Interview – Expanding the Extime platform at Paris airports and beyond

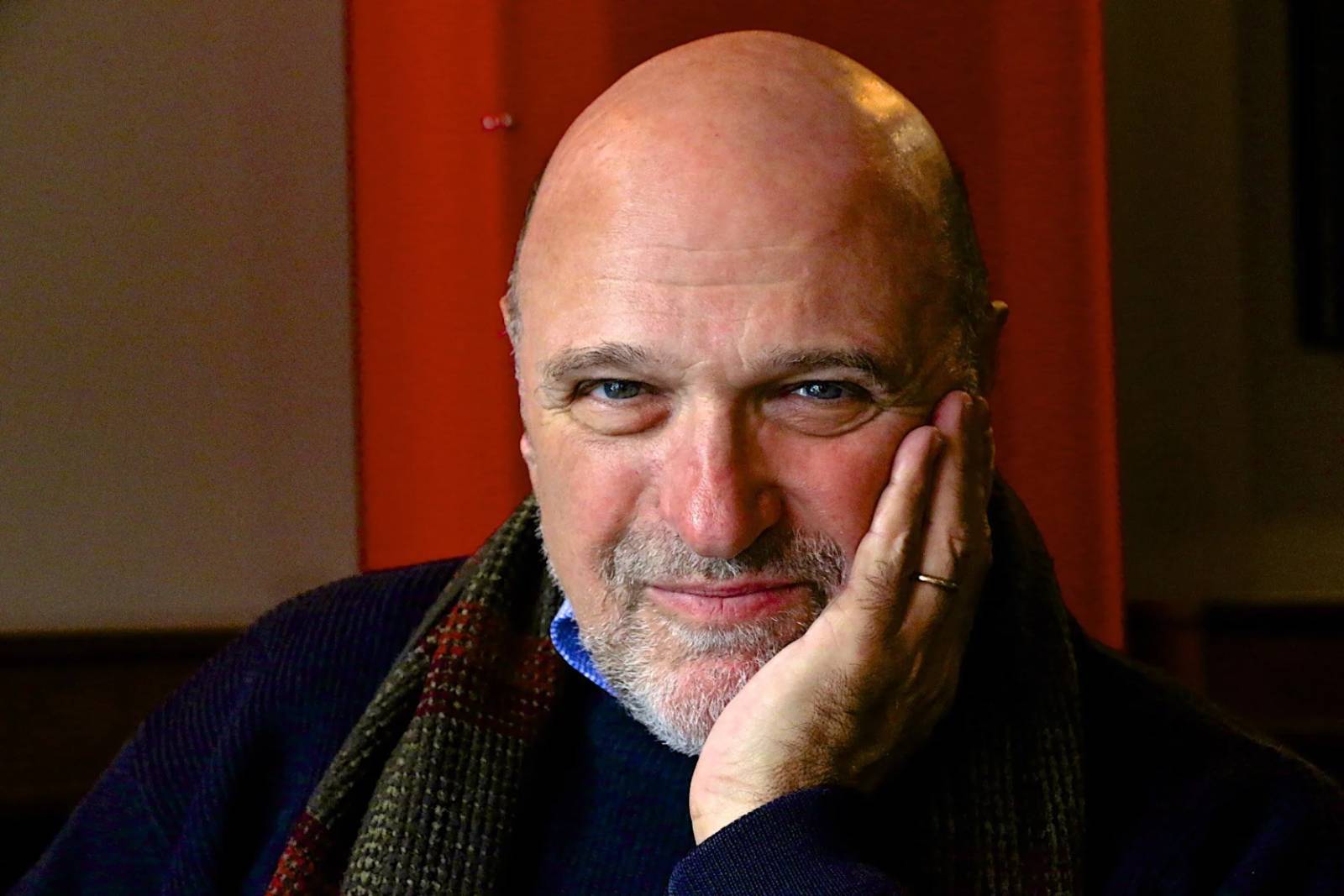

Groupe ADP Chief Customer Officer Mathieu Daubert talks about the airport company’s ambitions to extend its Extime retail and hospitality concept two years on from launch.

FRANCE. “Our priorities for 2025 are to build new Extime venues at Paris Charles de Gaulle (CDG) and Orly airports; to develop our community of ‘Extimers’; to increase digital integration across retail and services and to look at development opportunities beyond our airports.”

