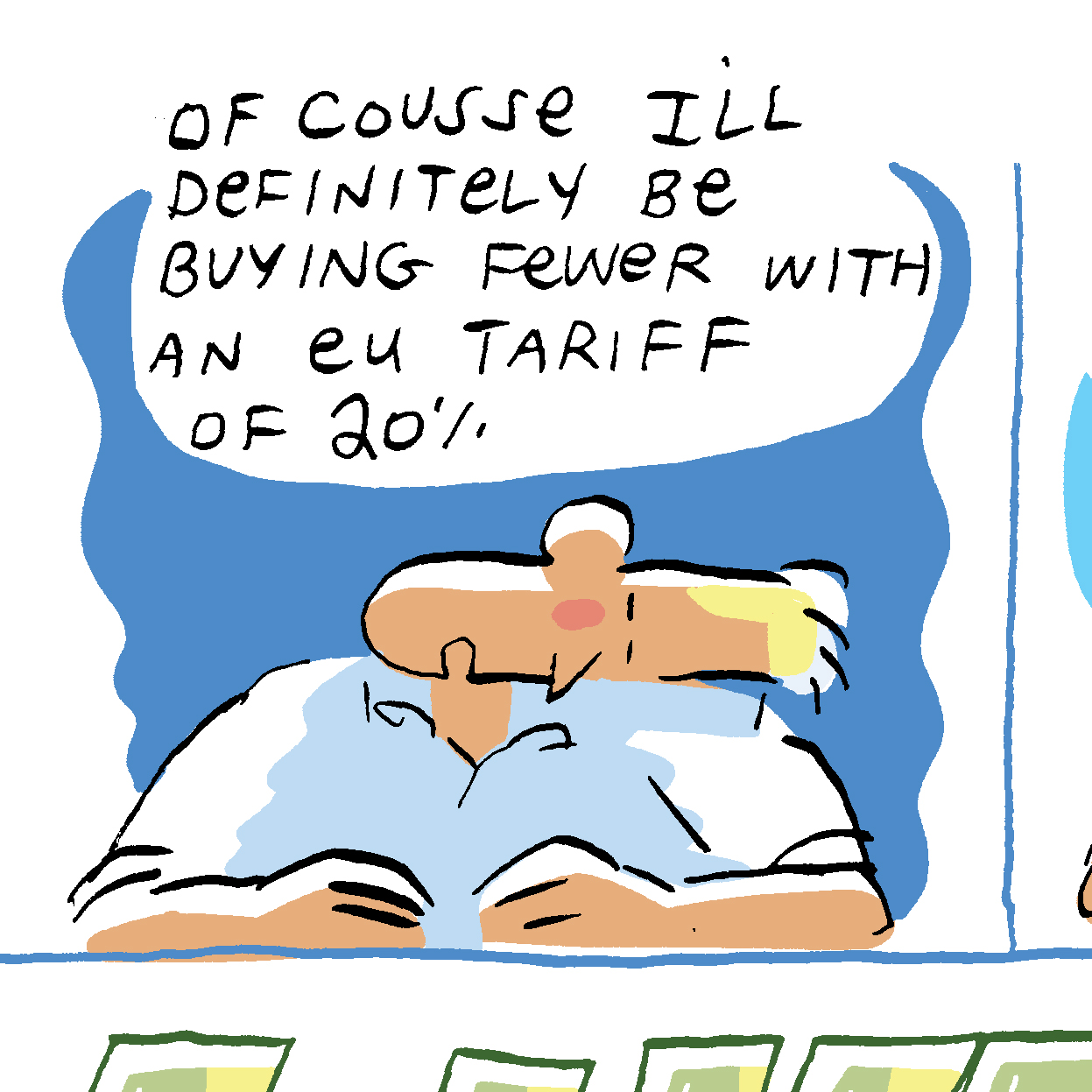

Gouisset says: “From day one we have a pledge on price positioning and we will defend the duty-free price promise. This price positioning will alter overnight.”

Price positioning in this context means “the best products at the best prices,” says Gouisset. “You will not buy cheaper in duty free. We are not a discounter, and clearly there are cases where you can sometimes find a single item cheaper online, but overall you will see the best prices across the range.

“We will assess and benchmark product by product, and then we have pricing rules that allow us to be competitive versus this benchmark. Our prices will be adjusted based on the full assortment to secure a competitive price position.”

He adds: “Now if you don’t explain this, then there’s no point doing it, so from late May/early June – in time for the summer peak – we will launch a campaign to tell our customers all about what this means, across POS, screens and staff of course.”

Addressing price positioning in the context of brand partners, Gouisset notes that pricing “is more a retailer topic than a brand topic, as long as you don’t affect the brand image through your pricing”.

