Interview – Talking consumers, key categories and the retail mix at Extime Duty Free Paris

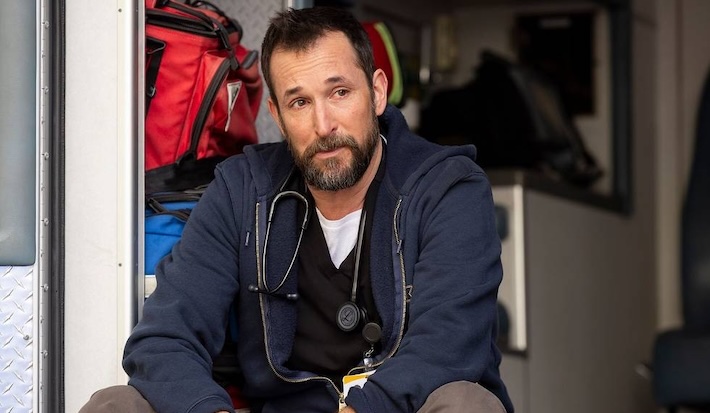

Extime Duty Free Paris Executive President Guy Bodescot assesses how retail spend per head can continue to grow at Paris Charles de Gaulle Airport, and about category opportunities in beauty, luxury and gastronomy.

Following a visit to meet Groupe ADP in Paris on 4 March, we continue our series on the evolution of the Extime Paris concept, two years on since its creation. The Extime project was developed as an eco-system to add value to retail, dining and services, initially at ADP airports but with ambitions to expand to other locations.

In this article we focus on the shopping offer at Paris Charles de Gaulle Airport, run by the ADP/Lagardère Travel Retail JV, with comments from Extime Duty Free Paris Executive President Guy Bodescot. Click here for our initial story and here for our story on the Extime Campus initiative.