FRANCE. “Our priorities for 2025 are to build new Extime venues at Paris Charles de Gaulle (CDG) and Orly airports; to develop our community of ‘Extimers’; to increase digital integration across retail and services and to look at development opportunities beyond our airports.”

So says Groupe ADP Chief Customer Officer Mathieu Daubert (right), speaking to The Moodie Davitt Report during a media day hosted by the Paris-based airport company on 4 March.

More details plus interviews with Extime Duty Free Paris Executive President Guy Bodescot and Groupe ADP Chief Marketing Officer Caroline Blanchet will follow.

The theme of the day was the evolution of the Extime project, brought to life by ADP in 2023 as an eco-system to add value to retail, dining and services, initially at its own airports but with ambitions to expand to others.

At the time the company devised a collection of ‘boutique terminals’ in Paris, inspired by the idea of a boutique hotel experience, with each reimagined in partnership with a different designer, and at ‘human scale’ to ensure short distances between services and gates.

Led by Paris CDG T1, reopened to much acclaim in early 2023, the ‘Premium’ boutique terminals concept now spans most of the major international terminals at CDG, with the ‘Lifestyle’ terminal concept more appropriate for Schengen and low-cost flights at CDG B/D, 2F and 2G.

In 2024, a further ‘Exclusive’ concept entered the portfolio with the opening of the first VIP Terminal at CDG just before the Paris Olympics, serving a luxury-seeking, fee-paying audience with services from kerbside to airplane.

In the two years since launch, airside spend per passenger (SPP) has grown sharply, exceeding expectations. In 2024, SPP at retail and hospitality outlets in Paris (under the Extime Paris brand, managed via joint ventures) grew +4.9% year-on-year to €32.10, and reached an impressive high of €87.60 in Terminal 1 (international), a figure that rose by +14% year-on-year, with €78 coming from shopping alone, with luxury the leading category.

In recent years airside spend has tracked at around three times the European average and consistently well ahead of traffic growth, according to ADP.

Drivers of the business in future will include regular introduction of new, relevant brands in retail; closer synergies between parts of the Extime eco-system (across retail, dining, advertising, hospitality and amenities), supported by digital; plus intensive work on raising the service level among the community of ‘Extimers’ on the front lines. With this in mind, an Extime Campus opened in late 2024 are Paris CDG as a training and service hub to bring this community of service teams together.

Having previously forecast SPP growth of +3-5% versus 2023 for the year ahead, the airport company is now projecting this figure to grow by +4-6% (compared to 2023) in 2025.