He adds: “Brands that work with Lagardère know the price strategy well. This is adapted to our strategy at Schiphol but is quite similar to the one we have at the main airports we operate in already. They know we do quality retail with a competitive price promise.

“And I must say brands have been very supportive of this project. They know that the retail will change dramatically in the next years and that Schiphol has more potential to grow than other European airports. We believe we can double the business. So brands want to be part of this. They understand that the opportunity must be taken now to benefit in one to two years, they are ready to invest and they don’t want to miss the train.”

The value message is also a critical one for Schiphol to communicate under this new partnership.

De Bie says: “Price is part of a total promise we are making at Schiphol. That element is backed by us changing these many smaller stores into fewer, larger outlets combining the core categories. Also, the total number of square metres will increase with the changes we plan. That also creates efficiencies with one rather than say three cash till systems.

“We can finally do proper brand presentation for hero brands. All of this is backed by a full upgrade of each lounge, which will feed into how we present and brand the overall environment. So the airport as a whole will be lifted to another level, from retail to dining to wayfinding to all of the detail in each.”

A new brand for Schiphol is being development and to be unveiled later this year – with translation to the retail look and branding. This should be rolled out in 2026, with full coverage by 2027.

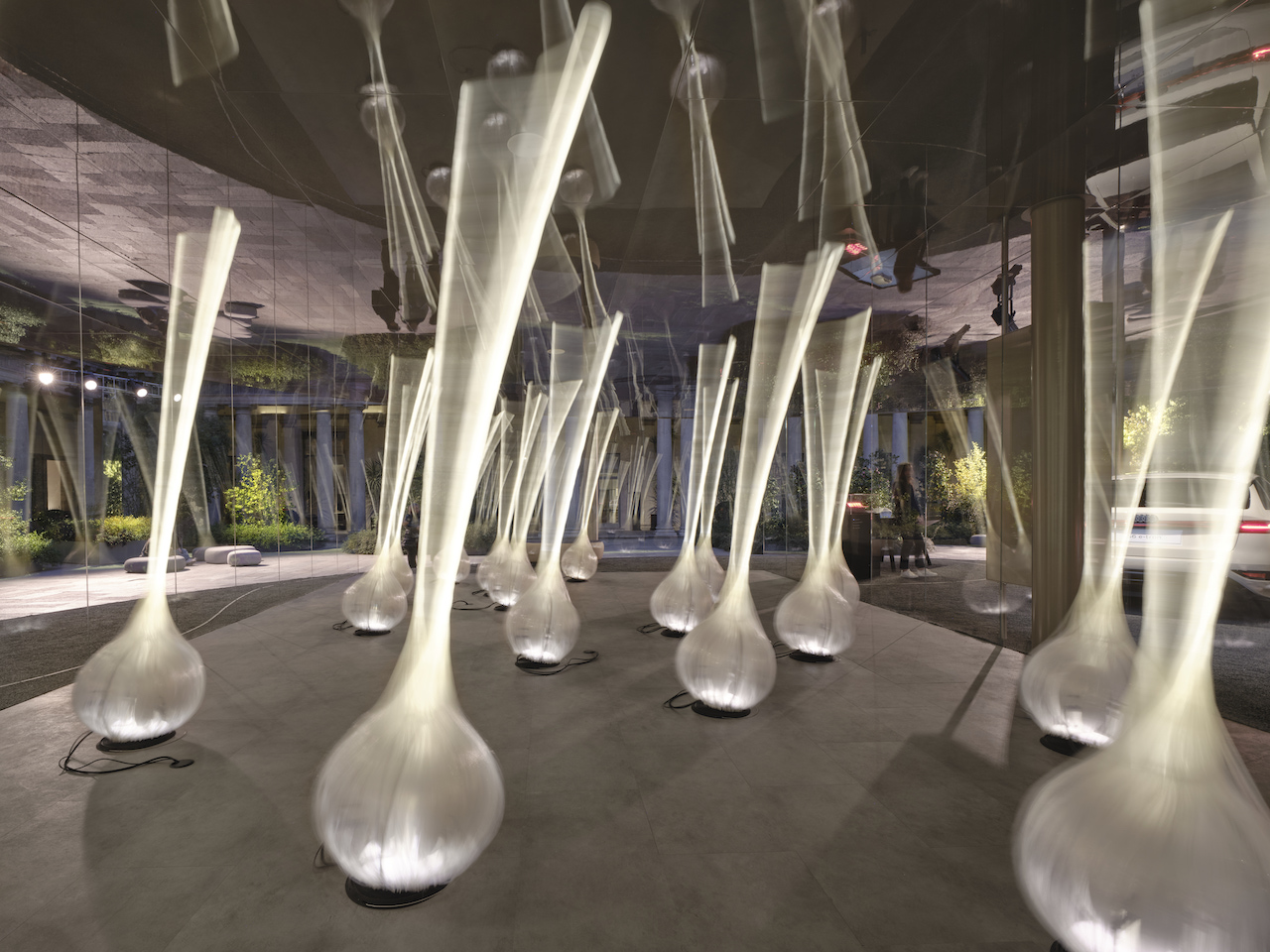

While this branding is part of the long-term picture, an earlier signature move will include the opening on 20 June of the first flagship store in the redevelopment, at Schiphol Lounge 1, as noted above.

“Although it will not be exactly the same, this will come close to the Lagardère DNA,” says Gouisset, “with a lot of brand personalisation, service and support from the staff.

“This will be the starting point of what we want retail at Schiphol to become in the next years, with a more trendy concept, with room to attract new brands and offer them visibility in a layout that was not possible before.”

The Lounge 1 store will lead the renovation drive, followed in 2026 and 2027 by other lounges, to create spaces that will be “at the highest standard of European travel retail”, according to Gouisset.

Brand opportunity will begin early too, adds Gouisset, with the Lagardère Travel Retail global animation calendar to include Schiphol locations from June. “The stores will benefit from the scale that Lagardère Travel Retail brings already from this point.”

Gouisset also identifies opportunity to develop core category duty-free at Schiphol in a number of key areas.

“On the assortment side, clearly we can improve on niche fragrances, trendy makeup and natural skincare within beauty. In future there may be opportunity for temporary or permanent monobrand shops in beauty or other areas, which don’t really exist today.