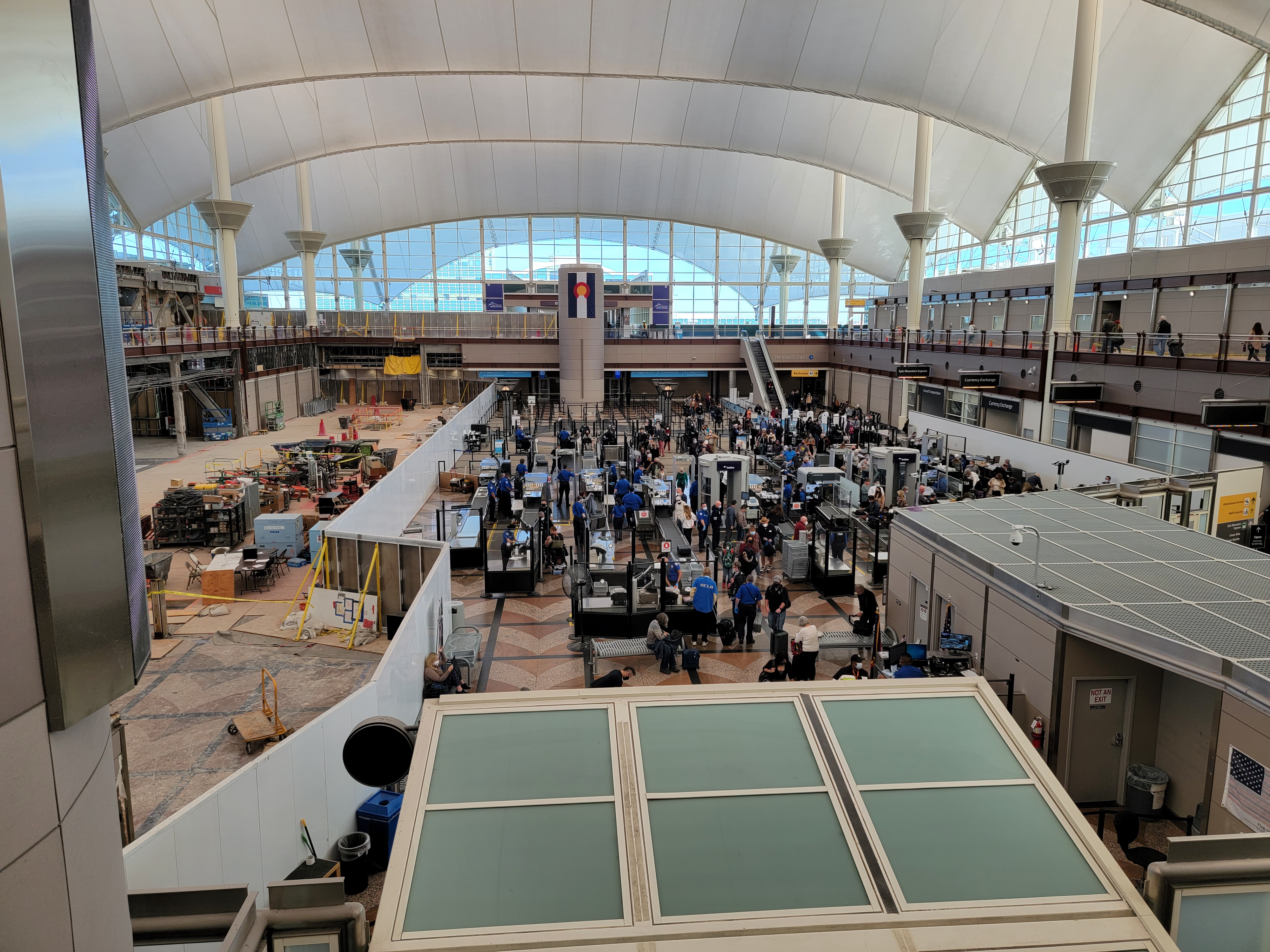

FRANCE. Luxury and beauty will be crucial to maintaining the recent strong spend per passenger (SPP) through Extime Paris at Paris Charles de Gaulle (CDG) Airport in years to come. That was a key message from our visit to Groupe ADP headquarters in early March to discover more about the Extime strategy.

The Extime eco-system, which came to life two years ago, comprises airport partnerships across duty free, travel essentials, food & beverage, media and hospitality, with shopping the largest revenue contributor.

In 2024, SPP at retail and hospitality outlets in Paris grew +4.9% year-on-year to €32.10, and reached an impressive high of €87.60 in Terminal 1 (international), a figure that rose by +14% year-on-year, with €78 coming from shopping alone, and two-thirds of this from luxury.

Extime Duty Free Paris Executive President Guy Bodescot says that even if most of the major terminal space expansion projects have now taken place, there will be room to grow SPP through improved retailer agility, a relentless focus on newness, closer brand partnerships, service and greater leverage of the expanding Extime eco-system.

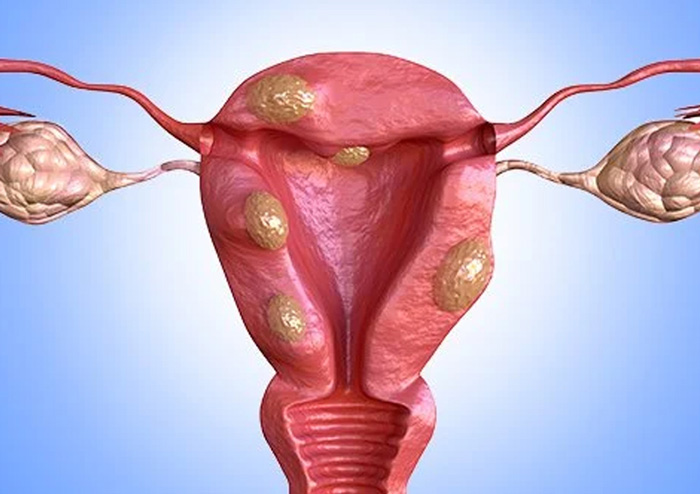

At CDG T1, beauty in the heart of the terminal plays a pivotal role in stopping travellers and enabling conversion.

Bodescot says: “It is a great asset to have beauty in the centre of the retail configuration. First of all, beauty has by far the highest stop ratio of any offer in the airport.

“The number of people who stop even to self-serve, not necessarily ask for support, is vast. They stop to look at or try a new perfume or a lipstick or a candle or even view new advertising. There is always something happening in beauty as it changes so much. Once people stop, we can convert.

“I believe that beauty will also be a big success in future. Even though it is successful today, it is still vastly impacted by the COVID crisis and the lack of Chinese visitors. That means skincare has fallen back while perfume has grown. This mix will remain but once Chinese return that makeup and skincare opportunity can also return.”

For the retailer, beauty also requires close and constant attention to ensure it retains high consumer engagement.