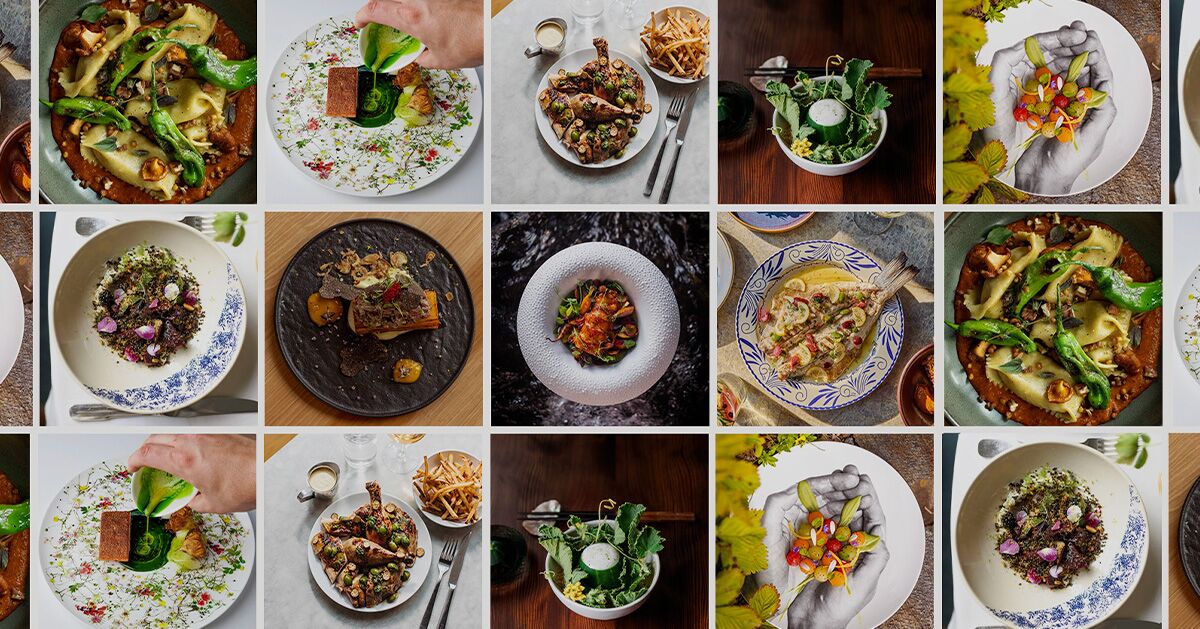

Key retail projects ahead include the crafting of a flagship Extime shopping and dining experience at Paris Orly T4 under the concept, ‘La Rue Parisienne’ in association with renowned architect Michael Malapert. Set to open in mid-2026, this will house a walk-through duty-free environment and extensive Paris-themed F&B.

Also to come is an Extime-branded transformation of Paris Charles de Gaulle Terminal 2E, Hall K, long one of the most successful terminals for passenger retail spend (SPP of €73 in 2024, up +4% year-on-year).

Work began in January and will continue over the next three years, in partnership with another well-known designer whose identity will be revealed soon. Highlight spaces will include The Lobby, The Rotunda, East & West Galleries and The Great Hall, with a focus on luxury shopping and dining.

Reflecting on the past two years since Extime was created, Daubert says: “The performance has been much better than even we expected, which is good news. What is nice is that we see growth across our activities. Some areas are growing faster, for example hospitality, but that came from almost a zero base and here we are really only at the beginning of the story.”

“CDG T1, which is our Premium format flagship, is doing incredibly well. The first year delivered very well and we wondered what might happen in year two. But it became our best-performing terminal, and in early 2025 it’s still growing. So the idea is to take the experience from T1 and to reproduce this in CDG Terminal 2E, Hall K for example.

“Hall K is a major contributor to our spend but since we opened T1 that has overtaken it in terms of performance. The investment we plan will allow Hall K to compete even better, in space we plan to organise like a luxury hotel.”

Other key developments last year that will contribute to the Extime network and commercial growth included the acquisitions, completed in October, of Paris Experience Group, a creator of tourist experiences in Ile-de-France, and P/S, an operator of luxury services at airport terminals in the USA.

P/S offers passengers high-end, tailor-made services such as private lounges, F&B, spa, valet, check-in and baggage reclaim, plus personalised experiences, including transportation to the aircraft by airside car, security checks and border crossings on site.

Further milestones last year included the opening of the first Extime Lounge outside Paris at Almaty International Airport in Kazakhstan, managed by TAV Operation Services.

Meanwhile Extime Media (a partnership with JCDecaux) will take on the advertising business at Amman Queen Alia International Airport in Jordan this year.

Daubert and his team have high ambitions to extend the Extime brand further afield but he issues a reminder that it is only two years old, and getting it right in its home market is paramount.

“Paris will always be our number one source of profitability – we are the airport and the operator of services, so we have to make sure we are fully focused on Paris for the long term.

“For the international airport business, we will develop those lines where we can access new business, for example led by hospitality. Lounges are an opportunity and a fragmented business compared to travel retail or F&B. We see Premium and Lifestyle lounges along the same lines as we do the strategy for our boutique terminals – Primeclass is the brand for Lifestyle, Extime for Premium. And we see room for development across both in future.

“With P/S, we know that VIP terminals cater to a growing need. We are the first international player in this space on both sides of the Atlantic, so having a strong position now in Los Angeles and Atlanta, soon to be extended to Dallas and Miami, can offer growth.

“We also have development beyond the airport with the integration into the Extime eco-system of Paris Experience Group, which is a lever of future growth.

“After we grow in these spaces we’ll look at global Extime projects, either in airports that are part of the ADP group or others that are opportunities. I strongly believe Extime can be an eco-system that can translate to other airports in future.”

Maintaining the strong spend momentum in the core business – namely retail in Paris – will be all about injecting newness into the offer and ensuring ADP and its joint-venture partners build even closer ties to the brand community.

Daubert says: “Luxury is two-thirds of revenues at CDG T1 so our mix is much closer to that of a department store than a classic duty-free operation. There are several factors. The brand portfolio from Louis Vuitton to Hermès to Chanel and many others is a different story to what you see elsewhere.