“We can better premiumise chocolate and confectionery, where there is a gap today in terms of price and a luxury offer. There is room for more specialisation here and for us to bring in brands such as Pierre Hermé. We like the idea of a ‘Chocolate House’ concept, inspired partly by the luxury wines & spirits store Exquisit already at Schiphol. That concept is something we can build on.

“On alcohol, we can also develop more tailor-made assortments by shop and by customer, creating a better connection between who we serve in what store, even if the overall offer is wider.

“We will also dramatically increase the number of staff in shops, as we know that advice from well-trained teams leads to sales. Also we will work with brands to ensure there are more experiences and always have something happening to enhance appeal. It’s not easy in Schiphol with the way space is laid out, but that is a key target.”

The JV plans to host “fewer but bigger animations” across categories. “Instead of 20-30 spots in the shops we’ll focus on two or three but make these really impactful events. We think this contributes more to showing newness than smaller animations,” says Gouisset.

Finally, as the 1 May handover nears, Gouisset says there is nervous excitement in the air.

“You can prepare as much as you can but there are always unforeseen issues. To support this event we have huge input from all over Europe from within Lagardère Travel Retail, with a vast task force on-site in the days before and after, to ensure all goes smoothly.

“There will be stresses, problems and challenges, but you always find solutions. And when you’re on the floor on these nights you have the feeling that you are building something new, that you are creating some history for the companies involved. It’s a very big event, which is why my main feeling is of excitement.”

![Explore the Cosmic Realm and Its Denizens in a New ‘DOOM: The Dark Ages’ Gameplay Trailer [Watch]](https://bloody-disgusting.com/wp-content/uploads/2025/04/doomdarkages.jpg)

![‘Amanda the Adventurer 3’ Announced for PC, Coming Later This Year [Trailer]](https://bloody-disgusting.com/wp-content/uploads/2025/04/ATA3-Logo.jpg)

![‘MobLand’ Clip: Pierce Brosnan & Tom Hardy Meet The Stevensons In A Tense Face Off [Exclusive]](https://cdn.theplaylist.net/wp-content/uploads/2025/04/26100833/MOBLAND_105_lv_0116_00440_RT.jpg)

![[Dead] Japan Airlines First Class wide open through JetBlue TrueBlue (though it’s expensive)](https://frequentmiler.com/wp-content/uploads/2024/11/JAL-first-seat.jpg?#)

![A good deal dies, 750K miles for big spenders, and is Wells Fargo a wannabe? [Week in Review]](https://frequentmiler.com/wp-content/uploads/2025/04/Two-Hawaiian-cards-dead.jpg?#)

-RTAガチ勢がSwitch2体験会でゼルダのラスボスを撃破して世界初のEDを流してしまう...【ゼルダの伝説ブレスオブザワイルドSwitch2-Edition】-00-06-05.png?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)

.jpg?width=1920&height=1920&fit=bounds&quality=70&format=jpg&auto=webp#)