Bodescot says: “As an industry we need to be faster in selecting the right product, the right brand, moving things around and I believe historically we have been too slow in doing this.

“There are many examples of new brands that emerge and at Sephora or elsewhere they are guaranteed a certain space to perform. In travel retail, due to the density of our shops and the time it takes to change the store, we tend not to move quickly.

“You also have the traditional players saying, I cannot lose one square metre and we should wait for the next negotiation before touching anything.

“But through technology the younger customer sees something new and you have to have it. If you don’t have it within two or three months after it emerges, you’re out of the market.

“That is the challenge for beauty going forward, and it is something that we keep on discussing with the brands. Beauty deserves to be located in a prime location, and it shines a light on the rest of the offer, including luxury, but we have to be more agile.”

Bodescot also takes the view that a signature category at the airport, French gastronomy, remains only a partially-fulfilled opportunity.

“We have done a lot but this category remains weaker than it should be. We need to shout more about the best of France. You might ask why, with so many great French brands everywhere in the terminal, do we need a shop-in-shop to promote those in food and drink in particular?

“But it’s not the same as showcasing beauty through a French beauty store. If you’re loyal to Dior you want to see the whole Dior universe in one place.

“If you buy a bottle of wine, a saucisson and a baguette, you’re not going to get the three products on the same shelf because you don’t keep those products in the same location or condition. Yet downtown they find a way to do it.

“In travel retail we are so focused on the density, the productivity and the negotiation. So the wine partner says, I don’t want to be with anybody but wine and other alcohol. And then the chocolate maker says, I don’t want to be with anything salty, I only want to be with the sweet products. And in the end, we fail to create something attractive. And yet it happens in other markets, including in some airports.

“I believe it is worth thinking about. We have Le Comptoir Gourmand and some other concepts that are very good stop points but we have not achieved what we can yet.”

The margin question is an ever-present in such conversations, but Bodescot says that if we want agility in the mix then airport and retailer need to consider reduced rent on certain local items to create a fully-rounded offer.

“You may lose out in percentage but with lower rent you create a new market as you give more oxygen to fund the tastings, the ever-changing marketing of the space and it is a growth opportunity. It’s more about food and wine, less so about Champagne or Cognac. These brands stand alone well and can create their own excellent environments.”

This also raises the question of how the visibility of gastronomy, spirits and confectionery can be raised at CDG T1.

That is no easy task, admits Bodescot, when luxury and beauty drive spends that are the envy of ADP’s peers in the airport world.

“First, there is a unique value to beauty and luxury in Paris that helps the business perform,” he says. “So if we are purely mathematical, wine, Champagne or gastronomy will never be at the front.

“Second, if you take any department store or hypermarket, usually the heavy products including food and wine are located further down the aisle, closer to the till. There is a global understanding that if you want a bottle of wine or something to eat, it won’t be at the front on the shop.”

Having said that, placing all other categories that are not beauty or luxury at only one end of T1 does create an imbalance, something that is under review.

“Right now we only spirits, confectionery and gastronomy only on the left as you enter and just a gate shop on the right side of the terminal. We are looking at how we can create a proper food and wine offer on the right in the years ahead.

“On the left side, where these categories are prominent, the entrance is narrow but it widens out to the back. It’s not ideal but positively we have McDonald’s and Starbucks one level above so these also act as traffic drivers in this area of T1.

“We also expected T1 to be partly driven by Chinese spend – hence the reason we have Hennessy so prominently placed at the front of the store – but they are not there. We now have more Champagne at the front and we are trialling some other things.”

On the plus side, the gastronomy concepts right at the front of this store help build basket sizes overall. Pierre Hermé is an example. A first for Paris CDG when it opened alongside the new-look T1, it generated €1 million in sales in year one, is now at €5 million with a target of €10 million a year.

Bodescot says: “We have three beautiful stories about conversion in this part of T1. The barber shop is one. The service is free but almost all who use it buy a grooming product afterwards.

“There is Le Comptoir Gourmand, which offers space to sample a glass of Champagne, cheese or paté, and it helps the team connect with the traveller.

“And there is our VIP salon. This can be opened to any customer, not just the highest-spending. Our team might identify someone who is taking a meaningful trip such as an anniversary, invite them to our salon, and it is amazing how this translates to spend. We see 75-80% conversion from these locations because we are creating that connection.