“It’s also, very importantly, about ‘clienteling’ to make sure you offer the right products. The partnership with brands has changed a lot. They know now they can identify new customers at the airport that they have not met even at their downtown flagships. They also know that huge sales can be done at the airport. But to manage this we have to create close relationships with the best (highest-spending) customers, which takes months of effort and communication. The brands need to accompany us by having the right stock in place for these customers when we need it, including via our digital eco-system.”

In other categories, niche fragrances have delivered strong numbers in the vast beauty zone in T1, and have helped compensate for the drop in skincare sales as fewer Asian and in particular Chinese travellers visit and spend post-pandemic – though China traffic at CDG is back at around two-thirds of pre-COVID levels today.

If brand partnerships have changed, so too have those with JV partners such as Lagardère Travel Retail, SSP and JCDecaux.

Daubert says: “When we tendered for the JVs we asked our partners to focus on purchasing, logistics, IT and other areas, letting us focus on the community of Extimers and the operations. That was a major change compared to before, where the partner led the operational side.

“The business model is also different today. Over several years we made huge investments with our partners in new terminals and new spaces; now it is more about organic growth, optimising our square metres, but beyond that the investment is in people, digital and commercial events, so it means a different cycle of growth, but one we hope will be the same as we have until now.

“In our new organisation all the companies come under the Extime umbrella. It’s not just a renaming, it’s a real reorganisation. We have to show all of the people who work here that they are part of a community of ‘Extimers’ and are part of the same project, not one differentiated by retail, F&B or other services.

“That’s what makes the Extime Campus an important development. It is the first phase of building the community. We are assessing how tools such as the Campus help drive professionalism, interaction between teams and give more emotion and pleasure to customers, which at the end of the day drives sales. It’s a major step – we have invested a lot in this Campus and we need a return in the form of quality of service.”

Creating an Extime digital eco-system is the other major work in progress. The new acquisitions will become part of this, with Paris Experience Group seen as a particular opportunity to engage Paris visitors with the group’s airport services.

Daubert says: “We expect a lot on the tourism synergy side. What is important in all this is to have a global story that benefits everybody, especially our passengers. They should be able to use points earned from retail to visit the Eiffel Tower or have a cruise on the Seine, all within Extime. That is the goal.”

Watch out for more on the Extime Paris story, coming soon on our platforms.

This article first appeared in The Moodie Davitt eZine; click here for that version.

![‘Silent Hill f’ Announced for PlayStation 5, Xbox Series and PC; New Trailer and Details Revealed [Watch]](https://bloody-disgusting.com/wp-content/uploads/2025/03/silenthillf-1.jpg)

![Final Pre-Sale Campaign Launched for ‘TerrorBytes: The Evolution of Horror Gaming’ [Trailer]](https://bloody-disgusting.com/wp-content/uploads/2024/02/terrorbyteslogo.jpg)

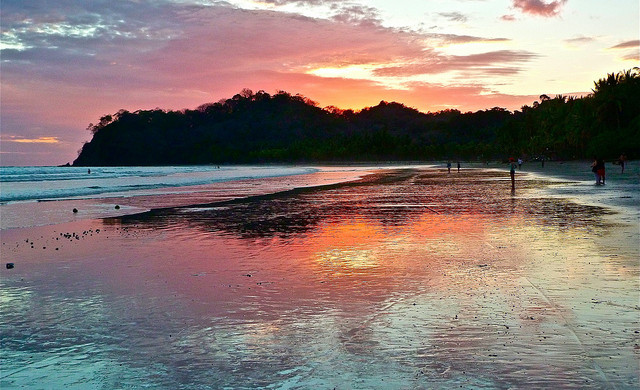

![[FINAL WEEK] Platinum Status And 170,000 Points: IHG’s New $99 Credit Card Offer Worth Getting And Keeping](https://viewfromthewing.com/wp-content/uploads/2016/06/IMG_3311.jpg?#)

.jpg?width=1920&height=1920&fit=bounds&quality=80&format=jpg&auto=webp#)

![[Podcast] Should Brands Get Political? The Risks & Rewards of Taking a Stand with Jeroen Reuven](https://justcreative.com/wp-content/uploads/2025/03/jeroen-reuven-youtube.png)