“People feel welcomed, rewarded, engaged. They don’t feel they have product pushed on them, they feel they have had an experience.”

In the largest category, luxury, the opportunity will lie in partnering with brands to deliver at the airport just as shoppers expect to be served in other channels.

Some brands make the case that they want to be present in international terminals CDG T1 or CDG 2E, Hall K, but not at Paris Orly as they don’t see the audience as relevant in the same way. Yet they will invest in an ecommerce platform that delivers goods to shoppers at home, but without the luxury ceremony.

“There is a future for travel retail in giving those passengers sitting for hours waiting for their plane the possibility to buy online and have it delivered to their seat before they board, including in luxury,” says Bodescot.

“Three or four years ago you could not have had that conversation with the brands. Today it is changing.

“We cannot create CDG T1 everywhere in Paris, but brands are raising the question of how to recruit new customers. They have had wonderful years in this business, but now everyone is looking at what comes next.

“We have the customer on our side. They might visit the downtown store but prefer to buy at the airport for convenience, yet in many cases they cannot.

“The historical excuse was the shop at the airport does not belong to us, or is not run by us. But if you are the brand owner, the customer feels they should be able to take the product at the airport on departure.

“Operational digitalisation is on its way. A brand might retain a flagship store in T1, but we can still order and ensure distribution anywhere in our terminals.

“We need to have the accounting mechanism for the brand to supply us and invoice us and ensure we together make the sale on time.”

Recently Bodescot and his Extime Paris team have been hosting away days with key brands to explain their vision for the business, outline sales ambitions, and workshop with them the path to future growth.

“More and more of them are taking availability into consideration. They see that the future is not only about great flagships, it is about all kinds of interaction, physical and digital.

“So to some top brands, we can say, yes you have ranked highly here at CDG for years, but if you do nothing, or don’t broaden your availability, other brands will pass you out.”

Bodescot is broadly upbeat about the ability of the ADP/Extime organisation to continue growing already robust sales and spend through a blend of physical and digital tools.

“I’m optimistic because the new digital facilitation via the loyalty programme, Extime Rewards, and the online marketplace will create more opportunity to sell some brands across all terminals, which we were not able to do before. Better understanding of and closer communication with our customers will create additional SPP.”

Beyond this incremental opportunity is another – the vast and mostly untapped potential of airport environments.

“On the whole, all of the people travelling, whether they are young or old, feel very happy to travel. They are in a good mood. Plus by definition, people will still have to physically come to the airport for the foreseeable future, so we have this huge marketing potential because we are in a physical environment that they must pass through.

“So with those two fantastic factors, we have to be very shrewd to transform this potential with the use of technology and also with staff engagement.

“The digital world is changing our behaviour. It shows people things they didn’t know existed. And once they see that same item on a physical shelf they will go to it. And if somebody is there that can tell a story about it, they will buy it.

“Also, if your staff feel autonomous enough to serve the customer up to the last minute and go beyond the limitation of their own corner; if they go to the till with the passenger, help the passenger to the boarding gate, or help them to find assistance in another shop, that will create a memorable experience.”

Elaborating on the key consumer drivers, Bodescot says that travel retail must respond to different dynamics than in the past.

“For one thing, the standards of visual merchandising must increase again and again. For the young generation, where everything is visual and pictorial, they must have colourful memories, If you show the same product all the time, if you are bad at display, people will reject it. Display is more important than ever.”

He concludes by doubling down on the message that airport shopping is less about buying product and more about the experience.

“Here in Paris our customers buy the way the French eat or the way they dress. There’s a cultural element to this. More customers will buy if there is an experience behind it, if they see or are informed about how the French use or eat an item. The story behind that is key: curate and show the story. Let them be able to say ‘this happened to me, it’s my story’. We don’t do that enough but it’s a big opportunity for travel retail.”

![Time-Tasting Places in 3 Current Releases [THE POWER OF THE DOG, PASSING, NO TIME TO DIE]](https://jonathanrosenbaum.net/wp-content/uploads/2021/11/000thepowerofthedog-1024x576.png)

![Hilton Used BBQ-Stained Sheets—Then Told The Guest ‘You Should’ve Asked for Full Housekeeping’ [Roundup]](https://viewfromthewing.com/wp-content/uploads/2025/03/bbq-stained-sheets.jpg?#)

.png?#)